Senseonics Holdings, Inc. (NYSE American: SENS), a medical

technology company focused on the development and commercialization

of long-term, implantable continuous glucose monitoring (CGM)

systems for people with diabetes, today reported financial results

for the quarter ended September 30, 2020.

Recent Highlights & Accomplishments:

- Reinitiated Eversense® new patient sales and marketing

activities in the U.S. with Ascensia Diabetes Care on October 1,

2020

- Submitted Premarket Approval (PMA) supplement application for

the extension of the wearable life of the Eversense CGM System for

up to 180 days to the United States Food and Drug Administration

(FDA)

- Announced PROMISE study accuracy results for the 180-day

Eversense product, demonstrating mean absolute relative difference

(MARD) matching the performance of the current 90-day Eversense

system of 8.5%-9.6%

- Continued efforts to expand patient access resulted in positive

coverage decisions representing approximately 80% of covered lives

in the U.S. This includes Medicare patients following the issuance

of Local Coverage Determinations from all Medicare Administrative

Contractors ahead of the 2021 Medicare Physician Fee Schedule

Proposed Rule that will provide national coverage for implantable

CGMs

- Generated third quarter 2020 revenue of $767 thousand driven by

increased sensor reinsertions and supply orders from existing

patients compared to the second quarter of 2020

- Reduced third quarter operating expenses by $18.9 million,

compared to the prior year period, due to the execution of cost

reduction actions and the streamlined operational focus implemented

in late March 2020

- Entered into a $12.0 million equity line of credit with Energy

Capital

“In the third quarter we continued to efficiently support

Eversense users who understand the heightened importance of

glycemic control amid this pandemic. At the start of the fourth

quarter we initiated commercial activity with Ascensia. Following a

successful training program, the Ascensia sales force is now

calling on Eversense prescribers in pursuit of new commercial and

Medicare patients,” said Tim Goodnow, PhD, President and Chief

Executive Officer of Senseonics. “We believe the organizational

changes for Senseonics resulting from the worldwide strategic

commercial collaboration, in combination with additional cost

reduction initiatives, will continue to drive expense and cash burn

reductions in the future. Investment and resources are focused on

the approval of the 180-day Eversense system in the U.S. and

driving the development of the 365-day product where we are making

great strides with configuration optimization. Following our PMA

supplement submission and the early efforts with Ascensia we are

excited and well positioned for a potential launch of the 180-day

product in the first half of next year. We continue to drive

execution across the company, including our product development and

commercialization efforts with our partner Ascensia, while

supporting our approximately 5,000 active patients globally. With

our strategic partnership set we believe we are continuing to build

a compelling value proposition for patients with diabetes.”

Anticipated Key Milestones:

Q1 2021 – Proposed Medicare National Payment Schedule Q1 2021 –

Initiation of commercial activities outside of the U.S. by Ascensia

H1 2021 – Expected decision on approval of 180-day Eversense

product by FDA H1 2021 – Planned IDE approval of 365-day Eversense

clinical trial by FDA, including pediatric population H2 2021 –

Planned enrollment of 365-day Eversense clinical trial

Third Quarter 2020 Results:

In the third quarter of 2020, revenue was reduced due to the

temporary suspension of commercial operations in March in the U.S.

following restructuring of the organization to preserve cash, as

well as the effects of temporary patient deferments resulting from

the global pandemic. Total net revenue for the quarter was $767

thousand compared to total net revenue of $4.3 million for the

third quarter of 2019. U.S. net revenue was $509 thousand after

accounting for gross to net adjustments. Net revenue outside the

U.S. was $258 thousand due to the deferral of orders by Roche.

Third quarter 2020 gross profit increased by $4.2 million

year-over-year, to $835 thousand. The positive gross margin in the

quarter was primarily due to the ability to fill resupply orders

with existing written off inventory as existing patient reinsertion

rates were above the expectations established in the first quarter

of 2020 amid the onset of the COVID-19 pandemic.

Third quarter 2020 sales and marketing expenses decreased by

$8.3 million year-over-year, to $3.2 million. The decrease was

primarily due to the recent changes in commercial activities.

Third quarter 2020 research and development expenses decreased

by $6.5 million year-over-year, to $4.6 million. The decrease was

primarily driven by lower clinical study costs and personnel

related expenses.

Third quarter 2020 general and administrative expenses increased

by $0.1 million year-over-year, to $5.5 million. The increase was

primarily due to an increase in stock-based compensation

expenses.

Net loss was $23.4 million, or $0.10 per share, in the third

quarter of 2020, compared to $19.5 million, or $0.10 per share, in

the third quarter of 2019. Net loss increased by $3.9 million due

to a $22.9 million increase to other expenses primarily related to

the accounting of the company’s financings partially offset by a

$18.9 million decrease in loss from operations.

As of September 30, 2020, cash, cash equivalents and restricted

cash were $26.4 million and outstanding indebtedness was $123.4

million.

Conference Call and Webcast Information:

Company management will host a conference call at 4:30 pm

(Eastern Time) today, November 9, 2020, to discuss these financial

results and recent business developments. This conference call can

be accessed live by telephone or through Senseonics’ website.

Live

Teleconference Information:

Live Webcast

Information:

Dial in number: 888-243-4451

Visit http://www.senseonics.com and

Entry Number: 4128608

select the “Investor Relations”

section

International dial in: 412-542-4135

A replay of the call can be accessed on Senseonics’ website

http://www.senseonics.com under “Investor Relations.”

About Senseonics

Senseonics Holdings, Inc. is a medical technology company

focused on the design, development and commercialization of

transformational glucose monitoring products designed to help

people with diabetes confidently live their lives with ease.

Senseonics' CGM systems, Eversense® and Eversense® XL, include a

small sensor inserted completely under the skin that communicates

with a smart transmitter worn over the sensor. The glucose data are

automatically sent every 5 minutes to a mobile app on the user's

smartphone.

Forward Looking Statements

Any statements in this press release about future expectations,

plans and prospects for Senseonics, including statements about the

potential benefits of the Ascensia commercialization and

collaboration agreement, including future expense and cash burn

reductions, potential coverage decisions, the potential approval

and commercial launch of the 180-day Eversense system in the United

States, the development of the 365-day product, the timing of

future key milestones, including the proposed Medicare Physician

Fee Schedule Proposed Rule, the initiation of commercial activities

outside of the U.S. by Ascensia, the expected decision on approval

of the 180-day Eversense product by FDA, the planned IDE approval

of the 365-day Eversense clinical trial by FDA and the planned

enrollment of the 365-day Eversense clinical trial, and other

statements containing the words “believe,” “expect,” “intend,”

“may,” “projects,” “will,” “planned,” and similar expressions,

constitute forward-looking statements within the meaning of The

Private Securities Litigation Reform Act of 1995. Actual results

may differ materially from those indicated by such forward-looking

statements as a result of various important factors, including:

uncertainties in the development and regulatory approval processes,

uncertainties inherent in the commercial launch and commercial

expansion of the product, uncertainties in insurer, regulatory and

administrative processes and decisions, uncertainties in the

duration and severity of the COVID-19 pandemic, the necessity of

receiving stockholder approval that will be required in order to

raise all of the capital pursuant to the preferred stock and

certain debt transactions described in this release, and such other

factors as are set forth in the risk factors detailed in

Senseonics’ Annual Report on Form 10-K for the year ended December

31, 2019, Senseonics’ Quarterly Report on Form 10-Q for the quarter

ended September 30, 2020 and Senseonics’ other filings with the SEC

under the heading “Risk Factors.” In addition, the forward-looking

statements included in this press release represent Senseonics’

views as of the date hereof. Senseonics anticipates that subsequent

events and developments will cause Senseonics’ views to change.

However, while Senseonics may elect to update these forward-looking

statements at some point in the future, Senseonics specifically

disclaims any obligation to do so except as required by law. These

forward-looking statements should not be relied upon as

representing Senseonics’ views as of any date subsequent to the

date hereof.

Senseonics Holdings,

Inc.

Condensed Consolidated Balance

Sheets

(in thousands, except share

and per share data)

September 30,

December 31,

2020

2019

(unaudited)

Assets

Current assets:

Cash and cash equivalents

$

26,192

$

95,938

Restricted cash

200

—

Accounts receivable, net

250

3,239

Accounts receivable - related parties

251

7,140

Inventory, net

4,284

16,929

Prepaid expenses and other current

assets

4,588

4,512

Total current assets

35,765

127,758

Purchase put option

4,224

—

Deposits and other assets

2,409

3,042

Property and equipment, net

1,665

2,001

Total assets

$

44,063

$

132,801

Liabilities and Stockholders’

Deficit

Current liabilities:

Accounts payable

$

949

$

4,285

Accrued expenses and other current

liabilities

9,153

18,636

Term Loans, net

—

43,434

2025 Notes, net

—

60,353

Total current liabilities

10,102

126,708

Long-term debt and notes payables, net

59,649

11,800

Derivative liabilities

24,590

664

Other liabilities

1,693

2,278

Total liabilities

96,034

141,450

Preferred stock and additional

paid-in-capital, subject to possible redemption: $0.001 par value

per share; 3,000 shares and 0 shares issued and outstanding as of

September 30, 2020 and December 31, 2019

2,811

—

Total temporary equity

2,811

—

Commitments and contingencies

Stockholders’ deficit:

Common stock, $0.001 par value per share;

450,000,000 shares authorized; 244,238,638 and 203,452,812 shares

issued and outstanding as of September 30, 2020 and December 31,

2019

244

203

Additional paid-in capital

491,853

464,491

Accumulated deficit

(546,879

)

(473,343

)

Total stockholders' deficit

(54,782

)

(8,649

)

Total liabilities and stockholders’

deficit

$

44,063

$

132,801

Senseonics Holdings,

Inc.

Unaudited Condensed

Consolidated Statements of Operations and Comprehensive

Loss

(in thousands, except share

and per share data)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2020

2019

2020

2019

Revenue, net

$

514

$

959

$

761

$

3,678

Revenue, net - related parties

253

3,360

303

8,671

Total revenue

767

4,319

1,064

12,349

Cost of sales

(68

)

7,659

21,006

23,552

Gross profit (loss)

835

(3,340

)

(19,942

)

(11,203

)

Expenses:

Sales and marketing expenses

3,234

11,560

17,521

38,573

Research and development expenses

4,568

11,076

15,726

28,688

General and administrative expenses

5,501

5,388

15,635

17,321

Operating loss

(12,468

)

(31,364

)

(68,824

)

(95,785

)

Other (expense) income, net:

Interest income

1

519

173

1,556

Loss on extinguishment and issuance of

debt

(9,527

)

(398

)

(20,458

)

(398

)

Interest expense

(3,632

)

(3,460

)

(11,560

)

(7,459

)

Debt issuance costs

(931

)

(3,344

)

(1,216

)

(3,344

)

Gain on fair value and change in fair

value of derivatives

3,520

19,186

29,069

26,147

Other expense

(391

)

(638

)

(720

)

(655

)

Total other (expense) income, net

(10,960

)

11,865

(4,712

)

15,847

Net loss

(23,428

)

(19,499

)

(73,536

)

(79,938

)

Total comprehensive loss

$

(23,428

)

$

(19,499

)

$

(73,536

)

$

(79,938

)

Basic and diluted net loss per common

share

$

(0.10

)

$

(0.10

)

$

(0.33

)

$

(0.43

)

Basic and diluted weighted-average shares

outstanding

236,519,812

197,223,419

220,250,060

183,804,257

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201109006020/en/

Investor Contact Lynn Lewis or Philip Taylor Investor

Relations 415-937-5406 Investors@senseonics.com

Senseonics Media Contact: Mirasol Panlilio 301-556-1631

Mirasol.panlilio@senseonics.com

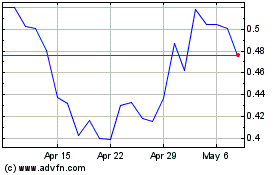

Senseonics (AMEX:SENS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Senseonics (AMEX:SENS)

Historical Stock Chart

From Apr 2023 to Apr 2024