Current Report Filing (8-k)

May 11 2021 - 4:31PM

Edgar (US Regulatory)

false

0000353184

0000353184

2021-05-05

2021-05-05

0000353184

airt:CommonStockCustomMember

2021-05-05

2021-05-05

0000353184

airt:AlphaIncomePreferredSecuritiesCustomMember

2021-05-05

2021-05-05

0000353184

airt:WarrantToPurchaseAipCustomMember

2021-05-05

2021-05-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 5, 2021

Air T, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

001-35476

|

52-1206400

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

5930 Balsom Ridge Road

|

Denver, North Carolina 28037

|

(Address of Principal Executive Offices, and Zip Code)

Registrant’s Telephone Number, Including Area Code

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

AIRT

|

NASDAQ Global Market

|

|

Alpha Income Preferred Securities (also referred to as 8% Cumulative Capital Securities) (“AIP”)

|

AIRTP

|

NASDAQ Global Market

|

|

Warrant to purchase AIP

|

AIRTW

|

NASDAQ Global Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On May 6, 2021, Air T, Inc. (the “Company”) announced the May 5, 2021 formation of a new aircraft asset management business called Contrail Asset Management, LLC (“CAM”), and a new aircraft capital joint venture called Contrail JV II LLC (“CJVII”). The new joint venture was formed as a scalable asset management platform to complement the Company’s existing operating businesses. The new venture will focus on acquiring commercial aircraft and jet engines for leasing, trading and disassembly. CJVII will target investments in current generation narrow-body aircraft and engines, building on the Company’s 79%-owned subsidiary Contrail Aviation Support, LLC (“Contrail”)’s origination and asset management expertise.

CJVII will initially be capitalized with up to $408,000,000 of equity from Air T and three institutional investor partners, consisting of $108,000,000 in initial commitments and $300,000,000 in upsize capacity, contingent on underwriting and transaction appeal. The three investor partners bring significant aviation experience to the joint venture.

The Company and Mill Road Capital (“MRC”) have agreed to became common members in CAM, the aircraft asset management business. CAM will serve two separate and distinct functions: 1) to direct the sourcing, acquisition and management of aircraft assets owned by CJVII (“Asset Management Function”), and 2) to directly invest into CJVII alongside other institutional investment partners (“Investment Function”). The Company and its affiliates will perform the services required for the Asset Management Function in exchange for 90% of the economic interest derived therefrom. For the Asset Management Function, CAM will receive origination fees, management fees, consignment fees (where applicable) and a promote.

For its Investment Function, CAM has an initial commitment to CJVII of approximately $53,000,000, which is comprised of an $8,000,000 initial commitment from the Company and an approximately $45,000,000 initial commitment from MRC. Any investment returns will be shared pro-rata between the Company and MRC.

The CAM LLC Agreement provides that the limited liability company and each series will continue for a period of seven (7) years from the closing date, provided that the term of the company and each series may be extended for two (2) consecutive one-year periods after the initial term.

The foregoing summary of the terms of the described transaction documents and the foregoing description of the Amended and Restated Limited Liability Company Agreement of Contrail Asset Management, LLC does not purport to be complete and is qualified in its entirety by reference to the Form of Amended and Restated Limited Liability Company Agreement, a copy of which is attached hereto as Exhibit 10.1, and incorporated by reference herein. Portions of the limited liability company agreement exhibit have been omitted for confidential treatment.

On May 6, 2021, the Company issued a press release discussing, among other things, formation of the aviation asset management vehicle (the “Press Release”). A copy of the Press Release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

*Portions of the limited liability company exhibit have been omitted for confidential treatment.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 11, 2021

|

|

AIR T, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Brian Ochocki

|

|

|

|

|

Brian Ochocki, Chief Financial Officer

|

|

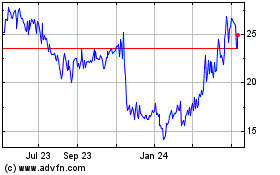

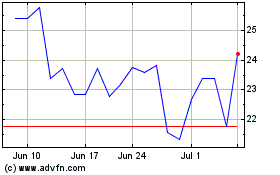

Air T (NASDAQ:AIRT)

Historical Stock Chart

From May 2024 to Jun 2024

Air T (NASDAQ:AIRT)

Historical Stock Chart

From Jun 2023 to Jun 2024