Current Report Filing (8-k)

June 03 2020 - 9:24AM

Edgar (US Regulatory)

false0000794619

0000794619

2020-06-01

2020-06-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 1, 2020

|

|

|

|

|

|

|

|

|

American Woodmark Corporation

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

Virginia

|

|

000-14798

|

|

54-1138147

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

|

|

|

|

561 Shady Elm Road,

|

Winchester,

|

Virginia

|

|

22602

|

|

(Address of principal executive offices

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (540) 665-9100

|

|

|

|

|

Not applicable

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

American Woodmark Corporation

ITEM 2.05 COSTS ASSOCIATED WITH EXIT OR DISPOSAL ACTIVITIES

On June 1, 2020, the Company’s Board of Directors approved the closure and eventual disposal of its manufacturing plant located in Humboldt, Tennessee. The closure is related to committed synergy capture from the acquisition of RSI Home Products Inc. and the subsequent realignment of its flatstock operations. A portion of the Humboldt facility’s capacity had been previously moved to Anaheim, California and the remaining capacity will be shifting to its Anaheim and Toccoa, Georgia facilities.

The manufacturing plant is expected to cease operations in September 2020. The Company expects to incur total pre-tax restructuring costs of $3.0 million to $5.0 million related to the closing of the plant, net of building proceeds. The restructuring costs consist of employee severance and separation costs of approximately $0.5 million to $1.0 million, and charges for asset impairment of property, equipment and inventory of approximately $2.5 million to $4.0 million.

The Company expects to recognize substantially all of these charges during fiscal 2021. Once completed, the Company expects to realize ongoing savings of approximately $6.0 million to $7.0 million per year as a result of these actions.

Forward-Looking Statements

Certain statements made in this report are not based on historical facts, but are forward-looking statements. These statements reflect the Company’s reasonable judgment with respect to future events and typically can be identified by the use of forward-looking terminology such as “believes,” “expects,” “projects,” “intends,” “plans,” “may,” “will,” “should,” “would,” “could” or “anticipates,” or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements, including but are not limited to: when or whether the Company is able to implement and complete the closure and sale of the Humboldt, Tennessee manufacturing plant; whether the Company incurs higher than expected charges or cash expenditures related to this closure and sale; whether the Company will achieve anticipated operating cost savings and efficiencies when and if the plant closure and sale is completed; whether the Company experiences disruptions to its manufacturing operations resulting from the plant closure and sale; and when and whether the Company will be able to dispose of the closed and idled plant and surplus or obsolete machinery and equipment at anticipated values; as well as other risks and uncertainties discussed under the headings “Forward-Looking Statements” and “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended January 31, 2020 and the Company’s Annual report on Form 10-K for the fiscal year ended April 30, 2019. Any forward-looking statement that the Company makes, speaks only as of the date of this report. The Company undertakes no obligation to publicly update or revise any forward-looking statements or cautionary factors, as a result of new information, future events or otherwise, except as required by law.

ITEM 2.06 MATERIAL IMPAIRMENTS

The information set forth under Item 2.05 of this report on Form 8-K is hereby incorporated in this Item 2.06 by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

AMERICAN WOODMARK CORPORATION

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

/s/ M. SCOTT CULBRETH

|

|

/s/ S. CARY DUNSTON

|

|

|

|

|

|

M. Scott Culbreth

|

|

S. Cary Dunston

|

|

Senior Vice President and Chief Financial Officer

|

|

Chairman & Chief Executive Officer

|

|

|

|

|

|

Date: June 3, 2020

|

|

Date: June 3, 2020

|

|

Signing on behalf of the registrant and as principal financial officer

|

|

Signing on behalf of the registrant and as principal executive officer

|

|

|

|

|

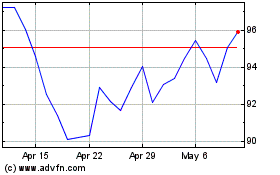

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

From Jun 2024 to Jul 2024

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

From Jul 2023 to Jul 2024