Conference call begins today at 4:30 p.m.

Eastern time

NovaBay® Pharmaceuticals,

Inc. (NYSE American: NBY), a biopharmaceutical company

focusing on commercializing prescription Avenova® for the domestic

eye care market, reports financial results for the three months

ended March 31, 2019 and provides a business update.

“As we discussed when reporting fourth quarter 2018 financial

results, net sales for the first quarter of 2019 were impacted by

significant industry-wide changes in the reimbursement of branded

pharmaceutical products,” said Justin Hall, interim President and

CEO. “Our objective remains to make Avenova affordable to patients

through rebates and coupons. However, the annual reset in

healthcare plan deductibles, the continuing trend toward individual

high-deductible healthcare plans along with the decision by certain

nationwide insurers to end reimbursement coverage for Avenova are

affecting unit sales and gross-to-net pricing more than in past

years.

“We are adapting to this new reimbursement environment with

various strategies to ensure that Avenova is affordable and

accessible to all patients while providing NovaBay with appropriate

economics,” he said. “We have expanded our partner pharmacy program

that serves patients in all 50 states, ensuring product

availability at the best pricing. This program has the added

benefit of contracted pricing for Avenova, therefore improving our

gross-to-net pricing. We are also opening opportunities for more

eye care specialists to access our in-office sales channel in which

they resell Avenova at affordable prices directly to their

patients. We plan in the coming months to further broaden access to

Avenova through an entirely new direct-to-patient sales

channel.

“In March we implemented the strategic shift in our commercial

operations and, as such, expenses for the first quarter reflect our

prior strategy,” he added. “We expect to begin realizing cost

savings from this reduction in force in the second quarter, and to

significantly reduce operating expenses over the remainder of

2019.”

First Quarter Financial Results

Net sales for the first quarter of 2019 were $1.5 million

compared with $2.9 million for the first quarter of 2018, with the

decrease due to lower unit sales and lower gross-to-net pricing of

Avenova. Gross margin on net product revenue was 77% for the first

quarter of 2019 compared with 91% for the prior-year period, with

the decrease due to lower product revenue.

Sales and marketing expenses for the first quarter of 2019 were

$3.5 million compared with $3.4 million for the first quarter of

2018. General and administrative expenses for the first quarters of

2019 and 2018 were unchanged at $1.6 million. Research and

development expenses for the first quarter of 2019 were $85,000

compared with $46,000 for 2018.

Operating loss for the first quarter of 2019 was $4.1 million

compared with an operating loss of $2.4 million for the first

quarter of 2018.

Non-cash loss on the change of fair value of warrant liability

for the first quarter of 2019 was $0.1 million compared with a

non-cash gain of $0.2 million for the first quarter of 2018.

Non-cash loss on the embedded derivative associated with the

convertible note for the first quarter of 2019 was $0.6 million.

The Company did not record a comparable loss or gain for the first

quarter of 2018. The Company is working with its auditors and

outside consultants regarding the valuation of the convertible

note, which may cause a variation in the financials reported in the

Company’s Form 10-Q.

The net loss for the first quarter of 2019 was $4.8 million, or

$0.28 per share, compared with a net loss for the first quarter of

2018 of $2.2 million, or $0.13 per share.

NovaBay reported cash and cash equivalents of $2.9 million as of

March 31, 2019, compared with $3.2 million as of December 31,

2018.

Conference Call

NovaBay management will host an investment community conference

call today beginning at 4:30 p.m. Eastern time (1:30 p.m. Pacific

time) to discuss the Company’s financial and operational results

and to answer questions. Shareholders and other interested parties

may participate in the conference call by dialing 800-608-8202 from

within the U.S. or 702-495-1913 from outside the U.S., with the

conference identification number 8495204.

A live webcast of the call will be available at

http://novabay.com/investors/events and will be archived for 90

days. A replay of the call will be available beginning two hours

after call ends through 8:59 p.m. Eastern time May 17, 2019 by

dialing 855-859-2056 from within the U.S. or 404-537-3406 from

outside the U.S., and entering the conference identification number

8495204.

Receipt of Audit Opinion with Going Concern

Qualification

As disclosed in its Annual Report on Form 10-K for the fiscal

year ended December 31, 2018, which was filed with the Securities

and Exchange Commission on March 29, 2019 and amended on April 12,

2019, the Company’s audited financial statements contained a going

concern explanatory paragraph in the audit opinion from its

independent registered public accounting firm. This announcement

does not represent any change or amendment to the Company’s

financial statements or to its Annual Report on Form 10-K for the

fiscal year ended December 31, 2018, as amended.

About Avenova®

Avenova is an eye care product formulated with our proprietary,

stable and pure form of hypochlorous acid. It has proven in

laboratory testing to have broad antimicrobial properties as a

preservative in solution as it removes foreign material including

microorganisms and debris from the skin on the eyelids and lashes

without burning or stinging. Avenova is marketed to optometrists

and ophthalmologists throughout the U.S. by NovaBay’s direct

salesforce. It is accessible from more than 90% of retail

pharmacies in the U.S. through agreements with McKesson

Corporation, Cardinal Health and AmerisourceBergen.

About NovaBay Pharmaceuticals, Inc.: Going Beyond

Antibiotics®

NovaBay Pharmaceuticals, Inc. is a biopharmaceutical company

focusing on commercializing and developing its non-antibiotic

anti-infective products to address the unmet therapeutic needs of

the global, topical anti-infective market with its two distinct

product categories: the NEUTROX® family of products and the

AGANOCIDE® compounds. The Neutrox family of products includes

AVENOVA® for the eye care market, NEUTROPHASE® for wound care

market, and CELLERX® for the aesthetic dermatology market. The

Aganocide compounds, still under development, have target

applications in the dermatology and urology markets.

Forward-Looking Statements

This release contains forward-looking statements that are based

upon management’s current expectations, assumptions, estimates,

projections and beliefs. These statements include, but are not

limited to, statements regarding our business strategies and future

focus, our estimated future revenue, and generally the Company’s

expected future financial results. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or achievements to be materially different and

adverse from those expressed in or implied by the forward-looking

statements. Factors that might cause or contribute to such

differences include, but are not limited to, risks and

uncertainties relating to the size of the potential market for our

products, improving sales rep productivity and product

distribution, obtaining adequate insurance reimbursement, and any

potential regulatory problems. Other risks relating to NovaBay’s

business, including risks that could cause results to differ

materially from those projected in the forward-looking statements

in this press release, are detailed in NovaBay’s latest Form 10-Q/K

filings with the Securities and Exchange Commission, especially

under the heading “Risk Factors.” The forward-looking statements in

this release speak only as of this date, and NovaBay disclaims any

intent or obligation to revise or update publicly any

forward-looking statement except as required by law.

Socialize and Stay informed on

NovaBay’s progressLike us on FacebookFollow us

on TwitterConnect with NovaBay on LinkedInVisit

NovaBay’s Website

Avenova Purchasing

InformationFor NovaBay Avenova purchasing

information:Please call 800-890-0329 or email sales@avenova.com.www.Avenova.com

NOVABAY PHARMACEUTICALS, INC. CONSOLIDATED BALANCE

SHEETS (in thousands, except par value amounts)

March 31, December 31,

2019 2018 (Unaudited)

ASSETS Current assets:

Cash and cash equivalents $ 2,932 $ 3,183 Accounts receivable, net

of allowance for doubtful accounts ($24 and $10 at March 31, 2019

and December 31, 2018, respectively) 2,430 3,385 Inventory, net of

allowance for excess and obsolete inventory and lower of cost or

estimated net realizable value adjustments ($110 and $104 at March

31, 2019 and December 31, 2018, respectively) 302 280 Prepaid

expenses and other current assets 1,451 1,760

Total current assets 7,115 8,608 Operating lease

right-of-use assets 1,870 - Property and equipment, net 193 201

Other assets 542 552 TOTAL ASSETS $

9,720 $ 9,361

LIABILITIES AND STOCKHOLDERS'

EQUITY Liabilities: Current liabilities: Accounts payable $ 462

$ 551 Accrued liabilities 2,860 3,255 Deferred revenue - 41

Operating lease liabilities 1,073 - Notes payable, related party

1,019 - Total current liabilities 5,414

3,847 Operating lease liabilities-non-current 1,143 - Deferred rent

- 184 Warrant liability 179 178 Convertible note 33 -

Embedded derivative liability associated

with the convertible note

2,410 - Other liabilities 201 198 Total

liabilities 9,380 4,407

Stockholders' equity:

Preferred stock: 5,000 shares authorized; none outstanding at March

31, 2019 and December 31, 2018 — — Common stock, $0.01 par value;

50,000 shares authorized; 17,095 and 17,089 shares issued and

outstanding at March 31, 2019 and December 31, 2018, respectively

171 171 Additional paid-in capital 120,300 119,764 Accumulated

deficit (120,131 ) (114,981 ) Total stockholders'

equity 340 4,954 TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY $ 9,720 $ 9,361

NOVABAY PHARMACEUTICALS, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS (Unaudited) (in

thousands except per share data)

Three Months Ended March 31,

2019 2018 Sales: Product revenue, net $

1,450 $ 2,934 Other revenue 41 13 Total sales, net

1,491 2,947 Product cost of goods sold 341 251

Gross profit 1,150 2,696 Research and

development 85 46 Sales and marketing 3,531 3,396 General and

administrative 1,605 1,622 Total operating expenses

5,221 5,064 Operating loss (4,071 ) (2,368 )

Non cash (loss) gain on changes in fair value of warrant liability

(57 ) 214 Non cash loss on embedded derivative associated with the

convertible note (592 ) - Other (expense) income, net (73 ) 4

Loss before provision for income taxes (4,793 )

(2,150 ) Provision for income tax (1 ) - Net loss and

comprehensive loss $ (4,794 ) $ (2,150 ) Net loss per share

attributable to common stockholders, basic $ (0.28 ) $ (0.13 ) Net

loss per share attributable to common stockholders, diluted $ (0.28

) $ (0.14 ) Weighted-average shares of common stock outstanding

used in computing net loss per share of common stock Basic 17,093

16,406 Diluted 17,093 16,670

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190509005885/en/

NovaBay ContactJustin

HallInterim President and Chief Executive

Officer510-899-8800jhall@novabay.com

Investor ContactLHA Investor

RelationsJody Cain310-691-7100jcain@lhai.com

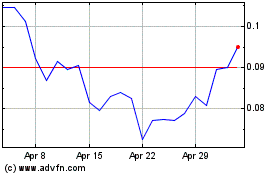

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Apr 2023 to Apr 2024