Altera's Estimates Decline - Analyst Blog

January 10 2012 - 6:30AM

Zacks

Earnings estimates for

Altera Corporation (ALTR) have declined

significantly in the last three months, driven by weak

macroeconomic conditions.

All the twenty-two firms covering

the stock have lowered their estimates in the last thirty days

pulling down the Zacks Consensus Estimate for 2011. This was

prompted by the company’s cut in outlook for the fourth

quarter.

Last month, the company

slashed its revenue guidance. Altera now expects revenues in the

fourth quarter to decline by 13% to 16% on a sequential basis,

compared to the previous guidance of 7% – 11%. The new guidance

implies revenues in the range of $438.9 million – $454.6 million,

significantly lower than the previous guidance of $465.0 million –

$485.9 million.

Altera stated that the

revenue outlook has deteriorated across all major vertical markets,

including both large and small customers. Only North America is

expected to benefit from rising military sales. All other

geographies are expected to be weak. Most customers reduced demand

due to economic uncertainty, macroeconomic concerns, and lower than

planned sales.

This is the second instance

where Altera lowered its revenue guidance in the past few quarters

against its usual practice of upgrading guidance as the quarter

progresses.

The reduction in guidance

was driven by industry-wide inventory correction and weak demand,

which continue to plague companies in the semiconductor

industry.

The same sentiment was echoed by

key rival Xilinx, Inc. (XLNX) as well, which also

trimmed its forecast for the December quarter.

The firms pulled back their

estimates for Altera citing weak demand in China and the European

wireless segment and believe that it is highly unlikely that the

company will bounce back before 2Q12. A significant cause of

concern is Altera’s higher exposure to China and service provider

segments. The macroeconomic slowdown in China is hurting Altera

more than Xilinx as Altera has more exposure to China than

Xilinx.

Given the turbulent economic

environment, we continue to be on the sidelines and await better

clarity on business development as the year progresses. Hence, we

maintain our Neutral recommendation on Altera. Our recommendation

is supported by a Zacks #3 Rank, which translates into a short-term

rating of Hold.

ALTERA CORP (ALTR): Free Stock Analysis Report

XILINX INC (XLNX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

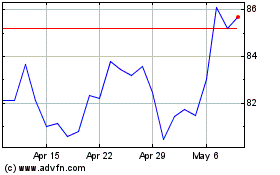

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From May 2024 to Jun 2024

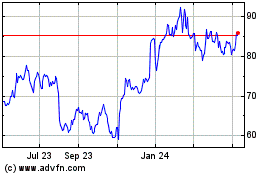

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Jun 2023 to Jun 2024