false

0001273441

0001273441

2024-01-23

2024-01-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): January 23, 2024

GRAN TIERRA ENERGY INC.

(Exact Name of Registrant as Specified in

its Charter)

| Delaware |

|

001-34018 |

|

98-0479924 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

Suite 900, 520-3 Avenue SW

Calgary, Alberta, Canada

T2P 0R3

(Address of Principal Executive Offices)

(Zip Code)

(403) 265-3221

(Registrant’s Telephone Number, Including

Area Code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which

registered |

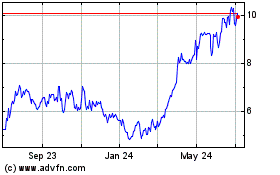

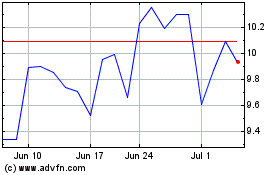

| Common Stock, par value $0.001 per share |

GTE |

NYSE American

Toronto Stock Exchange

London Stock Exchange

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. |

Results of Operations and Financial Condition. |

On January 23, 2024, Gran Tierra Energy Inc. (the “Company”)

issued a press release announcing its 2023 year-end reserves. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated

by reference herein in its entirety.

On January 23, 2024, the Company issued a press release announcing

its 2023 year-end production and 2024 guidance. A copy of the press release is attached hereto as Exhibit 99.2 and incorporated by reference

herein in its entirety.

The information in this Item 2.02 and in Exhibits 99.1 and 99.2 attached

to this report is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed

to be incorporated by reference into any filing by the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless

of any general incorporation language contained in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: January 23, 2024 |

GRAN TIERRA ENERGY INC. |

| |

|

|

| |

|

/s/ Ryan Ellson |

| |

|

By: Ryan Ellson |

| |

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Gran Tierra Energy Inc. Announces Strong Reserves

Replacement and Meaningful Reserves Growth in 2023

| · | Highest

Year-End Total Company Reserves in Company History - 90 MMBOE 1P, 147 MMBOE 2P and 207 MMBOE

3P |

| · | Added Total Company Reserves of 18 MMBOE

1P, 29 MMBOE 2P and 36 MMBOE 3P |

| · | Achieved 154% 1P, 242% 2P and 303% 3P

Reserves Replacement |

| · | Fifth

Consecutive Year of 1P Total Company Reserves Growth |

| · | Incurred F&D Costs, Excluding Change

in FDC, of $11.96 (1P), $7.58 (2P) and $6.06 (3P) per boe |

| · | Net

Present Value Before Tax Discounted at 10% of $1.9 Billion (1P), $3.1 Billion (2P), and $4.3

Billion (3P) |

| · | Net Asset Value per Share of $18.79

Before Tax and $10.46 After Tax (PDP), $44.48 Before Tax and $24.06 After Tax (1P), and $79.13

Before Tax and $42.71 After Tax (2P) |

CALGARY, Alberta – January 23,

2024 – Gran Tierra Energy Inc. (“Gran Tierra” or the “Company”) (NYSE American:GTE)(TSX:GTE)(LSE:GTE),

a company focused on international oil exploration and production with assets currently in Colombia and Ecuador, today announced the

Company’s 2023 year-end reserves as evaluated by the Company’s independent qualified reserves evaluator McDaniel & Associates

Consultants Ltd. (“McDaniel”) in a report with an effective date of December 31, 2023 (the “GTE McDaniel

Reserves Report”).

All dollar amounts are in United States (“U.S.”)

dollars and all reserves and production volumes are on a working interest before royalties (“WI”) basis. Production

is expressed in barrels (“bbl”) of oil per day (“bopd”), while reserves are expressed in bbl, bbl

of oil equivalent (“boe”) or million boe (“MMBOE”), unless otherwise indicated. The following reserves

categories are discussed in this press release: Proved Developed Producing (“PDP”), Proved (“1P”),

1P plus Probable (“2P”) and 2P plus Possible (“3P”).

Gary Guidry, President and Chief Executive Officer

of Gran Tierra, commented: “During 2023, a combination of our strong reserves growth, ongoing reductions in debt and share buybacks

allowed Gran Tierra to achieve net asset values per share** before tax of $44.48 (1P), up 288% from 2020, and $79.13 (2P),

up 144% from 2020. With this significant growth in our net asset values per share** over the last three years, we believe

Gran Tierra is well positioned to offer exceptional long-term stakeholder value.

Gran Tierra achieved strong 154% (1P), 242% (2P)

and 303% (3P) reserves replacement through our successful results from our development drilling, waterflooding programs, field performance

and the Suroriente Block Continuation Agreement*. This multi-faceted success resulted in record highs for the Company’s

year-end 1P, 2P and 3P oil reserves.

We completed our 2023 development plan on-budget

including waterflooding efforts and development drilling in the Acordionero, Costayaco and Moqueta oil fields. We also continued to evaluate

our successful ongoing production from key 2022 exploration discoveries in Colombia and Ecuador to plan for 2024 follow-up exploration

drilling. We believe our success on multiple fronts during 2023 demonstrates Gran Tierra's ability to be a full-cycle oil and gas exploration,

development and production company focused on value creation for all our stakeholders.

The success the Company achieved in 2023 also

reflects our ongoing conversion of reserves from the Probable to the Proved category. With 147 booked Proved plus Probable Undeveloped

future drilling locations, Gran Tierra is well positioned to continue to grow the Company's production and reserves in 2024 and beyond.

We have started 2024 strong with two rigs currently

drilling our planned series of development wells in Acordionero and Costayaco. Both rigs began their development campaigns in December

2023. Later in 2024, we look forward to our planned resumption of exploration drilling in Colombia and Ecuador to build upon our successful

exploration results in 2022, and the first development drilling in the Suroriente Block since 2018. Through our ongoing focus on the

development of our existing assets, appraisal of our 2022 discoveries and exploration drilling, we plan to continue to strengthen our

balance sheet, profitably increase production, grow our reserve base and return capital to shareholders through share buybacks.”

*See the section below titled “Suroriente

Continuation Agreement”.

**See the below tables for the definitions of net asset values per

share.

Highlights

2023 Year-End Reserves and Values

| Before

Tax (as of December 31, 2023) |

Units |

1P |

2P |

3P |

| Reserves |

MMBOE |

90 |

147 |

207 |

| Net

Present Value at 10% Discount (“NPV10”) |

$ million |

1,945 |

3,063 |

4,269 |

| Net Debt1 |

$ million |

(511) |

(511) |

(511) |

| Net

Asset Value (NPV10 less Net Debt) (“NAV”) |

$ million |

1,434 |

2,552 |

3,759 |

| Outstanding Shares2 |

million |

32.25 |

32.25 |

32.25 |

| NAV per Share |

$/share |

44.48 |

79.13 |

116.56 |

| After

Tax (as of December 31, 2023) |

Units |

1P |

2P |

3P |

| Reserves |

MMBOE |

90 |

147 |

207 |

| NPV10 |

$ million |

1,287 |

1,888 |

2,552 |

| Net Debt1 |

$ million |

(511) |

(511) |

(511) |

| NAV |

$ million |

776 |

1,377 |

2,041 |

| Outstanding Shares2 |

million |

32.25 |

32.25 |

32.25 |

| NAV per Share |

$/share |

24.06 |

42.71 |

63.29 |

1Based on estimated 2023 year-end

net debt of $511 million comprised of Senior Notes of $537 million (gross) plus the Credit Facility of $36 million (gross) less cash

and cash equivalents of $62 million, prepared in accordance with GAAP.

2Outstanding Shares. Reflects Gran

Tierra’s 1-for-10 reverse stock split that became effective May 5, 2023.

| · | As of December 31, 2023, Gran Tierra

achieved: |

| ◦ | Before Tax NAV of $1.4 billion (1P),

$2.6 billion (2P), and $3.8 billion (3P) |

| ◦ | After Tax NAV of $0.8 billion (1P),

$1.4 billion (2P), and $2.0 billion (3P) |

| ◦ | Strong reserves replacement ratios

of: |

| ▪ | 154%

1P, with 1P reserves additions of 18 MMBOE. |

| ▪ | 242%

2P, with 2P reserves additions of 29 MMBOE. |

| ▪ | 303%

3P, with 3P reserves additions of 36 MMBOE. |

| ◦ | Meaningful 1P, 2P and 3P reserves

additions largely driven by success with development drilling and waterflooding results in

the Chaza Block (which contains Costayaco and Moqueta fields) and the Suroriente Continuation

Agreement*. |

| ◦ | Finding and development costs (“F&D”),

including change in future development costs (“FDC”), on a per boe basis

of $20.58 (1P), $16.09 (2P) and $14.67 (3P). |

| ◦ | F&D costs excluding change in

FDC, on a per boe basis of $11.96 (1P), $7.58 (2P) and $6.06 (3P). |

| ◦ | F&D recycle ratios**,

including change in FDC, of 1.8 times (1P), 2.2 times (2P) and 2.5 times (3P). |

| · | Gran Tierra’s four major oil assets,

Acordionero, Costayaco, Moqueta and Suroriente (all on waterflood) represent 83% of the Company’s

1P reserves and 73% of its 2P reserves. |

| · | The Company’s PDP reserves account

for 48% of 1P reserves and 1P reserves account for 61% of 2P reserves, which demonstrate

the strength of Gran Tierra’s reserves base via the potential future conversion of

Probable reserves into 1P reserves and Proved Undeveloped reserves into PDP reserves. |

| · | FDC are forecast to be $561 million

for 1P reserves and $923 million for

2P reserves. Gran Tierra’s 2024 base case mid-point guidance for cash flow***

of $300 million is equivalent to 54% of 1P FDC and 33% of 2P FDC, which highlights

the Company’s potential ability to fund future development capital. Increases in FDC

relative to 2022 year-end reflect that the GTE McDaniel Reserves Report now assigns Gran

Tierra 95 Proved Undeveloped future drilling locations (up from 78 at 2022 year-end) and

147 Proved plus Probable Undeveloped future drilling locations (up from 115 at 2022 year-end). |

*See the section below titled “Suroriente

Continuation Agreement”.

**F&D recycle ratio is defined as fourth

quarter 2023 operating netback per WI sales volume boe divided by the appropriate F&D costs on a per boe basis. Operating netback

does not have a standardized meaning under generally accepted accounting principles in the United States of America (“GAAP”)

and is a non-GAAP measure. Operating netback is defined as oil sales less operating and transportation expenses. See “Non-GAAP

Measures” in this press release.

*** “Cash flow” refers to GAAP line

item “net cash provided by operating activities”. Gran Tierra’s 2024 base case guidance is based on a forecast 2024

average Brent oil price of $80/bbl. This forecast price used in Gran Tierra’s forecast is higher than the 2024 McDaniel Brent price

forecast.

GTE McDaniel Reserves Report

All reserves values, future net revenue and ancillary

information contained in this press release have been prepared by McDaniel and calculated in compliance with Canadian National Instrument

51-101 – Standards of Disclosure for Oil and Gas Activities (“NI 51-101”) and the Canadian Oil and Gas

Evaluation Handbook (“COGEH”) and derived from the GTE McDaniel Reserves Report, unless otherwise expressly stated.

Future Net Revenue

Future net revenue reflects McDaniel’s

forecast of revenue estimated using forecast prices and costs, arising from the anticipated development and production of reserves, after

the deduction of royalties, operating costs, development costs and abandonment and reclamation costs but before consideration of indirect

costs such as administrative, overhead and other miscellaneous expenses. The estimate of future net revenue below does not necessarily

represent fair market value.

Consolidated

Properties at December 31, 2023

Proved

(1P) Total Future Net Revenue ($ million)

Forecast

Prices and Costs

| | |

Sales

Revenue | | |

Total

Royalties | | |

Operating

Costs | | |

Future

Development

Capital | | |

Abandonment

and

Reclamation

Costs | | |

Future

Net

Revenue

Before

Future

Taxes | | |

Future

Taxes | | |

Future

Net

Revenue

After

Future

Taxes* | |

| 2024-2028 (5 Years) | |

| 4,334 | | |

| (858 | ) | |

| (939 | ) | |

| (561 | ) | |

| (7 | ) | |

| 1,969 | | |

| (629 | ) | |

| 1,340 | |

| Remainder | |

| 2,013 | | |

| (334 | ) | |

| (845 | ) | |

| — | | |

| (97 | ) | |

| 737 | | |

| (287 | ) | |

| 450 | |

| Total (Undiscounted) | |

| 6,347 | | |

| (1,192 | ) | |

| (1,784 | ) | |

| (561 | ) | |

| (104 | ) | |

| 2,706 | | |

| (916 | ) | |

| 1,790 | |

| Total (Discounted @ 10%) | |

| 4,453 | | |

| (854 | ) | |

| (1,138 | ) | |

| (475 | ) | |

| (39 | ) | |

| 1,947 | | |

| (658 | ) | |

| 1,289 | |

Consolidated

Properties at December 31, 2023

Proved

Plus Probable (2P) Total Future Net Revenue ($ million)

Forecast

Prices and Costs

| Years | |

Sales

Revenue | | |

Total

Royalties | | |

Operating

Costs | | |

Future

Development

Capital | | |

Abandonment

and

Reclamation

Costs | | |

Future

Net

Revenue

Before

Future

Taxes | | |

Future

Taxes | | |

Future

Net

Revenue

After

Future

Taxes* | |

| 2024-2028 (5 Years) | |

| 5,654 | | |

| (1,159 | ) | |

| (1,080 | ) | |

| (865 | ) | |

| (3 | ) | |

| 2,547 | | |

| (946 | ) | |

| 1,601 | |

| Remainder | |

| 4,935 | | |

| (870 | ) | |

| (1,664 | ) | |

| (57 | ) | |

| (122 | ) | |

| 2,222 | | |

| (890 | ) | |

| 1,332 | |

| Total (Undiscounted) | |

| 10,589 | | |

| (2,029 | ) | |

| (2,744 | ) | |

| (922 | ) | |

| (125 | ) | |

| 4,769 | | |

| (1,836 | ) | |

| 2,933 | |

| Total (Discounted @ 10%) | |

| 6,695 | | |

| (1,316 | ) | |

| (1,541 | ) | |

| (736 | ) | |

| (40 | ) | |

| 3,062 | | |

| (1,175 | ) | |

| 1,887 | |

Consolidated

Properties at December 31, 2023

Proved

Plus Probable Plus Possible (3P) Total Future Net Revenue ($ million)

Forecast

Prices and Costs

| Years | |

Sales

Revenue | | |

Total

Royalties | | |

Operating

Costs | | |

Future

Development

Capital | | |

Abandonment

and

Reclamation

Costs | | |

Future

Net

Revenue

Before

Future

Taxes | | |

Future

Taxes | | |

Future

Net

Revenue

After

Future

Taxes* | |

| 2024-2028 (5 Years) | |

| 6,580 | | |

| (1,369 | ) | |

| (1,150 | ) | |

| (979 | ) | |

| (3 | ) | |

| 3,079 | | |

| (1,213 | ) | |

| 1,866 | |

| Remainder | |

| 8,621 | | |

| (1,654 | ) | |

| (2,443 | ) | |

| (186 | ) | |

| (137 | ) | |

| 4,201 | | |

| (1,723 | ) | |

| 2,478 | |

| Total (Undiscounted) | |

| 15,201 | | |

| (3,023 | ) | |

| (3,593 | ) | |

| (1,165 | ) | |

| (140 | ) | |

| 7,280 | | |

| (2,936 | ) | |

| 4,344 | |

| Total (Discounted @ 10%) | |

| 8,799 | | |

| (1,774 | ) | |

| (1,834 | ) | |

| (884 | ) | |

| (38 | ) | |

| 4,269 | | |

| (1,718 | ) | |

| 2,551 | |

*The after-tax future net revenue of the Company’s

oil and gas properties reflects the tax burden on the properties on a stand-alone basis. It does not consider the corporate tax situation,

or tax planning. It does not provide an estimate of the value at the Company level which may be significantly different. The Company’s

financial statements, when available for the year ended December 31, 2023, should be consulted for information at the Company level.

Total Company WI Reserves

The following table summarizes Gran Tierra’s

NI 51-101 and COGEH compliant reserves in Colombia and Ecuador derived from the GTE McDaniel Reserves Report calculated using forecast

oil and gas prices and costs. Gran Tierra has determined that Ecuador reserves, included in the Total Proved, Total Probable and Total

Possible reserve categories for Light and Medium Crude Oil, are not material enough to present separately on a country basis. Therefore

all amounts are presented on a consolidated basis by foreign geographic area.

| | |

Light and

Medium

Crude Oil | | |

Heavy

Crude Oil | | |

Conventional

Natural Gas | | |

2023

Year-End | |

| Reserves Category | |

Mbbl* | | |

Mbbl* | | |

MMcf** | | |

Mboe*** | |

| Proved Developed Producing | |

| 21,308 | | |

| 22,372 | | |

| — | | |

| 43,680 | |

| Proved Developed Non-Producing | |

| 3,130 | | |

| 453 | | |

| — | | |

| 3,583 | |

| Proved Undeveloped | |

| 20,150 | | |

| 22,691 | | |

| — | | |

| 42,841 | |

| Total Proved | |

| 44,588 | | |

| 45,516 | | |

| — | | |

| 90,104 | |

| Total Probable | |

| 26,271 | | |

| 30,731 | | |

| — | | |

| 57,002 | |

| Total Proved plus Probable | |

| 70,859 | | |

| 76,247 | | |

| — | | |

| 147,106 | |

| Total Possible | |

| 24,108 | | |

| 35,642 | | |

| — | | |

| 59,750 | |

| Total Proved plus Probable plus Possible | |

| 94,967 | | |

| 111,889 | | |

| — | | |

| 206,856 | |

*Mbbl (thousand bbl of oil).

**MMcf (million cubic feet).

***Mboe (thousand boe).

Net Present Value Summary

Gran Tierra’s reserves were evaluated using

the average of 3 independent qualified reserves evaluators’ commodity price forecasts at January 1, 2024 (McDaniel, Sproule and

GLJ). See “Forecast Prices” for more information. It should not be assumed that the net present value of cash flow estimated

by McDaniel represents the fair market value of Gran Tierra’s reserves.

| Total Company | |

Discount Rate | |

| ($ millions) | |

0% | | |

5% | | |

10% | | |

15% | | |

20% | |

| Before Tax | |

| | | |

| | | |

| | | |

| | | |

| | |

| Proved Developed Producing | |

| 1,362 | | |

| 1,228 | | |

| 1,117 | | |

| 1,025 | | |

| 948 | |

| Proved Developed Non-Producing | |

| 135 | | |

| 115 | | |

| 99 | | |

| 87 | | |

| 77 | |

| Proved Undeveloped | |

| 1,209 | | |

| 932 | | |

| 730 | | |

| 579 | | |

| 465 | |

| Total Proved | |

| 2,706 | | |

| 2,275 | | |

| 1,946 | | |

| 1,691 | | |

| 1,490 | |

| Total Probable | |

| 2,062 | | |

| 1,493 | | |

| 1,117 | | |

| 861 | | |

| 680 | |

| Total Proved plus Probable | |

| 4,768 | | |

| 3,768 | | |

| 3,063 | | |

| 2,552 | | |

| 2,170 | |

| Total Possible | |

| 2,513 | | |

| 1,698 | | |

| 1,207 | | |

| 895 | | |

| 688 | |

| Total Proved plus Probable plus Possible | |

| 7,281 | | |

| 5,466 | | |

| 4,270 | | |

| 3,447 | | |

| 2,858 | |

| After Tax | |

| | | |

| | | |

| | | |

| | | |

| | |

| Proved Developed Producing | |

| 1,025 | | |

| 930 | | |

| 848 | | |

| 779 | | |

| 721 | |

| Proved Developed Non-Producing | |

| 73 | | |

| 63 | | |

| 54 | | |

| 48 | | |

| 42 | |

| Proved Undeveloped | |

| 691 | | |

| 514 | | |

| 384 | | |

| 288 | | |

| 216 | |

| Total Proved | |

| 1,789 | | |

| 1,507 | | |

| 1,286 | | |

| 1,115 | | |

| 979 | |

| Total Probable | |

| 1,142 | | |

| 816 | | |

| 601 | | |

| 455 | | |

| 353 | |

| Total Proved plus Probable | |

| 2,931 | | |

| 2,323 | | |

| 1,887 | | |

| 1,570 | | |

| 1,332 | |

| Total Possible | |

| 1,413 | | |

| 945 | | |

| 664 | | |

| 486 | | |

| 370 | |

| Total Proved plus Probable plus Possible | |

| 4,344 | | |

| 3,268 | | |

| 2,551 | | |

| 2,056 | | |

| 1,702 | |

Reserve Life Index (Years)

| | |

December

31, 2023* | |

| Total Proved | |

| 8 | |

| Total Proved plus Probable | |

| 13 | |

| Total Proved plus Probable plus Possible | |

| 18 | |

* Calculated using Gran Tierra’s average fourth quarter 2023

WI production of 31,309 bopd.

Future Development Costs

FDC reflects McDaniel's best estimate of what

it will cost to bring the Proved Undeveloped and Probable Undeveloped reserves on production. Changes in forecast FDC occur annually

as a result of development activities, acquisition and disposition activities, and changes in capital cost estimates based on improvements

in well design and performance, as well as changes in service costs. FDC for 2P reserves increased to $923 million at year-end 2023 from

$677 million at year-end 2022. The increase in FDC in 2023 was predominantly attributed to the increase in the numbers of future development

well locations identified by McDaniel in the Suroriente Continuation Agreement.

| ($ millions) | |

Total Proved | | |

Total Proved

Plus Probable | | |

Total Proved

Plus Probable

Plus Possible | |

| 2024 | |

| 127 | | |

| 134 | | |

| 138 | |

| 2025 | |

| 164 | | |

| 189 | | |

| 196 | |

| 2026 | |

| 159 | | |

| 237 | | |

| 246 | |

| 2027 | |

| 102 | | |

| 217 | | |

| 260 | |

| 2028 | |

| 9 | | |

| 89 | | |

| 139 | |

| Remainder | |

| — | | |

| 57 | | |

| 186 | |

| Total (undiscounted) | |

| 561 | | |

| 923 | | |

| 1,165 | |

| ($ millions) | |

Proved | | |

Proved plus

Probable | | |

Proved plus

Probable plus

Possible | |

| Acordionero | |

| 142 | | |

| 142 | | |

| 142 | |

| Chaza Block (Costayaco & Moqueta) | |

| 128 | | |

| 161 | | |

| 161 | |

| Suroriente | |

| 125 | | |

| 202 | | |

| 286 | |

| Ecuador | |

| 90 | | |

| 177 | | |

| 232 | |

| Other | |

| 76 | | |

| 241 | | |

| 344 | |

| Total FDC Costs (undiscounted) | |

| 561 | | |

| 923 | | |

| 1,165 | |

Finding and Development Costs

| Reserves (Mboe) | |

Year

Ended

December 31, 2023 | |

| Proved Developed Producing | |

| 43,680 | |

| Total Proved | |

| 90,104 | |

| Total Proved plus Probable | |

| 147,106 | |

| Total Proved plus Probable plus Possible | |

| 206,856 | |

| Capital Expenditures ($000s) | |

| | |

| - including and excluding acquired properties | |

| 219,060 | |

| Operating Netback* ($/bbl, per WI sales volumes) | |

| | |

| Operating Netback* - fourth quarter 2023 | |

| 36.05 | |

*Operating Netback is a Non-GAAP measure and

does not have a standardized meaning under GAAP. Operating netback as presented is defined as oil sales less operating and transportation

expenses. See "Non-GAAP Measures" in this press release.

Finding and Development Costs, Excluding FDC*

| | |

Year Ended

December 31, 2023 | |

| Proved Developed Producing | |

| | |

| Reserve Additions (Mboe) | |

| 8,451 | |

| F&D Costs ($/boe) | |

| 25.92 | |

| F&D Recycle Ratio | |

| 1.4 | |

Finding and Development Costs, Including FDC*

| | |

Year Ended

December

31, 2023 | |

| Proved Developed Producing | |

| | |

| Change in FDC ($000s) | |

| (11,389 | ) |

| Reserve Additions (Mboe) | |

| 8,451 | |

| F&D Costs ($/boe) | |

| 24.57 | |

| F&D Recycle Ratio | |

| 1.5 | |

Finding and Development Costs, Excluding FDC*

| | |

Year Ended

December

31, 2023 | |

| Total Proved | |

| | |

| Reserve Additions (Mboe) | |

| 18,322 | |

| F&D Costs ($/boe) | |

| 11.96 | |

| F&D Recycle Ratio | |

| 3.0 | |

Finding and Development Costs, Including FDC*

| | |

Year Ended

December

31, 2023 | |

| Total Proved | |

| | |

| Change in FDC ($000s) | |

| 157,950 | |

| Reserve Additions (Mboe) | |

| 18,322 | |

| F&D Costs ($/boe) | |

| 20.58 | |

| F&D Recycle Ratio | |

| 1.8 | |

Finding and Development Costs, Excluding FDC*

| | |

Year Ended

December

31, 2023 | |

| Total Proved plus Probable | |

| | |

| Reserve Additions (Mboe) | |

| 28,893 | |

| F&D Costs ($/boe) | |

| 7.58 | |

| F&D Recycle Ratio | |

| 4.8 | |

Finding and Development Costs, Including FDC*

| | |

Year Ended

December

31, 2023 | |

| Total Proved plus Probable | |

| | |

| Change in FDC ($000s) | |

| 245,746 | |

| Reserve Additions (Mboe) | |

| 28,893 | |

| F&D Costs ($/boe) | |

| 16.09 | |

| F&D Recycle Ratio | |

| 2.2 | |

Finding and Development Costs, Excluding FDC*

| | |

Year Ended

December

31, 2023 | |

| Total Proved plus Probable plus Possible | |

| | |

| Reserve Additions (Mboe) | |

| 36,120 | |

| F&D Costs ($/boe) | |

| 6.06 | |

| F&D Recycle Ratio | |

| 5.9 | |

Finding and Development Costs, Including FDC*

| | |

Year Ended

December

31, 2023 | |

| Total Proved plus Probable plus Possible | |

| | |

| Change in FDC ($000s) | |

| 310,776 | |

| Reserve Additions (Mboe) | |

| 36,120 | |

| F&D Costs ($/boe) | |

| 14.67 | |

| F&D Recycle Ratio | |

| 2.5 | |

*In all cases, the F&D number is calculated

by dividing the identified capital expenditures by the applicable reserves additions both before and after changes in FDC costs. Both

F&D costs take into account reserves revisions during the year on a per boe basis. F&D recycle ratio is defined as fourth quarter

2023 operating netback per WI sales volume boe divided by the appropriate F&D costs on a per boe basis. The aggregate of the exploration

and development costs incurred in the financial year and the changes during that year in estimated future development costs may not reflect

the total F&D costs related to reserves additions for that year. Operating Netback is a Non-GAAP measure and does not have a standardized

meaning under GAAP. Operating netback is defined as oil sales less operating and transportation expenses. See “Non-GAAP Measures”

in this press release.

Forecast Prices

The pricing assumptions used in estimating NI

51-101 and COGEH compliant reserves data disclosed above with respect to net present values of future net revenue are set forth below.

The price forecasts are based on an average of three independent qualified reserves evaluators’ commodity price forecasts at January

1, 2024 (McDaniel, Sproule and GLJ). All three of these companies are independent qualified reserves evaluators and auditors pursuant

to NI 51-101.

| | |

Brent Crude Oil | | |

WTI Crude Oil | |

| Year | |

$US/bbl | | |

$US/bbl | |

| | |

January 1, 2024 | | |

January 1, 2024 | |

| 2024 | |

$ | 78.00 | | |

$ | 73.67 | |

| 2025 | |

$ | 79.18 | | |

$ | 74.98 | |

| 2026 | |

$ | 80.36 | | |

$ | 76.14 | |

| 2027 | |

$ | 81.79 | | |

$ | 77.66 | |

| 2028 | |

$ | 83.41 | | |

$ | 79.22 | |

Suroriente Continuation Agreement

On April 11, 2023, the Company announced that

it had entered into an agreement with Ecopetrol S.A., the national oil company of Colombia (the “Suroriente Continuation Agreement”),

by which the parties renegotiated the terms and the duration of the contract for the Suroriente Block in the Department of Putumayo,

which was scheduled to end in mid-2024. The Suroriente Continuation Agreement provides an opportunity to add significant value, as well

as economic life, to the Suroriente Block by continuing its duration for 20 years from the Suroriente Continuation Agreement's effective

date. On August 31, 2023, the Company announced that it had satisfied all outstanding conditions precedent to the effectiveness of the

Suroriente Continuation Agreement.

Corporate Presentation:

Gran Tierra’s Corporate Presentation has

been updated and is available on the Company website at www.grantierra.com.

Contact Information

For investor and media inquiries please contact:

Gary Guidry, Chief Executive Officer

Ryan Ellson, Executive Vice President & Chief Financial Officer

Rodger Trimble, Vice President, Investor Relations

Tel: +1.403.265.3221

About Gran Tierra Energy Inc.

Gran Tierra Energy Inc. together with its subsidiaries

is an independent energy company currently focused on international oil and natural gas exploration and production in Colombia and Ecuador.

The Company is currently developing its existing portfolio of assets in Colombia and Ecuador and will continue to pursue additional growth

opportunities that would further strengthen the Company’s portfolio. The Company’s common stock trades on the NYSE American,

the Toronto Stock Exchange and the London Stock Exchange under the ticker symbol GTE. Additional information concerning Gran Tierra is

available at www.grantierra.com. Information on the Company’s website (including the Corporate Presentation referenced above) does

not constitute a part of this press release. Investor inquiries may be directed to info@grantierra.com or (403) 265-3221.

Gran Tierra's U.S. Securities and Exchange Commission

("SEC") filings are available on the SEC website at www.sec.gov. The Company's Canadian securities regulatory filings

are available on SEDAR at www.sedar.com and UK regulatory filings are available on the National Storage Mechanism (the "NSM")

website at https://data.fca.org.uk/#/nsm/nationalstoragemechanism. Gran Tierra's filings on the SEC, SEDAR and the NSM websites are not

incorporated by reference into this press release.

FORWARD LOOKING STATEMENTS ADVISORY

This press release contains opinions, forecasts,

projections, and other statements about future events or results that constitute forward-looking statements within the meaning of the

United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended, and financial outlook and forward looking information within the meaning of applicable

Canadian securities laws (collectively, "forward-looking statements"), which can be identified by such terms as “expect,”

“plan,” “can,” “will,” “should,” “guidance,” “estimate,” “forecast,”

“signal,” “progress” and “believes,” derivations thereof and similar terms identify forward-looking

statements. Such forward-looking statements include, but are not limited to, the Company's expectations regarding its estimated quantities

and net present values of reserves, capital program, and ability to fund the Company's exploration program over a period of time, statements

about the Company’s financial and performance targets and other forecasts or expectations regarding, or dependent on, the Company’s

business outlook for 2024 and beyond, capital spending plans and any benefits of the changes in our capital program or expenditures,

well performance, production, the restart of production and workover activity, future development costs, infrastructure schedules, waterflood

impacts and plans, growth of referenced reserves, forecast prices, five-year expected oil sales and cash flow and net revenue, estimated

recovery factors, liquidity and access to capital, the Company's strategies and results thereof, the Company's operations including planned

operations and developments, disruptions to operations and the decline in industry conditions, and expectations regarding environmental

commitments.

The forward-looking statements contained in this

press release reflect several material factors and expectations and assumptions of Gran Tierra including, without limitation, that Gran

Tierra will continue to conduct its operations in a manner consistent with its current expectations, the accuracy of testing and production

results and seismic data, pricing and cost estimates (including with respect to commodity pricing and exchange rates), rig availability,

the effects of drilling down-dip, the effects of waterflood and multi-stage fracture stimulation operations, the extent and effect of

delivery disruptions, and the general continuance of current or, where applicable, assumed operational, regulatory and industry conditions

including in Colombia and Ecuador and areas of potential expansion, and the ability of Gran Tierra to execute its current business and

operational plans in the manner currently planned. Gran Tierra believes the material factors, expectations and assumptions reflected

in the forward-looking statements are reasonable at this time but no assurance can be given that these factors, expectations and assumptions

will prove to be correct.

Among the important factors that could cause

actual results to differ materially from those indicated by the forward-looking statements in this press release are: Gran Tierra's operations

are located in South America and unexpected problems can arise due to guerilla activity, strikes, local blockades or protests; technical

difficulties and operational difficulties may arise which impact the production, transport or sale of Gran Tierra’s products; other

disruptions to local operations; global and regional changes in the demand, supply, prices, differentials or other market conditions

affecting oil and gas, including inflation and changes resulting from a global health crisis, geopolitical events, including the ongoing

conflicts in Ukraine and the Gaza region, or from the imposition or lifting of crude oil production quotas or other actions that might

be imposed by OPEC and other producing countries and resulting company or third-party actions in response to such changes; changes in

commodity prices, including volatility or a prolonged decline in these prices relative to historical or future expected levels; the risk

that current global economic and credit conditions may impact oil prices and oil consumption more than Gran Tierra currently predicts,

which could cause Gran Tierra to further modify its strategy and capital spending program; prices and markets for oil and natural gas

are unpredictable and volatile; the effect of hedges, the accuracy of productive capacity of any particular field; geographic, political

and weather conditions can impact the production, transport or sale of Gran Tierra’s products; the ability of Gran Tierra to execute

its business plan and realize expected benefits from current initiatives; the risk that unexpected delays and difficulties in developing

currently owned properties may occur; the ability to replace reserves and production and develop and manage reserves on an economically

viable basis; the accuracy of testing and production results and seismic data, pricing and cost estimates (including with respect to

commodity pricing and exchange rates); the risk profile of planned exploration activities; the effects of drilling down-dip; the effects

of waterflood and multi-stage fracture stimulation operations; the extent and effect of delivery disruptions, equipment performance and

costs; actions by third parties; the timely receipt of regulatory or other required approvals for Gran Tierra’s operating activities;

the failure of exploratory drilling to result in commercial wells; unexpected delays due to the limited availability of drilling equipment

and personnel; volatility or declines in the trading price of Gran Tierra’s common stock or bonds; the risk that Gran Tierra does

not receive the anticipated benefits of government programs, including government tax refunds; Gran Tierra's ability to comply with financial

covenants in its credit agreement and indentures and make borrowings under its credit agreement; and the risk factors detailed from time

to time in Gran Tierra's periodic reports filed with the SEC, including, without limitation, under the caption "Risk Factors"

in Gran Tierra's Annual Report on Form 10-K for the year ended December 31, 2022 filed on February 21, 2023 and its other filings with

the SEC. These filings are available on the Securities and Exchange Commission website at http://www.sec.gov and on SEDAR at www.sedar.com.

Statements relating to "reserves" are

also deemed to be forward-looking statements, as they involve the implied assessment, based on certain estimates and assumptions, including

that the reserves described can be profitably produced in the future.

Guidance is uncertain, particularly when given

over extended periods of time, and results may be materially different. Although the current capital spending program and long term strategy

of Gran Tierra is based upon the current expectations of the management of Gran Tierra, should any one of a number of issues arise, Gran

Tierra may find it necessary to alter its business strategy and/or capital spending program and there can be no assurance as at the date

of this press release as to how those funds may be reallocated or strategy changed and how that would impact Gran Tierra's results of

operations and financing position. In particular, the unprecedented nature of the economic downturn and industry decline may make it

particularly difficult to identify risks or predict the degree to which identified risks will impact Gran Tierra's business and financial

condition. All forward-looking statements are made as of the date of this press release and the fact that this press release remains

available does not constitute a representation by Gran Tierra that Gran Tierra believes these forward-looking statements continue to

be true as of any subsequent date. Actual results may vary materially from the expected results expressed in forward-looking statements.

Gran Tierra disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise, except as expressly required by applicable law. Gran Tierra's forward-looking statements are expressly qualified

in their entirety by this cautionary statement.

The estimates of future net revenue, cash flow

and certain expenses may be considered to be future-oriented financial information or a financial outlook for the purposes of applicable

Canadian securities laws. Financial outlook and future-oriented financial information contained in this press release about prospective

financial performance, financial position or cash flows are provided to give the reader a better understanding of the potential future

performance of the Company in certain areas and are based on assumptions about future events, including economic conditions and proposed

courses of action, based on management's assessment of the relevant information currently available, and to become available in the future.

In particular, this press release contains projected operational and financial information for 2024 and for the next five years to allow

readers to assess the Company's ability to fund its programs. These projections contain forward-looking statements and are based on a

number of material assumptions and factors set out above. Actual results may differ significantly from the projections presented herein.

The actual results of Gran Tierra's operations for any period could vary from the amounts set forth in these projections, and such variations

may be material. See above for a discussion of the risks that could cause actual results to vary. The future-oriented financial information

and financial outlooks contained in this press release have been approved by management as of the date of this press release. Readers

are cautioned that any such financial outlook and future-oriented financial information contained herein should not be used for purposes

other than those for which it is disclosed herein. The Company and its management believe that the prospective financial information

has been prepared on a reasonable basis, reflecting management's best estimates and judgments, and represent, to the best of management's

knowledge and opinion, the Company's expected course of action. However, because this information is highly subjective, it should not

be relied on as necessarily indicative of future results. See Gran Tierra's press release dated January 23, 2024 for additional information

regarding cash flow guidance referred to herein.

Non-GAAP Measures

This press release includes non-GAAP measures

which do not have a standardized meaning under GAAP. Investors are cautioned that these measures should not be construed as alternatives

to oil sales, net income or loss or other measures of financial performance as determined in accordance with GAAP. Gran Tierra's method

of calculating these measures may differ from other companies and, accordingly, they may not be comparable to similar measures used by

other companies.

Operating netback as presented is defined as

oil sales less operating and transportation expenses. Management believes that operating netback is a useful supplemental measure for

investors to analyze financial performance and provide an indication of the results generated by Gran Tierra's principal business activities

prior to the consideration of other income and expenses. A reconciliation of operating netback per boe to the most directly comparable

measure calculated and presented in accordance with GAAP is as follows:

| | |

Three months ended

December 31, 2023 | |

| | |

(Thousands of

U.S Dollars) | | |

($/bbl, per WI

sales volumes) | |

| Oil sales | |

| 154,944 | | |

$ | 54.04 | |

| Operating expenses | |

| (47,637 | ) | |

| (16.61 | ) |

| Transportation expenses | |

| (3,947 | ) | |

| (1.38 | ) |

| Operating netback | |

$ | 103,360 | | |

$ | 36.05 | |

Unaudited Financial Information

Certain financial and operating results included

in this press release, including debt, capital expenditures, and production information, are based on unaudited estimated results. These

estimated results are subject to change upon completion of the Company's audited financial statements for the year ended December 31,

2023, and changes could be material. Gran Tierra anticipates filing its audited financial statements and related management's discussion

and analysis for the year ended December 31, 2023 on or before February 20, 2024.

DISCLOSURE OF OIL AND GAS INFORMATION

Boe’s have been converted on the basis

of six thousand cubic feet (“Mcf”) natural gas to 1 bbl of oil. Boe's may be misleading, particularly if used in isolation.

A boe conversion ratio of 6 Mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and

does not represent a value equivalency at the wellhead. In addition, given that the value ratio based on the current price of oil as

compared with natural gas is significantly different from the energy equivalent of six to one, utilizing a boe conversion ratio of 6

Mcf: 1 bbl would be misleading as an indication of value.

All reserves values, future net revenue and ancillary

information contained in this press release have been prepared by McDaniel and are derived from the GTE McDaniel Reserves Report, unless

otherwise expressly stated. Any reserves values or related information contained in this press release as of a date other than December 31,

2023 has an effective date of December 31 of the applicable year and is derived from a report prepared by Gran Tierra's independent qualified

reserves evaluator as of such date, and additional information regarding such estimate or information can be found in Gran Tierra's applicable

Statement of Reserves Data and Other Oil and Gas Information on Form 51-101F1 filed on SEDAR at www.sedar.com.

Estimates of net present value and future net

revenue contained herein do not necessarily represent fair market value. Estimates of reserves and future net revenue for individual

properties may not reflect the same level of confidence as estimates of reserves and future net revenue for all properties, due to the

effect of aggregation. There is no assurance that the forecast price and cost assumptions applied by McDaniel in evaluating Gran Tierra's

reserves will be attained and variances could be material. All reserves assigned in the GTE McDaniel Reserves Report are located in Colombia

and Ecuador and presented on a consolidated basis by foreign geographic area.

All evaluations of future net revenue contained

in the GTE McDaniel Reserves Report are after the deduction of royalties, operating costs, development costs, production costs and abandonment

and reclamation costs but before consideration of indirect costs such as administrative, overhead and other miscellaneous expenses. It

should not be assumed that the estimates of future net revenues presented in this press release represent the fair market value of the

reserves. There are numerous uncertainties inherent in estimating quantities of crude oil reserves and the future cash flows attributed

to such reserves. The reserve and associated cash flow information set forth in the GTE McDaniel Reserves Report are estimates only and

there is no guarantee that the estimated reserves will be recovered. Actual reserves may be greater than or less than the estimates provided

therein.

References to a formation where evidence of hydrocarbons

has been encountered is not necessarily an indicator that hydrocarbons will be recoverable in commercial quantities or in any estimated

volume. Gran Tierra's reported production is a mix of light crude oil and medium and heavy crude oil for which there is no precise breakdown

since the Company's oil sales volumes typically represent blends of more than one type of crude oil. Drilling locations disclosed herein

are derived from the GTE McDaniel Reserves Report and account for drilling locations that have associated Proved Undeveloped and Proved

plus Probable Undeveloped reserves, as applicable. Well test results should be considered as preliminary and not necessarily indicative

of long-term performance or of ultimate recovery. Well log interpretations indicating oil and gas accumulations are not necessarily indicative

of future production or ultimate recovery. If it is indicated that a pressure transient analysis or well-test interpretation has not

been carried out, any data disclosed in that respect should be considered preliminary until such analysis has been completed. References

to thickness of "oil pay" or of a formation where evidence of hydrocarbons has been encountered is not necessarily an indicator

that hydrocarbons will be recoverable in commercial quantities or in any estimated volume.

Definitions

Proved reserves are those reserves that can be

estimated with a high degree of certainty to be recoverable. It is likely that the actual remaining quantities recovered will exceed

the estimated proved reserves.

Probable reserves are those additional reserves

that are less certain to be recovered than proved reserves. It is equally likely that the actual remaining quantities recovered will

be greater or less than the sum of the estimated proved plus probable reserves.

Possible reserves are those additional reserves

that are less certain to be recovered than Probable reserves. There is a 10% probability that the quantities actually recovered will

equal or exceed the sum of Proved plus Probable plus Possible reserves.

Proved developed producing reserves are those

reserves that are expected to be recovered from completion intervals open at the time of the estimate. These reserves may be currently

producing or, if shut-in, they must have previously been on production, and the date of resumption of production must be known with reasonable

certainty.

Developed non-producing reserves are those reserves

that either have not been on production, or have previously been on production but are shut-in and the date of resumption of production

is unknown.

Undeveloped reserves are those reserves expected

to be recovered from known accumulations where a significant expenditure (e.g., when compared to the cost of drilling a well) is required

to render them capable of production. They must fully meet the requirements of the reserves category (proved, probable, possible) to

which they are assigned.

Certain terms used in this press release but

not defined are defined in NI 51-101, CSA Staff Notice 51-324 – Revised Glossary to NI 51-101, Standards of Disclosure for Oil

and Gas Activities (“CSA Staff Notice 51-324”) and/or the COGEH and, unless the context otherwise requires, shall

have the same meanings herein as in NI 51-101, CSA Staff Notice 51-324 and the COGEH, as the case may be.

Oil and Gas Metrics

This press release contains a number of oil and

gas metrics, including NAV per share, F&D costs, F&D recycle ratio, operating netback, reserve life index and reserves replacement,

which do not have standardized meanings or standard methods of calculation and therefore such measures may not be comparable to similar

measures used by other companies and should not be used to make comparisons. Such metrics have been included herein to provide readers

with additional measures to evaluate the Company's performance; however, such measures are not reliable indicators of the future performance

of the Company and future performance may not compare to the performance in previous periods.

| · | NAV

per share is calculated as NPV10 (before or after tax, as applicable) of the applicable reserves

category minus estimated net debt, divided by the number of shares of Gran Tierra's common

stock issued and outstanding. Management uses NAV per share as a measure of the relative

change of Gran Tierra's net asset value over its outstanding common stock over a period of

time. |

| · | F&D

costs are calculated as estimated exploration and development capital expenditures, excluding

acquisitions and dispositions, divided by the applicable reserves additions both before and

after changes in FDC costs. The calculation of F&D costs incorporates the change in FDC

required to bring proved undeveloped and developed reserves into production. The aggregate

of the exploration and development costs incurred in the financial year and the changes during

that year in estimated FDC may not reflect the total F&D costs related to reserves additions

for that year. Management uses F&D costs per boe as a measure of its ability to execute

its capital program and of its asset quality. |

| · | F&D

recycle ratio is calculated as described in this press release. Management uses F&D recycle

ratio as an indicator of profitability of its oil and gas activities. |

| · | Operating

netback is calculated as described in this press release. Management believes that operating

netback is a useful supplemental measure for investors to analyze financial performance and

provide an indication of the results generated by Gran Tierra's principal business activities

prior to the consideration of other income and expenses. |

| · | Reserve

life index is calculated as reserves in the referenced category divided by the referenced

estimated production. Management uses this measure to determine how long the booked reserves

will last at current production rates if no further reserves were added. |

| · | Reserves

replacement is calculated as reserves in the referenced category divided by estimated referenced

production. Management uses this measure to determine the relative change of its reserve

base over a period of time. |

Disclosure of Reserve Information and Cautionary

Note to U.S. Investors

Unless expressly stated otherwise, all estimates

of proved, probable and possible reserves and related future net revenue disclosed in this press release have been prepared in accordance

with NI 51-101. Estimates of reserves and future net revenue made in accordance with NI 51-101 will differ from corresponding estimates

prepared in accordance with applicable U.S. Securities and Exchange Commission ("SEC") rules and disclosure requirements of

the U.S. Financial Accounting Standards Board ("FASB"), and those differences may be material. NI 51-101, for example, requires

disclosure of reserves and related future net revenue estimates based on forecast prices and costs, whereas SEC and FASB standards require

that reserves and related future net revenue be estimated using average prices for the previous 12 months. In addition, NI 51-101 permits

the presentation of reserves estimates on a "company gross" basis, representing Gran Tierra's working interest share before

deduction of royalties, whereas SEC and FASB standards require the presentation of net reserve estimates after the deduction of royalties

and similar payments. There are also differences in the technical reserves estimation standards applicable under NI 51-101 and, pursuant

thereto, the COGEH, and those applicable under SEC and FASB requirements.

In addition to being a reporting issuer in certain

Canadian jurisdictions, Gran Tierra is a registrant with the SEC and subject to domestic issuer reporting requirements under U.S. federal

securities law, including with respect to the disclosure of reserves and other oil and gas information in accordance with U.S. federal

securities law and applicable SEC rules and regulations (collectively, "SEC requirements"). Disclosure of such information

in accordance with SEC requirements is included in the Company's Annual Report on Form 10-K and in other reports and materials filed

with or furnished to the SEC and, as applicable, Canadian securities regulatory authorities. The SEC permits oil and gas companies that

are subject to domestic issuer reporting requirements under U.S. federal securities law, in their filings with the SEC, to disclose only

estimated proved, probable and possible reserves that meet the SEC's definitions of such terms. Gran Tierra has disclosed estimated proved,

probable and possible reserves in its filings with the SEC. In addition, Gran Tierra prepares its financial statements in accordance

with United States generally accepted accounting principles, which require that the notes to its annual financial statements include

supplementary disclosure in respect of the Company's oil and gas activities, including estimates of its proved oil and gas reserves and

a standardized measure of discounted future net cash flows relating to proved oil and gas reserve quantities. This supplementary financial

statement disclosure is presented in accordance with FASB requirements, which align with corresponding SEC requirements concerning reserves

estimation and reporting.

Proved reserves are reserves which, by analysis

of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward

from known reservoirs under existing economic conditions, operating methods, and government regulations prior to the time at which contracts

providing the right to operate expires, unless evidence indicates that renewal is reasonably certain. Probable reserves are reserves

that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered.

Estimates of probable reserves which may potentially be recoverable through additional drilling or recovery techniques are by nature

more uncertain than estimates of proved reserves and accordingly are subject to substantially greater risk of not actually being realized

by us. Possible reserves are reserves that are less certain to be recovered than probable reserves. Estimates of possible reserves are

also inherently imprecise. Estimates of probable and possible reserves are also continually subject to revisions based on production

history, results of additional exploration and development, price changes, and other factors.

The Company believes that the presentation of

NPV10 is useful to investors because it presents (i) relative monetary significance of its oil and natural gas properties regardless

of tax structure and (ii) relative size and value of its reserves to other companies. The Company also uses this measure when assessing

the potential return on investment related to its oil and natural gas properties. NPV10 and the standardized measure of discounted future

net cash flows do not purport to present the fair value of the Company's oil and gas reserves. The Company has not provided a reconciliation

of NPV10 to the standardized measure of discounted future net cash flows because it is impracticable to do so.

Investors are urged to consider closely the disclosures

and risk factors in the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and in the other reports and filings with

the SEC, available from the Company's offices or website. These reports can also be obtained from the SEC website at www.sec.gov.

Exhibit 99.2

Gran Tierra Energy Inc. Announces 2024 Guidance

and Operations Update

| · | 2024 Capital Expenditure Budget of $210-240 Million and Expected 2024 Cash Flow1 of $280-320 Million in Base Case

|

| · | Plan to Drill 13-17 Development Wells and 6-9 High Impact Near-Field Exploration Wells |

| · | Forecast 2024 Production of 32,000-35,000 BOPD, Increases of 4% from 2023, 11% from 2022 and 28% from 2021 |

| · | Forecast 2024 Free Cash Flow2 of $175 Million Before Exploration, $75 Million After Exploration in Base Case |

| · | Plan to Allocate Up to 50% of Free Cash Flow to Share Buybacks |

| · | Met 2023 Production Guidance by Achieving 2023 Total Company Average Production of Approximately 32,650 BOPD, an Increase of

6% from 2022 |

| · | Strong Results from the Costayaco-56 Well Producing Over 2,000 BOPD |

| · | Achieved Company’s Best Safety Performance on Record in 2023 |

| · | Development Drilling Campaigns Underway in Acordionero and Costayaco Fields with Encouraging Results |

CALGARY, ALBERTA, January 23, 2024, Gran Tierra

Energy Inc. (“Gran Tierra” or the “Company”) (NYSE American:GTE)(TSX:GTE)(LSE:GTE) today announced

its 2024 capital budget and production guidance. All dollar amounts are in United States dollars and all production volumes are on

a working interest before royalties basis and are expressed in barrels (“bbl”) of oil per day (“BOPD”),

unless otherwise stated.

Key Highlights:

| ◦ | Gran Tierra is forecasting the following ranges for the Company’s 2024 budget: |

| 2024 Budget |

Low Case |

Base Case |

High Case |

| Average Brent Oil Price ($/bbl) |

70.00 |

80.00 |

90.00 |

| Total Company Production (BOPD) |

32,000-35,000 |

32,000-35,000 |

32,000-35,000 |

| Operating Netback4 ($ million) |

380-420 |

450-490 |

530-570 |

| EBITDA3 ($ million) |

335-395 |

400-460 |

480-540 |

| Cash Flow1 ($ million) |

240-280 |

280-320 |

330-370 |

| Total Capital ($ million) |

190-220 |

210-240 |

210-240 |

| Free Cash Flow2 ($ million) |

20-90 |

40-110 |

90-160 |

| Number of Development Wells (gross) |

13-17 |

13-17 |

13-17 |

| Number of Exploration Wells (gross) |

4-7 |

6-9 |

6-9 |

| ◦ | 2024 Base Capital Program – Profitable Production Growth and High Impact Near-Field Exploration:

|

| ▪ | Building on a successful development campaign in 2023, Gran Tierra plans to continue to grow production,

while also seeking to add new reserves and future growth through exploration. A key area of focus for the Company, that is underpinned

by the 2023 announcement of the Suroriente Continuation Agreement, is the South Putumayo and Ecuador development and exploration corridor

which includes the Suroriente, Alea-1848A, Put-7, Charapa and Chanangue Blocks. This corridor offers material growth potential through

development and exploration. This core growth area for the Company is expected to provide years of drilling opportunities and profitable

production growth. |

| ▪ | Development: Gran Tierra expects to allocate approximately 55-60% of its 2024 capital program towards

development activities in its core assets in Colombia, including: |

| • | Acordionero: the Company plans to drill 6 to 8 development wells in the Acordionero oil field in

the Middle Magdalena Valley Basin. Acordionero’s 2024 plans also include drilling pad extensions and ongoing waterflood optimization. |

| • | Costayaco: in this oil field, located in the northern Putumayo Basin, Gran Tierra plans to drill

3 to 5 development wells. |

| • | Suroriente: in the southern Putumayo Basin, Gran Tierra plans to commence development drilling

later in second half 2024 in the Cohembi oil field located in the Suroriente Block, which would be the first wells drilled by the Company

in this block since 2018. In addition to development drilling, the Company is also planning facility expansion, an increase in gas to

power generation, new development well pads and social investment in the area. With the planned investments in 2024, production is expected

to materially increase in 2025 and 2026. |

| ▪ | Exploration: Approximately 40-45% of the Company’s 2024 capital program is expected to be

allocated to high impact near-field exploration activities and the drilling of 6 to 9 exploration wells in Colombia and Ecuador in the

Base Case and High Case. Gran Tierra’s 2024 exploration drilling is planned to follow up on the encouraging results from the Company’s

2022 exploration program. The Company focuses its exploration program on short-cycle time, near-field prospects in proven basins with

access to transportation infrastructure. In addition to drilling exploration wells, the Company plans to commence a 238 km2

3D seismic program over the Charapa Block in Ecuador and pre-invest in advancing drilling licenses and building pads for the 2025 exploration

program in Colombia and Ecuador. |

| ◦ | Fully Funded Capital Program Generating Free Cash Flow2: Gran Tierra’s mid-point

Base Case 2024 capital budget of $225 million is expected to be fully funded from the Base Case 2024 mid-point Cash Flow1 forecast

of $300 million, based on an assumed average $80.00/bbl Brent oil price. Gran Tierra remains focused on generating strong Free Cash Flow2,

ongoing net debt5 reduction and shareholder returns via share buybacks. |

| ◦ | Share Buybacks: During 2024, Gran Tierra plans to allocate up to approximately 50% of its Free

Cash Flow to share buybacks in the Base Case. During 2023, the Company repurchased approximately 7.1% of its outstanding shares. |

| ◦ | Control of Capital Program: Gran Tierra holds a 100% working interest in and operatorship of the

Company’s major assets in Colombia and Ecuador. This full control provides the Company with the flexibility to swiftly optimize

its development and exploration programs in response to fluctuations, whether positive or negative, in oil prices. |

Gran Tierra’s Commitment to Go “Beyond

Compliance” in Environmental, Social and Governance

| · | 2023 was the Company’s safest year on record, with a total of 16.3 million person-hours without

a Lost Time Injury (LTI), and a Total Recordable Case Frequency (TRCF) of 0.02, which places Gran Tierra within the region`s top quartile

in safety performance. |

| · | Gran Tierra is pleased to announce that the Company has been accepted by the Voluntary Principles Initiative

(VPI) as an official member of the Voluntary Principles for Security and Human Rights world-wide initiative. This appointment strengthens

the Company’s commitment to the responsible implementation of Human Rights policies and practices in all our operations. |

| · | In 2023, Gran Tierra signed a four-year extension with the prominent environmental NGO Conservation International

to continue and expand upon the Company’s highly successful NaturAmazonas program, the largest reforestation program of its nature

in Colombia. This extension continues to harmonize economic development and conservation in the Piedmont region of the Putumayo department

in southern Colombia. |

Message to Shareholders

Gary Guidry, President and Chief Executive Officer

of Gran Tierra, commented: “Gran Tierra Energy is looking forward to a successful and profitable 2024 and we are committed to delivering

value to all our stakeholders by focusing on safety, sustainable growth, and robust return of capital to shareholders. Our 2024 budget,

expected to be fully funded by Cash Flow1, takes a balanced, returns-focused approach to capital allocation. We plan to focus

on four key areas: profitably growing reserves and production in our existing assets, prudently pursuing high impact exploration in our

portfolio, fortifying our balance sheet through net debt5 reduction, and executing share buybacks. During 2024, we are targeting

a net debt5 to EBITDA3 ratio of 0.8 to 1.2 times.

We are excited to restart drilling in our high-impact

exploration portfolio in 2024 which may present us with opportunities for substantial growth in both Ecuador and Colombia. Having meticulously

high-graded our exploration portfolio, we are dedicated to pursuing transformative opportunities that could enhance our growth trajectory

and bring significant value to our stakeholders.

We believe Gran Tierra is well-positioned to navigate

the current volatile environment with our low base decline, conventional oil asset base and our full operational control of capital allocation

and timing. As we profitably pursue our operational and financial objectives, we remain steadfast in our commitment to the well-being

of our employees and the communities in which we operate, recognizing their vital importance to our success.”

Operations Update:

| ◦ | Gran Tierra achieved total company average production in 2023 of approximately 32,650 BOPD, an increase

of 6% from 2022 and 23% from 2021, and was within the Company’s prescribed 2023 guidance. |

| ◦ | Following Gran Tierra’s successful 2023 development drilling campaigns at the Acordionero and Costayaco

fields, the Company has accelerated its 2024 development program and, in mid-December 2023, commenced ongoing multi-well drilling campaign

in both fields. |

| ◦ | Costayaco Development Campaign (Putumayo Basin): |

| ▪ | Since December 2023, Gran Tierra has so far drilled 2 oil wells. |

| ▪ | The first well in the current drilling campaign, the CYC-56, was spud on December 16, 2023. The well has

been completed and is now on production and yielding encouraging results. The Company is completing the second well, the CYC-57, with

production testing planned during January 2024. |

| ▪ | During January 8-15, 2024, the CYC-56 produced on jet pump at a stable average rate of 2,118 BOPD (30-degree

API gravity) with a watercut of 1.4% and a gas-oil ratio of 141 standard cubic feet per stock tank bbl. |

| ▪ | The CYC-56 provides further evidence that multiple additional drilling opportunities may exist in the

northern region of Costayaco where the Company plans to target un-swept portions of oil with future wells. |

| ▪ | During all of 2024, the Company plans to drill a total of 3 to 5 development wells in Costayaco. |

| ◦ | Acordionero Development Campaign (Middle Magdalena Valley Basin): |

| ▪ | Since December 2023, Gran Tierra has drilled 4 wells so far (3 oil producers and 1 water injector) in

Acordionero, with results meeting expectations. |

| ▪ | During all of 2024, the Company plans to drill a total of 6 to 8 development wells in Acordionero. |

Corporate

Presentation:

| · | Gran Tierra’s Corporate Presentation has been updated and

is available at www.grantierra.com. |

1 “Cash Flow” refers to line

item “net cash provided by operating activities” under generally accepted accounting principles in the United States of America

(“GAAP”).

2 “Free Cash Flow” is a

non-GAAP measure and does not have a standardized meaning under GAAP. Free cash flow is defined as “net cash provided by operating

activities” less capital

expenditures. Refer to "Non-GAAP Measures"

in this press release. Forecast 2024 free cash flow of $175 million “before exploration” is equal to the Base Case midpoint

cash flow of $300 million less the Base Case midpoint total capital of $225 million, with Base Case midpoint exploration -only capital

of approximately $100 million added back. Forecast 2024 Free Cash Flow of $75 million “after exploration” is equal to the

Base Case midpoint cash flow of $300 million less the Base Case midpoint total capital of $225 million. Free Cash Flows in the table above

are the midpoints of the ranges of cash flows less the midpoints of the ranges of total capital expenditures for each oil price scenario.

3 Earnings before interest, taxes and

depletion, depreciation and accretion (“EBITDA”) is a non-GAAP measure and does not have a standardized meaning under

GAAP. Refer to "Non-GAAP Measures" in this press release.

4 “Operating netback” is

a non-GAAP measures and does not have standardized meaning under GAAP. Refer to “Non-GAAP Measures” in this press release.

5 Net debt is defined as GAAP total

debt before deferred financing fees less cash.

Contact Information

For investor and media inquiries please contact:

Gary Guidry

President & Chief Executive Officer

Ryan Ellson

Executive Vice President & Chief Financial Officer

Rodger Trimble

Vice President, Investor Relations

+1-403-265-3221

info@grantierra.com

About Gran Tierra Energy Inc.

Gran Tierra Energy Inc. together with its subsidiaries

is an independent international energy company currently focused on oil and natural gas exploration and production in Colombia and Ecuador.

The Company is currently developing its existing portfolio of assets in Colombia and Ecuador and will continue to pursue additional growth

opportunities that would further strengthen the Company’s portfolio. The Company’s common stock trades on the NYSE American,

the Toronto Stock Exchange and the London Stock Exchange under the ticker symbol GTE. Additional information concerning Gran Tierra is

available at www.grantierra.com. Information on the Company's website (including the Corporate Presentation referenced above) does not

constitute a part of this press release. Investor inquiries may be directed to info@grantierra.com or (403) 265-3221.

Gran Tierra's Securities and Exchange Commission

filings are available on the SEC website at http://www.sec.gov. The Company’s Canadian securities regulatory filings are available

on SEDAR at http://www.sedar.com and UK regulatory filings are available on the National Storage Mechanism website at https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

Forward Looking Statements and Legal Advisories:

This press release contains opinions, forecasts,

projections, and other statements about future events or results that constitute forward-looking statements within the meaning of the

United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended, and financial outlook and forward looking information within the meaning of applicable

Canadian securities laws (collectively, “forward-looking statements, which can be identified by such terms as “expect”,

“plan”, “can,” “will,” “should,” “guidance,” “forecast,” “signal,”

“measures taken to” and “believes”, derivations thereof and similar terms identify forward-looking statements.

Such forward-looking statements include, but are not limited to, the Company’s capital budget amount and uses; ability of hedges

to protect cash flows, the Company’s strategies related to drilling and operation activities; expectations regarding reservoir

prospects and production amounts; future well results (including initial oil production rates and productive capacity based on past performance);

expected future net cash provided by operating activities (described in this press release as “cash flow”), free cash flow,