0000093314false00000933142024-08-082024-08-08iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 8, 2024

_________________________

VolitionRx Limited |

(Exact name of registrant as specified in its charter) |

Delaware | | 001-36833 | | 91-1949078 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

1489 West Warm Springs Road, Suite 110

Henderson, Nevada 89014

(Address of principal executive offices, including zip code)

+1 (646) 650-1351

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.001 per share | VNRX | NYSE American, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry Into a Material Definitive Agreement.

Registered Direct Offering

On August 8, 2024, VolitionRx Limited, a Delaware corporation (the “Company”), entered into a securities purchase agreement (the “Purchase Agreement”) with an institutional investor, which provides for the issuance and sale, in a registered direct offering by the Company (the “Offering”), of 9,170,000 shares (the “Shares”) of common stock, par value $0.001 (the “Common Stock”), pre-funded warrants to purchase 3,557,273 shares of Common Stock (the “Pre-Funded Warrants”), Series A common stock purchase warrants to purchase 12,727,273 shares of Common Stock (the “Series A Warrants”) and Series B common stock purchase warrants to purchase 12,727,273 shares of Common Stock (the “Series B Warrants” and, together with the Series A Warrants, the “Common Warrants”). The Shares were sold at an offering price of $0.55 per Share and accompanying Common Warrants, and the Pre-Funded Warrants were sold at an offering price of $0.549 per Pre-Funded Warrant and accompanying Common Warrants. The Shares, Pre-Funded Warrants, Common Warrants, Placement Agent Warrants (defined below), and shares of Common Stock underlying the Pre-Funded Warrants, Common Warrants and Placement Agent Warrants, are collectively referred to herein as the “Securities”.

The Pre-Funded Warrants have an exercise price of $0.001, are immediately exercisable and can be exercised at any time after their original issuance until such Pre-Funded Warrants are exercised in full. Each of the respective Common Warrants will have an exercise price of $0.57 per share. The Series A Warrants are exercisable on or after February 12, 2025 (the “Initial Exercise Date”) and will be exercisable until the earlier of (a) the two (2) year anniversary of the Initial Exercise Date and (b) the date that is 60 days following the Company’s public announcement on a Current Report on Form 8-K of the occurrence of the Company entering into one or more agreements relating to the development and commercialization of a product, technology, or process in the human space, provided at least one such agreement covers a territory that includes all or a part of the European Union, the United States, the United Kingdom, Japan, or China, and which, during the term of all such agreements and pursuant to the terms thereof, collectively such agreements include aggregate (i) potential milestone payments to the Company of at least $10.0 million, or (ii) potential milestone payments to the Company of at least $5.0 million and potential total payments of at least $20.0 million. The Series B Warrants are exercisable on or after the Initial Exercise Date, and will be exercisable until the earlier of (a) the five (5) year anniversary of the Initial Exercise Date and (b) the date that is six (6) months following the Company’s public announcement on a Current Report on Form 8-K of the occurrence of the Company or a third party receiving the first U.S. Food and Drug Administration (“FDA”) approval of a product, technology, or process in the human space utilizing the Company’s intellectual property, provided, however, that the FDA’s approval of a protocol for a clinical trial of a product, technology, or process in the human space, or the FDA’s acceptance of data from invitro trials or in vivo animal trials, shall not constitute “FDA approval” for purposes of this definition of this milestone (the "Series B Milestone Announcement").

The Securities sold in the Offering were offered and sold by the Company pursuant to a Registration Statement on Form S-3 originally filed on September 24, 2021, as amended (including the prospectus forming a part of such Registration Statement), with the Securities and Exchange Commission (the “SEC”) under the Securities Act (File No. 333-259783), and declared effective by the SEC on November 8, 2021. The Company filed a prospectus supplement with the SEC on August 12, 2024 in connection with the Offering.

H.C. Wainwright & Co., LLC (“Wainwright”) acted as the Company’s placement agent in connection with the Offering. In connection with the Offering, the Company agreed to pay Wainwright (i) a cash fee equal to 8.0% of the aggregate gross proceeds from the Registered Direct Offering, (ii) $25,000 for non-accountable fees and expenses, (iii) up to $100,000 of legal fees and expenses, and (v) $15,950 for the closing expenses. In addition, the Company agreed to grant placement agent warrants to Wainwright or its designees to purchase up to 381,818 shares of Common Stock (the “Placement Agent Warrants”). The Placement Agent Warrants have substantially the same terms as the Series B Warrants, except that the Placement Agent Warrants have an exercise price of $0.6875 per share and will be exercisable until the earlier of (a) August 8, 2029 and (b) the date that is six (6) months following the Series B Milestone Announcement. Wainwright did not purchase or sell any of the Shares, the Common Warrants or the Pre-Funded Warrants and was not required to arrange the purchase or sale of any specific number or dollar amount of securities.

The foregoing descriptions of the Pre-Funded Warrants, the Common Warrants, the Placement Agent Warrants and the Purchase Agreement are not complete and are qualified in their entirety by reference to the full text of the form of Pre-Funded Warrants, the form of Series A Warrants, the form of Series B Warrants, and the form of Purchase Agreement, copies of which are filed as Exhibits 4.1, 4.2, 4.3, and 10.1, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

The gross proceeds to the Company from the Offering were $7.0 million, before deducting placement agent fees and other offering expenses payable by the Company. The Company anticipates using the net proceeds from the Offering for research and continued product development, clinical studies, product commercialization, working capital and other general corporate purposes.

The Purchase Agreement contains customary representations and warranties, agreements and obligations, conditions to closing and termination provisions. The representations, warranties and covenants contained in the Purchase Agreement were made solely for the benefit of the parties thereof. In addition, such representations, warranties and covenants (i) are intended as a way of allocating the risk between the parties to the Purchase Agreement and not as statements of fact, and (ii) may apply standards of materiality in a way that is different from what may be viewed as material by shareholders of, or other investors in, the Company. Accordingly, the form of Purchase Agreement is included with this filing only to provide investors with information regarding the terms of the transactions. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in public disclosures.

Item 8.01. Other Events.

On August 8, 2024, the Company issued a press release announcing the pricing of the Offering. A copy of such press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is hereby incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| VOLITIONRX LIMITED | |

| | | |

Date: August 12, 2024 | By: | /s/ Cameron Reynolds | |

| | Cameron Reynolds | |

| | Chief Executive Officer & President | |

nullnullnullnullnullnull

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

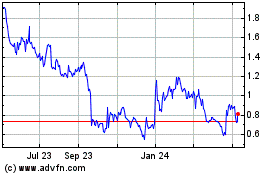

VolitionRX (AMEX:VNRX)

Historical Stock Chart

From Oct 2024 to Nov 2024

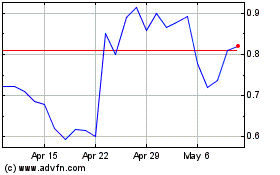

VolitionRX (AMEX:VNRX)

Historical Stock Chart

From Nov 2023 to Nov 2024