false

0000946563

0000946563

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

| Date

of Report (Date of earliest event reported) |

August 14, 2024 |

Retractable

Technologies, Inc.

(Exact name of registrant

as specified in its charter)

| Texas |

001-16465 |

75-2599762 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

| 511

Lobo Lane, Little

Elm, Texas |

75068-5295 |

| (Address of principal executive

offices) |

(Zip Code) |

| Registrant's

telephone number, including area code |

(972)

294-1010 |

None

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock |

RVP |

NYSE

American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

Emerging

growth company ¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On August 14, 2024, the

Company issued a press release, a copy of which is attached to this Form 8-K as Exhibit 99, announcing results for the periods

ended June 30, 2024.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| 104 | Cover Page Interactive Date File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| DATE: August 14, 2024 |

|

RETRACTABLE TECHNOLOGIES, INC. |

| |

|

(Registrant) |

| |

|

|

|

| |

|

|

|

| |

|

BY: |

/s/ John W. Fort III |

| |

|

|

JOHN W. FORT III |

| |

|

|

VICE PRESIDENT, CHIEF FINANCIAL OFFICER, AND

CHIEF ACCOUNTING OFFICER |

Exhibit 99

RETRACTABLE TECHNOLOGIES, INC. RESULTS

FOR THE PERIODS ENDED JUNE 30, 2024

LITTLE

ELM, TEXAS, August 14, 2024 — Retractable Technologies, Inc. (NYSE American: RVP) reports total net sales of $6.0 million

for the second quarter of 2024 and an operating loss of $5.8 million for the period, as compared to total net sales for the same period

last year of $8.0 million and an operating loss of $5.0 million. For the first half of the year, net sales were $13.6 million and

operating losses were $8.7 million as compared to 2023 net revenues of $19.0 million and operating losses of $7.8 million. In the three

months ended June 30, 2024, declines in domestic demand were a primary factor in Retractable’s lower revenues and in the six

months ended June 30, 2024, lower international vaccination-related sales had a larger impact on lower revenues.

In May 2024, a new 50% tariff on syringes

and needles imported from China was proposed but has not yet been enacted. A final determination regarding the tariffs is expected later

this month and the rules would likely take effect within two weeks thereof. For the first six months of 2024, 91% of Retractable’s

products were purchased from China, most of which would be impacted by the contemplated tariffs. In the event that the tariffs are enacted,

the resulting increase in costs could have a material impact to Retractable’s results of operations and financial position. Retractable

is working to evaluate options to lessen the financial impact of the tariffs, including shifting a larger portion of its manufacturing

to its domestic manufacturing facility. Such a shift would likely increase labor costs, and the Company estimates additional one-time

equipment expenditures of approximately $1 million.

A material portion of the net losses of $14.2

million and $13.7 million for the three and six months ended June 30, 2024, respectively, is comprised of the approximately $8.3

million change in valuation allowance on the deferred tax asset. Based on current information, it is more likely than not that Retractable

wouldn’t be in a position to use loss carryforwards against future taxable net income based on a variety of factors and accounting

guidelines. The expected implementation of tariffs on imported syringes from China was one of the factors considered in this determination.

Retractable reports the following results of operations

for the three and six months ended June 30, 2024 and 2023, respectively. Further details concerning the results of operations, as

well as other matters, are available in Retractable’s Form 10-Q filed on August 14, 2024 with the U.S Securities and Exchange

Commission.

Comparison of Three Months Ended June 30,

2024 and June 30, 2023

Domestic sales accounted for 83.2% and 91.6% of

the revenues for the three months ended June 30, 2024 and 2023, respectively. Domestic revenues decreased 31.3% principally due to

lower demand. Domestic unit sales decreased 22.1%. Domestic unit sales were 79.3% of total unit sales for the three months ended June 30,

2024. International revenues increased approximately 51.5% or $345 thousand. The increase in international revenues is primarily due to

the timing of international shipments. Overall unit sales decreased 13.6%. There is uncertainty as to the timing of future international

orders.

Cost

of manufactured product decreased 15.7% principally due to lower unit sales. Royalty expense decreased 8.8% due to the associated

decrease in gross sales.

Operating expenses decreased 1.2% from the prior

year due to a reduction of property tax expense as a result of newly enacted property tax exemption legislation relating to medical device

property, offset by an increase in the allowance for anticipated credit losses.

The loss from operations was $5.8 million compared

to a loss of $5.0 million for the same period last year. The increased loss was due to lower gross profit for the current period, offset

by a slight reduction in overall operating expenses.

The unrealized loss on debt and equity securities

was $1.8 million due to the decreased market values of those securities.

The provision for income taxes was $8.3 million

for the second quarter of 2024 as compared to a benefit for income taxes of $932 thousand in the second quarter of 2023. The increase

in income tax expense is primarily related to the valuation allowance against the Deferred tax asset.

Comparison of Six Months Ended June 30,

2024 and June 30, 2023

Domestic sales accounted for 85.5% and 67.1% of

the revenues for the six months ended June 30, 2024 and 2023, respectively. Domestic revenues decreased 8.4% principally due to lower

demand. Domestic unit sales decreased 4.6%. Domestic unit sales were 82.8% of total unit sales for the six months ended June 30,

2024. International revenues decreased approximately 68.4% predominately due to fewer international vaccination-related sales. Overall

unit sales decreased 35.8%. There is uncertainty as to the timing of future international orders.

Cost

of manufactured product decreased 23.8% principally due to lower unit sales. Royalty expense decreased 12.5% due to the associated

decrease in gross sales.

Operating expenses decreased 7.2% from the prior

year. This is substantially due to a reduction of property tax expense as a result of newly enacted property tax exemption legislation

relating to medical device property.

The loss from operations was $8.7 million compared

to a loss of $7.8 million for the same period last year. The increased loss was due to lower gross profit for the current period, offset

by a slight reduction in overall operating expenses.

The provision for income taxes was $8.4 million

for the first six months of 2024 as compared to a benefit for income taxes of $701 thousand in the first six months of 2023. The year-to-date

income tax provision is primarily related to the second quarter of 2024 as a result of fully reserving the Company’s Deferred tax

asset.

ABOUT RETRACTABLE

Retractable manufactures and markets VanishPoint®

and Patient Safe® safety medical products and the EasyPoint® needle. The VanishPoint® syringe,

blood collection, and IV catheter products are designed to prevent needlestick injuries and product reuse by retracting the needle directly

from the patient, effectively reducing exposure to the contaminated needle. Patient Safe® syringes are uniquely designed

to reduce the risk of bloodstream infections resulting from catheter hub contamination. The EasyPoint® is a retractable

needle that can be used with luer lock syringes, luer slip syringes, and prefilled syringes to give injections. The EasyPoint®

needle also can be used to aspirate fluids and for blood collection. Retractable's products are distributed by various specialty and general

line distributors.

For

more information on Retractable, visit its website at www.retractable.com.

Forward-looking statements in this press release

are made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 and reflect Retractable's current

views with respect to future events. Retractable believes that the expectations reflected in such forward-looking statements are accurate.

However, Retractable cannot assure you that such expectations will materialize. Actual future performance could differ materially from

such statements.

Factors that could cause or contribute to such

differences include, but are not limited to: material changes in demand, potential tariffs, Retractable's ability to maintain liquidity;

Retractable's maintenance of patent protection; Retractable's ability to maintain favorable third party manufacturing and supplier arrangements

and relationships; foreign trade risk; Retractable's ability to access the market; production costs; the impact of larger market players

in providing devices to the safety market; and other risks and uncertainties that are detailed from time to time in Retractable's periodic

reports filed with the U.S. Securities and Exchange Commission.

Retractable Technologies, Inc.

John W. Fort III, 888-806-2626 or 972-294-1010

Vice President, Chief Financial Officer, and Chief Accounting

Officer

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

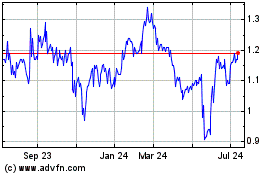

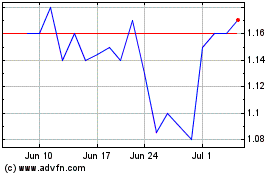

Retractable Technologies (AMEX:RVP)

Historical Stock Chart

From Aug 2024 to Sep 2024

Retractable Technologies (AMEX:RVP)

Historical Stock Chart

From Sep 2023 to Sep 2024