Filed Pursuant to General Instruction II.L of Form F-10

File No. 333-237948

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This prospectus supplement (the "Prospectus Supplement"), together with the accompanying short form base shelf prospectus dated May 12, 2020 (the "Base Prospectus") to which it relates, as amended or supplemented, (this Prospectus Supplement and the Base Prospectus are together the "Prospectus") and each document deemed to be incorporated by reference herein and therein, constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons authorized to sell such securities.

This Prospectus and the Offering (as defined below) are only addressed to, and directed at, persons in member states of the European Economic Area (“EEA”) and the United Kingdom who are qualified investors within the meaning of Article 2(e) of the Prospectus Regulation (Regulation (EU) 2017/1129) (“Qualified Investors”). In addition, in the United Kingdom, this Prospectus and the Offering are addressed to, and directed only at, Qualified Investors who: (i) are persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”); (ii) are persons who are high net worth entities falling within Article 49(2)(a) to (d) of the Order; or (iii) are other persons to whom they may otherwise lawfully be communicated (all such persons together being referred to as “Relevant Persons”). This Prospectus and the Offering must not be acted on or relied on: (i) in the United Kingdom, by persons who are not Relevant Persons; and (ii) in any member state of the EEA, by persons who are not Qualified Investors. Any investment or investment activity to which this Prospectus and the Offering relate is available only to Relevant Persons in the United Kingdom and Qualified Investors in any member state of the EEA, and will be engaged in only with such persons. This Prospectus contains no offer to the public within the meaning of section 102B of the Financial Services and Markets Act 2000, as amended (“FSMA”) or otherwise. This Prospectus is not a prospectus for the purposes of section 85 of the FSMA. Accordingly, this Prospectus has not been nor will it be approved as a prospectus by the United Kingdom Financial Conduct Authority (the “FCA”) under section 87A of the FSMA and it has not been filed with the FCA pursuant to the United Kingdom Prospectus Regulation Rules nor has it been approved by the London Stock Exchange plc (the “LSE”) or by a person authorized for the purposes of section 21 of FSMA.

Information has been incorporated by reference in this Prospectus Supplement from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from Taseko Mines Limited, 15th Floor, 1040 West Georgia Street, Vancouver, British Columbia, V6E 4H1 (Telephone 778-373-4533) (Attn: the Corporate Secretary), and are also available electronically at www.sedar.com.

PROSPECTUS SUPPLEMENT

To the Short Form Base Shelf Prospectus dated May 12, 2020

|

New Issue

|

November 12, 2020

|

US$23,032,500

Common Shares

We are hereby qualifying for distribution 27,750,000 common shares (the “Offered Shares”) of Taseko Mines Limited (“Taseko” or the “Company”) at a price (the “Offering Price”) of US$0.83 per Offered Share (the “Offering”). The Offering is made pursuant to an underwriting agreement (the “Underwriting Agreement”) dated November 12, 2020 among the Company and Cantor Fitzgerald Canada Corporation as lead underwriter and sole bookrunner (the “Lead Underwriter”), and a syndicate of underwriters, including Velocity Trade Capital Ltd., BMO Nesbitt Burns Inc., National Bank Financial Inc. and TD Securities Inc. (together with the Lead Underwriter, collectively, the “Underwriters”), as more fully described under the section entitled “Plan of Distribution” in this Prospectus Supplement. The Offered Shares will be offered in the United States and Canada through the Underwriters either directly or through their respective U.S. or Canadian broker-dealer affiliates or agents. The Offering is being made concurrently in the United States under the terms of a registration statement on Form F-10 (the “Registration Statement”) filed with the United States Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “U.S. Securities Act”).

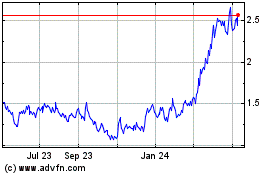

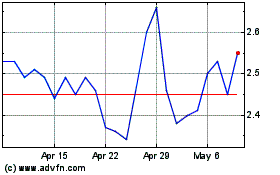

Our common shares (“Common Shares”) are listed and posted for trading on the Toronto Stock Exchange (the “TSX”) and admitted to trading on the LSE under the trading symbol “TKO” and the NYSE American (the “NYSE American”) under the trading symbol “TGB”. The Offered Shares will be listed for trading on the TSX and NYSE American and listed on the standard segment of the Official List of the FCA (the “Official List”) and admitted to trading on the LSE’s main market for listed securities (the “Main Market”), subject to the fulfilment of the notification or listing requirements of each stock exchange. The closing price of the Company’s Common Shares on the TSX, the NYSE American, and the LSE on November 11, 2020, being the trading session on the last trading day before the date of the Prospectus, was $1.30 per Common Share, US$0.99 per Common Share and GB£0.75 per Common Share, respectively.

i

|

Price: US$0.83 per Offered Share

|

|

|

Price

to the Public

|

|

Underwriters'

Fee(1)

|

|

Net Proceeds

to the Company(2)

|

|

Per Offered Share

|

US$0.83

|

|

US$0.0498

|

|

US$0.7802

|

|

Total Offering

|

US$23,032,500

|

|

US$1,381,950

|

|

US$21,650,550

|

(1) Pursuant to the Underwriting Agreement, the Company has agreed to pay the Underwriters a cash fee (the "Underwriters' Fee") equal to 6.0% of the aggregate purchase price paid by the Underwriters to the Company per Offered Share, including the sale of any Over-Allotment Shares (as defined herein) sold pursuant to the exercise of the Over-Allotment Option (as defined herein), and reimburse the Underwriters for their expenses in connection with the Offering. See "Plan of Distribution".

(2) After deducting the Underwriters' Fee, but before deducting the expenses of the Offering (including listing fees, legal fees and reimbursement of the Underwriters' expenses), which are estimated at US$450,000.

We have granted to the Underwriters an option (the “Over-Allotment Option”) to purchase up to 4,162,500 additional Common Shares (the “Over-Allotment Shares”) at the Offering Price, representing 15% of the total number of shares sold under the Offering. The Over-Allotment Option is exercisable in whole or in part at any time on or before the 30th calendar day after the Closing Date. If the Over-Allotment Option is exercised in full, the total “Price to the Public”, “Underwriters’ Fee” and “Net Proceeds to the Company” will be US$26,487,375, US$1,589,242.50 and US$24,898,132.50, respectively. This Prospectus Supplement qualifies the distribution of the Over-Allotment Option and the Over-Allotment Shares. A purchaser who acquires Over-Allotment Shares forming part of the Underwriters’ over-allocation position acquires those securities under this Prospectus Supplement, regardless of whether the over-allocation position is ultimately filled through the exercise of the Over-Allotment Option or secondary market purchases. See “Plan of Distribution”.

The following table sets out the number of securities issuable under the Over-Allotment Option:

|

Underwriters' Position

|

Maximum Size or Number of Securities Available

|

Exercise Period or Acquisition Date

|

Exercise Price or Average Acquisition Price

|

|

|

|

|

|

|

Over-Allotment Option

|

Option to acquire up to

4,162,500 additional

Common Shares

|

Exercisable within 30 days

following the Closing Date

|

US$0.83 per

Over-Allotment Share

|

In addition to the Offering, the Company is undertaking a non-brokered private placement of up to 2,409,638 Common Shares at the Offering Price for gross proceeds to the Company of up to US$2,000,000 (the “Concurrent Private Placement”). No commission or finder’s fee is payable to the Underwriters in connection with the Concurrent Private Placement. This Prospectus Supplement does not qualify the distribution of the Common Shares issuable pursuant to the Concurrent Private Placement. Common Shares issued pursuant to the Concurrent Private Placement will be subject to a four month hold period under Canadian securities laws. Closing of the Concurrent Private Placement is subject to a number of conditions, including the approval of the TSX, the NYSE American and the LSE. Closing of the Offering is not conditional upon the closing of the Concurrent Private Placement, and closing of the Concurrent Private Placement is not conditional upon the closing of the Offering.

Unless the context otherwise requires, all references to the "Offering" in this Prospectus Supplement shall include the Over-Allotment Option and all references to "Offered Shares" shall include Over-Allotment Shares, as applicable.

The Underwriters, as principals, conditionally offer the Offered Shares qualified under this Prospectus Supplement, subject to prior sale, if, as and when issued by us and accepted by the Underwriters in accordance with the conditions contained in the Underwriting Agreement referred to under "Plan of Distribution", and subject to the approval of certain legal matters on behalf of the Company by McMillan LLP and certain legal matters in connection with the Offering will be passed upon for the Underwriters by Stikeman Elliott LLP, with respect to Canadian law, and by Cooley LLP, with respect to U.S. law.

ii

Subscriptions will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. One or more book entry-only certificates representing the Offered Shares will be issued in registered form to CDS Clearing and Depository Services Inc. ("CDS") or its nominee or The Depositary Trust Company ("DTC") and deposited with CDS or DTC on the closing date, which is expected to take place on November 17, 2020, or such later date as may be agreed upon by the Company and the Underwriters but in any event no later than 42 days following the date of filing of this Prospectus Supplement. A purchaser of Offered Shares will receive only a customer confirmation from the registered dealer through which the Offered Shares are purchased. Subject to applicable laws and in connection with the Offering, the Underwriters may effect transactions which stabilize or maintain the market price of the Company's Common Shares at levels other than those which otherwise might prevail on the open market. Such transactions, if commenced, may be discontinued at any time. See "Plan of Distribution".

The Offering Price was determined by negotiation between the Company and the Lead Underwriter, on behalf of the Underwriters, with reference to the prevailing market price of the Common Shares.

The Underwriters propose to initially offer either directly, or through their broker-dealer affiliates or agents, the Offered Shares at the Offering Price. After a reasonable effort has been made to sell all of the Offered Shares at the Offering Price, the Underwriters may subsequently reduce the selling price to purchasers. Any such reduction will not affect the proceeds received by the Company. See "Plan of Distribution".

None of Cantor Fitzgerald & Co., BMO Capital Markets Corp., National Bank of Canada Financial Inc. or TD Securities (USA) LLC, is registered as an investment dealer in any Canadian jurisdiction and, accordingly, they will only sell the Offered Shares into the United States and will not, directly or indirectly, solicit offers to purchase or sell the Offered Shares in Canada.

This Prospectus Supplement should be read in conjunction with and may not be delivered or utilized without the Base Prospectus.

An investment in the Offered Shares involves significant risks. You should carefully read the "Risk Factors" section of this Prospectus Supplement beginning on page S-26, the "Risk Factors" section in the Base Prospectus beginning on page S-33 and in the documents incorporated by reference herein and therein.

You should rely only on the information contained in or incorporated by reference into this Prospectus. The Company has not authorized anyone to provide you with different information. The Company is not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this Prospectus or incorporated by reference in this Prospectus is accurate as of any date other than the date on the front of this Prospectus Supplement or the date of such documents incorporated by reference herein, as applicable.

This Offering is made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States and Canada ("MJDS"), to prepare this Prospectus Supplement and the Base Prospectus in accordance with Canadian disclosure requirements. Prospective investors in the United States should be aware that such requirements are different from those of the United States. Financial statements included or incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB") and may not be comparable to financial statements of United States companies. Our financial statements are subject to audit in accordance with the standards of the Public Company Accounting Oversight Board (United States) ("PCAOB") and our auditor is subject to both Canadian auditor independence standards and the auditor independence standards of the PCAOB and the United States Securities and Exchange Commission ("SEC").

Prospective investors should be aware that the acquisition of the securities described herein may have tax consequences both in the United States and in Canada. Such consequences for investors who are resident in, or citizens of, the United States may not be described fully herein. You should read the tax discussion in this Prospectus Supplement and the accompanying Base Prospectus fully and consult with your own tax advisers. See "Certain Canadian Federal Income Tax Considerations", "Certain Material United States Federal Income Tax Considerations" and "Risk Factors".

iii

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that we are incorporated under the laws of British Columbia, Canada, that the majority of our officers and directors are not residents of the United States, that the majority of the experts named in the registration statement are not residents of the United States and that a substantial portion of the assets of these persons are located outside the United States.

THESE OFFERED SHARES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY STATE OR CANADIAN SECURITIES COMMISSION NOR HAS ANY SUCH SECURITIES REGULATORY AUTHORITY PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Unless otherwise stated, all references in this Prospectus Supplement and the Base Prospectus to “dollars” or “$” are to Canadian dollars, references to “U.S. dollars” or “US$” are to United States dollars and references to GB£ are to British pounds sterling.

Peter Mitchell, a director of the Company, and Dan Johnson, P.E., who is named as an expert in the Base Prospectus, reside outside of Canada. Each of Mr. Mitchell and Mr. Johnson has appointed McMillan LLP, located at Suite 1500 - 1055 West Georgia Street, Vancouver, British Columbia V6E 4N7, as his agent for service of process in British Columbia. Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any such person, even though they have each appointed an agent for service of process.

Our head office is at 15th Floor, 1040 West Georgia Street, Vancouver, British Columbia V6E 4H1. The registered office of the Company is located at Suite 1500 - 1055 West Georgia Street, Vancouver, British Columbia V6E 4N7.

|

Cantor Fitzgerald Canada Corporation

|

|

Velocity Trade Capital Ltd.

|

|

BMO Nesbitt Burns Inc.

|

National Bank Financial Inc.

|

TD Securities Inc.

|

iv

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

Page

v

TABLE OF CONTENTS

BASE SHELF PROSPECTUS

vi

IMPORTANT NOTICE

This document is in two parts. The first part is this Prospectus Supplement, which describes the specific terms of the Offering and the method of distribution of the Offered Shares and also adds to and updates information contained in the Base Prospectus and the documents that are incorporated by reference into this Prospectus Supplement and the Base Prospectus. The second part is the Base Prospectus which provides more general information. This Prospectus Supplement and the Base Prospectus are together referred to as the "Prospectus". This Prospectus Supplement is deemed to be incorporated by reference into the Prospectus solely for the purposes of the offering of the Offered Shares. Other documents are also incorporated or deemed to be incorporated by reference into this Prospectus Supplement and into the Prospectus. See "Documents Incorporated by Reference".

We filed the Base Prospectus with the securities commissions in all Canadian provinces other than Québec (the "Canadian Qualifying Jurisdictions") in order to qualify the offering of the securities described in the Base Prospectus in accordance with National Instrument 44-102 - Shelf Distributions ("NI 44-102"). The British Columbia Securities Commission issued a receipt dated May 13, 2020 in respect of the final Base Prospectus as the principal regulatory authority under Multilateral Instrument 11-102 - Passport System, and each of the other commissions in the Canadian Qualifying Jurisdictions is deemed to have issued a receipt under National Policy 11-202 - Process for Prospectus Review in Multiple Jurisdictions.

The Base Prospectus also forms part of a registration statement on Form F-10 (the "Registration Statement") that we filed with the SEC under the U.S. Securities Act utilizing the MJDS. The Registration Statement was declared effective by the SEC under the U.S. Securities Act on June 24, 2020 (SEC File No. File No. 333-237948). The Registration Statement incorporates the Base Prospectus with certain modifications and deletions permitted by Form F-10. This Prospectus Supplement is being filed by us with the SEC in accordance with the instructions to the SEC Form F-10.

This Prospectus Supplement shall not be used by anyone for any purpose other than in connection with the Offering. You should rely only on the information contained in or incorporated by reference in this Prospectus Supplement and the Base Prospectus. If the description of the Offered Shares varies between this Prospectus Supplement and the Base Prospectus, you should rely on the information in this Prospectus Supplement. To the extent that any statement made in this Prospectus Supplement differs from those in the Base Prospectus, the statements made in the Base Prospectus and the information incorporated by reference and therein are deemed modified or superseded by the statements made by this Prospectus Supplement and the information incorporated by reference herein. We have not authorized any other person to provide investors with additional or different information. If anyone provides you with any additional, different or inconsistent information, you should not rely on it.

You should not assume that the information contained in or incorporated by reference in this Prospectus Supplement or the Base Prospectus is accurate as of any date other than the date of the document in which such information appears. Our business, financial condition, results of operations and prospects may have changed since those dates. Information in this Prospectus Supplement updates and modifies the information in the Base Prospectus and information incorporated by reference herein and therein. This Prospectus Supplement does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this Prospectus Supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

This Prospectus Supplement is not a prospectus for the purposes of section 85 of the FSMA and has not been approved as a prospectus by the FCA under section 87A of FSMA. In addition, this Prospectus Supplement has not been filed with the FCA pursuant to the UK Prospectus Regulation Rules, nor has it been approved by a person authorized under the FSMA or by the LSE.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents ("documents incorporated by reference" or "documents incorporated herein by reference") that we have filed with the securities regulatory authorities in the jurisdictions in Canada in which we are a reporting issuer and filed with, or furnished to, the SEC, are specifically incorporated by reference into, and form an integral part of, this Prospectus Supplement:

1. our annual information form for the year ended December 31, 2019, dated as at March 30, 2020 and filed on March 30, 2020 (the "2019 AIF");

2. our audited consolidated financial statements for the years ended December 31, 2019 and 2018 together with the report of the independent auditor thereon, filed February 20, 2020

3. our management's discussion and analysis for the year ended December 31, 2019, filed February 20, 2020 (the "2019 Annual MD&A");

4. our unaudited interim condensed consolidated financial statements for the three and nine months ended September 30, 2020, filed October 26, 2020 (the “Interim Financial Statements”);

5. our management’s discussion and analysis of financial condition and operations for the three and nine months ended September 30, 2020, filed October 26, 2020 (the “Interim MD&A”); and

6. our management information circular dated June 2, 2020 distributed in connection with the annual meeting of shareholders held on July 8, 2020.

All documents of the type referred to in Section 11.1 of Form 44-101F1 of National Instrument 44-101 - Short Form Prospectus Distributions filed by us with the securities regulatory authorities in the jurisdictions in Canada in which we are a reporting issuer after the date of this Prospectus Supplement, and before the termination of the distribution, are also deemed to be incorporated by reference into this Prospectus Supplement and the Prospectus (the "Additional Documents Incorporated by Reference"). These documents will include any documents of the type referred to in the preceding paragraph, including all annual information forms, all information circulars, all annual and interim financial statements, all management's discussion and analysis relating thereto, all material change reports (excluding confidential material change reports, if any), news releases containing financial information for financial periods more recent than the most recent annual or interim financial statements and all business acquisition reports filed by us subsequent to the date of this Prospectus Supplement and prior to the termination of the distribution under this Prospectus Supplement. To the extent that we file any additional prospectus supplements disclosing additional or updated information relating to the distribution of the Offered Shares with securities commissions or similar authorities in the relevant provinces of Canada after the date of this Prospectus Supplement and prior to the sale of all Offered Shares hereunder, such additional prospectus supplements shall be deemed to be incorporated by reference into the Prospectus.

Further, to the extent that any document or information incorporated by reference into this Prospectus Supplement is included in any report on Form 6-K, Form 40-F, Form 20-F, Form 10-K, Form 10-Q or Form 8-K (or any respective successor form) that we file or furnish to the SEC after the date of this Prospectus Supplement and prior to the date that all the Offered Shares offered hereby have been sold or this Prospectus Supplement is withdrawn, such document or information shall be deemed to be incorporated by reference as an exhibit to the registration statement of which this Prospectus Supplement forms a part (in the case of documents or information filed or furnished on Form 6-K or Form 8-K, only to the extent specifically stated therein). For certainty, all of the documents and information listed in paragraphs 1 through 6 above, all of which have been filed with or furnished to the SEC as part of filings on Form 40-F or Form 6-K, are hereby incorporated by reference as exhibits to the registration statement of which this Prospectus Supplement forms a part.

Any statement contained in this Prospectus Supplement, the Base Prospectus or in a document (or part thereof) incorporated by reference herein or therein, or deemed to be incorporated by reference herein or therein, shall be deemed to be modified or superseded, for purposes of this Prospectus Supplement, to the extent that a statement contained in this Prospectus Supplement or in any subsequently filed document (or part thereof) that also is, or is deemed to be, incorporated by reference in this Prospectus Supplement or in the Base Prospectus modifies or replaces such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute part of this Prospectus Supplement or the Base Prospectus. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document which it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purpose that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

Upon a new annual information form and related annual financial statements being filed by us with, and where required, accepted by, the applicable securities regulatory authority during the currency of this Prospectus, the previous annual information form, the previous annual financial statements and all interim financial statements, material change reports and information circulars and all prospectus supplements of the Company filed prior to the commencement of our financial year in which a new annual information form is filed shall be deemed no longer to be incorporated into this Prospectus for purposes of future offers and sales of Offered Shares hereunder. Upon the filing by us of the condensed consolidated interim financial statements and the accompanying management's discussion and analysis of financial condition and results of with the applicable Canadian securities commissions or similar regulatory authorities during the period that this Prospectus is effective, all condensed consolidated interim financial statements and the accompanying management's discussion and analysis of financial condition and results of operations filed prior to such new condensed consolidated interim financial statements and management's discussion and analysis of financial condition and results of operations shall be deemed to no longer be incorporated into this Prospectus for purposes of future offers and sales of Offered Shares under this Prospectus. In addition, upon the filing by us of a new management information circular for an annual meeting of shareholders with the applicable Canadian securities commissions or similar regulatory authorities during the period that this Prospectus is effective, the previous management information circular filed in respect of the prior annual meeting of shareholders shall no longer be deemed to be incorporated into this Prospectus for purposes of future offers and sales of Offered Shares under this Prospectus.

Information contained on our website, www.tasekomines.com, is not part of this Prospectus Supplement or the Base Prospectus and is not incorporated herein by reference and may not be relied upon by you in connection with an investment in the Offered Shares.

Copies of the documents incorporated herein by reference may be obtained from us upon request without charge from Taseko Mines Limited, 15th Floor, 1040 West Georgia Street, Vancouver, British Columbia, V6E 4H1 (Telephone 778-373-4533) Attn: the Corporate Secretary, or by accessing our disclosure documents available on our profile on SEDAR at www.sedar.com or at the web site of the SEC at www.sec.gov.

SUMMARY OF THE OFFERING

|

The following is a summary of the principal features of the Offering and is subject to, and should be read together with the more detailed information, financial data and statements contained elsewhere in, and incorporated by reference into, this Prospectus Supplement and the accompanying Base Prospectus.

|

|

|

|

Common Shares Offered

|

27,750,000 Common Shares having an aggregate offering price of US$23,032,500.

|

|

|

|

|

Over-Allotment Option

|

The Company has granted to the Underwriters an option to purchase up to an additional 4,162,500 Common Shares at the Offering Price (having an offering price of up to US$3,454,875 if the Underwriters exercise the Over-Allotment Option in full) on the same terms and conditions as the Offering, exercisable in whole or in part and from time to time, for a period of up to 30 days following closing the Closing Date to cover over-allotments, if any.

|

|

|

|

|

Plan of Distribution

|

The Offering is made pursuant to the Underwriting Agreement dated November 12, 2020 among the Company and the Underwriters. See "Plan of Distribution", including for details regarding the Underwriters' Fee.

|

|

|

|

|

Use of Proceeds

|

We will use the net proceeds of the Offering and the Concurrent Private Placement to fund ongoing operating, engineering and project costs in connection with the advancement of the development of the Florence Cooper Project, for general corporate purposes and working capital. See "Use of Proceeds".

|

|

|

|

|

Risk Factors

|

Investing in our common shares is speculative and involves a high degree of risk. Each prospective investor should carefully consider the risks described under the sections titled "Risk Factors" in this Prospectus Supplement and in the Base Prospectus, and under similar headings in the documents incorporated by reference herein and therein before investing in the Offered Shares.

|

|

|

|

|

Listing

|

The Company has applied to list the Offered Shares qualified for distribution by this Prospectus Supplement on the TSX and the NYSE American. The Company will apply to the FCA and the LSE, respectively for the admission of the Offered Shares to listing on the standard segment of the Official List and to trading on the Main Market. Listing will be subject to the Company fulfilling all of the listing requirements of the TSX, NYSE American and the FCA and LSE.

|

|

|

|

|

Closing

|

Closing on a T+3 basis, on or about November 17, 2020 or such other date as the Company and the Lead Underwriter, on behalf of itself and the other Underwriters, mutually agree (the "Closing Date").

|

|

|

|

|

Trading symbols

|

TSX: TKO

NYSE American: TGB

LSE: TKO

|

MARKETING MATERIALS

Any marketing materials are not part of this Prospectus Supplement to the extent that the contents thereof have been modified or superseded by a statement contained in this Prospectus Supplement. Any template version of any marketing materials filed with the securities commission or similar authority in each of the provinces of Canada, except Québec, in connection with the Offering after the date of this Prospectus Supplement but prior to the termination of the distribution of the Offered Shares under this Prospectus Supplement (including any amendments to, or an amended version of, any template version of marketing materials) is deemed to be incorporated by reference in this Prospectus Supplement.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This Prospectus Supplement, the Base Prospectus and the documents incorporated herein and therein by reference contain certain forward-looking information and forward-looking statements within the meaning of applicable Canadian securities laws and forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the U.S. Securities Act of 1933, as amended and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Forward-looking statements describe our future plans, strategies, expectations and objectives, and are generally, but not always, identifiable by use of the words "may", "will", "should", "continue", "expect", "anticipate", "estimate", "believe", "intend", "plan" or "project" or the negative of these words or other variations on these words or comparable terminology.

Examples of forward-statements made in this Prospectus Supplement and the Base Prospectus, including the documents incorporated by reference, include statements relating to:

-

our expectations for production at Gibraltar and our related production guidance;

-

our expectations regarding achievement of reduced site spending under our new operating plan without impacting 2020 copper production;

-

our expectations regarding the capital and operating costs under our current mine plan for Gibraltar;

-

our expectations regarding the impact of the COVID-19 pandemic on our operations;

-

our expectations regarding our hedging strategies;

-

our expectations of the impact of the results of the Production Test Facility ("PTF") at Florence on the projected capital and operating costs for commercial scale operations at Florence;

-

our expectations for the timing and achievement of permitting for commercial scale operations at Florence;

-

the expected timing of commencement, the related capital and operating costs, and the method and achievement of project financing, of construction for commercial scale operations at Florence;

-

the economics of our development stage projects, including the Florence Copper Project and the Yellowhead Copper Project, including the projected capital and operating costs, net present values and internal rates of return of these projects based on technical studies completed by us;

-

our expectations for the market for copper and other commodities and the impact of these commodities prices on our cash flows from operations and our ability to finance our development projects;

-

our provisions for future asset retirement obligations relating to our mining activities at Gibraltar and Florence;

-

our strategy to grow our business from operating cash flow from Gibraltar and develop a pipeline of complementary projects for development; and

-

our expectations with regards to litigation relating to our development projects.

Such statements reflect our management's current views with respect to future events and are subject to risks and uncertainties and are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties and known or unknown risks and contingencies. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements, including, among others:

-

uncertainties about the future market price of copper and the other metals that we produce or may seek to produce;

-

changes in general economic conditions, the financial markets and in the demand and market price for our input costs, such as diesel fuel, steel, concrete, electricity and other forms of energy, mining equipment, and fluctuations in exchange rates, particularly with respect to the value of the U.S. dollar, Canadian dollar and British pound sterling, and the continued availability of capital and financing;

-

uncertainties about the effect of COVID-19, and the response of local, provincial, state, federal and international governments to the threat of COVID-19, on our operations (including our suppliers, customers, supply chain, employees and contractors) and economic conditions generally and in particular with respect to the demand for copper and other metals we produce;

-

inherent risks associated with mining operations, including our current mining operations at Gibraltar, and their potential impact on our ability to achieve our production estimates;

-

uncertainties as to our ability to achieve reduced costs under our updated mine plan for Gibraltar and to otherwise control our operating costs without impacting our planned copper production;

-

the risk of inadequate insurance or inability to obtain insurance to cover mining risks;

-

the risk that the results from our operations of the Florence PTF and ongoing engineering and costs updates will negatively impact our estimates for current projected economics for commercial operations at the Florence Copper Project;

-

uncertainties related to the accuracy of our estimates of mineral reserves (as defined below), mineral resources (as defined below), production rates and timing of production, future production and future cash and total costs of production and milling;

-

the risk that we may not be able to expand or replace reserves as our existing mineral reserves are mined;

-

uncertainties related to feasibility studies for the Florence Copper Project and the Yellowhead Copper Project that provide estimates of expected or anticipated capital and operating costs, expenditures and economic returns from these mining projects;

-

the availability of, and uncertainties relating to the development of, additional financing and infrastructure necessary for the continued operation and development of our projects, including with respect to our ability to obtain the required construction financing to move forward with commercial operations at the Florence Copper Project;

-

our ability to comply with the extensive governmental regulation to which our business is subject;

-

uncertainties related to our ability to obtain necessary title, licenses and permits for our future development projects and project delays due to third party opposition, particularly in respect to the Florence Copper Project that requires two key regulatory permits in order to advance to commercial operations;

-

uncertainties related to First Nations claims and consultation issues;

-

our reliance on rail transportation for production from Gibraltar;

-

uncertainties related to unexpected judicial or regulatory proceedings;

-

changes in, and the effects of, the laws, regulations and government policies affecting our exploration and development activities and mining operations;

-

our dependence solely on our 75% interest in Gibraltar (as defined below) for revenues;

-

our ability to extend existing concentrate off-take agreements or enter into new agreements;

-

environmental issues and liabilities associated with mining including processing and stock piling ore;

-

labor strikes, work stoppages, or other interruptions to, or difficulties in, the employment of labor in markets in which we operate mines, industrial accidents, equipment failure or other events or occurrences, including third party interference that interrupt the production of minerals in our mines;

-

environmental hazards and risks associated with climate change, including the potential for damage to infrastructure and stoppages of operations due to forest fires, flooding, drought, or other natural events in the vicinity of our operations;

-

litigation risks and the inherent uncertainty of litigation, including litigation to which our Florence Copper Project is subject;

-

our actual costs of reclamation and mine closure may exceed our current estimates of these liabilities;

-

our ability to renegotiate our existing union agreement for Gibraltar when it expires in 2021;

-

the capital intensive nature of our business both to sustain current mining operations and to develop any new projects;

-

our reliance upon key personnel;

-

the competitive environment in which we operate;

-

the effects of forward selling instruments to protect against fluctuations in copper prices;

-

the risk of changes in accounting policies and methods we use to report our financial condition, including uncertainties associated with critical accounting assumptions and estimates;

-

risks related to our long-term debt that will become due and payable in 2022; and

-

other risks detailed from time-to-time in our annual information forms, annual reports, MD&A, quarterly reports and material change reports filed with and furnished to securities regulators, and those risks which are discussed under the heading "Risk Factors".

Such information is included, among other places, in the Base Prospectus under the headings "The Company" and "Risk Factors", in our 2019 AIF under the headings "Description of Business" and "Risk Factors" and in our 2019 Annual MD&A and Interim MD&A, each of which documents are incorporated by reference into this Prospectus Supplement and the Base Prospectus, and any Additional Documents Incorporated by Reference.

Should one or more of these risks and uncertainties materialize, or should underlying factors or assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements. Material factors or assumptions involved in developing forward-looking statements include, without limitation, that:

-

the price of copper and other metals will not decline significantly or for a protracted period of time;

-

our mining operations will not experience any significant production disruptions that would materially affect our production forecasts or our revenues;

-

we will be able to achieve the projected cost savings under our revised mining plan for 2020 without adversely impacting 2020 copper production;

-

our estimates regarding future capital and operating costs at Gibraltar will be accurate;

-

grades and recoveries at Gibraltar remain consistent with current mine plans;

-

we will be able to incorporate the Gibraltar pit into our operations as planned;

-

the results from our operations of the Production Test Facility at Florence will continue to support that commercial operations at the Florence Copper Project are technically and economically feasible;

-

we will be able to obtain the construction financing necessary for us to advance the Florence Copper Project to commercial production;

-

we will be able to obtain the required permits necessary for us to proceed with commercial operations at Florence;

-

litigation regarding the Florence Copper Project will not materially impede or delay our ability to proceed with commercial operations at Florence;

-

there are no changes to any existing agreements or relationships with affected First Nations groups which would materially and adversely impact our operations;

-

there are no adverse regulatory changes affecting any of our operations;

-

exchange rates, prices of key consumables, costs of power, labour, material costs, supplies and services, and other cost assumptions at our projects are not significantly higher than prices assumed in planning;

-

our mineral reserve and resource estimates and the assumptions on which they are based, are accurate;

-

our estimates of reclamation liabilities and mine closure costs are accurate;

-

COVID-19, and the response of governments thereto, will not result in a material slow down or stoppage of our mining operations, disrupt our permitting activities or the timing of the response of government agencies to our permitting activities;

-

we will be able to re-finance the payment of our outstanding long-term debt when it matures in 2022; and

-

we will continue to generate positive cash flows from Gibraltar and be able to secure additional funding necessary for the development and continued advancement of our development projects.

These factors should be considered carefully and readers are cautioned not to place undue reliance on the forward-looking statements. Readers are cautioned that the foregoing list of risk factors is not exhaustive and it is recommended that prospective investors consult the more complete discussion of risks and uncertainties facing the Company included in the Prospectus. See "Risk Factors" for a more detailed discussion of these risks.

Although we believe that the expectations conveyed by the forward-looking statements are reasonable based on the information available to us on the date such statements were made, no assurances can be given as to future results, approvals or achievements. The forward-looking statements contained in the Prospectus and the documents incorporated by reference herein are expressly qualified by this cautionary statement. We disclaim any duty to update any of the forward-looking statements after the date of the Prospectus to conform such statements to actual results or to changes in our expectations except as otherwise required by applicable law.

WE QUALIFY ALL THE FORWARD-LOOKING STATEMENTS CONTAINED IN THE BASE PROSPECTUS AND THIS PROSPECTUS SUPPLEMENT AND THE DOCUMENTS INCORPORATED BY REFERENCE HEREIN AND THEREIN BY THE FOREGOING CAUTIONARY STATEMENTS.

CANADIAN MINERAL PROPERTY STANDARDS AND RESOURCE ESTIMATES

As a Canadian issuer, we are required to comply with reporting standards in Canada that require that we make disclosure regarding our mineral properties, including any estimates of mineral reserves and resources, in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this Prospectus Supplement have been prepared in accordance with NI 43-101.

This Prospectus Supplement uses the certain technical terms presented below as they are defined in accordance with the CIM Definition Standards on mineral resources and reserves (the "2014 CIM Definition Standards") adopted by the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM Council"), as required by NI 43-101. The following definitions are reproduced from the latest version of the CIM Standards, which were adopted by the CIM Council on May 10, 2014 (the "CIM Definitions"):

|

feasibility study

|

A comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable modifying factors together with any other relevant operational factors and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a pre-feasibility study.

|

|

indicated mineral resource

|

That part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An indicated mineral resource has a lower level of confidence than that applying to a measured mineral resource and may only be converted to a probable mineral reserve.

|

|

inferred mineral resource

|

That part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and may not be converted to a mineral reserve. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration.

|

|

measured mineral resource

|

That part of a mineral resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of modifying factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A measured mineral resource has a higher level of confidence than that applying to either an Indicated mineral resource or an inferred mineral resource. It may be converted to a proven mineral reserve or to a probable mineral reserve.

|

|

mineral reserve

|

The economically mineable part of a measured and/or indicated mineral resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility level as appropriate that include application of modifying factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which mineral reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully informed as to what is being reported. The public disclosure of a mineral reserve must be demonstrated by a pre-feasibility study or feasibility study.

|

|

mineral resource

|

A concentration or occurrence of solid material of economic interest in or on the Earth's crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling.

|

|

modifying factors

|

Considerations used to convert mineral resources to mineral reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors.

|

|

NI 43-101

|

Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects, as adopted by the Canadian Securities Administrators.

|

|

pre-feasibility study

|

A comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on the modifying factors and the evaluation of any other relevant factors which are sufficient for a qualified person, acting reasonably, to determine if all or part of the mineral resource may be converted to a mineral reserve at the time of reporting. A pre-feasibility study is at a lower confidence level than a feasibility study.

|

|

probable mineral reserve

|

The economically mineable part of an indicated, and in some circumstances, a measured mineral resource. The confidence in the modifying factors applying to a probable mineral reserve is lower than that applying to a proven mineral reserve.

|

|

proven mineral reserve

|

The economically mineable part of a measured mineral resource. A proven mineral reserve implies a high degree of confidence in the modifying factors.

|

CAUTIONARY NOTES TO U.S. INVESTORS CONCERNING CANADIAN MINERAL PROPERTY DISCLOSURE STANDARDS

The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Exchange Act. These amendments became effective February 25, 2019 (the "SEC Modernization Rules") with compliance required for the first fiscal year beginning on or after January 2, 2021. The SEC Modernization Rules have replaced the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7 ("Guide 7"), which will be rescinded from and after the required compliance date of the SEC Modernization Rules.

The SEC Modernization Rules include the adoption of definitions of the following terms, which are substantially similar to the corresponding terms under the CIM Definition Standards that are presented above under "Canadian Mineral Property Disclosure Standards and Resource Estimates":

-

feasibility study;

-

indicated mineral resource;

-

inferred mineral resource;

-

measured mineral resource;

-

mineral reserve;

-

mineral resource;

-

modifying factors;

-

preliminary feasibility study (or "pre-feasibility study");

-

probable mineral resource; and

-

proven mineral reserve.

As a result of the adoption of the SEC Modernization Rules, the SEC will now recognize estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definitions.

We are not required to provide disclosure on our mineral properties under the SEC Modernization Rules as we are presently a "foreign issuer" under the U.S. Exchange Act and entitled to file continuous disclosure reports with the SEC under the MJDS between Canada and the United States. Accordingly, we anticipate that we will be entitled to continue to provide disclosure on our mineral properties in accordance with NI 43‐101 disclosure standards and CIM Definition Standards. However, if we either cease to be a "foreign issuer" or cease to be entitled to file reports under the MJDS, then we will be required to provide disclosure on our mineral properties under the SEC Modernization Rules, subject to a transition period with full compliance required for fiscal years beginning on or after January 1, 2021. Accordingly, United States investors are cautioned that the disclosure that we provide on our mineral properties in this Prospectus and under our continuous disclosure obligations under the U.S. Exchange Act may be different from the disclosure that we would otherwise be required to provide as a U.S. domestic issuer or a non‐MJDS foreign issuer under the SEC Modernization Rules.

United States investors are cautioned that while the above terms are substantially similar to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral resources that we may report as "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had we prepared the resource estimates under the standards adopted under the SEC Modernization Rules.

United States investors are also cautioned that while the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", investors should not to assume that any part or all of the mineral deposits in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described by these terms has a great amount of uncertainty as to their economic and legal feasibility. Accordingly, investors are cautioned not to assume that any "measured mineral resources", "indicated mineral resources", or "inferred mineral resources" that we report in this Prospectus Supplement are or will be economically or legally mineable.

Further, "inferred resources" have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred resources exist. In accordance with Canadian rules, estimates of "inferred mineral resources" cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

For the above reasons, information contained in this Prospectus Supplement and the documents incorporated by reference herein containing descriptions of our mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

NOTE TO U.S. READERS REGARDING DIFFERENCES BETWEEN UNITED STATES AND CANADIAN REPORTING PRACTICES

We prepare our financial statements in accordance with IFRS, as issued by the IASB, which differs from U.S. generally accepted accounting principles ("U.S. GAAP"). Accordingly, our financial statements incorporated by reference in the Prospectus Supplement, and in the documents incorporated by reference in this Prospectus Supplement, may not be comparable to financial statements of United States companies prepared in accordance with U.S. GAAP.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

Unless stated otherwise or as the context otherwise requires, all references to dollar amounts in this Prospectus Supplement are references to Canadian dollars. References to “dollars” or "$" are to Canadian dollars, references to "U.S. dollars" or "US$" are to United States dollars, and references to GB£ are to British pounds sterling.

Except as otherwise noted in our 2019 AIF and the Company's financial statements and related management's discussion and analysis of financial condition and results of operations of the Company that are incorporated by reference into this Prospectus, the financial information contained in such documents is expressed in Canadian dollars.

As of November 11, 2020, the Bank of Canada daily exchange rate for the U.S. dollar in terms of Canadian dollars, was U.S.$1.00 = $1.3017 and for the U.S. dollar against the British pound sterling was U.S.$1.00 = £0.7623.

The high, low, average and average daily exchange rates for the U.S. dollar in terms of Canadian dollars for each of the financial periods of the Company ended December 31, 2019, December 31, 2018 and December 31, 2017, as quoted by the Bank of Canada, were as follows:

|

|

Year ended December 31, 2019

|

Year ended December 31, 2018

|

Year ended December 31, 2017

|

|

|

|

|

|

|

(in Canadian Dollars)

|

|

|

|

High

|

1.3600

|

1.3642

|

1.3743

|

|

|

|

|

|

|

Low

|

1.2988

|

1.2288

|

1.2128

|

|

|

|

|

|

|

Average

|

1.3269

|

1.2957

|

1.2986

|

|

|

|

|

|

|

Closing

|

1.2988

|

1.3642

|

1.2545

|

THE COMPANY

This summary does not contain all the information about the Company that may be important to you. You should read the more detailed information, public filings and financial statements and related notes that are incorporated by reference into and are considered to be a part of this Prospectus Supplement.

Taseko is a Vancouver, B.C. headquartered mining company that is focused on the operation of the Gibraltar Mine, and on the development of the Florence Copper Project towards a construction decision and the advancement of the Yellowhead Copper Project, the New Prosperity Gold and Copper Project, and Aley Niobium Project. The Company was incorporated on April 15, 1966 under the laws of the Province of British Columbia and is governed by the BCBCA. Our registered office is located at Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia, V6E 4N7, and our operational head office is located at 15th Floor, 1040 West Georgia Street, Vancouver, British Columbia, V6E 4H1. We operate our business through our subsidiaries, as described in our 2019 AIF.

Gibraltar

Our principal operating asset is our 75% joint venture interest in the Gibraltar Mine, a large copper mine located in central British Columbia. Gibraltar is the second largest open pit copper mine in Canada, having produced 126 million pounds of copper in 2019 (on a 100% basis). Gibraltar also produces molybdenum and silver and has an expected mine life of at least 18 years based on Proven Sulphide Mineral Reserves and Probable Sulphide Mineral Reserves of 564 million tons at a grade of 0.25% copper as of December 31, 2019. Between 2006 and 2013, we expanded and modernized the Gibraltar Mine ore concentrator, added a second ore concentrator, increased the mining fleet and made other production improvements at the mine. Following this period of mine expansion and capital expenditure, Gibraltar has achieved a stable level of operations and our focus is on further improvements to operating practices to reduce unit costs.

Florence

We are also proceeding with the development of the Florence Copper Project in Arizona. We completed construction of a production test facility (the "PTF") for the Florence Copper Project in 2018 and wellfield operations commenced in the fourth quarter of 2018. The PTF has operated as planned since then, producing first copper from the SX/EW plant in April 2019. The PTF wellfield is performing to its design, has demonstrated that hydraulic control of the wellfield can be maintained, and the SX-EW plant is producing a high-quality copper cathode.

The second phase of the Florence Copper Project will consist of the permitting, construction and operation of the commercial ISCR facility. Completion of the ISCR production facility has an estimated capital cost of approximately US$204 million (plus reclamation bonding and working capital) on a Q4 2016 cost basis. The Company is currently evaluating various financing alternatives to raise the construction financing through a combination of the potential sale of a minority joint venture interest in the Florence project, a potential royalty or metal stream financing, a potential debt financing, excess cash flow from the Gibraltar mine operations and, if required, additional equity financings.

Future Development Projects

We have a diverse pipeline of wholly-owned development projects at various stages of technical and economic studies, including the Yellowhead Copper Project, the New Prosperity Gold and Copper Project, and Aley Niobium Project. We also own the Harmony Gold Project, currently a dormant exploration stage gold property.

Corporate Strategy

Our strategy has been to grow by leveraging cash flow from the Gibraltar Mine to acquire and develop a pipeline of projects. We continue to believe this will generate long-term returns for shareholders. Our development projects are located in British Columbia and Arizona and represent a diverse range of metals, including gold, copper, molybdenum and niobium. Our project focus is currently on the development of the Florence Copper Project and we have incurred $13.3 million in PTF operation and other project development costs for the n months ended September 30, 2020.

Additional information on our recent activities are included in our 2019 AIF, our 2019 MD&A and our Interim MD&A.

Recent Developments

Florence Copper Project

Steady state operation of the PFT was achieved in 2019 and the focus turned to testing different wellfield operating strategies, including adjusting pumping rates, solution strength, flow direction, and the use of packers in recovery and injection wells to isolate different zones of the ore body. The operating team has used physical and operating control mechanisms to adjust solution chemistry and flow rates and has successfully achieved targeted copper concentration in solution. Pregnant leach solution (“PLS”) grade in the centre recovery well (most representative of the performance of the commercial wellfield) has achieved targeted levels the SX/EW plant produced at a rate of approximately one million pounds of copper cathode per year, mainly from the centre recovery well, prior to switching to the rinsing phase of testing in late June 2020. Data collected during this final rinsing phase will further inform commercial operations.

The PTF has provided valuable data to validate the Company’s modelled assumptions and operating parameters, and this data is being used to refine operating plans for the commercial phase. Detailed engineering for the commercial facility is ongoing with the objective to have it substantially complete ahead of receipt of the final permits and a final construction decision.

Two permits are required to commence construction of the commercial scale wellfield at Florence Copper, which is expected to produce 85 million pounds of copper cathode annually for 20 years. These are the Aquifer Protection Permit (“APP”) from the Arizona Department of Environmental Quality (“ADEQ”) and the Underground Injection Control (“UIC”) Permit from the U.S. Environmental Protection Agency (“EPA”).

On August 6, 2020, the draft APP was issued by the ADEQ and a public comment period was initiated. During this hearing, the Florence Copper Project received overwhelming support from local community members, local business owners, elected state officials and city councillors, a state senator and representatives from the technical services sector. The public comment period ended on October 12 and the ADEQ is reviewing comments received before issuing the final permit.

The EPA is also nearing completion of its technical review for the UIC permit and no significant issues have been identified. While progress is being made, the COVID-19 situation in Arizona has had an impact on the EPA process and this has extended the timeline by a few months, but management still expects the project will be fully permitted in early 2021.

The Company continued to advance discussions with interested parties regarding the potential sale of a minority interest in the Florence project, and the proceeds of any such sale could fund a significant portion of the capital required to develop the commercial operation. Discussions with potential lenders and other finance providers are ongoing. The Company targets having a committed financing package in place prior to receipt of the permits.

COVID-19 and Gibraltar Operations Update

To-date, there have been no interruptions to the Company’s operations, logistics and supply chains as a result of the COVID-19 pandemic. Heightened health and safety protocols continue to be implemented and monitored for effectiveness. In light of the overall economic volatility experienced earlier this year due to Covid-19, management implemented a revised mining plan in March that reduced costs over the last six months while still maintaining long-term mine plan requirements.

Annual production guidance for 2020 remains at 130 million pounds (+/- 5%). Copper production for the nine months ended September 30, 2020 was 98.1 million pounds and sales for the same period were 99.0 million pounds.

Yellowhead

In May 2020, the Company entered into an agreement with an Indigenous Nation regarding Taseko's intentions to commence the regulatory approval process of the Yellowhead Copper Project. The agreement represents Taseko's commitment to recognize and respect the Nation's inherent right to govern its lands, and the importance of assessing the Yellowhead Copper Project in accordance with its values, laws, and community aspirations to make an informed decision on the project.

Changes to the Board of Directors

On July 8, 2020, the Company held its 2020 Annual General Meeting, at which Richard Mundie and Alex Morrison did not stand for re-election, and Peter Mitchell was appointed to the Board of Directors. Mr. Mitchell is a Chartered Accountant (CPA-CA) with over 35 years of senior financial management experience in both public and private equity sponsored companies.

PLAN OF DISTRIBUTION

The Offered Shares will be offered in each of the provinces of Canada, except Québec, and in the United States pursuant to the MJDS and, subject to applicable law and the Underwriting Agreement, certain jurisdictions outside of Canada and the United States. Pursuant to the Underwriting Agreement, the Company has agreed to issue and sell and the Underwriters have severally agreed to purchase, as principals, subject to compliance with all necessary legal requirements and the terms and conditions contained in the Underwriting Agreement, a total of 27,750,000 Offered Shares at the Offering Price of US$0.83 per Offered Share, payable in cash to the Company against delivery of such Offered Shares, on the Closing Date. In consideration for their services in connection with the Offering, the Underwriters will be paid the Underwriters’ Fee equal to 6.0% of the gross proceeds of the Offering (US$0.0498 per Offered Share, for an aggregate fee payable by the Company of US$1,381,950, exclusive of the Over-Allotment Shares). The Offering Price was determined by negotiation between the Company and the Lead Underwriter, on its own behalf and on behalf of the other Underwriters. Subject to the terms and conditions of the Underwriting Agreement, the Company has agreed to sell to the Underwriters, and each Underwriter has severally agreed to purchase, at the Offering Price less the Underwriting Fee set forth on the cover page of this Prospectus Supplement, the number of Offered Shares listed next to its name in the following table:

|

|

Number of Offered

Shares

|

|

Cantor Fitzgerald Canada Corporation

|

13,875,000

|

|

Velocity Trade Capital Ltd.

|

5,550,000

|

|

BMO Nesbitt Burns Inc.

|

2,775,000

|

|

National Bank Financial Inc.

|

2,775,000

|

|

TD Securities Inc.

|

2,775,000

|

|

Total

|

27,750,000

|

In connection with the Offering, the Underwriters may, for stabilization purposes, over-allot common shares up to a maximum of 15% of the total number of common shares comprised in the Offering. Pursuant to the Underwriting Agreement, Taseko has granted to the Underwriters the Over-Allotment Option, exercisable in whole or in part at any time up to 30 calendar days after the Closing Date, to purchase up to an additional 4,162,500 Common Shares (equivalent to up to 15% of the total number of common shares comprised in the Offering) at the Offering Price to cover over-allocations, if any, and for market stabilization purposes, on the same terms and conditions as apply to the purchase of Offered Shares thereunder. The Over-Allotment Option will be exercisable in whole or in part, upon notice by the Underwriters, at any time on or before the 30th calendar day after the Closing Date.

A purchaser who acquires Over-Allotment Shares forming part of the Underwriters' over-allocation position acquires those Over-Allotment Shares under the Prospectus Supplement, regardless of whether the over-allocation position is ultimately filled through the exercise of the Over-Allotment Option or secondary market purchases.

In connection with the Offering, Cantor Fitzgerald Canada Corporation or any of its agents, may (but will be under no obligation to), to the extent permitted by applicable law, over-allot common shares or effect other transactions with a view to supporting the market price of the common shares at a higher level than that which might otherwise prevail in the open market. Cantor Fitzgerald Canada Corporation is not required to enter into such transactions and such transactions may be effected on any securities market, over-the-counter market, stock exchange or otherwise and may be undertaken at any time during the period commencing on November 11, 2020 and ending no later than the 30th calendar day after the Closing Date. However, there will be no obligation on Cantor Fitzgerald Canada Corporation or any of its agents to effect stabilizing transactions and there is no assurance that stabilizing transactions will be undertaken. Such stabilization, if commenced, may be discontinued at any time without prior notice. In no event, will measures be taken to stabilize the market price of the common shares above the Offering Price. Except as required by law or regulation, neither the Underwriters nor any of their agents intend to disclose the extent of any over-allotments made and/or stabilization transactions conducted in relation to the Offering.

Cantor Fitzgerald Canada Corporation, BMO Nesbitt Burns Inc., National Bank Financial Inc. and TD Securities Inc. may sell Offered Shares in the United States through their U.S. affiliates, Cantor Fitzgerald & Co., BMO Capital Markets Corp., National Bank of Canada Financial Inc. and TD Securities (USA) LLC, respectively, each of which is not registered as an investment dealer in any Canadian jurisdiction and, accordingly, will only sell Offered Shares into the United States or other jurisdictions outside of Canada and will not, directly or indirectly, solicit offers to purchase or sell the Offered Shares in Canada. Subject to applicable law, the Underwriters may offer to sell the Offered Shares outside of Canada and the United States.

The TSX has conditionally approved the listing of the Offered Shares offered under this short form prospectus, subject to the Company fulfilling the listing requirements of the TSX. The Common Shares will be listed on the standard segment of the Official List and admitted to trading on the Main Market, and will be listed on the NYSE American, subject to the Company fulling notification and requirements of the LSE, FCA and NYSE American, respectively.

The Company understands that certain directors and officers of the Company may purchase Offered Shares under the Offering.

Pursuant to policies of certain Canadian securities regulatory authorities, the Underwriters may not, throughout the period of distribution under the Offering, bid for or purchase Common Shares for their own accounts or for accounts over which they exercise control or direction. The foregoing restriction is subject to certain exceptions, on the condition that the bid or purchase not be engaged in for the purpose of creating actual or apparent active trading in or raising the price of the Common Shares. These exceptions include a bid or purchase permitted under Universal Market Integrity Rules for Canadian marketplaces administered by the Investment Industry Regulatory Organization of Canada relating to market stabilization and passive market making activities, and a bid or purchase made for or on behalf of a customer where the order was not solicited during the period of distribution. Subject to the foregoing, the Underwriters may effect transactions which stabilize or maintain the market price of the Common Shares at levels other than those which otherwise might prevail on the open market. These stabilizing transactions, syndicate covering transactions and penalty bids may have the effect of preventing or mitigating a decline in the market price of the Common Shares, and may cause the price of the Offered Shares to be higher than would otherwise exist in the open market absent such stabilizing activities. As a result, the price of the Offered Shares may be higher than the price that might otherwise exist in the open market. Such transactions, if commenced, may be discontinued at any time.