Current Report Filing (8-k)

January 26 2021 - 4:22PM

Edgar (US Regulatory)

0001616543

false

0001616543

2021-01-21

2021-01-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

January 21, 2021

|

SENSEONICS

HOLDINGS, INC.

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Delaware

|

|

001-37717

|

|

47-1210911

|

(State or Other

Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

20451 Seneca Meadows Parkway

Germantown, MD 20876-7005

|

|

(Address of Principal Executive Office) (Zip Code)

|

Registrant's telephone number, including

area code: (301) 515-7260

Not Applicable

Former name or former address, if changed

since last report

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2 below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

SENS

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry Into a Material

Definitive Agreement.

On January 21, 2021, Senseonics

Holdings, Inc. (the “Company”) entered into an amended and restated underwriting agreement (the

“Underwriting Agreement”) with H.C. Wainwright & Co., LLC, as representative of the

underwriters (the “Underwriters”), to issue and sell 51,948,052 shares of common stock of the

Company, par value $0.001 per share (“Common Stock”), in an underwritten public offering pursuant

to effective registration statements on Form S-3 (File Nos. 333-235297 and 333-252317) and a related prospectus and

prospectus supplement, in each case filed with the Securities and Exchange Commission (the

“Offering”). The offering price to the public is $1.925 per share of Common Stock. The

Underwriters have agreed to purchase the shares from the Company pursuant to the Underwriting Agreement at a price of

$1.799875 per share (representing an underwriting discount of six and one-half percent (6.5%)) and the Company also agreed to reimburse them for customary

fees and expenses. In addition, the Company granted the Underwriters an option to purchase, for a period of 30 days

from the date of the Underwriting Agreement, up to an additional 7,792,207 shares of Common Stock. The Company

estimates that the net proceeds from the Offering will be approximately $92.2 million, or approximately $106.1 million if the

Underwriters exercise in full their option to purchase additional shares of Common Stock, in each case after deducting

underwriting discounts and commissions and estimated offering expenses. The closing of the Offering occurred on January 26, 2021.

The Underwriting Agreement contains customary representations,

warranties, covenants and agreements by the Company, indemnification obligations of the Company and the Underwriters, including

for liabilities under the Securities Act of 1933, as amended (the “Securities Act”), other obligations

of the parties and termination provisions. The representations, warranties and covenants contained in the Underwriting Agreement

were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to such agreement,

and may be subject to limitations agreed upon by the contracting parties. A copy of the Underwriting Agreement is filed as

Exhibit 1.1 to this Current Report on Form 8-K and is incorporated herein by reference. The foregoing description

of the Underwriting Agreement is qualified in its entirety by reference to such exhibit. A copy of the opinion of Cooley LLP as

to the legality of the shares of Common Stock to be issued and sold in the Offering and related consent is filed as Exhibit 5.1

to this Current Report on Form 8-K.

Item 7.01 Regulation FD Disclosure.

On January 21, 2021, the Company issued

a press release announcing the commencement and pricing of the Offering. On January 21, 2021, the Company issued a press release

announcing that it had increased the size of the Offering. Copies of the press releases are filed herewith as Exhibits 99.1

and 99.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

Caution Concerning Forward-Looking Statements

This Current Report on Form 8-K may contain forward-looking

statements made in reliance upon the safe harbor provisions of Section 27A of the Securities Act and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that do not relate solely to historical

or current facts, and can be identified by the use of words such as “may,” “will,” “expect,”

“project,” “estimate,” “anticipate,” “plan,” “believe,” “potential,”

“should,” “continue” or the negative versions of those words or other comparable words. These forward-looking

statements include statements about the Company’s public offering, such as expected net proceeds and anticipated closing

date. These forward-looking statements are based on information currently available to the Company and its current plans or expectations,

and are subject to a number of uncertainties and risks that could significantly affect current plans. Actual results and performance

could differ materially from those projected in the forward-looking statements as a result of many factors, including the uncertainties

related to market conditions and the completion of the public offering on the anticipated terms or at all. The Company’s

forward-looking statements also involve assumptions that, if they prove incorrect, would cause its results to differ materially

from those expressed or implied by such forward-looking statements. These and other risks concerning the Company’s business

are described in additional detail in the Company’s Annual Report on Form 10-K for the year ended December 31,

2019, the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, the Preliminary Prospectus Supplement

and in the Company’s other Periodic and Current Reports filed with the Securities and Exchange Commission. The Company is

under no obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements, whether

as a result of new information, future events or otherwise.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Date: January 26, 2021

|

SENSEONICS HOLDINGS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Nick Tressler

|

|

|

Name:

|

Nick Tressler

|

|

|

Title:

|

Chief Financial Officer

|

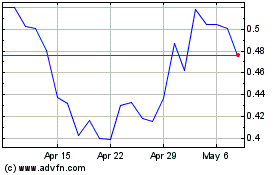

Senseonics (AMEX:SENS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Senseonics (AMEX:SENS)

Historical Stock Chart

From Sep 2023 to Sep 2024