- Fourth quarter revenue growth driven by success in Middle

East; International revenue was 6 times greater than prior year and

more than double the trailing third quarter

- Annual revenue of $19.0 million, increased 4.1% over prior

year

- Annual International revenue nearly quadrupled to $1.3

million

- Reduced total debt by $2.9 million, or 27%, in 2019

Superior Drilling Products, Inc. (NYSE American: SDPI) (“SDP” or

the “Company”), a designer and manufacturer of drilling tool

technologies, today reported financial results for the fourth

quarter and full-year ended December 31, 2019

Troy Meier, Chairman and CEO, noted, “Revenue from the increased

use of our leading technology, the Drill-N-Ream® well bore

conditioning tool (“DNR”), in the Middle East drove growth in the

quarter. And in fact, North America revenue grew in the quarter

despite the dramatic reduction of drilling activity in the U.S.,

driven by increased tool sales and greater demand for contract

services. We believe that this demonstrates continued building of

demand for the DNR and further market penetration, as well as the

success of our strategy to expand our relationship and

opportunities with our leading legacy customer.”

Fourth Quarter 2019 Review ($ in thousands, except per

share amounts) (See at “Definitions” the composition of

product/service revenue categories.)

($ in thousands,except per share amounts)

Q4 2019 Q4

2018 $Y/YChange % Y/YChange Q3 2019 $

Seq.Change % Seq.Change Tool Sales/Rental

$

1,196

$

426

$

770

180.5%

$

1,361

$

(165)

(12.1)%

Other Related Tool Revenue

1,708

1,753

(45)

(2.6)%

1,834

(126)

(6.9)%

Tool Revenue

2,904

2,180

724

33.2%

3,195

(291)

(9.1)%

Contract Services

1,437

1,301

136

10.4%

1,881

(444)

(23.6)%

Total Revenue

$

4,341

$

3,481

$

860

24.7%

$

5,076

$

(735)

(14.5)%

When compared with the prior-year period, revenue grew 24.7%

driven by the increase in Tool Sales and Rental from strong growth

in the rental of the DNR in the Middle East, increased tool sales

in the U.S. and higher Contract Services revenue as demand from the

Company’s legacy customer increased to serve the larger geographic

area, additional types of tools being repaired and more custom

manufacturing requirements.

Fourth Quarter 2019 Operating Costs

($ in thousands)

Q4 2019 Q4 2018 $ Y/YChange

% Y/Y Change

Q3 2019 $ Seq.Change

% Seq. Change

Cost of revenue

$

2,063

$

1,670

$

393

23.5%

$

2,063

0

0.0%

As a percent of sales

47.5%

48.0%

40.6%

Selling, general & administrative

$

1,901

$

2,116

$

(215)

(10.2)%

$

2,502

(601)

(24.0)%

As a percent of sales

43.8%

60.8%

49.3%

Depreciation & amortization

$

748

$

940

$

(192)

(20.4)%

$

739

10

1.3%

Total operating expenses

$

4,712

$

4,726

$

(14)

(0.3)%

$

5,303

$

(591)

(11.1)%

Operating loss

$

(371)

$

(1,245)

$

874

NM

$

(227)

$

(144)

NM

As a % of sales

(8.5)%

(35.8)%

(4.5)%

Other income (expense) includingincome tax (expense)

$

533

$

171

$

361

211.0%

$

(191)

723

NM

Net income (loss)

$

125

$

(1,081)

$

1,206

NM

$

(418)

$

542

NM

Diluted earnings (loss) per share

$

0.00

$

(0.04)

$

0.05

NM

$

(0.02)

$

0.02

NM

Adjusted EBITDA(1)

$

621

$

233

$

387

165.9%

$

1,083

$

(462)

(42.6)%

(1)See the attached tables for important disclosures regarding

SDP's use of Adjusted EBITDA, as well as a reconciliation of net

loss to Adjusted EBITDA.

The cost of revenue as a percentage of sales decreased 50 basis

points over the prior-year period on higher volume, offset by the

current higher cost of International revenue as the Company creates

greater scale in that market.

The decline in selling, general and administrative expense

(SG&A) was the result of higher noncash bonus expense in the

prior-year’s fourth quarter, the difference in timing which more

than offset higher legal expenses and the cost of international

market development efforts in the 2019 fourth quarter.

Net income for the quarter was $125 thousand, up from a net loss

of $1.1 million in the fourth quarter of 2018. Adjusted EBITDA(1),

a non-GAAP measure defined as earnings before interest, taxes,

depreciation and amortization, non-cash stock compensation expense

and unusual items, expanded as a percent of revenue by 760 basis

points to 14.3% compared with the fourth quarter of 2018.

The Company believes that when used in conjunction with measures

prepared in accordance with U.S. generally accepted accounting

principles (“GAAP”), Adjusted EBITDA, which is a non-GAAP measure,

helps in the understanding of its operating performance.

Full Year 2019 Review

($ in thousands,except per share amounts)

2019

2018

$ Change % Change Tool sales/rental

$

5,310

$

6,580

$

(1,270)

(19.3)%

Other Related Tool Revenue

6,806

6,562

244

3.7%

Tool Revenue

$

12,116

$

13,142

$

(1,026)

(7.8)%

Contract Services

6,881

5,104

1,777

34.8%

Total Revenue

$

18,997

$

18,245

$

752

4.1%

Operating expenses

19,899

17,945

1,954

10.9%

Operating (loss) income

$

(902)

$

300

$

(1,202)

(400.4)%

Net loss

$

(936)

$

(58)

$

(878)

NM

Diluted loss per share

$

(0.04)

$

(0.00)

$

(0.03)

NM

Adjusted EBITDA(1)

$

3,972

$

5,074

$

(1,102)

NM

(1)See the attached tables for important disclosures regarding

SDP's use of Adjusted EBITDA, as well as a reconciliation of net

loss to Adjusted EBITDA.

Revenue growth in 2019 was the result of increased Middle East

tool rental revenue, more DNR maintenance and royalty revenue as

the tool continues to demonstrate its resiliency, and higher demand

from the Company’s legacy customer for drill bit and other tool

refurbishment and contract manufacturing. This more than offset

lower Tool Sales and Rental revenue which reflected a reduction in

tool sales.

The increase in operating expenses in 2019 was primarily due to

incremental costs associated with the Middle East expansion, the

addition of a Texas service center and higher annual noncash bonus

expense. Operating loss was $0.9 million in 2019, compared with

operating income in 2018 of $0.3 million.

Net loss for 2019 was $0.9 million, or $(0.04) per diluted

share. Adjusted EBITDA(1) for 2019 was $4.0 million. Adjusted

EBITDA margin was 21% in 2019, compared with 27% in 2018.

Balance Sheet and Liquidity

Cash at the end of the quarter was $1.2 million and working

capital was $0.8 million. Capital expenditures were $0.1 million in

the quarter and $0.5 million in 2019.

Total debt at the end of the year was $8.0 million, down $2.9

million, or 26.9%, compared with $10.9 million at December 31,

2018. Subsequent to the end of the year, the Company made a

$750,000 principal payment on the Hard Rock note. Three remaining

payments of $750 thousand in principal are due 2020.

In December 2019, SDP entered into an amended lending agreement

which reloaded and expanded its term loan to $1.0 million for total

funds to the Company of $350,000. In February 2020, SDP sold an

aircraft asset for a gain of $146 thousand and subsequently paid

off the $212 thousand remaining on the loan related to the

aircraft, resulting in net cash of $117 thousand. The Company

believes that cash on hand and cash generated from operations will

provide sufficient liquidity for the year to meet its

obligations.

2020 Outlook:

Mr. Meier concluded, “2020 has begun strong both in the U.S. and

Middle East, and we are making solid progress on discussions to

build out our distribution channels in both markets to further our

market reach with additional strategic partnerships. However giving

the sudden turn of event in the oil and gas industry we are

hesitant to provide a forecast at this time. Nonetheless, given our

solid business model, strong cost discipline and leading drilling

technologies, we believe we can outperform against the headwinds of

the industry.”

Definitions and Composition of Product/Service

Revenue:

Contract Services Revenue is comprised of drill bit and other

repair and manufacturing services.

Other Related Tool Revenue is comprised of royalties and fleet

maintenance fees.

Tool Sales/Rental revenue is comprised of revenue from either

the sale of tools or tools rented to customers.

Tool Revenue is the sum of Other Related Tool Revenue and Tool

Sales/Rental revenue.

Webcast and Conference Call

The Company will host a conference call and live webcast today

at 10:00 am MT (12:00 pm ET) to review the financial and operating

results for the quarter and discuss its corporate strategy and

outlook. The discussion will be accompanied by a slide presentation

that will be made available immediately prior to the conference

call on SDP's website at www.sdpi.com/events. A question-and-answer

session will follow the formal presentation.

The conference call can be accessed by calling (201) 689-8470.

Alternatively, the webcast can be monitored at www.sdpi.com/events.

A telephonic replay will be available from 1:00 p.m. MT (3:00 p.m.

ET) the day of the teleconference until Thursday, March 19, 2020.

To listen to the archived call, please call (412) 317-6671 and

enter conference ID number 13697748, or access the webcast replay

at www.sdpi.com, where a transcript will be posted once

available.

About Superior Drilling Products, Inc.

Superior Drilling Products, Inc. is an innovative, cutting-edge

drilling tool technology company providing cost saving solutions

that drive production efficiencies for the oil and natural gas

drilling industry. The Company designs, manufactures, repairs and

sells drilling tools. SDP drilling solutions include the patented

Drill-N-Ream® well bore conditioning tool and the patented Strider™

oscillation system technology. In addition, SDP is a manufacturer

and refurbisher of PDC (polycrystalline diamond compact) drill bits

for a leading oil field service company. SDP operates a

state-of-the-art drill tool fabrication facility, where it

manufactures its solutions for the drilling industry, as well as

customers’ custom products. The Company’s strategy for growth is to

leverage its expertise in drill tool technology and innovative,

precision machining in order to broaden its product offerings and

solutions for the oil and gas industry.

Additional information about the Company can be found at:

www.sdpi.com.

Safe Harbor Regarding Forward Looking Statements

This news release contains forward-looking statements and

information that are subject to a number of risks and

uncertainties, many of which are beyond our control. All

statements, other than statements of historical fact included in

this release, regarding our strategy, future operations, success at

developing future tools, the Company’s effectiveness at executing

its business strategy and plans, financial position, estimated

revenue and losses, projected costs, prospects, plans and

objectives of management, and ability to outperform are

forward-looking statements. The use of words “could,” “believe,”

“anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,”

“predict,” “potential,” “project”, “forecast,” “should” or “plan,

and similar expressions are intended to identify forward-looking

statements, although not all forward -looking statements contain

such identifying words. These statements reflect the beliefs and

expectations of the Company and are subject to risks and

uncertainties that may cause actual results to differ materially.

These risks and uncertainties include, among other factors, success

at expansion in the Middle East, options available for market

channels in North America, commercialization of the Strider

technology, the success of the Company’s business strategy and

prospects for growth; the market success of the Company’s

specialized tools, effectiveness of its sales efforts, its cash

flow and liquidity; financial projections and actual operating

results; the amount, nature and timing of capital expenditures; the

availability and terms of capital; competition and government

regulations; and general economic conditions. These and other

factors could adversely affect the outcome and financial effects of

the Company’s plans and described herein. The Company undertakes no

obligation to revise or update any forward-looking statements to

reflect events or circumstances after the date hereof

Superior Drilling Products, Inc. Consolidated Condensed

Statements Of Operations For the Years Ended December 31,

2019 and 2018 (unaudited)

For the Three Months

For the Year Ended Ended December 31, Ended

December 31,

2019

2018

2019

2018

Revenue North America

$

3,724,893

$

3,377,748

$

17,682,560

$

17,882,929

International

616,117

102,887

1,314,454

362,283

Total revenue

$

4,341,010

$

3,480,635

$

18,997,014

$

18,245,212

Operating cost and expenses Cost of revenue

2,063,117

1,669,955

8,182,546

7,077,344

Selling, general, and administrative expenses

1,900,627

2,115,951

8,287,832

7,107,432

Depreciation and amortization expense

748,333

940,048

3,428,403

3,760,231

Total operating costs and expenses

4,712,077

4,725,954

19,898,781

17,945,007

Operating income (loss)

(371,067)

(1,245,319)

(901,767)

300,205

Other income (expense) Interest income

8,552

24,927

60,996

55,007

Interest expense

(173,949)

(220,988)

(764,754)

(773,680)

Recovery of related party note

678,148

377,746

678,148

377,746

Loss on Fixed Asset Impairment

-

-

(6,143)

-

Gain (loss) on sale or disposition of assets

1,500

(14,013)

15,647

(14,013)

Total other income (expense)

514,251

167,672

(16,106)

(354,940)

Income (loss) before income taxes

$

143,184

$

(1,077,647)

$

(917,873)

$

(54,735)

Income tax expense

(18,550)

(3,640)

(18,550)

(3,640)

Net income (loss)

$

124,634

$

(1,081,287)

$

(936,423)

$

(58,375)

Basic income (loss) earnings per common share

$

0.00

$

(0.04)

$

(0.04)

$

(0.00)

Basic weighted average common shares outstanding

25,231,845

24,820,600

25,090,283

24,608,967

Diluted income (loss) per common Share

$

0.00

$

(0.04)

$

(0.04)

$

(0.00)

Diluted weighted average common shares outstanding

25,231,845

24,820,600

25,090,283

24,608,967

Superior Drilling Products, Inc. Consolidated Condensed

Balance Sheets (Unaudited)

December 31, 2019 December 31, 2018 Assets

Current assets: Cash

$

1,217,014

$

4,264,767

Accounts receivable, net

3,850,509

2,273,189

Prepaid expenses

139,070

133,607

Inventories

924,032

1,003,623

Asset held for sale

252,704

-

Other current assets

252,178

-

Total current assets

6,635,507

7,675,186

Property, plant and equipment, net

8,045,692

8,226,009

Intangible assets, net

1,986,111

3,686,111

Other noncurrent assets

93,619

51,887

Total assets

$

16,760,929

$

19,639,193

Liabilities and Shareholders' Equity Current

liabilities: Accounts payable

$

945,414

$

717,721

Accrued expenses

683,832

631,860

Customer Deposits

61,421

-

Income tax payable

15,880

3,640

Current portion of long-term debt, net of discounts

4,102,543

4,578,759

Total current liabilities

$

5,809,090

$

5,931,980

Long-term debt, less current portion, net of discounts

3,848,863

6,296,994

Total liabilities

$

9,657,953

$

12,228,974

Stockholders' equity Common stock (25,418,126 and

25,018,098)

25,418

25,018

Additional paid-in-capital

40,069,391

39,440,611

Accumulated deficit

(32,991,833

)

(32,055,410

)

Total stockholders' equity

$

7,102,976

$

7,410,219

Total liabilities and shareholders' equity

$

16,760,929

$

19,639,193

Superior Drilling Products, Inc. Consolidated Condensed

Statement of Cash Flows For The Years Ended December 31,

2019 and 2018 (Unaudited) December 31,2019

December 31,2018 Cash Flows From Operating Activities

Net Loss

$

(936,423

)

$

(58,375

)

Adjustments to reconcile net loss to net cash provided by operating

activities: Depreciation and amortization expense

3,428,403

3,760,231

Amortization of debt discount

-

77,641

Share based compensation expense

629,180

518,956

Impairment of inventories

-

116,396

Loss on sale or disposition of assets

21,921

14,013

Impairment on asset held for sale

6,143

-

Amortization of deferred loan cost

14,942

-

Changes in operating assets and liabilities: Accounts receivable

(1,577,320

)

393,853

Inventories

(680,904

)

77,760

Prepaid expenses and other current assets

(299,373

)

(58,010

)

Accounts payable and accrued expenses

257,533

(215,646

)

Income tax expense

12,240

3,640

Other long-term liabilities

61,421

-

Net Cash Provided By Operating Activities

937,763

4,630,459

Cash Flows From Investing Activities Purchases of

property, plant and equipment

(509,055

)

(745,204

)

Net Cash Provided By (Used In) Investing Activities

(509,055

)

(745,204

)

Cash Flows From Financing Activities Principal

payments on debt

(4,746,145

)

(2,009,941

)

Proceeds received from debt borrowings

1,150,000

-

Payments on Revolving Loan

(1,924,939

)

-

Proceeds received from Revolving Loan

2,118,226

-

Proceeds from Exercised Options

-

14,274

Debt issuance Costs

(73,603

)

-

Net Cash Used In Financing Activities

(3,476,461

)

(1,995,667

)

Net Increase (Decrease) in Cash

(3,047,753

)

1,889,588

Cash at Beginning of Period

4,264,767

2,375,179

Cash at End of Period

$

1,217,014

$

4,264,767

Supplemental information: Cash paid for interest

$

856,012

$

577,814

Non-cash payment of other liabilities by offsetting recovery of

related-party note receivable

$

678,148

$

377,746

Acquisition of equipment by issuance of Liability

559,304

$

-

Inventory converted to property, plant and equipment

$

760,495

$

-

Superior Drilling Products,

Inc.

Adjusted EBITDA(1)

Reconciliation

(unaudited)

($, in thousands)

Three Months Ended December

31,2019 December 31,2018 September 30,2019

GAAP net income

$

124,634

$

(1,081,287

)

$

(417,758

)

Add back: Depreciation and amortization

748,333

940,048

738,555

Interest expense, net

165,397

93,929

184,502

Share-based compensation

155,464

146,745

155,749

Net non-cash compensation

88,200

377,746

415,438

Income tax expense

18,550

3,640

-

Inventory impairment

-

116,396

-

(Gain) Loss on disposition of assets

(1,500

)

14,013

6,143

Recovery of Related Party Note Receivable

(678,148

)

(377,746

)

-

Non-GAAP adjusted EBITDA(1)

$

620,930

$

233,484

$

1,082,629

GAAP Revenue

$

4,341,010

$

3,480,635

$

5,076,215

Non-GAAP Adjusted EBITDA Margin

14.3%

6.7%

21.3%

Year Ended December 31,2019 December

31,2018 GAAP net income

$

(936,423

)

$

(58,375

)

Add back: Depreciation and amortization

3,428,403

3,760,231

Interest expense, net

703,758

718,673

Net non-cash compensation

680,038

377,746

Share-based compensation

629,180

518,956

Inventory Impairment

136,000

116,396

Income tax expense

18,550

3,640

Impairment on asset held for sale

6,143

-

(Gain) Loss on disposition of assets

(15,647

)

14,013

Recovery of related party note receivable

(678,148

)

(377,746

)

Non-GAAP Adjusted EBITDA(1)

$

3,971,854

$

5,073,534

GAAP Revenue

$

18,997,014

$

18,245,212

Non-GAAP Adjusted EBITDA Margin

20.9%

27.8%

(1) Adjusted EBITDA represents net income adjusted for income

taxes, interest, depreciation and amortization and other items as

noted in the reconciliation table. The Company believes Adjusted

EBITDA is an important supplemental measure of operating

performance and uses it to assess performance and inform operating

decisions. However, Adjusted EBITDA is not a GAAP financial

measure. The Company’s calculation of Adjusted EBITDA should not be

used as a substitute for GAAP measures of performance, including

net cash provided by operations, operating income and net income.

The Company’s method of calculating Adjusted EBITDA may vary

substantially from the methods used by other companies and

investors are cautioned not to rely unduly on it.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200312005131/en/

Deborah K. Pawlowski, Kei Advisors LLC (716) 843-3908,

dpawlowski@keiadvisors.com

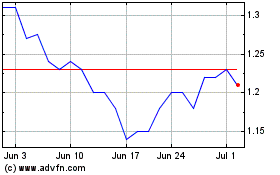

Superior Drilling Products (AMEX:SDPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Superior Drilling Products (AMEX:SDPI)

Historical Stock Chart

From Apr 2023 to Apr 2024