UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 11-K

_____________________

[ X ] ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission File Number 000-14798

A.Full title of the plan and the address of the plan, if different from that of the issuer named below:

American Woodmark Corporation

Retirement Savings Plan

B.Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

American Woodmark Corporation

561 Shady Elm Road

Winchester, VA 22602

AMERICAN WOODMARK CORPORATION

RETIREMENT SAVINGS PLAN

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

|

|

|

|

Financial Statements:

|

|

|

|

|

|

|

|

Statements of Net Assets Available for Benefits - December 31, 2020 and 2019

|

|

|

|

|

|

|

|

Statements of Changes in Net Assets Available for Benefits - Years ended December 31,

|

|

|

|

|

2020 and 2019

|

|

|

|

|

|

|

|

Notes to Financial Statements

|

|

|

|

|

|

|

Supplemental Schedule:

|

|

|

|

|

|

|

|

Schedule H, Line 4(i) - Schedule of Assets (Held at End of Year) - December 31, 2020

|

|

|

|

|

|

|

Signatures

|

|

Report of Independent Registered Public Accounting Firm

To the Plan Participants, Plan Administrator and Pension Committee

American Woodmark Corporation Retirement Savings Plan:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of American Woodmark Corporation Retirement Savings Plan (the Plan) as of December 31, 2020, and 2019, the related statements of changes in net assets available for benefits for the year ended December 31, 2020, and 2019, and the related notes to the financial statements (collectively, the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2020, and 2019, and the changes in net assets available for benefits for the year ended December 31, 2020, and 2019, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Report on Supplemental Information

The supplemental information in the accompanying Schedule of Assets (Held at End of Year) as of December 31, 2020, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but includes supplemental information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedule, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedule is fairly stated in all material respects in relation to the financial statements as a whole.

We have served as the Plan’s auditor since 2020.

/s/ Yount, Hyde & Barbour, P.C.

Winchester, Virginia

June 24, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMERICAN WOODMARK CORPORATION

|

|

RETIREMENT SAVINGS PLAN

|

|

|

|

Statements of Net Assets Available for Benefits

|

|

December 31, 2020 and 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

ASSETS

|

|

|

|

|

|

|

|

|

Investments at fair value:

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

286,230

|

|

|

$

|

115,828

|

|

|

|

|

Collective fund

|

|

|

8,961,723

|

|

|

|

7,439,657

|

|

|

|

|

Mutual funds

|

|

|

205,036,321

|

|

|

|

189,464,088

|

|

|

|

|

American Woodmark Corporation Stock Fund:

|

|

|

|

|

|

|

|

|

|

|

Money market fund

|

|

|

724,905

|

|

|

|

914,806

|

|

|

|

|

|

Common stock - American Woodmark Corporation

|

|

|

46,841,662

|

|

|

|

58,201,097

|

|

|

|

|

|

Total investments, at fair value

|

|

|

261,850,841

|

|

|

|

256,135,476

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

|

|

|

|

Employer’s contributions

|

|

|

7,973,522

|

|

|

|

162,602

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes receivable from participants

|

|

|

7,806,651

|

|

|

|

8,878,678

|

|

|

|

|

|

Total receivables

|

|

|

15,780,173

|

|

|

|

9,041,280

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$

|

277,631,014

|

|

|

$

|

265,176,756

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMERICAN WOODMARK CORPORATION

|

|

RETIREMENT SAVINGS PLAN

|

|

|

|

Statements of Changes in Net Assets Available for Benefits

|

|

Years ended December 31, 2020 and 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

ADDITIONS TO ASSETS ATTRIBUTED TO:

|

|

|

|

|

|

|

|

|

Investment income:

|

|

|

|

|

|

|

|

|

|

Net appreciation in fair value of investments

|

|

$

|

17,804,678

|

|

|

$

|

58,174,995

|

|

|

|

|

Interest and dividends

|

|

|

4,301,978

|

|

|

|

5,171,035

|

|

|

|

|

|

Total investment income

|

|

|

22,106,656

|

|

|

|

63,346,030

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on notes receivable from participants

|

|

|

543,859

|

|

|

|

515,936

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributions:

|

|

|

|

|

|

|

|

|

|

Participants’ contributions

|

|

|

15,074,284

|

|

|

|

14,375,472

|

|

|

|

|

Rollovers

|

|

|

1,726,895

|

|

|

|

1,166,201

|

|

|

|

|

Employer’s contributions

|

|

|

14,427,976

|

|

|

|

15,340,692

|

|

|

|

|

|

Total contributions

|

|

|

31,229,155

|

|

|

|

30,882,365

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEDUCTIONS FROM ASSETS ATTRIBUTED TO:

|

|

|

|

|

|

|

|

|

Benefits paid to participants

|

|

|

(41,071,969)

|

|

|

|

(26,478,824)

|

|

|

|

Administrative expenses

|

|

|

(353,443)

|

|

|

|

(379,064)

|

|

|

|

|

|

Total deductions

|

|

|

(41,425,412)

|

|

|

|

(26,857,888)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net increase in net assets available for benefits

|

|

|

12,454,258

|

|

|

|

67,886,443

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits at beginning of year

|

|

|

265,176,756

|

|

|

|

158,750,416

|

|

|

|

|

|

|

|

|

|

|

Transfers into the plan

|

|

|

—

|

|

|

|

38,539,897

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits at end of year

|

|

$

|

277,631,014

|

|

|

$

|

265,176,756

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to financial statements.

|

|

|

|

|

|

|

AMERICAN WOODMARK CORPORATION

RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2020 and 2019

(1) Description of the Plan

The following description of the American Woodmark Corporation Retirement Savings Plan (“the Plan”) provides only general information. A complete description of the Plan provisions, including those relating to participation, vesting and benefits, is contained in the Plan document.

a.General

The Plan is a defined contribution plan that covers all employees of American Woodmark Corporation (“the Corporation”) upon meeting certain eligibility requirements. Eligible participants include all employees participating in the Plan prior to January 1, 2002, and employees who after December 31, 2001 have reached the age of 18 and have been employed by the Corporation for at least five consecutive months. Employees who are eligible participants are automatically enrolled at a contribution percentage of 4% if hired after December 31, 2012 and before January 1, 2019 and 3% if hired after December 31, 2018. Enrollment is on the first day following the completion of five consecutive months of service. Beginning January 1, 2021, the contribution rate for participants that have an eligibility start date of January 1, 2019 and thereafter will automatically escalate by 1%. The automatic escalation will continue at the rate of 1% per calendar year, up to a contribution rate cap of 8%. New hires have the option to opt out of participating in the plan during their initial enrollment period. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended. Newport Trust Company is the trustee of the Plan.

b.Plan Merger

On January 1, 2019, the Plan merged with the RSI Home Products 401K Retirement Savings Plan (“RSI Plan”) to transfer all assets of the RSI Plan into the Plan. In total, 1,566 participants and $38,539,897 in assets were transferred into the Plan.

Participants who transferred from the RSI Plan effective January 1, 2019 were eligible for a profit sharing contribution as of April 30, 2020.

c.Contributions

The Plan allows participants to contribute up to 100% of their annual compensation excluding extraordinary remuneration not generally received by the participants as a class. The statutory maximum amount of contributions allowed was $19,500 and $19,000 for the years ended December 31, 2020 and December 31, 2019, respectively. Participants who are 50 years or older on the last day of the Plan year are eligible to contribute an additional catch-up contribution up to the limit imposed by law. The catch-up limit for 2020 and 2019 was $6,500 and $6,000, respectively. Participants may elect to invest their contributions in the investment options made available by the Corporation. The accounts of participants who have not made investment elections are automatically invested in the applicable Vanguard Target Retirement fund.

The Corporation makes matching contributions equal to 100% of each participant’s salary reduction contribution up to the first 4% of the participant’s annual compensation. All matching contributions by the Corporation are made in cash by the Corporation.

The Corporation also makes profit sharing contributions to each eligible participant in the Plan equal to 3% of the Corporation’s net income for fiscal years in which the Corporation’s net income exceeds $0 in total but is less than or equal to $20 million, 4% of the Corporation’s net income for fiscal years in which the Corporation’s net income exceeds $20 million but is less than or equal to $30 million, and 5% of the Corporation’s net income for fiscal years in which the Corporation’s net income exceeds $30 million, divided by the number of eligible employees. These contributions are made in the form of the Corporation’s common stock. Profit sharing contributions made in 2020 and 2019 were $3,743,048 and $3,788,960, respectively. Additional incentive contributions may be made at the option of the Corporation’s board of directors, however none were made in 2020 or 2019.

AMERICAN WOODMARK CORPORATION

RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2020 and 2019

d.Participant Accounts

Each participant’s account is credited with the participant’s contributions and the related matching contribution, an allocation of the Corporation’s profit sharing, and incentive contributions and Plan earnings. Allocations of income (losses) attributable to investment funds are made proportionately based upon account balances to each participant’s account.

e.Vesting

Participants are immediately vested in their contributions and the Corporation’s contributions plus actual earnings thereon.

f.Loans

Participants are allowed to take out loans from their vested balances. The minimum loan amount is $1,000 and only one loan can be outstanding at any time. The maximum loan amount is equal to the lesser of 50% of the participant’s vested account or $50,000 in accordance with the Department of Labor’s regulations. Loan payments are made through payroll deductions with interest based on the prime interest rate as listed in the Wall Street Journal on the first day of the calendar quarter in which the loan is made plus 2%. Loans must be repaid over a period not to exceed five years. Loans transferred from the RSI Plan merger may be longer than five years for the purchase of a primary residence and generally bear interest at a rate commensurate with the rates that a bank or other professional lender would charge for making a loan in a similar circumstance.

g.Payment of Benefits

Upon termination of service a participant may receive a lump-sum amount equal to the vested balance of their account or leave the vested balance in the Plan up to the Plan year in which the participant reaches age 65.

h.CARES Act

On March 27, 2020, the “Coronavirus Aid, Relief, and Economic Security (CARES) Act.” was signed into law. The CARES Act, among other things, included several relief provisions available to tax-qualified retirement plans and their participants. Under the CARES Act the following provisions were adopted by the Plan:

•Emergency coronavirus distributions up to $100,000

•Suspension of Required Minimum Distributions for 2020

i.Plan Termination

Although it has not expressed any intent to do so, the Corporation has the right under the Plan to amend, modify, suspend, or terminate the Plan. In the event of termination of the Plan, participants would become fully vested in their account balances.

j.Investment Options

Participants in the Plan may direct their individual contributions into any of the investment options offered by the Plan. The Plan currently provides that the Corporation’s matching contributions are invested in the employee’s current investment elections. The Corporation’s profit sharing contributions are automatically invested in the Corporation’s common stock, which is held by the American Woodmark Corporation Stock Fund (“the Stock Fund”). The Plan allows participants to diversify their matching and profit sharing contributions out of the Stock Fund.

AMERICAN WOODMARK CORPORATION

RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2020 and 2019

k.Forfeited accounts

At December 31, 2020 and 2019, the balance of forfeited non-vested accounts was $4,651 and $482, respectively. Forfeited balances of terminated participants’ non-vested accounts may be used to reduce future Corporation contributions or pay administrative expenses of the Plan. In 2020 and 2019, forfeited non-vested accounts were used to reduce employer contributions by $27 and $16,986, respectively, and administrative expenses by $13,157 and $15,775, respectively.

l.Administrative Expenses

The Corporation pays for all recordkeeping services less any reimbursements to the Plan from the participating mutual funds, trustee and custodial fees for the Corporation’s common stock. All other expenses are paid by the Plan.

1.Summary of Significant Accounting Policies

a.Basis of Accounting

The accompanying financial statements of the Plan have been prepared on the accrual basis of accounting.

b.Investment Valuation and Income Recognition

Investments are stated at fair value. The fair value of mutual funds is based on quoted market prices on the last business day of the Plan year. The fair value of the Corporation’s common stock within the Stock Fund is based on the closing price on the last business day of the Plan year. Participants own units of the Stock Fund, not shares of the Corporation’s common stock. The collective funds are valued by applying the Plan’s ownership percentage in the fund to the fund’s net asset value at the valuation date as a practical expedient of fair value. Money market fund balances are valued based on redemption values on the last business day of the Plan year.

The Stock Fund consists of the Plan’s investment in the Corporation’s common stock and a money market fund.

In accordance with the Plan’s policy of stating investments at fair value, the amount reflected as the net appreciation in fair value of investments represents the change in fair value as compared to cost and realized gains and losses, with cost determined using the average cost method. Purchases and sales of securities are recorded on the trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

The Plan’s investments, in general, are exposed to various risks, including interest rate, credit and overall market volatility risks. In addition, due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and such changes could materially affect the amounts reported in the statements of net assets available for benefits.

Included in investments at December 31, 2020 and 2019, are shares of American Woodmark Common stock amounting to $46,841,662 and $58,201,097, respectively. This investment represents 18% and 22% of total investments at December 31, 2020 and 2019, respectively. A significant decline in the market value of American Woodmark stock would significantly affect the net assets available for benefits.

c.Notes receivable from participants

Notes receivable from participants (loans) are carried at their unpaid principal plus accrued and unpaid interest. Delinquent participant loans are considered in default and treated as a distribution to the participant.

d.Benefit Payments

Benefit payments are recorded upon distribution.

AMERICAN WOODMARK CORPORATION

RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2020 and 2019

e.Use of Estimates

The preparation of the Plan’s financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of changes in net assets available for benefits during the reporting period. Actual results could differ from those estimates.

f.Recent Accounting Pronouncements

In July 2018, the FASB issued ASU 2018-09, Codification Improvements. ASU 2018-09 provides amendments to a wide variety of topics in the FASB’s ASC. Specific to employee benefit plans, this ASU includes an amendment to Subtopic 962-325, Plan Accounting--Defined Contribution Pension Plans--Investments--Other. This amendment updates the consideration for whether a certain type of investment should be considered to be eligible to use the net asset value per share practical expedient when there is actually a readily determinable fair value. Investments that have a readily determinable fair value are precluded from using the net asset value per share practical expedient and should be included in the fair value hierarchy disclosure. ASU 2018-09 will be effective for the Plan’s fiscal year beginning after December 15, 2019. The provisions of ASU 2018-09 did not have a material impact on the Plan’s fair value disclosures, nor an impact on the fair value measurements of the investments.

2.Fair Value Measurements

The Plan’s investments are carried at fair value using a three-level valuation hierarchy for fair value measurement. These levels are described below:

Level 1 – Investments with quoted prices for identical assets or liabilities in active markets.

Level 2 – Investments with observable inputs other than Level 1 prices, such as quoted prices for similar assets or liabilities in active markets; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 – Investments with unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

Financial assets and liabilities measured at fair value on a recurring basis are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements as of December 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Cash

|

$

|

286,230

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

286,230

|

|

|

Mutual funds

|

205,036,321

|

|

|

—

|

|

|

—

|

|

|

205,036,321

|

|

|

Collective funds

|

—

|

|

|

8,961,723

|

|

|

—

|

|

|

8,961,723

|

|

|

American Woodmark Corporation stock fund:

|

|

|

|

|

|

|

|

|

Money market fund

|

—

|

|

|

724,905

|

|

|

—

|

|

|

724,905

|

|

|

American Woodmark Corporation common stock

|

—

|

|

|

46,841,662

|

|

|

—

|

|

|

46,841,662

|

|

|

Total American Woodmark Corporation stock fund

|

—

|

|

|

47,566,567

|

|

|

—

|

|

|

47,566,567

|

|

|

Total investments

|

$

|

205,322,551

|

|

|

$

|

56,528,290

|

|

|

$

|

—

|

|

|

$

|

261,850,841

|

|

AMERICAN WOODMARK CORPORATION

RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2020 and 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements as of December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Cash

|

$

|

115,828

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

115,828

|

|

|

Mutual funds

|

189,464,088

|

|

|

—

|

|

|

—

|

|

|

189,464,088

|

|

|

Collective funds

|

—

|

|

|

7,439,657

|

|

|

—

|

|

|

7,439,657

|

|

|

American Woodmark Corporation stock fund:

|

|

|

|

|

|

|

|

|

Money market fund

|

—

|

|

|

914,806

|

|

|

—

|

|

|

914,806

|

|

|

American Woodmark Corporation common stock

|

—

|

|

|

58,201,097

|

|

|

—

|

|

|

58,201,097

|

|

|

Total American Woodmark Corporation stock fund

|

—

|

|

|

59,115,903

|

|

|

—

|

|

|

59,115,903

|

|

|

Total investments

|

$

|

189,579,916

|

|

|

$

|

66,555,560

|

|

|

$

|

—

|

|

|

$

|

256,135,476

|

|

There were no transfers between Level 1 or Level 2 during 2020 and 2019. There were no liabilities measured at fair value on a recurring basis.

3.Reconciliation of Financial Statements to Form 5500

The following is a reconciliation of net assets available for benefits per the financial statements to the Form 5500 for the years ended December 31, 2020 and 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

2020

|

|

2019

|

|

|

|

|

|

|

Net assets available for benefits per the financial statements

|

$

|

277,631,014

|

|

|

$

|

265,176,756

|

|

|

Less amounts allocated to withdrawing participants

|

(4,197,524)

|

|

|

(3,008,195)

|

|

|

Net assets available for benefits per the Form 5500

|

$

|

273,433,490

|

|

|

$

|

262,168,561

|

|

The following is a reconciliation of benefits paid to participants per the financial statements to the Form 5500 for the years ended December 31, 2020 and 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

2020

|

|

2019

|

|

|

|

|

|

|

Benefits paid to participant per the financial statements

|

41,071,969

|

|

|

$

|

26,478,824

|

|

|

Plus amounts allocated on Form 5500 to withdrawing participants and benefit payments pending distribution at end of the year

|

4,197,524

|

|

|

3,008,195

|

|

|

Less amounts allocated on Form 5500 to withdrawing participants and benefit payments pending distribution at beginning of the year

|

(3,008,195)

|

|

|

(1,415,293)

|

|

|

Benefits paid to participants per the Form 5500

|

$

|

42,261,298

|

|

|

$

|

28,071,726

|

|

Amounts allocated to withdrawing participants and benefit payments pending distribution are recorded on the Form 5500 for benefit claims that have been processed and approved for payment by the Corporation prior to December 31 but not yet paid as of that date.

4.Related-Party Transactions

During 2020 and 2019, the Plan received no dividends from the Corporation. Certain administrative services are provided by the Corporation without cost to the Plan; while all out-of-pocket administrative expenses are paid by the

AMERICAN WOODMARK CORPORATION

RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2020 and 2019

Plan. Loans to participants, which are considered parties-in-interest, were granted throughout the year as part of normal plan operations.

5.Federal Income Taxes

The Internal Revenue Service (“IRS”) determined and informed the Corporation by a letter dated August 21, 2015 that the Plan, as amended, qualified under Section 401 of the Internal Revenue Code (“IRC”). The Trust established under the Plan is tax exempt under Section 501. The plan administrator believes the Plan is designed and is currently being operated in compliance with the applicable requirements of the IRC.

U.S. generally accepted accounting principles require management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would be sustained upon examination by taxing authorities. The plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2020 and 2019, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

6.Subsequent Events

Beginning January 1, 2021 the employer match contribution will be made on a per pay period basis. Beginning May1, 2021, the Plan will also allow participants who have terminated service to take partial withdrawals, provided the minimum withdrawal is $1,000, and substantially equal installments. The mandatory distribution at normal retirement age will also be removed.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMERICAN WOODMARK CORPORATION

|

|

RETIREMENT SAVINGS PLAN

|

|

|

|

Schedule H, Line 4(i) – Schedule of Assets (Held at End of Year)

|

|

|

|

December 31, 2020

|

|

|

|

|

|

|

Identity of issuer, borrower, lessor, or similar party

|

Description of investment

|

Number of shares or units, Par or face amount, rate of interest, maturities

|

Current value

|

|

Cash:

|

|

|

|

|

M&T Investment Group

|

Non-Interest Bearing Cash

|

286,230.05

|

$

|

286,230

|

|

|

Wilmington Fund

|

Wilmington U.S. Government Money Market Institutional

|

724,905 shares of money market fund, pays interest at 0.32%

|

724,905

|

|

|

|

Total

|

|

1,011,135

|

|

|

|

|

|

|

|

Wilmington Collective Funds

|

Wilmington Trust Retirement and Institutional Services Company Collective Investment Trust

|

453,367.868

|

8,961,723

|

|

|

|

|

|

|

|

Mutual Funds:

|

|

|

|

|

American Funds

|

EuroPacific Growth

|

11,872.327

|

822,752

|

|

|

Blackrock Funds

|

Blackrock Equity Dividend

|

91,273.308

|

1,842,808

|

|

|

Fidelity Funds

|

Fidelity Small Cap Value

|

124,634.144

|

2,112,549

|

|

|

Invesco Funds

|

Invesco Developing Markets

|

20,912.700

|

1,117,993

|

|

|

JP Morgan Funds

|

JP Morgan Large Cap Growth

|

143,879.882

|

8,897,532

|

|

|

Legg Mason Funds

|

Legg Mason Global Asset Management Trust

|

177,117.320

|

2,118,323

|

|

|

Metropolitan West

|

Metropolitan West Total Return Bond Fund Plan

|

329,991.095

|

3,461,607

|

|

|

Vanguard Funds

|

Vanguard Institutional Target Retirement 2015

|

66,370.328

|

1,630,055

|

|

|

Vanguard Funds

|

Vanguard Institutional Target Retirement 2020

|

418,433.489

|

10,983,879

|

|

|

Vanguard Funds

|

Vanguard Institutional Target Retirement 2025

|

1,157,190.736

|

31,764,886

|

|

|

Vanguard Funds

|

Vanguard Institutional Target Retirement 2030

|

1,008,086.339

|

28,357,469

|

|

|

Vanguard Funds

|

Vanguard Institutional Target Retirement 2035

|

857,418.027

|

24,633,620

|

|

|

Vanguard Funds

|

Vanguard Institutional Target Retirement 2040

|

688,151.779

|

20,197,255

|

|

|

Vanguard Funds

|

Vanguard Institutional Target Retirement 2045

|

539,538.980

|

16,126,820

|

|

|

Vanguard Funds

|

Vanguard Institutional Target Retirement 2050

|

315,107.056

|

9,443,758

|

|

|

Vanguard Funds

|

Vanguard Institutional Target Retirement 2055

|

263,485.222

|

7,917,731

|

|

|

Vanguard Funds

|

Vanguard Institutional Target Retirement 2060

|

173,581.827

|

5,231,756

|

|

|

Vanguard Funds

|

Vanguard Institutional Target Retirement 2065

|

10,758.506

|

296,827

|

|

|

Vanguard Funds

|

Vanguard Institutional Target Retire Income

|

42,285.305

|

1,028,801

|

|

|

Vanguard Funds

|

Vanguard REIT Index Fund Admiral Shares

|

10,040.127

|

1,208,630

|

|

|

Vanguard Funds

|

Vanguard Small Cap Growth

|

53,397.118

|

5,019,863

|

|

|

Vanguard Funds

|

Vanguard Total Bond Market Index Adm

|

507,888.706

|

5,901,667

|

|

|

Vanguard Funds

|

Vanguard Total Intl Stock Index Admiral

|

110,107.473

|

3,574,089

|

|

|

Vanguard Funds

|

Vanguard Total Stock Market Index Fund Admiral

|

119,755.653

|

11,345,651

|

|

|

|

Total

|

7,241,277.447

|

205,036,321

|

|

|

|

|

|

|

*American Woodmark Corporation

|

Common Stock

|

499,112.000

|

46,841,662

|

|

|

|

|

|

|

* Participants’ loans

|

Notes receivable from participants

|

Rates of interest ranging from 4.5% to 10.75%; Loan maturities ranging from 1 to 30 years

|

7,806,651

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

269,657,492

|

|

|

|

|

|

|

|

* Party-in-interest

|

|

|

|

|

See accompanying Report of Independent Registered Public Accounting Firm.

|

|

|

SIGNATURE

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the Plan Administrator of the American Woodmark Corporation Retirement Savings Plan has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

AMERICAN WOODMARK CORPORATION

|

|

|

RETIREMENT SAVINGS PLAN

|

|

|

|

|

Date: June 24, 2021

|

By: _/s/ PAUL JOACHIMCZYK____________

|

|

|

Paul Joachimczyk

|

|

|

Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

Exhibit

Number

|

Description

|

|

|

|

|

|

|

|

Consent of Yount, Hyde & Barbour, P.C. (Filed herewith)

|

|

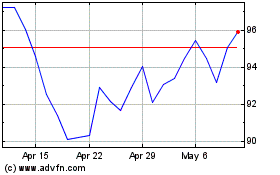

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

From Jun 2024 to Jul 2024

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

From Jul 2023 to Jul 2024