For Immediate Release

Chicago, IL – December 29, 2011 – Zacks.com announces the list

of stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include Xilinx Inc. ( XLNX),

Broadcom Corporation ( BRCM), Altera

Corporation ( ALTR), Texas

Instrument ( TXN) and H&R Block

Inc. ( HRB).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Wednesday’s Analyst

Blog:

Estimates Decline for Xilinx

Earnings estimates for Xilinx Inc. ( XLNX) have

declined significantly in the last seven days after the company

recently downgraded its guidance for the third quarter of fiscal

2012.

Xilinx recently revised its sales guidance for the December

quarter. The company now expects sales to decline by 9% – 12%,

significantly lower than the previous guidance of a sales decline

of 3% to 8% sequentially.

The new guidance implies sales to come between $488.6 million

and $505.2 million compared to its previous estimate of $538.5

million and $510.8 million.

The decline in sales was primarily driven by a decrease in large

customer business in Communications end market.

Xilinx now expects gross margin to be approximately 65%, up from

its previous estimate of 64%. This is a revision from

previous guidance of approximately 64%.

With the second quarter earnings conference call, Xilinx stated

that sales from Virtex-6 and Spartan-6 families will increase

sequentially. Sales from Communications were projected to be

down sequentially as decline in wireless sales would offset an

increase from Wired Communications.

Xilinx had reduced its guidance for the September quarter as

well. Most semiconductor companies have downgraded their guidance

for the December quarter in view of the macroeconomic slowdown with

the exception of Broadcom Corporation ( BRCM).

Earlier in the month, prime rival Altera

Corporation ( ALTR) slashed its revenue guidance for the

fourth quarter of 2011.

Altera now expects revenues in the fourth quarter to decline by

13% to 16% on a sequential basis, compared to its previous guidance

of 7% – 11%. The new guidance implies revenues in the range of

$438.9 million – $454.6 million, significantly lower than the

previous guidance of $465.0 million – $485.9 million.

In particular, the severe weakening of demand in Europe has

majorly affected business for most semiconductor players.

Industry leader Texas Instrument (

TXN) also slashed its revenue guidance for the December quarter as

demand was adversely impacted with most customers bringing down

their high-level of inventories. Texas stated that the reductions

are due to broadly lower demand across a wide range of product

markets, customers, end products, the only exception being wireless

applications processors. In particular, recessionary environment in

Europe continues to impact the business followed by Asia and the

US.

Earnings estimates have already declined of late for Xilinx.

With the downgrade in guidance, we expect a more severe decline

hereafter.

We continue to maintain a Neutral recommendation on Xilinx. Our

recommendation is supported by Zacks #3 Rank which translates into

a short-term rating of Hold.

H&R Block Downgraded

We are downgrading H&R Block Inc. ( HRB) to

Neutral from Outperform because of the higher-than-estimated

net loss incurred in its fiscal second quarter results. The company

also had to drop plans to acquire 2SS Holdings after the federal

judge passed a ruling against the deal on antitrust

grounds.

H&R Block reported adjusted loss of $0.38 per share, wider

than the Zacks Consensus Estimate of a loss of $0.35 as well as

$0.36 a share incurred in the year-ago period. Litigation costs

coupled with charges related to the discontinuation of ExpressTax

also weighed on the results in the quarter.

After a long wait, H&R Block dropped its plan to acquire 2SS

Holdings, Inc, developer of Tax ACT digital tax preparation

solutions, in a $287.5 million all-cash deal. The decision came

after a federal judge passed a ruling against the merger

on antitrust grounds. The acquisition was intended to augment the

company’s digital tax offerings as well as aid performance. The

company had plans of consolidating its H&R Block At Home

digital business and the acquired TaxACT unit. Had the acquisition

materialized, H&R Block would have enjoyed an enlarged

client based.

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

ALTERA CORP (ALTR): Free Stock Analysis Report

BROADCOM CORP-A (BRCM): Free Stock Analysis Report

BLOCK H & R (HRB): Free Stock Analysis Report

TEXAS INSTRS (TXN): Free Stock Analysis Report

XILINX INC (XLNX): Free Stock Analysis Report

To read this article on Zacks.com click here.

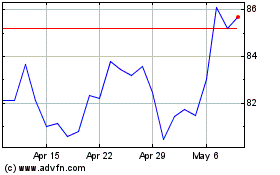

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From May 2024 to Jun 2024

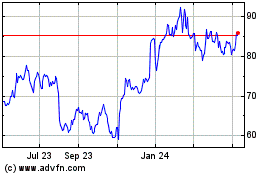

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Jun 2023 to Jun 2024