TIDMWAFR

RNS Number : 8437Y

Walls & Futures REIT PLC

24 August 2018

24 August 2018

WALLS & FUTURES REIT PLC

("Wall & Futures" or the "Company")

Final Results for the Year to 31 March 2018 & Notice of

AGM

Walls & Futures, the Ethical Housing REIT, is pleased to

announce its final results and the publication of its audited

annual report and accounts for the year to 31 March 2018. A copy of

the annual report and accounts has been posted on the Company's

website, www.wallsandfutures.com, and can also be viewed here:

http://www.rns-pdf.londonstockexchange.com/rns/8437Y_2-2018-8-24.pdf

Walls & Futures REIT plc is an Ethical Housing REIT

providing homes for some of the most vulnerable people in society.

Our strategy is to build a portfolio of high yielding residential

properties let on long term leases, with rents increasing in line

with inflation, to low risk tenants including Charities and Housing

Associations.

Rather than acquire existing portfolios, we originate

investments, dealing directly with Local Authorities, Housing

Associations and Charities. This approach enables us to directly

add capacity and ensure the quality of the homes delivered while

creating immediate equity growth and higher yields.

Walls & Futures REIT plc do not have any involvement with

care delivered within the properties, this is managed by care

providers approved by Local Authorities.

Highlights:

-- Revenue up by 126.6% to GBP102,901 (2017: GBP45,400)

-- Profit before tax increased to GBP45,386 (2017: Loss of GBP314,716)

-- Investment property value increased 9.22%

-- Earnings per share 1.38p (2017: -17.07p)

-- Net Asset Value per share 92p (2017: 90p)

-- Delivered our first Supported Housing development, providing six new places

-- Joined MSCI IPD UK Residential Index

-- Portfolio performance for the calendar year 2017 delivered a

total return of 11.5% against benchmark 7%

-- Joined Social Stock Exchange/Impact Investment Network

-- Named "Impact Company of the Year" at the 2018 NEX Exchange Small Cap Awards

-- Raised GBP222,603 in new equity in the year, (with GBP80,080

raised after the year end in May 2018)

Further details of the Company's financial results can be viewed

below.

The Company also announces it has today posted the notice to

shareholders of its Annual General Meeting "AGM"), which is to be

held at 1.00 pm on Thursday 27 September 2018 at 3(rd) Floor, 111

Buckingham Palace Road, London, SW1W 0SR. A copy of the notice of

AGM can be viewed on the Company's website,

www.wallsandfutures.com, and can also be viewed here:

http://www.rns-pdf.londonstockexchange.com/rns/8437Y_1-2018-8-24.pdf

A resolution will be proposed at the AGM to approve a new

Management Incentive Plan (the "MIP"). The MIP will be a

discretionary cash and share incentive plan operated by Walls &

Futures for the benefit of its senior management for their

contribution to the achievement of Walls & Futures annual

company goals and objectives. It is designed so as to:

-- align with the business strategy and the achievement of planned business goals;

-- support the creation of sustainable long-term shareholder value; and

-- provide an appropriate balance between remuneration elements

that attract, retain and motivate the highest calibre of executive

talent.

Further information on the MIP can be viewed in Appendix 1 of

the notice of AGM.

For further information, contact:

Walls & Futures REIT PLC 0333 700 7171

Joe McTaggart, Chief Executive

Website www.wallsandfutures.com

Allenby Capital Limited (Corporate Adviser)

Nick Harriss/James Reeve 020 3328 5656

Overview & Strategy

During the year the Group completed its first supported housing

property, a freehold, detached grade two listed building, in the

Cotswold market town of Stroud. The renovation and redevelopment

successfully completed at the end of August to provide a

high-quality home with specialist support for six adults with

physical & learning disabilities.

The property is being let on a 25-year full repairing and

insuring lease, with rents adjusted annually in line with inflation

(CPI), to one of the UK's leading care providers who has more than

50 years of experience and expertise in the sector and currently

supports more than 2,500 adults nationwide.

In February 2018 we announced that we had joined MSCI IPD UK

Residential Property Index. The index measures unleveraged total

returns of directly held standing property investments. As of

December 2016, it tracked the performance of 11,201 residential

property investments, with a total capital value of GBP12.1

billion. Being part of the MSCI IPD UK Residential Property Index

provides our shareholders with a transparent and meaningful method

of comparing our absolute and relative performance with that of the

index and our larger peers.

For the calendar year 2017, our portfolio delivered a total

return of 11.5% against the MSCI IPD UK Residential index, which

returned 7%. We believe this illustrates the performance benefit of

our development strategy.

In March 2018, applications were received by the Company in

respect of the new share offer. A total of 236,812 ordinary shares

were issued, the gross proceeds received from this subscription

were GBP222,603.28.

Post balance sheet events

On 22 May 2018 the Company issued a total of 85,192 Ordinary

Shares of 5p at 94p each. The gross proceeds received by the

Company from this subscription are GBP 80,080.

On 1 June 2018, the Company appointed Allenby Capital Limited as

its NEX Exchange Growth market Corporate Advisor.

On 14 June 2018, the Company was named "Impact Company of the

Year" at the 2018 NEX Exchange Small Cap Awards. The annual event

shines a light on the best companies and participants in the small

and micro-cap community (sub GBP100m market capitalisation).

Principle Risks & Uncertainties

The Group portfolio is exclusively invested in the UK and

therefore exposed to the risks and uncertainties of the UK

economy.

The value of the properties are subject to fluctuating market

conditions and may be affected by consumer confidence, the

performance of the UK economy and liquidity in the market.

The Group does not currently have any borrowings and is

therefore not currently exposed to interest rate risk. It does

however have an ongoing requirement to fund its activities through

the debt and/or equity markets and in the future to obtain finance

for property acquisitions. There is no certainty that such funds

will be available when needed and thus inhibit growth.

Risk management

The success of the Group is predicated on increasing the size of

the portfolio, which would be at risk without further capital. In

order to mitigate this, the directors will be engaged in regular

fund raising.

Outlook

We have developed a pipeline of potential investments with a

number of transactions currently under consideration and will be

announced as they are finalised.

The directors will continue the same investment policies which

have been successful since joining the NEX Exchange Growth

Market.

Report of the Directors

The directors present their report with the financial statements

of the company and the group for the year ended 31 March 2018.

Dividends

No dividends will be distributed for the year ended 31 March

2018.

Events since the end of the year

Information relating to events since the end of the year is

given in the notes to the financial statements.

Directors

The directors shown below have held office during the whole of

the period from 1 April 2017 to the date of this report.

J K McTaggart

D P White

P A Wylie

Statement of directors' responsibilities

The directors are responsible for preparing the Group Strategic

Report, the Report of the Directors and the financial statements in

accordance with applicable law and regulations.

Company law requires the directors to prepare financial

statements for each financial year. Under that law the directors

have elected to prepare the financial statements in accordance with

United Kingdom Generally Accepted Accounting Practice (United

Kingdom Accounting Standards and applicable law), including

Financial Reporting Standard 102 'The Financial Reporting Standard

applicable in the UK and Republic of Ireland'. Under company law

the directors must not approve the financial statements unless they

are satisfied that they give a true and fair view of the state of

affairs of the company and the group and of the profit or loss of

the group for that period. In preparing these financial statements,

the directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether applicable accounting standards have been

followed, subject to any material departures disclosed and

explained in the financial statements;

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the company will

continue in business.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the company's and

the group's transactions and disclose with reasonable accuracy at

any time the financial position of the company and the group and

enable them to ensure that the financial statements comply with the

Companies Act 2006. They are also responsible for safeguarding the

assets of the company and the group and hence for taking reasonable

steps for the prevention and detection of fraud and other

irregularities.

Statement as to disclosure of information to auditors

So far as the directors are aware, there is no relevant audit

information (as defined by Section 418 of the Companies Act 2006)

of which the group's auditors are unaware, and each director has

taken all the steps that he ought to have taken as a director in

order to make himself aware of any relevant audit information and

to establish that the group's auditors are aware of that

information.

Auditors

The auditors, Kingston Smith LLP, will be proposed for

re-appointment at the forthcoming Annual General Meeting.

Consolidated Income Statement

For year ended 31 March 2018

Year ended Period 18/3/16

31/3/18 to 31/3/17

----------- ---------------

GBP GBP

----------- ---------------

TURNOVER 102,901 45,400

----------- ---------------

Cost of sales 26,717 15,461

----------- ---------------

GROSS PROFIT 76,184 29,939

----------- ---------------

Administrative expenses 229,223 112,342

----------- ---------------

(153,039) (82,403)

----------- ---------------

Gain/loss on revaluation of tangible

assets 198,333 (30,000)

----------- ---------------

OPERATING PROFIT/(LOSS) 45,294 (112,403)

----------- ---------------

Cost of fundamental reorganisation - 202,333

----------- ---------------

45,294 (314,736)

----------- ---------------

Interest receivable and similar

income 92 22

----------- ---------------

45,386 (314,714)

----------- ---------------

Interest payable and similar expenses - 2

----------- ---------------

PROFIT/(LOSS) BEFORE TAXATION 45,386 (314,716)

----------- ---------------

Tax on profit/(loss) - (219)

----------- ---------------

PROFIT/(LOSS) FOR THE FINANCIAL

YEAR 45,386 (314,497)

----------- ---------------

Profit/(loss) attributable to:

Owners of the parent 45,386 (314,497)

----------- ---------------

Consolidated Other Comprehensive Income

For year ended 31 March 2018

Year ended Period 18/3/16

31/3/18 to 31/3/17

----------- ---------------

GBP GBP

----------- ---------------

PROFIT/(LOSS) FOR THE YEAR 45,386 (314,497)

----------- ---------------

OTHER COMPREHENSIVE INCOME

----------- ---------------

Gain on bargain purchase - 2,509

----------- ---------------

Income tax relating to other comprehensive - -

income

----------- ---------------

OTHER COMPREHENSIVE INCOME FOR

THE YEAR, NET OF INCOME TAX - 2,509

----------- ---------------

TOTAL COMPREHENSIVE INCOME FOR

THE YEAR 45,386 (311,988)

----------- ---------------

Total comprehensive income attributable

to:

Owners of the parent 45,386 (311,988)

----------- ---------------

Earnings per share expressed in

pence per share:

----------- ---------------

Basic 1.38p (17.14)p

----------- ---------------

Diluted 1.38p (17.14)p

----------- ---------------

Consolidated Statement of Financial Position

31 March 2018

2018 2017

-------------------- --------------------

GBP GBP GBP GBP

-------- ---------- -------- ----------

FIXED ASSETS

-------- ---------- -------- ----------

Investments -

-------- ---------- -------- ----------

Investment Property 3,025,000 2,150,000

-------- ---------- -------- ----------

3,025,000 2,150,000

-------- ---------- -------- ----------

CURRENT ASSETS

-------- ---------- -------- ----------

Debtors 195,995 4,749

-------- ---------- -------- ----------

Cash at bank 44,186 842,911

-------- ---------- -------- ----------

240,181 847,660

-------- ---------- -------- ----------

CREDITORS

-------- ---------- -------- ----------

Amounts falling due within

one year 18,955 19,423

-------- ---------- -------- ----------

NET CURRENT ASSETS 221,226 2,978,237

-------- ---------- -------- ----------

TOTAL ASSETS LESS CURRENT

LIABILITIES 3,246,226 2,978,237

-------- ---------- -------- ----------

CAPITAL AND RESERVES

-------- ---------- -------- ----------

Called up share capital 176,352 164,511

-------- ---------- -------- ----------

Share premium 3,336,476 3,125,714

-------- ---------- -------- ----------

Revaluation reserve 168,333 -

-------- ---------- -------- ----------

Retained earnings (434,935) (311,988)

-------- ---------- -------- ----------

SHAREHOLDERS' FUNDS 3,246,226 2,978,237

-------- ---------- -------- ----------

Consolidated Statement of Changes in Equity

For The Year Ended 31 March 2018

Called Retained Share Fair Total

up Earnings Premium value Equity

Share reserve

Capital

--------- ---------- ---------- --------- ----------

GBP GBP GBP GBP GBP

--------- ---------- ---------- --------- ----------

Changes in equity

--------- ---------- ---------- --------- ----------

Issue of share capital 164,511 - 3,125,714 - 3,290,225

--------- ---------- ---------- --------- ----------

Total comprehensive

income - (311,988) - - (311,988)

--------- ---------- ---------- --------- ----------

Balance at 31 March

2017 164,511 (311,988) 3,125,714 - 2,978,237

--------- ---------- ---------- --------- ----------

Changes in equity

--------- ---------- ---------- --------- ----------

Issue of share capital 11,841 - 210,762 222,603

--------- ---------- ---------- --------- ----------

Total comprehensive

income - (122,947) - 168,333- 45,386

--------- ---------- ---------- --------- ----------

Balance at 31 March

2018 176,352 (434,935) 3,336,476 168,333 3,246,226

--------- ---------- ---------- --------- ----------

Consolidated Statement of Cash Flows

For year ended 31 March 2018

Year ended Period 18/3/16

31/3/18 to 31/3/17

----------- ---------------

GBP GBP

----------- ---------------

Cash flows from operating activities

----------- ---------------

Cash generated from operations (152,517) (268,115)

----------- ---------------

Interest paid - (2)

----------- ---------------

Tax paid (562) 781

----------- ---------------

Net cash from operating activities (153,079) (267,336)

----------- ---------------

Cash flows from investing activities

----------- ---------------

Purchase of investment property (676,667) -

----------- ---------------

Interest received 92 22

----------- ---------------

Net cash from investing activities (676,575) 22

----------- ---------------

Cash flows from financing activities

----------- ---------------

Proceeds from issues of shares 30,929 1,110,225

----------- ---------------

Net cash from financing activities 30,929 1,110,225

----------- ---------------

(Decrease)/increase in cash and

cash equivalents (798,725) 842,911

----------- ---------------

Cash and cash equivalents at beginning 842,911 -

of year

----------- ---------------

Cash and cash equivalents at end

of year 44,186 842,911

----------- ---------------

About Walls & Futures REIT plc

Walls & Futures is an Ethical Housing REIT providing new

homes for some of the most vulnerable people in society, including

learning and physical disabilities, mental health needs,

homelessness and extra care (housing with care for the

elderly).

We collaborate with our customers, including charities and

housing associations, to design, fund, build and deliver quality

homes that are sustainable in terms of their environmental impact,

energy efficiency and financially viability.

Our aim is to generate a measurable and beneficial social impact

alongside a financial return, which is to deliver a long-term

annual net return of 7-9% of which 3-4% will be paid in the form of

a dividend.

Walls & Futures REIT plc was named "Impact Company of the

Year" at the 2018 NEX Exchange Small Cap Awards.

Walls & Futures is quoted on the NEX Exchange Growth Market

(Ticker: WAFR) and is a member of the Social Stock Exchange and

Impact Investment Network.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NEXFKQDQKBKDDFB

(END) Dow Jones Newswires

August 24, 2018 08:00 ET (12:00 GMT)

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From Jun 2024 to Jul 2024

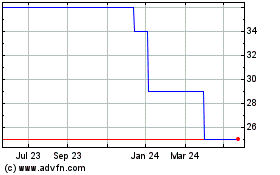

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From Jul 2023 to Jul 2024