Bitcoin Mining Costs Spike To Nearly $50K As Miners Look To AI For Survival

November 04 2024 - 5:30PM

NEWSBTC

Bitcoin mining is now a highly competitive industry that’s not just

expensive but technology-intensive as well. Individuals interested

in joining the growing mining industry must invest in a specialized

computer system, steady internet, reliable energy supply, and a

good amount of skill to manage the process. Related Reading: Why

One Analyst Says Now’s The Time To Buy XRP—Before It Hits $14 As

such, miners often turn to credit facilities to fund their

operations. Today, mining costs continue to grow, with some experts

saying that costs have skyrocketed to $49,500 as of the second

quarter. CoinShares reports that the second quarter data is $2,300

more than the first quarter when mining costs average $47,200. The

investment company further explained that the miners’ cash expenses

average $85,900, and prediction costs amount to $96,100. Failing to

secure a credit line is now a common complaint among BTC miners,

while others say rising interest rates worsen their situation. BTC

Miners Fail To Capitalize On Recent Price Rallies Bitcoin mining is

inextricably linked to the digital asset’s extreme volatility. For

example, many of our miners failed to capitalize on the rumors of

Bitcoin ETFs circulating in late 2023. In January 2024, the

Securities Exchange Commission (SEC) finally approved the

applications of at least 11 ETFs, pushing Bitcoin to breach the

$70k level. The sudden increase in the asset’s valuation only

showed that the mining industry is sensitive to these price

movements, especially after the halving of rewards took effect.

Today, many mining analysts are looking at models that can

anticipate the asset’s continuing increase in hash rate. Current

models used by most miners expect the rate to hit 765 EH/s. Time

For BTC Mining To Embrace Alternative Energy Sources? One of the

complaints against BTC mining is that it hurts the environment due

to the massive energy requirements, not to mention the carbon

footprint it emits. Experts say that if miners use alternative

energy sources, we can reduce our carbon footprint by 63% by 2050.

Miners should be ready to embrace these alternative energy sources

since expenses grow as the hash rate increases. Related Reading:

Solana DeFi Momentum Soars With $5.7 Billion Locked In Q3 As Costs

Rise, Some Bitcoin Miners Turn To AI Since mining efficiency is

starting to fall, many miners are looking for ways to augment their

revenues. For example, many experienced miners are holding tokens

instead of mining them. Others turn to AI-related solutions as a

potential source of revenue. It’s safe to say that the BTC mining

industry is entering a new phase. When planning and moving forward,

miners and other stakeholders must consider the challenges, from

costs to compliance to competition. As costs continue to increase,

miners must find solutions and options to remain profitable.

Featured image from Dall-E, chart from TradingView

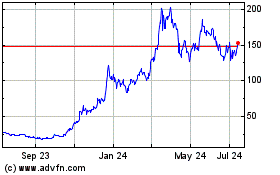

Solana (COIN:SOLUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Solana (COIN:SOLUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024