KfW Prices $750 Million Tap Of Floating Rate Note Maturing 2014

March 15 2012 - 12:44PM

Dow Jones News

State-owned German development bank KfW has priced a $750

million tap of its floating-rate note maturing January 2014, one of

the banks running the deal said Thursday.

That takes the total amount outstanding to $2 billion, the bank

said.

Bank of America Merrill Lynch and BNP Paribas SA were the lead

managers on the sale, which has the following terms:

Amount: $750 million

Maturity: Jan. 17, 2014

Coupon: 18 basis points over the three-month dollar Libor

Reoffer Price: 100.3734

Payment Date: March 22, 2012

Debt Ratings: Aaa (Moody's)

AAA (Standard & Poor's)

AAA (Fitch)

Denominations: $1,000

Listing: Luxembourg

-By Ben Edwards, Dow Jones Newswires, 44 20 7842 9287;

ben.edwards@dowjones.com

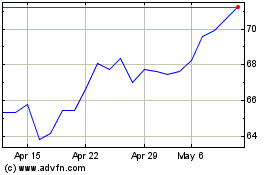

BNP Paribas (EU:BNP)

Historical Stock Chart

From Jun 2024 to Jul 2024

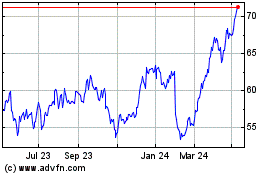

BNP Paribas (EU:BNP)

Historical Stock Chart

From Jul 2023 to Jul 2024