U.S. Dollar Extends Slide On Fed Rate Cut Hopes

November 20 2023 - 8:42PM

RTTF2

The U.S. dollar extended its early loss against other major

currencies in the Asian session on Tuesday, as investor sentiment

boosted amid expectations that U.S. interest rates may have peaked,

easing U.S.-Sino tensions and optimism over a recovery in China's

property sector.

Investors looked ahead to the release of minutes from Federal

Reserve's latest meeting later in the day for additional clues on

the rate outlook.

Oil extended gains after rising more than 2 percent on Monday

amid hopes of OPEC+ deepening output cuts.

Richmond Fed president Thomas Barkin said it's not yet the right

time to declare victory on inflation and focus should remain and

getting price growth back to the 2 percent goal.

Bank of England's Governor Andrew Bailey is set to testify

before the parliamentary committee later today.

European Central Bank President Christine Lagarde is set to

speak on the occasion of the 100th anniversary of the currency

reform in Germany in 1923.

The U.S. dollar started weakening against its major rivals, from

November 17th, 2023. The soft U.S. labor market and inflation

readings from last week, boosted the traders' sentiments to bet on

Fed's rate hike pause.

In the Asian trading today, the U.S. dollar fell to nearly a

3-1/2-month low of 1.0966 against the euro, from yesterday's

closing value of 1.0938. The greenback is likely to find support

around the 1.12 region.

Against the pound and the yen, the greenback, dropped to near

2-1/2-month lows of 1.2541 and 147.24 from yesterday's closing

quotes of 1.2504 and 148.36, respectively. If the greenback extends

its downtrend, it is likely to find support around 1.27 against the

pound and 145.00 against the yen.

The greenback edged down to 0.8827 against the Swiss franc, from

Monday's closing value of 0.8848. Then next possible downside

target for the greenback is seen around the 0.86 region.

Against the Australia and the New Zealand dollars, the greenback

slid to near 3-1/2-month lows of 0.6587 and 0.6075 from yesterday's

closing quotes of 0.6556 and 0.6036, respectively. On the downside,

0.67 against the aussie and 0.61 against the kiwi are seen as the

next support levels for the greenback.

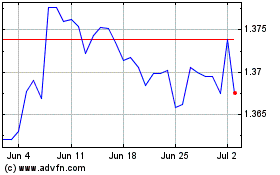

The greenback dropped to 1.3705 against the Canadian dollar,

from Monday's closing value of 1.3724. The greenback may test

support near the 1.34 region.

Looking ahead, Switzerland foreign trade data and U.K. public

sector finance data, both for October, are due to be released at

2:00 am ET in the pre-European session.

At 5:15 am ET, Bank of England Governor Andrew Bailey along with

Monetary Policy Committee members Dave Ramsden, Jonathan Haskel and

Catherine L Mann are set to attend the Treasury Select Hearing.

In the New York session, Canada inflation data and new housing

price index and U.S. existing home sales data, all for October, are

slated for release.

At 11.00 am ET, European Central Bank President Christine

Lagarde is set to speak on the occasion of the 100th anniversary of

the currency reform in Germany in 1923 organized by the German

Ministry of Finance in Berlin.

At 2:00 pm ET, U.S. FOMC meeting minutes is set to be

published.

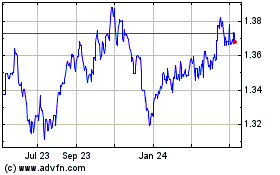

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Jun 2024 to Jul 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Jul 2023 to Jul 2024