TIDMWAFR

RNS Number : 7548U

Virgata Services Ltd

08 April 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

8 April 2021

FIRM CASH OFFER

BY

VIRGATA SERVICES LIMITED

FOR

WALLS & FUTURES REIT PLC

Summary

-- Virgata Services Limited ("Virgata") is pleased to announce

the terms of its firm cash offer ("Offer") to acquire the entire

issued and to be issued ordinary share capital of Walls &

Futures REIT plc ("Walls & Futures").

-- Under the terms of the Offer, which will be subject to the

Conditions and further terms to be set out in the Offer Document,

Walls & Futures' Shareholders will be entitled to receive:

for each Walls & Futures Share: 50 pence in cash

-- The Offer values the entire issued ordinary share capital of

Walls & Futures at approximately GBP1.9 million and represents

a material premium of approximately:

-- 42.9 per cent. to the Closing Bid Price of 35 pence per Walls

& Futures Share on the Last Practicable Date; and

-- 25 per cent. to the Closing Mid Price of 40 pence per Walls

& Futures Share on the Last Practicable Date.

-- The Closing B id P rice represents a significant discount of

12.5 per cent. to the Closing Mid Price, reflecting the lack of

liquidity for shareholders wishing to dispose of their Walls &

Futures Shares. Virgata believes that the Offer provides a cash

exit (with no transaction fees) for Walls & Futures'

Shareholders, without suffering the significant impact of the

Bid-Offer Spread (being the difference between the prices quoted

for an immediate sale and an immediate purchase of a share) in

Walls & Futures Shares .

-- It is intended that the Offer be effected by means of a

takeover offer within the meaning of Part 28 of the Companies

Act.

-- If, after the date of this announcement, any dividend and/or

other distribution and/or other return of capital is announced,

declared or paid in respect of the Walls & Futures Shares,

Virgata reserves the right to reduce the Offer by an amount up to

the amount of such dividend and/or distribution and/or return of

capital so announced, declared or paid, in which case any reference

in this announcement or the Offer Document to the Offer for the

Walls & Futures Shares will be deemed to be a reference to the

Offer as so reduced.

-- Depending on the level of valid acceptances for the Offer

received, Virgata intends to keep Walls & Futures as an

independent operating company benefitting from the experience,

expertise and customer reach of Virgata. Virgata therefore intends

to seek to maintain the Admission of Walls & Futures Shares to

trading on the AQSE Growth Market.

-- It is expected that the Offer Document, containing the full

terms and conditions of, and further information about, the Offer,

and the Form of Acceptance (for Walls & Futures' Shareholders

that hold their Walls & Futures Shares in certificated form

only) will be published within 28 days of this announcement (or

such later date as may be agreed with the Takeover Panel) and not

within 14 days of this announcement, other than with the consent of

the Walls & Futures Board.

The full terms of the Offer will be set out in the Offer

Document and, for holders of Walls & Futures Shares in

certificated form, the Form of Acceptance. Relevant documentation

is expected to be sent (or made available on the Virgata website)

to Walls & Futures' Shareholders and, for information purposes,

to persons with information rights in due course. In deciding

whether or not to accept the Offer in respect of their Walls &

Futures Shares, Walls & Futures' Shareholders should consider

the information contained in, and the procedures described in, such

documentation.

This summary should be read in conjunction with, and is subject

to, the full text of this announcement (including the appendices to

this announcement). The Offer will be subject to the Conditions and

certain further terms set out in Appendix 1 and to the full terms

and conditions which shall be set out in the Offer Document and the

Form of Acceptance. Appendix 2 contains the sources and bases of

calculation of certain information contained in this announcement,

and Appendix 3 contains definitions of certain expressions used in

this announcement. The Appendices form part of this

announcement.

For further information, please contact:

Virgata Services Limited

Jordi Goetstouwers Tel: +44 (0) 208 123 9740

Andrew Hilbert Tel: +44 (0) 7748 638 542

Cairn Financial Advisers LLP (financial adviser to Virgata)

James Lewis / Sandy Jamieson Tel: +44 (0) 207 213 0880

Capitalised words and phrases used in this document shall have

the meanings given to them in Appendix 3.

Important notices relating to financial advisers

Cairn Financial Advisers LLP, which is authorised and regulated

by the Financial Conduct Authority in the United Kingdom, is acting

exclusively for Virgata and no one else in connection with the

Offer and will not be responsible to any person other than Virgata

for providing the protections afforded to clients of Cairn

Financial Advisers LLP or for providing advice in relation to the

Offer or any matter referred to herein.

This announcement is for information purposes only and is not an

invitation, inducement or the solicitation of an offer to purchase,

or otherwise acquire, subscribe for or sell or otherwise dispose of

or exercise rights in respect of any securities. The Offer will be

made solely through the Offer Document and any accompanying forms

of acceptance.

Further information

This announcement is not intended to, and does not, constitute,

or form part of, any offer, invitation or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of any securities, or the solicitation of any

vote or approval in any jurisdiction, pursuant to the Offer or

otherwise. The Offer will be made solely by means of the Offer

Document and the Form of Acceptance accompanying the Offer

Document, which will contain the full terms of, and Conditions to,

the Offer, including details of how the Offer may be accepted. Any

response to the Offer should be made only on the basis of

information contained in the Offer Document. Walls & Futures'

Shareholders are advised to read the formal documentation in

relation to the Offer carefully once it has been despatched.

This announcement has been prepared for the purposes of

complying with English law, UK MAR, the rules of the Aquis Exchange

and the Code and the information disclosed may not be the same as

that which would have been disclosed if this announcement had been

prepared in accordance with the laws and regulations of any

jurisdiction outside the United Kingdom.

Overseas jurisdictions

The distribution of this announcement in jurisdictions other

than the United Kingdom and the ability of Walls & Futures'

Shareholders who are not resident in the United Kingdom to

participate in the Offer may be affected by the laws of relevant

jurisdictions. Therefore any persons who are subject to the laws of

any jurisdiction other than the United Kingdom or Walls &

Futures' Shareholders who are not resident in the United Kingdom

will need to inform themselves about, and observe, any applicable

legal or regulatory requirements. Any failure to comply with the

applicable restrictions may constitute a violation of the

securities laws of any such jurisdiction. Further details in

relation to overseas Walls & Futures' Shareholders will be

contained in the Offer Document.

The Offer is not being, and will not be, made available,

directly or indirectly, in or into or by the use of the mails of,

or by any other means or instrumentality of interstate or foreign

commerce of, or any facility of a national state or other

securities exchange of, any Restricted Jurisdiction unless

conducted pursuant to an exemption from the applicable securities

laws of such Restricted Jurisdiction.

Accordingly, copies of this announcement and all documents

relating to the Offer are not being, and must not be, directly or

indirectly, mailed, transmitted or otherwise forwarded, distributed

or sent in, into or from any Restricted Jurisdiction except

pursuant to an exemption from the applicable securities laws of

such Restricted Jurisdiction and persons receiving this

announcement (including, without limitation, agents, nominees,

custodians and trustees) must not distribute, send or mail it in,

into or from such jurisdiction. Any person (including, without

limitation, any agent, nominee, custodian or trustee) who has a

contractual or legal obligation, or may otherwise intend, to

forward this announcement and/or the Offer Document and/or any

other related document to a jurisdiction outside the United Kingdom

should inform themselves of, and observe, any applicable legal or

regulatory requirements of their jurisdiction.

Forward-looking statements

This announcement may contain certain "forward-looking

statements" with respect to Virgata Walls & Futures and/or the

Walls & Futures Group. These forward-looking statements can be

identified by the fact that they do not relate only to historical

or current facts. Forward-looking statements often use words such

as 'anticipate', 'target', 'expect', 'estimate', 'intend', 'plan',

'goal', 'believe', 'will', 'may', 'should', 'would', 'could' or

other words or terms of similar meaning or the negative thereof.

Forward-looking statements include statements relating to the

following: (i) future capital expenditures, expenses, revenues,

earnings, synergies, economic performance, indebtedness, financial

condition, dividend policy, losses and future prospects; (ii)

business and management strategies and the expansion and growth of

Virgata or the Walls & Futures Group and potential synergies

resulting from the Acquisition; and (iii) the expected timing and

scope of the Acquisition.

These forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause actual

results, performance or developments to differ materially from

those expressed in, or implied by, such forward-looking statements.

These forward-looking statements are based on numerous assumptions

regarding present and future strategies and environments. You are

cautioned not to place undue reliance on such forward-looking

statements, which speak only as of the date of this announcement.

All subsequent oral or written forward-looking statements

attributable to Virgata, Walls & Futures and/or the Walls &

Futures Group or any person acting on their behalf (respectively)

are expressly qualified in their entirety by the cautionary

statement above. Should one or more of these risks or uncertainties

materialise, or should underlying assumptions prove incorrect,

actual results may vary materially from those described in this

announcement. Virgata, Walls & Futures and/or the Walls &

Futures Group assume no obligation to update publicly or revise

forward-looking or other statements contained in this announcement,

whether as a result of new information, future events or otherwise,

except to the extent legally required.

Rounding

Certain figures included in this announcement have been

subjected to rounding adjustments. Accordingly, figures shown for

the same category presented in different tables may vary slightly

and figures shown as totals in certain tables may not be an

arithmetic aggregation of the figures that precede them.

No profit forecasts or estimates

No statement in this announcement is intended as a profit

forecast or estimate for any period and no statement in this

announcement should be interpreted to mean that earnings or

earnings per share for Virgata or Walls & Futures, as

appropriate, for the current or future financial years would

necessarily match or exceed the historical published earnings or

earnings per share for Virgata or Walls & Futures, as

appropriate.

Information relating to Walls & Futures' Shareholders

Walls & Futures' Shareholders should be aware that

addresses, electronic addresses and certain other information

provided by Walls & Futures' Shareholders and other relevant

persons for the receipt of communications from Walls & Futures

may be provided to Virgata during the Offer Period as required

under Section 4 of Appendix 4 to the Code.

Publication on website and availability of hard copies

A copy of this announcement and the display documents required

to be published pursuant to Rule 26.1 and 26.2 of the Code will be

made available, free of charge and subject to certain restrictions

relating to persons resident in Restricted Jurisdictions, on

Virgata's website at www.virgatagroup.com/westminster by no later

than 12.00 noon (London time) on the business day following the

release of this announcement. For the avoidance of doubt, neither

the contents of such website nor the content of any other website

accessible from hyperlinks on such websites is incorporated into,

or forms part of, this announcement.

In accordance with Rule 30.3 of the Code, a person so entitled

may request a hard copy of this announcement, free of charge, by

contacting Neville Registrars Limited on 0121 585 1131 (+44 (0) 121

585 1131). For persons who receive a copy of this announcement in

electronic form or via a website notification, a hard copy of this

announcement will not be sent unless so requested. In accordance

with Rule 30.3 of the Code, a person so entitled may also request

that all future documents, announcements and information to be sent

to them in relation to the Offer should be in hard copy form.

Disclosure requirements of the Code

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th business day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s), save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 pm (London time) on the business

day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.or g.uk ,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

If you are in any doubt about the contents of this announcement

or the action you should take, you are recommended to seek your own

independent financial advice immediately from your stockbroker,

bank manager, solicitor or independent financial adviser duly

authorised under the Financial Services and Markets Act 2000 (as

amended) if you are resident in the United Kingdom or, if not, from

another appropriate authorised independent financial adviser.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

8 April 2021

FIRM CASH OFFER

BY

VIRGATA SERVICES LIMITED

FOR

WALLS & FUTURES REIT PLC

1. Introduction

On 16 February 2021, Virgata approached the Walls & Futures

Board regarding a possible cash offer for the issued and to be

issued share capital of the Company of 45 pence for each Walls

& Futures Share (the "Initial Approach"). The Initial Approach

was unequivocally rejected by the Walls & Futures Board,

without entering into any discussions with Virgata or Virgata's

advisers.

On 6 April 2021, Virgata approached the Walls & Futures

Board with a revised proposal (the "Improved Approach"). The

Improved Approach offered for Virgata to subscribe, via a Whitewash

process, for 4,000,000 newly issued shares in the Company (the

"Placing") at 50 pence per Walls & Futures Share (the "Placing

Price"). The Placing would have raised GBP2.0 million for the

Company (the "Placing Proceeds") and made Virgata a controlling

shareholder in Walls & Futures. Additionally, Virgata proposed

that following the Placing, GBP0.75 million of the Placing Proceeds

be used to acquire shares, by an appropriate mechanism, from

existing Walls & Futures' Shareholders at the Placing Price,

enabling a cash exit to shareholders that may desire it.

Virgata believed that the Improved Approach would have enabled

existing shareholders of Walls & Futures to benefit from its

experience and access to capital, enabling Walls & Futures to

scale the business and through time, seek to close the discount at

which Walls & Futures shares trade relative to the underlying

net asset value.

The Placing Price, at 50 pence per Walls & Futures Share,

was a material 42.9 per cent. premium to the Closing Bid Price of

35 pence per Walls & Futures Share on 1 April, being the last

business day prior to the submission of the Improved Approach to

the Board of the Company.

The Improved Approach was also unequivocally rejected by the

Walls & Futures Board without entering into discussions with

Virgata or Virgata's advisers.

Virgata recognizes that Walls & Futures' ability to grow the

value of its portfolio of investment property is currently

constrained by a lack of capital. Furthermore, Walls & Futures'

annual revenue is exceeded by its annual costs, therefore Walls

& Futures consumes an amount of cash each year to continue.

Without the financial means to acquire further investment

properties to increase the annual revenue, Walls & Futures will

remain in a position where it is unable to fund the cost of its

business from revenue, and the Virgata management believe it will

be forced to either raise more capital or reduce costs further, or

both. As a result, Virgata is extremely disappointed that the Board

of Walls & Futures was so quick to reject the Improved Approach

without discussion.

Virgata has therefore decided to make a firm cash offer direct

to Walls & Futures' Shareholders.

2. The Offer

Under the terms of the Offer, which will be subject to the

satisfaction (or waiver, if permitted) of the Conditions set out in

Appendix 1, to the certain further terms set out in Appendix 1, and

to the full terms and conditions which will be set out in the Offer

Document, Walls & Futures' Shareholders will be entitled to

receive:

for each Walls & Futures Share: 50 pence in cash

The Offer values the entire issued ordinary shares of Walls

& Futures at GBP1.9 million and represents a material premium

of approximately:

-- 42.9 per cent. to the Closing Bid Price of 35 pence per Walls

& Futures Share on the Last Practicable Date; and

-- 25 per cent. to the Closing Mid Price of 40 pence per Walls

& Futures Share on the Last Practicable Date.

Virgata believes that the Offer also provides a cash exit (with

no transaction fees) for Walls & Futures' Shareholders, without

suffering the significant impact of the Bid-Offer Spread (being the

difference between the prices quoted for an immediate sale and an

immediate purchase of a share) in Walls & Futures Shares.

Virgata reserves the right to reduce the offer consideration by

the amount of any dividend (or other distribution) which is paid or

becomes payable by Walls & Futures to its shareholders, unless,

and to the extent that, Walls & Futures' Shareholders are

entitled to receive and retain all or part of a specified dividend

(or other distribution) in addition to the offer consideration;

and, if Virgata exercises the right to reduce the offer

consideration by all or part of the amount of a dividend (or other

distribution) that has not been paid, Walls & Futures'

Shareholders will be entitled to receive and retain that dividend

(or other distribution).

3. Information on Walls & Futures

Walls & Futures was incorporated to acquire the assets of

the Walls & Futures London Growth Fund by way of a

restructuring and to raise additional equity finance to acquire,

refurbish or develop residential properties in the UK.

On admission to ISDX in November 2016, the Company's stated

strategy was to invest in cities and towns across the UK with an

emphasis on acquiring assets that can be developed or redeveloped

to create value and enhance yields. The initial focus was on the

provision of residential housing for the private rented and

supported housing sectors, providing a blend of capital growth and

higher yielding assets.

On admission the Company raised just over GBP1 million at an

issue price of 100 pence per Walls & Futures Share.

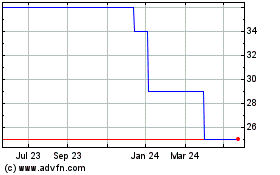

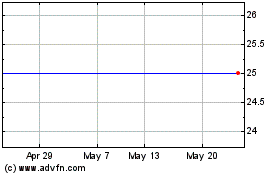

Since the Company's admission, the share price of each Walls

& Futures Share has fallen from 100 pence per Walls &

Futures Share to a Closing Bid Price of 35 pence on the Last

Practicable Date. A fall of 65 per cent..

Following admission, the Company distributed no dividends for

the financial years ended 31 March 2017, 2018, 2019 or 2020.

4. Information on Virgata

Virgata is a 100 per cent. subsidiary of Virgata Holdings SA

("VHSA"). VHSA is the family office of the Goetstouwers family,

created in 2015.

Jordi Goetstouwers, Managing Director of VHSA, was a Senior

Managing Director for Lone Star Funds in Europe until 2015 and in

this capacity during the period from 2005 to 2015 he originated,

executed, managed and exited transactions in credit instruments and

commercial property worth several billion euros across a variety of

European jurisdictions. He is also a former supervisory board

member of Corealcredit Bank AG (now part of Aareal Bank) and IKB

Deutsche Industriebank AG and currently a member of the investment

committee of Eurazeo Patrimoine, the French real estate private

equity firm.

Since inception, Virgata has demonstrated a strong track record

of value creation within its property portfolio and currently owns

in excess of EUR80 million of property directly, as well as stakes

in sizeable (re)development projects in the Netherlands. Thanks to

active and diligent asset management Virgata has succeeded in

increasing the value of its largest asset, the Van Nellefabriek

campus in Rotterdam more than threefold since acquisition in

2018.

Virgata expects that its existing business will be unchanged by

the acquisition of shares in Walls & Futures. This is due to

Virgata's current business activities being entirely outside the UK

whereas Walls & Futures' business activities are entirely

within the UK.

Virgata does not anticipate any material changes in conditions,

balance of skills or functions for its employees and management,

nor for its places of business and HQ / HQ functions as a result of

the Offer.

5. Background and reasons for the Offer

Virgata recognises that since the Initial Public Offering of the

Company's shares at 100 pence on 29 November 2016, the share price

available to a Walls & Futures shareholder wishing to exit in

the market has reduced by 65 per cent. over a four year period to a

Closing Bid Price of 35 pence on 7 April 2021.

Virgata believes that Walls & Futures is restricted in its

ability to create shareholder value because it has insufficient

capital to invest in acquiring further properties and the annual

revenue of Walls & Futures being exceeded by the annual

administrative expenses of the Company.

Virgata intends to preserve, and where possible expand, Walls

& Futures' property holding and development business by using

additional funding and other sources of investment capital

available to Virgata.

Virgata believes that the Offer provides a compelling

opportunity for a Walls & Futures shareholder to realise a cash

exit, at no cost, from their shareholding in the Company.

Following completion of the transaction, and complementary to

the intentions set out in Section 6 below, Virgata intends to

conduct a detailed strategic and operational review of the Walls

& Futures business (the "Strategic Review") and to identify

opportunities arising from the transaction.

6. Intentions of Virgata with regards to Walls & Futures'

business, management, employees, pension scheme and listing

status

Lack of access to undertake detailed planning

Virgata has not been provided with access to Walls &

Futures' operational management or internal Walls & Futures

data and therefore has only been able to undertake diligence from

industry information and publicly available data. Accordingly,

Virgata has not been able to undertake any substantial analysis in

order to formulate detailed plans or intentions regarding the

impact of the Offer on Walls & Futures' business.

Intentions in respect of the business of Walls & Futures,

its management and employees

Virgata, through its subsidiaries operates a portfolio of

commercial and residential properties in the Netherlands, Malta and

Belgium (through an affiliate). Virgata has successfully grown its

business to date by acquiring commercial properties with existing

management and supporting the management with financial and

managerial resources to increase the value of the properties and

businesses. Virgata 's strategy is to operate its businesses with

management that are experienced in the markets and geographical

regions in which their business operates. Virgata does not manage

the operations of its businesses from a central function,

preferring to retain incentivised management teams within each

operating business.

Since the IPO of Walls & Futures in 2016, the Company has

had three (3) employees, Mr J McTaggart, Mr D White and Mr P Wylie,

all of whom are directors of Walls & Futures. The company's

registered and head office is located on the 3(rd) Floor, 111

Buckingham Palace Road, London, SW1W 0SR.

The business of Walls & Futures is an excellent strategic

fit for Virgata which currently has no presence or activities in

the UK. This is an opportunity for Virgata to enter the UK market

for commercial and residential property, which is attractive.

Virgata recognizes that Walls & Futures' ability to grow the

value of its portfolio of investment property is currently

constrained by a lack of capital. Furthermore, Walls & Futures'

annual revenue is exceeded by its annual costs, therefore Walls

& Futures consumes an amount of cash each year to continue.

Without the financial means to acquire further investment

properties to increase the annual revenue, Walls & Futures will

remain in a position where it is unable to fund the cost of its

business from revenue, and it will be forced to either raise more

capital or reduce costs further, or both.

Virgata intends to grow the business of Walls & Futures as a

property business operating in the UK property market through

further acquisitions of properties. Virgata therefore intends that

Walls & Futures retains a management team in the UK, focused on

growing Walls & Futures' property business in the UK. Virgata

does not intend that any of the current managerial functions of

Walls & Futures are undertaken elsewhere within Virgata's group

of businesses. Virgata has significant management and financial

capabilities that it can deploy to support the growth of Walls

& Futures.

This growth will be funded through a combination of Virgata's

financial resources and, in the event that Walls & Futures

Shares remain listed on the AQSE Growth Market, potentially through

the issue of new shares using Walls & Futures' public listing

once the Company has a demonstrable track record of growth.

However, given the lack of access to Walls & Futures, its

management and employees, Virgata intends to conduct the Strategic

Review following completion of the transaction. The Strategic

Review will be carried out alongside the appropriate operational

management in order to formulate a detailed plan to drive

performance and improve their businesses. These plans may

include:

-- broadening the categories of property in which Walls & Futures invests;

-- evaluation of the company's fixed cost base and directors; and

-- evaluation of the company's banking and financing arrangements.

An important aspect of the Strategic Review will be

understanding the balance of UK property income and the Director

Payments. In the period covering the last three annual reports of

Walls & Futures, Director Payments totalled GBP369,681,

compared to total UK property income of GBP376,815. When other

costs of sales, administrative and finance expenses are considered,

this is not a balance that Virgata could, based on the information

in the public domain, allow to continue.

As a result, while Virgata can confirm that the existing

contractual and statutory employment rights, including in relation

to existing pensions contributions, of Walls & Futures'

directors will be fully safeguarded in accordance with the

applicable law, the Strategic Review may result in the need to

reduce the headcount within Walls & Futures, change the balance

of skills and the functions of the directors and / or redeploy the

technical skills and expertise of Walls & Futures' directors in

the wider Virgata Group. Given the regulatory requirements of the

AQSE Growth Market, the outcome of the Strategic Review (e.g. in

relation to the number of directors in Walls & Futures) will

also depend on whether Walls & Futures Shares remain traded on

the AQSE Growth Market.

Virgata intends to maintain Walls & Futures' existing

customers and pending conclusion of the Strategic Review, Walls

& Futures' businesses will continue to be operated in the

ordinary course (including as to employment, the conditions of

employment and the balance of the skills and the functions of the

directors, the locations of Walls & Futures' places of business

and the deployment of its fixed assets).

It is expected that the Strategic Review will be completed

within three months of the Offer becoming unconditional in all

respects, with the results of the Strategic Review being

implemented within the following six months.

Intentions in respect of Walls & Futures' research and

development functions and pension scheme

Walls & Futures' latest annual report and accounts does not

disclose any research and development ("R&D") costs nor any

costs or payments in relation to any pension scheme available to

the Walls & Futures directors.

As a result, Virgata does not believe that Walls & Futures

carries out any R&D or makes contributions to any pension

schemes for its directors. It is Virgata's intention that this

would remain the case.

Intentions in respect of Walls & Futures' locations,

headquarters and fixed assets

The annual report and accounts of Walls & Futures do not

disclose any details around the lease terms or rent payable for the

company's head office, located in central London. Given that none

of Walls & Futures' assets are located in central London and

future acquisitions in central London are unlikely given Walls

& Futures' limited resources, the Strategic Review is not

unlikely to conclude that it may be appropriate and more economical

to change the location of Walls & Futures' place of business

and headquarters, which will result in a redeployment of Walls

& Futures' fixed assets and a reduction of its fixed cost

base.Virgata intends that the existing investment property held by

Walls & Futures will be retained for a period that meets the

requirements of the rules applying to Real Estate Investment Trusts

(REITs), and to generate cash to go toward meeting the majority of

its overhead costs. Further to that, Virgata intends that from

time-to-time investment properties shall be sold to realise a

return on investment and liquidate capital to reinvest. Virgata

understands that the amount of tangible assets and investments

(other than investment properties) that Walls & Futures holds

are immaterial.

Intentions in respect of Walls & Futures Shares admission to

trading on the Aquis Exchange

Depending on the level of valid acceptances which are received

for the Offer, if the Offer becomes or is declared unconditional in

all respects, Virgata intends to seek to maintain the admission to

trading of the Walls & Futures Shares on the AQSE Growth

Market. However, in the event that the number of Walls &

Futures Shares in public hands falls below 10 per cent. on

completion of the Offer and Walls & Futures is not in

compliance with Rule 2.12 of the Aquis Rules, Virgata would, with

Walls & Futures, enter discussions with the Aquis Exchange to

assess the options available at that time to rectify this.

7. Walls & Futures Warrants

There are currently 43,485 Warrants in issue, each exercisable

at 100 pence per Walls & Futures Share on or before 30

September 2022.

As a result of the Warrants being "out of the money", Virgata is

not required to make an offer for the Warrants under Rule 15 of the

Code. Accordingly, no offer is being made for the Warrants.

8. Financing arrangements

The cash consideration payable by Walls & Futures under the

Offer will be financed by cash resources from the Goetstouwers

family, made available to Virgata through the Facility

Agreement.

Cairn Financial Advisers LLP, in its capacity as financial

adviser to Virgata, is satisfied that sufficient resources are

available to Virgata to satisfy, in full, the cash consideration

payable to Walls & Futures' Shareholders under the terms of the

Offer.

9. Conditions and further terms of the Offer

The Offer is subject to the Conditions and certain further terms

set out in Appendix 1 to this announcement and which will be set

out in the Offer Document. Under Rule 31.7 of the Code, except with

the consent of the Panel, all the Conditions must be satisfied or

the Offer will lapse within 21 days of the first closing date or

the date the Offer becomes or is declared unconditional as to

acceptances, whichever is the later. Rule 31.7 also provides that

the Panel's consent to an extension will normally only be granted,

broadly, if the outstanding condition involves a material official

authorisation or regulatory clearance relating to the

transaction.

Walls & Futures' Shareholders who have accepted the Offer

will not be able to withdraw their acceptances from the date on

which the Offer becomes or is declared unconditional as to

acceptances until the date on which the Offer becomes or is

declared unconditional in all respects or lapses. Accordingly, if

the 21 day period in Rule 31.7 is extended by the Panel in the

manner described above, Walls & Futures' Shareholders will not

be able to withdraw acceptances for the duration of this extended

period.

Virgata will keep the Offer open for acceptances for at least 14

days following the date on which the Offer becomes or is declared

unconditional in all respects in accordance with the requirements

of the Code.

10. Structure of the Offer and the Offer Document

It is intended that the Offer be implemented by means of a

takeover offer under the Code and within the meaning given to that

term in section 974 of the Companies Act. Virgata reserves the

right, subject to the consent of Walls & Futures and the

Takeover Panel, to effect the Acquisition by way of a

Court-sanctioned scheme of arrangement under Part 26 of the

Companies Act.

The Walls & Futures Shares will be acquired by Virgata fully

paid, or credited as fully paid, and free from all liens, equities,

charges, equitable interests, encumbrances, rights of pre-emptions

and other third party rights and/or interests of any nature

whatsoever and together with all rights attaching to them, now and

in the future, including voting rights and the right to receive and

retain all dividends, interests and other distributions (if any)

declared made or paid after 8 April 2021 (being the date of the

announcement of the Offer by Virgata for Walls & Futures).

The Offer Document and the Form of Acceptance accompanying the

Offer Document will be published within 28 days of this

announcement (or such later date as may be agreed with the Takeover

Panel), and not within 14 days of this announcement, other than

with the consent of the Walls & Futures Board. The Offer

Document and accompanying Form of Acceptance will be made available

to all Walls & Futures' Shareholders at no charge to them.

Walls & Futures' Shareholders are urged to read the Offer

Document and the accompanying Form of Acceptance when they are sent

to them because they will contain important information.

11. Compulsory acquisition

If Virgata receives acceptances under the Offer in respect of,

and/or otherwise acquires, 90 per cent. or more of the Walls &

Futures Shares to which the Offer relates by nominal value and

voting rights attaching to such shares and assuming that all of the

other conditions of the Offer have been satisfied or waived (if

capable of being waived), Virgata would have rights pursuant to the

provisions of Chapter 3 of Part 28 of the Companies Act to acquire

compulsorily the remaining Walls & Futures Shares in respect of

which the Offer has not been accepted on the same terms as the

Offer.

However, as Virgata intends to seek to maintain the admission to

trading on the Aquis Exchange of Walls & Futures Shares, it

does not currently intend to exercise any rights of compulsory

acquisition which it may have under Chapter 3 of Part 28 of the

Companies Act.

12. Disclosure of interests in Walls & Futures

As at the close of business on 7 April 2021, being the Last

Practicable Date, none of Virgata, nor the Virgata Directors, nor

so far as the Virgata Board is aware, any person acting, or deemed

to be acting, in concert (within the meaning of the Code) with

Virgata has;

(a) had an interest in, or right to subscribe for, relevant

securities of Walls & Futures;

(b) had any short position in (whether conditional or absolute

and whether in the money or otherwise), including any short

position under a derivative, any agreement to sell or any delivery

obligation or right to require another person to purchase or take

delivery of, relevant securities of Walls & Futures;

(c) had procured an irrevocable commitment to accept the terms

of the Offer in respect of relevant securities of Walls &

Futures;

(d) had borrowed or lent any Walls & Futures Shares; or

(e) entered into any financial collateral arrangement in respect

of relevant securities in Walls & Futures.

Furthermore no arrangement exists between Virgata or Walls &

Futures or a person acting in concert with Virgata or Walls &

Futures in relation to Walls & Futures Shares. For these

purposes, an "arrangement" includes any indemnity or option

arrangement, any agreement or any understanding, formal or

informal, of whatever nature, relating to Walls & Futures

Shares which may be an inducement to deal or refrain from dealing

in such securities.

13. General

The Offer will be subject to the Conditions and other terms set

out in this announcement and to the full terms and Conditions which

will be set out in the Offer Document.

Appendix 1 to this announcement contains a summary of the

principal terms and Conditions. The Offer Document will be posted

to Walls & Futures' Shareholders (and, for information only, to

Walls & Futures Warrant holders) as soon as is practicable and,

in any event, within 28 days of the date of this announcement,

unless Virgata and Walls & Futures otherwise agree, and the

Takeover Panel consents, to a later date. Appendix 2 contains

details of sources of information and bases of calculation

contained in this announcement. Appendix 3 contains definitions of

certain terms used in this announcement.

14. Publication of this announcement and availability of other information

A copy of this announcement will be made available (subject to

certain restrictions relating to persons resident in Restricted

Jurisdictions) on Virgata's website at

www.virgatagroup.com/westminster by no later than 12.00 noon

(London time) on the business day following the release of this

announcement in accordance with Rule 26.1 of the Code. Neither the

contents of this website nor the content of any other website

accessible from hyperlinks on such website is incorporated into, or

forms part of, this announcement.

A copy of this announcement is being made available to employees

of the Virgata Group.

In accordance with Rule 30.3 of the Code, a person so entitled

may request a hard copy of this announcement, free of charge, by

contacting Neville Registrars Limited on 0121 585 1131 (or +44 (0)

121 585 1131 if telephoning from outside the UK). For persons who

receive a copy of this announcement in electronic form or via a

website notification, a hard copy of this announcement will not be

sent unless so requested. In accordance with Rule 30.3 of the Code,

a person so entitled may also request that all future documents,

announcements and information to be sent to them in relation to the

Offer should be in hard copy form.

The following documents are also available on Virgata's website

at:

www.virgatagroup.com/westminster

(i) This announcement

(ii) Cairn Financial Advisers' consent letter

15. Consent

Cairn Financial Advisers has given and has not withdrawn its

written consent to the issue of this Announcement with the

inclusion herein of the references to its name in the form and

context in which it appears.

For further information, please contact:

Virgata Services Limited

Jordi Goetstouwers Tel: +44 (0) 208 123 9740

Andrew Hilbert Tel: +44 (0) 7748 638 542

Cairn Financial Advisers LLP (financial adviser to Virgata)

James Lewis / Sandy Jamieson Tel: +44 (0) 207 213 0880

Important Information

This announcement is for information purposes only and is not an

invitation, inducement or the solicitation of an offer to purchase,

or otherwise acquire, subscribe for or sell or otherwise dispose of

or exercise rights in respect of any securities. The Offer will be

made solely through the Offer Document and any accompanying forms

of acceptance and/or proxy.

Important notices relating to financial advisers

Cairn Financial Advisers LLP, which is authorised and regulated

by the Financial Conduct Authority in the United Kingdom, is acting

exclusively for Virgata and no one else in connection with the

Offer and will not be responsible to any person other than Virgata

for providing the protections afforded to clients of Cairn

Financial Advisers LLP or for providing advice in relation to the

Offer or any matter referred to herein.

This announcement is for information purposes only and is not an

invitation, inducement or the solicitation of an offer to purchase,

or otherwise acquire, subscribe for or sell or otherwise dispose of

or exercise rights in respect of any securities. The Offer will be

made solely through the Offer Document and any accompanying forms

of acceptance.

Further information

This announcement is not intended to, and does not, constitute,

or form part of, any offer, invitation or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of any securities, or the solicitation of any

vote or approval in any jurisdiction, pursuant to the Offer or

otherwise.

The Offer will be made solely by means of the Offer Document and

the Form of Acceptance accompanying the Offer Document, which will

contain the full terms of, and Conditions to, the Offer, including

details of how the Offer may be accepted. Any response to the Offer

should be made only on the basis of information contained in the

Offer Document. Walls & Futures' Shareholders are advised to

read the formal documentation in relation to the Offer carefully

once it has been despatched.

This announcement has been prepared for the purposes of

complying with English law, UK MAR, the rules of the Aquis Exchange

and the Code and the information disclosed may not be the same as

that which would have been disclosed if this announcement had been

prepared in accordance with the laws and regulations of any

jurisdiction outside the United Kingdom.

Overseas jurisdictions

The distribution of this announcement in jurisdictions other

than the United Kingdom and the ability of Walls & Futures'

Shareholders who are not resident in the United Kingdom to

participate in the Offer may be affected by the laws of relevant

jurisdictions. Therefore any persons who are subject to the laws of

any jurisdiction other than the United Kingdom or Walls &

Futures' Shareholders who are not resident in the United Kingdom

will need to inform themselves about, and observe, any applicable

legal or regulatory requirements. Any failure to comply with the

applicable restrictions may constitute a violation of the

securities laws of any such jurisdiction. Further details in

relation to overseas Walls & Futures' Shareholders will be

contained in the Offer Document.

The Offer is not being, and will not be, made available,

directly or indirectly, in or into or by the use of the mails of,

or by any other means or instrumentality of interstate or foreign

commerce of, or any facility of a national state or other

securities exchange of, any Restricted Jurisdiction unless

conducted pursuant to an exemption from the applicable securities

laws of such Restricted Jurisdiction.

Accordingly, copies of this announcement and all documents

relating to the Offer are not being, and must not be, directly or

indirectly, mailed, transmitted or otherwise forwarded, distributed

or sent in, into or from any Restricted Jurisdiction except

pursuant to an exemption from the applicable securities laws of

such Restricted Jurisdiction and persons receiving this

announcement (including, without limitation, agents, nominees,

custodians and trustees) must not distribute, send or mail it in,

into or from such jurisdiction. Any person (including, without

limitation, any agent, nominee, custodian or trustee) who has a

contractual or legal obligation, or may otherwise intend, to

forward this announcement and/or the Offer Document and/or any

other related document to a jurisdiction outside the United Kingdom

should inform themselves of, and observe, any applicable legal or

regulatory requirements of their jurisdiction.

Forward-looking statements

This announcement may contain certain "forward-looking

statements" with respect to Virgata Walls & Futures and/or the

Walls & Futures Group. These forward-looking statements can be

identified by the fact that they do not relate only to historical

or current facts. Forward-looking statements often use words such

as 'anticipate', 'target', 'expect', 'estimate', 'intend', 'plan',

'goal', 'believe', 'will', 'may', 'should', 'would', 'could' or

other words or terms of similar meaning or the negative thereof.

Forward-looking statements include statements relating to the

following: (i) future capital expenditures, expenses, revenues,

earnings, synergies, economic performance, indebtedness, financial

condition, dividend policy, losses and future prospects; (ii)

business and management strategies and the expansion and growth of

Virgata or the Walls & Futures Group and potential synergies

resulting from the Acquisition; and (iii) the expected timing and

scope of the Acquisition.

These forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause actual

results, performance or developments to differ materially from

those expressed in, or implied by, such forward-looking statements.

These forward-looking statements are based on numerous assumptions

regarding present and future strategies and environments. You are

cautioned not to place undue reliance on such forward-looking

statements, which speak only as of the date of this announcement.

All subsequent oral or written forward-looking statements

attributable to Virgata, Walls & Futures and/or the Walls &

Futures Group or any person acting on their behalf (respectively)

are expressly qualified in their entirety by the cautionary

statement above. Should one or more of these risks or uncertainties

materialise, or should underlying assumptions prove incorrect,

actual results may vary materially from those described in this

announcement. Virgata, Walls & Futures and/or the Walls &

Futures Group assume no obligation to update publicly or revise

forward-looking or other statements contained in this announcement,

whether as a result of new information, future events or otherwise,

except to the extent legally required.

Rounding

Certain figures included in this announcement have been

subjected to rounding adjustments. Accordingly, figures shown for

the same category presented in different tables may vary slightly

and figures shown as totals in certain tables may not be an

arithmetic aggregation of the figures that precede them.

No profit forecasts or estimates

No statement in this announcement is intended as a profit

forecast or estimate for any period and no statement in this

announcement should be interpreted to mean that earnings or

earnings per share for Virgata or Walls & Futures, as

appropriate, for the current or future financial years would

necessarily match or exceed the historical published earnings or

earnings per share for Virgata or Walls & Futures, as

appropriate.

Information relating to Walls & Futures' Shareholders

Walls & Futures' Shareholders should be aware that

addresses, electronic addresses and certain other information

provided by Walls & Futures' Shareholders and other relevant

persons for the receipt of communications from Walls & Futures

may be provided to Virgata during the Offer Period as required

under Section 4 of Appendix 4 to the Code.

Disclosure requirements of the Code

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th business day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s), save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 pm (London time) on the business

day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

Appendix 1

Conditions of the Offer

The Offer will be made on the terms and Conditions set out in

this Appendix and to be set out in the Offer Document and, in the

case of certificated Walls & Futures Shares, the Form of

Acceptance.

1. Conditions of the Offer

The Offer shall be conditional upon:

Acceptance Condition

valid acceptances being received (and not, where permitted,

withdrawn) by not later than 1.00 p.m. (London time) on the first

closing date of the Offer (or such later time(s) and/or date(s) as

Virgata may, in accordance with the Takeover Code or with the

consent of the Takeover Panel, decide) in respect of not less than

51 per cent. of the Walls & Futures Shares to which the Offer

relates and of the voting rights carried by those shares (or such

lower percentage as Virgata may decide), provided that (unless

agreed by the Takeover Panel) this condition will not be satisfied

unless Virgata and/or any of Virgata's wholly owned subsidiaries

shall have acquired or agreed to acquire (pursuant to the Offer or

otherwise) Walls & Futures Shares carrying, in aggregate, more

than 50 per cent. of the voting rights then normally exercisable at

general meetings of Walls & Futures; and for this purpose:

(i) Walls & Futures Shares which have been unconditionally

allotted but not issued before the Offer becomes, or is declared,

unconditional as to acceptances, whether pursuant to the exercise

of any outstanding subscription or conversion rights or otherwise

shall be deemed to carry the voting rights they shall carry upon

issue;

(ii) the expression "Walls & Futures Shares to which the

Offer relates" shall be construed in accordance with Chapter 3 of

Part 28 of the Companies Act;

(iii) Walls & Futures Shares (if any) that cease to be held

in treasury before the Offer becomes, or is declared, unconditional

as to acceptances are Walls & Futures Shares to which the Offer

relates; and

(iv) valid acceptances shall be deemed to have been received in

respect of Walls & Futures Shares which are treated for the

purposes of Part 28 of the Companies Act as having been acquired or

contracted to be acquired by Virgata by virtue of acceptances of

the Offer;

Consents, waiting periods, authorisations and filings

(f) all authorisations, orders, grants, consents, clearances,

licences, permissions and approvals ("Authorisations"), in any

jurisdiction, reasonably considered necessary or appropriate by

Virgata for or in respect of the Offer, the proposed acquisition of

any shares or securities in, or control of, Walls & Futures by

Virgata or the carrying on of the business of any member of the

Wider Walls & Futures Group or Virgata, or any matters arising

therefrom being obtained in terms reasonably satisfactory to

Virgata from all appropriate Relevant Authorities or (without

prejudice to the generality of the foregoing) from any persons or

bodies with whom any member of the Wider Walls & Futures Group

or Virgata has entered into contractual arrangements (in each case

where the absence of such Authorisation would have a material

adverse effect on Virgata) and such authorisations, orders, grants,

consents, clearances, licences, permissions and approvals remaining

in full force and effect and there being no intimation of any

intention to revoke or not to renew the same and all necessary

filings having been made, all appropriate waiting and other time

periods (including extensions thereto) under any applicable

legislation and regulations in any jurisdiction having expired,

lapsed or been terminated and all necessary statutory or regulatory

obligations in any jurisdiction in respect of the Offer or the

proposed acquisition of Walls & Futures by Virgata or of any

Walls & Futures Shares or any matters arising therefrom having

been complied with;

(g) no government or governmental, quasi-governmental,

supranational, statutory, administrative or regulatory body, or any

court, institution, investigative body, association, trade agency

or professional or environmental body or (without prejudice to the

generality of the foregoing) any other person or body in any

jurisdiction (each, a "Relevant Authority") having decided to take,

instituted, implemented or threatened any action, proceeding, suit,

investigation, enquiry or reference or enacted, made or proposed

any statute, regulation or order or otherwise taken any other step

or done anything, and there not being outstanding any statute,

legislation or order, that would or might reasonably be expected to

(in any case to an extent which is material in the context of the

Wider Walls & Futures Group or Virgata, as the case may be or

on the context of the Offer):

(i) make the Offer or its implementation or the proposed

acquisition of Walls & Futures or of any Walls & Futures

Shares or any other shares or securities in, or control of, Walls

& Futures, illegal, void or unenforceable in or under the laws

of any jurisdiction;

(ii) directly or indirectly restrict, restrain, prohibit, delay,

impose additional conditions or obligations with respect to or

otherwise interfere with the implementation of the Offer or the

acquisition of any Walls & Futures Shares by Virgata or control

or management of Walls & Futures by Virgata or any matters

arising therefrom or require amendment to the terms of the

Offer;

(iii) result in a limit or delay in the ability of Virgata, or

render Virgata unable, to acquire some or all of the Walls &

Futures Shares;

(iv) require, prevent, delay or affect the divestiture (or alter

the terms of any proposed divestiture) by Virgata or the Wider

Walls & Futures Group of all or any portion of their respective

businesses, assets or property or of any Walls & Futures Shares

or other securities in Walls & Futures or impose any limitation

on their ability to conduct all or part of their respective

businesses or to own, control or manage all or part of their

respective assets or properties;

(v) impose any limitation on the ability of Virgata to acquire

or hold or exercise effectively, directly or indirectly, all rights

of all or any of the Walls & Futures Shares (whether acquired

pursuant to the Offer or otherwise) or to exercise voting or

management control over Walls & Futures;

(vi) impose any limitation on, or result in any delay in, the

ability of Virgata or any member of the Wider Walls & Futures

Group to integrate or co-ordinate its business, or any part of it,

with the businesses or any part of the businesses of Virgata or any

other member of the Wider Walls & Futures Group;

(vii) require the divestiture by Virgata of any shares,

securities or other interests in any member of the Wider Walls

& Futures Group;

(viii) otherwise adversely affect any or all of the businesses,

assets, financial or trading position or prospects or profits of

Virgata or the Wider Walls & Futures Group or the exercise of

rights of shares in Walls & Futures;

and all applicable waiting and other time periods (including

extensions thereof) during which any such Relevant Authority could

decide to take, institute, implement or threaten any such action,

proceedings, suit, investigation, enquiry or reference or otherwise

intervene having expired, lapsed or been terminated;

(h) all material filings, applications and/or notifications

which are necessary or reasonably considered appropriate by Virgata

having been made and all relevant waiting periods and other time

periods (including any extensions thereof) under any applicable

legislation or regulation of any jurisdiction having expired,

lapsed or been terminated and all applicable statutory or

regulatory obligations in any jurisdiction having been complied

with in each case in respect of the Offer and the acquisition or

the proposed acquisition of any shares or other securities in, or

control or management of, Walls & Futures or any member of the

Wider Walls & Futures Group by Virgata or the carrying on by

any member of the Wider Walls & Futures Group of its

business;

Confirmation of absence of adverse circumstances

(i) save as Disclosed, there being no provision of any

authorisation, agreement, arrangement, licence, permit, lease,

franchise or other instrument to which any member of the Wider

Walls & Futures Group is a party or by or to which any such

member or any of its assets is or may be bound, entitled or subject

which, as a result of the Acquisition or the acquisition or

proposed acquisition by Virgata of any Walls & Futures Shares,

or change in the control or management of Walls & Futures or

otherwise, would or might reasonably be expected to result in (in

each case, to an extent which is material in the context of the

Wider Walls & Futures Group, taken as a whole, or in the

context of the Offer):

(i) any monies borrowed by or any other indebtedness (actual or

contingent) of, or any grant available to, any member of the Wider

Walls & Futures Group becoming repayable, or capable of being

declared repayable, immediately or earlier than the stated maturity

or repayment date or the ability of such member to borrow monies or

incur any indebtedness being withdrawn or inhibited;

(ii) the rights, liabilities, obligations, interests or business

of any member of the Wider Walls & Futures Group under any such

authorisation, agreement, arrangement, licence, permit, lease,

franchise or other instrument or the rights, liabilities,

obligations, interests or business of any member of the Wider Walls

& Futures Group in or with any other firm or company or body or

person (or any agreement or arrangement relating to any such

rights, liabilities, obligations, interests or business) being, or

becoming capable of being, terminated or adversely modified or

adversely affected or any onerous obligation or liability arising

or any adverse action being taken or arising thereunder;

(iii) the creation or enforcement of any mortgage, charge or

other security interest over the whole or any part of the business,

property or assets of any member of the Wider Walls & Futures

Group or any such mortgage, charge or other security interest

(whenever arising or having arisen) becoming enforceable;

(iv) any assets, property or interest of, or any asset the use

of which is enjoyed by, any member of the Wider Walls & Futures

Group being, or falling to be, disposed of by, or ceasing to be

available to, any member of the Wider Walls & Futures Group or

any right arising under which any such asset or interest could be

required to be disposed of or charged or could cease to be

available to any member of the Wider Walls & Futures Group;

(v) any member of the Wider Walls & Futures Group ceasing to

be able to carry on business under any name under which it

presently does so;

(vi) the financial or trading or regulatory position or

prospects or the value of any member of the Wider Walls &

Futures Group being materially prejudiced or materially adversely

affected;

(vii) the creation, acceleration or assumption of any

liabilities (actual, contingent or prospective) by any member of

the Wider Walls & Futures Group;

(viii) any requirement on any member of the Wider Walls &

Futures Group to acquire, subscribe, pay up or repay any shares or

other securities (or the equivalent) in and/or any indebtedness of

any member of the Wider Walls & Futures Group owned by any

third party;

(ix) any liability of any member of the Wider Walls &

Futures Group to make any severance, termination, bonus or other

payment to any of its directors or other officers; and

(x) no event having occurred which, under any provision of any

such authorisation, agreement, arrangement, licence, permit, lease,

franchise or other instrument to which any member of the Wider

Walls & Futures Group is a party or by or to which any such

member or any of its assets may be bound or be subject, could

result in any of the events or circumstances as are referred to in

this paragraph (e);

Certain events occurring since 31 March 2020

(j) save as Disclosed, no member of the Wider Walls &

Futures Group having since 31 March 2020:

(i) issued or agreed to issue, or authorised or proposed the

issue of, additional shares of any class or issued or authorised or

proposed the issue of or granted securities convertible into or

rights, warrants or options to subscribe for or acquire such shares

or convertible securities;

(ii) recommended, declared, paid or made or proposed or resolved

to recommend, declare, pay or make any dividend, bonus issue or

other distribution, whether payable in cash or otherwise, other

than a distribution to Walls & Futures or one of its

wholly-owned subsidiaries;

(iii) implemented or authorised any reconstruction,

amalgamation, scheme or other transaction or arrangement with a

substantially equivalent effect;

(iv) purchased, redeemed or repaid any of its own shares or

other securities or reduced or made or authorised any other change

in its share capital;

(v) redeemed, purchased, repaid or reduced or announced any

intention to do so or made any other change in its share

capital;

(vi) (except for transactions between Walls & Futures and

its wholly-owned subsidiaries, or between its wholly-owned

subsidiaries or transactions in the ordinary course of business),

made or authorised or proposed or announced any change in its loan

capital;

(vii) issued or authorised or proposed the issue of any

debentures or incurred or increased any indebtedness or liability

(actual or contingent) which in any case is material in the context

of the Wider Walls & Futures Group, or in the context of the

Offer;

(viii) other than pursuant to the Offer, implemented or

authorised any merger or demerger or acquired or disposed of or

transferred, mortgaged or charged, encumbered or created any other

security interest over, any asset or any right, title or interest

in any asset or authorised, proposed or announced any intention to

do so (in each case, to an extent which is material in the context

of the Wider Walls & Futures Group, or in the context of the

Offer);

(ix) (except for transactions between Walls & Futures and

its wholly-owned subsidiaries, or between its wholly-owned

subsidiaries or transactions in the ordinary course of business),

entered into, or authorised, proposed or announced the entry into,

any joint venture, asset or profit-sharing arrangement, partnership

or, other than pursuant to the Offer, merger of businesses or

corporate entities;

(x) entered into, varied or terminated, or authorised the entry

into, variation or termination of, any contract, commitment or

arrangement (whether in respect of capital expenditure, real estate

or otherwise) which is outside the ordinary course of business or

which is of a long term, onerous or unusual nature or magnitude or

which involves or could involve an obligation of a nature or

magnitude which is material or is otherwise than in the ordinary

course of business or could reasonably be regarded as restricting

the business of any member of the Wider Walls & Futures Group

or Virgata, or authorised, proposed or announced any intention to

do so;

(xi) entered into, or varied the terms of, or terminated or

given notice of termination of, any contract, agreement or

arrangement with, or for the services of, any of the directors or

senior executives of any member of the Wider Walls & Futures

Group;

(xii) (other than in respect of a subsidiary of Walls &

Futures which is dormant and was solvent at the relevant time)

taken or proposed any corporate action or had any legal proceedings

started, served or threatened against it or any documents filed in

court for its winding-up (voluntary or otherwise), dissolution or

reorganisation or for the appointment of a liquidator, provisional

liquidator, receiver, administrator, administrative receiver,

trustee or similar officer of all or any of its assets and revenues

or any analogous proceedings in any jurisdiction or appointed any

analogous person in any jurisdiction;

(xiii) made any amendment to its memorandum or articles of

association or other constitutional documents;

(xiv) been unable or deemed unable, or admitted that it is

unable, to pay its debts as they fall due or having stopped or

suspended (or threatened to stop or suspend) payment of its debts

generally or ceased or threatened to cease carrying on all or a

substantial part of its business;

(xv) commenced negotiations with any of its creditors or taken

any step with a view to rescheduling or restructuring any of its

indebtedness or entered into a composition, compromise, assignment

or arrangement with any of its creditors whether by way of a

voluntary arrangement, scheme of arrangement, deed of compromise or

otherwise;

(xvi) except in the ordinary course of business, waived,

compromised, settled, abandoned or admitted any dispute, claim or

counter-claim whether made or potential and whether by or against

any member of the Wider Walls & Futures Group (in each case, to

an extent which is material in the context of the Wider Walls &

Futures Group, taken as a whole, or in the context of the

Offer);