US Mega Banks JP Morgan And Wells Fargo Unveil Bitcoin Exposure As BTC Drops To $60,000

May 11 2024 - 9:00PM

NEWSBTC

JP Morgan and Wells Fargo, two of the largest banks in the United

States, have announced their investments into Spot Bitcoin ETFs,

unveiling their exposure to BTC, the world’s largest

cryptocurrency. This significant development comes amidst the

persistent downturn in the crypto market, resulting in BTC’s price

dipping slightly above $60,000. US Financial Banks Expose

Spot Bitcoin ETF Holdings American financial services companies,

Wells Fargo and JP Morgan, have revealed their exposure to BTC by

disclosing their adoption of Spot Bitcoin ETFs in a recent filing.

This decision to invest in BTC ETFs marks a notable change from the

banks’ previous cautious approach to cryptocurrencies.

Related Reading: Crypto Analyst Says XRP Price Can Break Out From

Falling Pennant, But Can It Reach $1? Wells Fargo revealed in its

new filing to the United States Securities and Exchange Commission

(SEC) that it currently holds 2,245 shares of Grayscale Bitcoin

Trust (GBTC), valued at $121,207, which it has since converted into

an ETF. Additionally, the American bank holds 37 shares of the

ProShares Bitcoin Strategy ETF (BITO), valued at $1,195. On

the other hand, JP Morgan, which holds about $2.9 trillion in

Assets Under Management (AUM), has revealed its total Spot BTC ETF

holdings in an SEC filing. The bank reported that it had purchased

about $760,000 worth of shares of BlackRock’s iShares Bitcoin Trust

(IBIT), Fidelity’s Wise Origin Bitcoin Fund (FBTC), Grayscale

Bitcoin Trust (GBTC), Bitwise Bitcoin ETF, and ProShares Bitcoin

Strategy ETF (BITO). Moreover, JP Morgan also owns about

25,021 shares valued at $47,000 in cryptocurrency ATM provider,

Bitcoin Depot. The investment company also unveiled its exposure to

Spot BTC ETFs just hours after Wells Fargo’s announcement.

Despite the regulatory uncertainty and the market’s continuous

volatility, institutional interest in cryptocurrencies,

particularly BTC, has been growing rapidly. Bloomberg senior

analyst, Eric Balchunas also forecasted that more financial

services companies would likely follow JP Morgan and Wells Fargo’s

footsteps to unveil holdings in Spot Bitcoin ETFs as market makers

or Authorized Participants (APs). BTC Price sUFFERS More

Declines Despite the increasing interest from traditional financial

institutions seeking exposure to BTC, the price of the

cryptocurrency has shown a surprising lack of bullish momentum.

Since its halving event on April 20, BTC has been trading sideways,

witnessing continuous declines that have pushed its price down to

around $57,000 previously. Related Reading: Crypto Analyst

Sets $10 Price Target For Cardano As Volume Jumps 90% The

cryptocurrency, which recorded an all-time high above $73,000 in

March, has seen a 14.20% drop over the past month. Additionally,

Bitcoin gave up a large portion of its gains before the halving and

is currently trading at $60,494, according to CoinMarketCap.

Blockchain analytics platform, Santiment, revealed that the ongoing

lack of interest in BTC and the broader market sentiments could be

a strong sign that the cryptocurrency is getting close to its

bottom. BTC price falls below $61,000 | Source: BTCUSD on

Tradingview.com Featured image from PlasBit, chart from

Tradingview.com

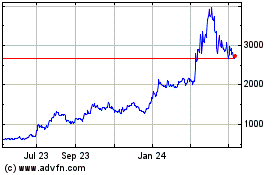

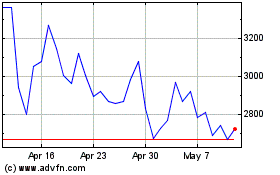

Maker (COIN:MKRUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Maker (COIN:MKRUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024