FBHS Upgraded to Strong Buy - Analyst Blog

January 21 2013 - 8:30AM

Zacks

On Jan 19, Zacks Investment

Research upgraded Fortune Brands Home & Security,

Inc. (FBHS) to a Zacks Rank #1 (Strong Buy).

Why the

Upgrade?

Fortune Brands H&S has been

witnessing rising earnings estimates driven by strong fiscal

third-quarter 2012 results and an enhanced fiscal 2012 guidance.

Moreover, this well-known producer of home and security products

delivered positive earnings surprises in 3 of the last 4 quarters

with an average beat of 63.1%. The long-term expected earnings

growth rate for this stock is 16.3%.

On Oct 23, 2012, Fortune Brands

H&S posted third quarter 2012 adjusted earnings of 29 cents per

share, exceeding the Zacks Consensus Estimate and year-ago

quarters’ earnings of 25 cents and 20 cents, respectively. The year

over year upbeat results benefited from top-line growth and

cost-saving actions.

Total revenue went up 7.2% to

$909.0 million from the year-ago quarter’s level, primarily driven

by higher sales volume from an improving U.S. home products market,

price increases and new product launches. The results beat the

Zacks Consensus Estimate of $900.0 million.

Following the upbeat third quarter

and improvement in the home products market, management raised its

earnings per share outlook for 2012. The company now expects

earnings per share to be between 86 cents and 88 cents, up from the

prior forecast of 77–87 cents.

The Zacks Consensus Estimate for

fiscal 2012 increased 6.0% to 88 cents per share as most of the

estimates were revised higher over the last 90 days. The current

estimate is at the higher end of the company’s guidance range. For

fiscal 2013, estimates were revised higher over the same time

frame, lifting the Zacks Consensus Estimate by 1.8% to $1.15 per

share.

Other Stocks to

Consider

Besides Fortune Brands H&S,

other stocks that are currently performing well include

American Woodmark Corporation (AMWD),

Virco Mfg. Corporation (VIRC) and Pier 1

Imports, Inc. (PIR). All these companies carry a Zacks

Rank #1 (Strong Buy) except Pier 1 Imports, which holds a Zacks

Rank #2 (Buy).

AMER WOODMARK (AMWD): Free Stock Analysis Report

FORTUNE BRD H&S (FBHS): Free Stock Analysis Report

PIER 1 IMPORTS (PIR): Free Stock Analysis Report

(VIRC): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

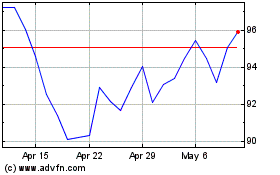

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

From Jun 2024 to Jul 2024

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

From Jul 2023 to Jul 2024