Form 8-K - Current report

January 11 2024 - 7:57AM

Edgar (US Regulatory)

0000004904false00000049042024-01-092024-01-090000004904aep:AppalachianPowerCompanyIncMember2024-01-092024-01-090000004904us-gaap:CommonStockMemberexch:XNAS2024-01-092024-01-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

| | | | | |

| Date of report (Date of earliest event reported) | January 9, 2024 |

| | |

| AMERICAN ELECTRIC POWER COMPANY, INC. |

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| New York | 1-3525 | 13-4922640 |

| (State or Other Jurisdiction of | (Commission File Number) | (IRS Employer Identification |

Incorporation) | | No.) |

| | |

| APPALACHIAN POWER COMPANY |

| | |

| Virginia | 1-3457 | 54-0124790 |

| (State or Other Jurisdiction of | (Commission File Number) | (IRS Employer Identification |

Incorporation) | | No.) |

| | | | | | | | | | | |

| 1 Riverside Plaza, | Columbus, | OH | 43215 |

| (Address of Principal Executive Offices) | (Zip Code) |

| | | | | | | | | | | |

| (Registrant's Telephone Number, Including Area Code) | (614) | 716-1000 | |

| | | |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Registrant | Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| American Electric Power Company, Inc. | Common Stock, $6.50 par value | AEP | The NASDAQ Stock Market LLC |

| | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

Emerging growth company | ☐ |

| |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

| □ |

Item 2.06. Material Impairments

Reference is made to page 126 of the Form 10-Q for the period ended September 30, 2023 of American Electric Power Company (AEP) and of Appalachian Power Company (APCo) under ‘APCo and WPCo (Wheeling Power Company) Rate Matters (Applies to AEP and APCo)’ and the subheading ‘ENEC (Expanded Net Energy Cost) Filings’ for a discussion of APCo and WPCo (“the Companies”) under-recovered ENEC regulatory asset balances and the 2021 and 2022 ENEC cases filed with the Public Service Commission of West Virginia (WVPSC).

On January 9, 2024, the WVPSC issued a final order disallowing approximately $232 million of the Companies under-recovered ENEC regulatory asset balance. The final order provides for the recovery of the Companies remaining $321 million under-recovered ENEC regulatory asset balance over a ten-year period beginning September 1, 2024.

As a result of the WVPSC’s final order, AEP anticipates recording a pretax, non-cash disallowance of approximately $222 million (approximately $127 million attributable to APCo and approximately $95 million attributable to WPCo) in the fourth quarter of 2023.

Item 7.01. Regulation FD Disclosure

The disallowance referenced above will be excluded from AEP’s 2023 Operating Earnings (Non-GAAP). Further, as of the date hereof, AEP is reaffirming the forecasted financial data previously issued on November 10, 2023 relating to its 2024 Operating Earnings guidance, its projected 6%-7% long-term earnings growth rate and its 14%-15% FFO/Debt target.

This report made by AEP and APCo contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. Although AEP and APCo believe that their expectations are based on reasonable assumptions, any such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected. Among the factors that could cause actual results to differ materially from those in the forward-looking statements are: changes in economic conditions, electric market demand and demographic patterns in AEP service territories; the impact of pandemics and any associated disruption of AEP’s business operations due to impacts on economic or market conditions, costs of compliance with potential government regulations, electricity usage, supply chain issues, customers, service providers, vendors and suppliers; the economic impact of increased global trade tensions including the conflict between Russia and Ukraine, and the adoption or expansion of economic sanctions or trade restrictions; inflationary or deflationary interest rate trends; volatility and disruptions in the financial markets precipitated by any cause, including failure to make progress on federal budget or debt ceiling matters, particularly developments affecting the availability or cost of capital to finance new capital projects and refinance existing debt; the availability and cost of funds to finance working capital and capital needs, particularly if expected sources of capital, such as proceeds from the sale of assets or subsidiaries, do not materialize, and during periods when the time lag between incurring costs and recovery is long and the costs are material; decreased demand for electricity; weather conditions, including storms and drought conditions, and AEP’s ability to recover significant storm restoration costs; the cost of fuel and its transportation, the creditworthiness and performance of fuel suppliers and transporters and the cost of storing and disposing of used fuel, including coal ash and spent nuclear fuel; the availability of fuel and necessary generation capacity and the performance of generation plants; AEP’s ability to recover fuel and other energy costs through regulated or competitive electric rates; the ability to transition from fossil generation and the ability to build or acquire renewable generation, transmission lines and facilities (including the ability to obtain any necessary regulatory approvals and permits) when needed at acceptable prices and terms, including favorable tax treatment, and to recover those costs; new legislation, litigation and government regulation, including changes to tax laws and regulations, oversight of nuclear generation, energy commodity trading and new or heightened requirements for reduced emissions of sulfur, nitrogen, mercury, carbon, soot or particulate matter and other substances that could impact the continued operation, cost recovery, and/or profitability of generation plants and related assets; the impact of federal tax legislation on results of operations, financial condition, cash flows or credit ratings; the risks associated with fuels used before, during and after the generation of electricity and the byproducts and wastes of such fuels, including coal ash and spent nuclear fuel; timing and resolution of pending and future rate cases, negotiations and other regulatory decisions, including rate or other recovery of new investments in generation, distribution and transmission service and environmental compliance; resolution of litigation; AEP’s ability to constrain operation and maintenance costs; prices and demand for power generated and sold at wholesale; changes in technology, particularly with respect to energy storage and new, developing, alternative or distributed sources of generation; AEP’s ability to recover through rates any remaining unrecovered investment in generation units that may be retired before the end of their previously projected useful lives; volatility and changes in markets for coal and other energy-related commodities, particularly changes in the price of natural gas; the impact of changing expectations and demands of customers, regulators, investors and stakeholders, including heightened emphasis on environmental, social and governance concerns; changes in utility regulation and the allocation of costs within regional transmission organizations, including ERCOT, PJM and SPP; changes in the creditworthiness of the counterparties with contractual arrangements, including participants in the energy trading market; actions of rating agencies, including changes in the ratings of debt; the impact of volatility in the capital markets on the value of the investments held by

AEP’s pension, other postretirement benefit plans, captive insurance entity and nuclear decommissioning trust and the impact of such volatility on future funding requirements; accounting standards periodically issued by accounting standard-setting bodies; other risks and unforeseen events, including wars and military conflicts, the effects of terrorism (including increased security costs), embargoes, naturally occurring and human-caused fires, cyber security threats and other catastrophic events; and the ability to attract and retain the requisite work force and key personnel.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| AMERICAN ELECTRIC POWER COMPANY, INC. |

| APPALACHIAN POWER COMPANY |

| | |

| By: | /s/ David C. House |

| Name: | David C. House |

| Title | Assistant Secretary |

January 11, 2024

v3.23.4

Document and Entity Information

|

Jan. 09, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 09, 2024

|

| Entity Registrant Name |

AMERICAN ELECTRIC POWER COMPANY, INC.

|

| Entity File Number |

1-3525

|

| Entity Incorporation, State or Country Code |

NY

|

| Entity Tax Identification Number |

13-4922640

|

| Entity Address, Address Line One |

1 Riverside Plaza,

|

| Entity Address, City or Town |

Columbus,

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

43215

|

| City Area Code |

(614)

|

| Local Phone Number |

716-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000004904

|

| Amendment Flag |

false

|

| Appalachian Power Company, Inc. |

|

| Entity Information [Line Items] |

|

| Entity Registrant Name |

APPALACHIAN POWER COMPANY

|

| Entity File Number |

1-3457

|

| Entity Incorporation, State or Country Code |

VA

|

| Entity Tax Identification Number |

54-0124790

|

| The NASDAQ Stock Market LLC | Common Stock, $6.50 par value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $6.50 par value

|

| Trading Symbol |

AEP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=aep_AppalachianPowerCompanyIncMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNAS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementEquityComponentsAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

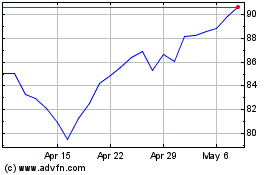

American Electric Power (NASDAQ:AEP)

Historical Stock Chart

From Apr 2024 to May 2024

American Electric Power (NASDAQ:AEP)

Historical Stock Chart

From May 2023 to May 2024