Walls & Futures REIT PLC Unaudited interim results and development update (3860Y)

December 31 2019 - 4:30AM

UK Regulatory

TIDMWAFR

RNS Number : 3860Y

Walls & Futures REIT PLC

31 December 2019

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR")

31 December 2019

WALLS & FUTURES REIT PLC

("Wall & Futures" or the "Company")

Half Year Results for the period to 30 September 2019 &

Development Update

Walls & Futures REIT plc ("WAFR") the Ethical Housing

Investor and developer, is pleased to announce its interim results

for the six months to 30th September 2019.

We are also happy to announce the completion of the

redevelopment of our Didcot property, the acquisition of which was

announced on 4 June 2019. The property has been let on a 25-year

full repairing and insuring lease, with rents adjusted annually in

line with inflation (CPI), to one of the UK's largest and longest

established care providers, who currently support more than 2,500

adults nationwide.

Consolidated Income Statement

For the Six-Month Period to 30 September 2019

6 Months to 6 Months to

30 September 30 September

2019 2018

GBP GBP

Rent received 67,650 67,041

Cost of sales - 4,826

Increase in property values - -

Gross Profit 67,650 62,215

Administrative Expenses (151,526) (131,638)

____________ ____________

OPERATING PROFIT/(LOSS) (83,876) (69,423)

Interest receivable and similar

income 218 224

Interest payable (8,542) -

____________ ____________

PROFIT/(LOSS) BEFORE TAXATION (92,200) (69,199)

Taxation - -

____________ ____________

PROFIT/(LOSS) FOR THE FINANCIAL

PERIOD (92,200) (69,199)

Consolidated Balance Sheet

30 September 2019

30 September 2019 30 September 2018

GBP GBP GBP GBP

FIXED ASSETS

Investment Property 3,730,010 3,025,000

CURRENT ASSETS

Cash at Bank 169,036 228,710

Debtors and Prepayments 6,645 5,764

------- --------

175,681 234,474

CREDITORS

Amounts falling due within

one year (6,176) (2,367)

------- --------

NET CURRENT ASSETS 169,505 232,107

--------------- -------------------

TOTAL ASSETS LESS CURRENT

LIABILITIES 3,899,515 3,257,107

Provision for Liabilities - -

Amounts falling due over (600,000) -

one year

--------------- -------------------

NET ASSETS 3,299,515 3,257,107

CAPITAL AND RESERVES

Called up share capital 187,754 180,611

Share Premium 3,505,154 3,412,297

Fair Value Reserve 297,150 168,333

Retained Earnings (690,543) (504,134)

3,299,515 3,257,107

The above figures have not been reviewed by the Company's

auditors.

The Directors of the issuer accept responsibility for the

contents of this announcement.

For further information, contact:

Walls & Futures REIT PLC 0333 700 7171

Joe McTaggart, Chief Executive

Website www.wallsandfutures.com

Allenby Capital Limited (Corporate Adviser)

Nick Harriss/James Reeve 020 3328 5656

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NEXEANAFDFKNFEF

(END) Dow Jones Newswires

December 31, 2019 04:30 ET (09:30 GMT)

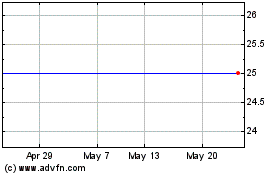

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From May 2024 to Jun 2024

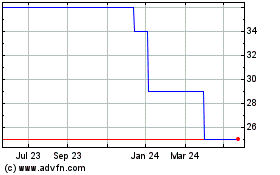

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From Jun 2023 to Jun 2024