Ameristar Casinos, Inc. - Growth & Income

October 12 2011 - 8:00PM

Zacks

Investors willing to gamble that the U.S. isn't heading for another

recession could get a big payoff from

Ameristar Casinos,

Inc. (ASCA) if they're right.

The company has delivered three consecutive

positive earnings surprises and has seen earnings estimates soar

this year, but the stock, along with the overall market, has taken

it on the chin since late July over recession fears in the U.S.

Shares now trade at just 7.9x 12-month forward

earnings and sport a PEG ratio of 0.5. This, along with a 2.3%

dividend yield, could provide some tremendous upside if the economy

doesn't turn south.

Company Description

Ameristar operates 8 casinos in Missouri, Iowa,

Colorado, Mississippi, Indiana and Nevada. The company was founded

in 1954 and is headquartered in Las Vegas, Nevada. It has a market

cap of $595 million.

Second Quarter Results

Ameristar reported better than expected results for

the second quarter of 2011. Net revenues climbed 4% to $305.094

million, ahead of the Zacks Consensus Estimate of $302.0

million.

Five of the company's properties experienced

year-over-year revenue growth, with its East Chicago and Council

Bluffs locations delivering the strongest growth at 10% and 8%,

respectively.

Adjusted EBITDA (earnings before interest, taxes,

depreciation and amortization) increased 18% as the company

leveraged its fixed costs.

Adjusted earnings per share came in at 50 cents,

beating the Zacks Consensus Estimate of 47 cents. It was a whopping

285% increase over the same quarter in 2010, due in part to a much

lower share count.

Outlook

Analysts revised their earnings estimates

significantly higher for Ameristar following strong Q2 results,

sending the stock to a Zacks #1 Rank (Strong Buy) stock. Consensus

estimates have been trending higher over the last several months as

the company has delivered three consecutive positive earnings

surprises:

Analysts are forecasting strong growth to continue

for Ameristar over the next two years due in part to an improving

regional gaming environment. The Zacks Consensus Estimate for 2011

is $1.94, representing 166% growth over 2010 EPS. The 2012

consensus estimate is currently $2.35, corresponding with 21% EPS

growth.

Dividend

In addition to strong earnings growth, Ameristar

offers investors a stable dividend that yields 2.3%. The company

has paid the same 10.5 cent per share quarterly dividend since the

beginning of 2008.

If earnings growth accelerates at the pace it's

expected to, then a dividend hike could be on the horizon soon.

Valuation

Shares of Ameristar have taken a beating along with

the overall market since late July. If another recession isn't

right around the corner, however, then Ameristar looks like a great

value.

The stock trades at just 7.9x 12-month forward

earnings, well below the industry average of 19.0x and a

significant discount to its 10-year median of 14.8x.

Its PEG ratio is only 0.5 based on a 5-year EPS

growth rate of 16.5%.

The Bottom Line

With rising earnings estimates, strong growth

prospects and a 2.3% dividend yield, Ameristar looks very

attractive at just 7.9x forward earnings. If the U.S. doesn't slip

into another recession anytime soon, then this casino stock could

pay off big.

Todd Bunton is the Growth & Income Stock

Strategist for Zacks Investment Research and Co-Editor of the

Reitmeister Value Investor.

AMERISTAR CASIN (ASCA): Free Stock Analysis Report

Zacks Investment Research

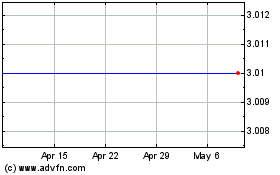

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From May 2024 to Jun 2024

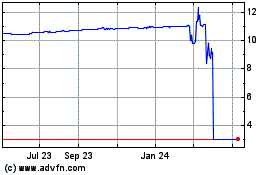

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jun 2023 to Jun 2024