Commodity investing has remained choppy, pretty much across the

board. Thanks to the political gridlock, many commodity ETFs have

of late been pushed into the red as demand for risky assets has

been uncertain.

Meanwhile, in the natural gas market, prices have been severely

under pressure, not just for this month, but for the longer term as

well. This is largely due to a burst of supply, thanks to fresh

technologies that bring out more of this precious commodity.

The success of ‘shale gas’ – natural gas trapped within dense

sedimentary rock formations or shale formations – has transformed

the domestic energy supply, with a potentially inexpensive and

abundant new source of fuel for one of the world’s largest energy

consumers (Read: The Comprehensive Guide to Natural Gas ETFs).

With the U.S. projected to surpass Russia in the global energy race

this year, the Oil & Gas sector in the U.S. has been in focus.

According to the Energy Information Administration (EIA), the

U.S. is projected to produce almost 50 quadrillion British thermal

units of oil and natural gas in 2013, which is almost 10% above the

second-largest producer, Russia, and double the third-largest

producer, Saudi Arabia.

The short-term projections look favorable for the natural gas

sector due to a few rig shutdowns in the Gulf of Mexico in the wake

of tropical storms, which raised natural gas prices. Warmer weather

expected for the month of October also acted as a catalyst.

Though this trend might be short-lived in the natural gas market,

more hot (or cold) weather could definitely extend this rally for a

bit longer (Read: Natural Gas ETFs Jump on Hopes of Warm

Weather).

However, many investors generally focus in on one ETF for their

exposure to this space, United States Natural Gas ETF

(

UNG). This product attracts a great deal of

assets, and remains quite popular, despite a potentially better

long term option existing, First Trust ISE Revere Natural Gas Fund

(

FCG).

Below we have given a comparative analysis of these two ETFs from

the Natural Gas segment, each taking different sides on the

performance front due to the difference in approach. Hopefully, by

taking a look at some of these factors, investors can better

ascertain which natural gas ETF is right for them:

Fund Objective and Index Exposure

Launched in May 2007,

FCG tracks the

ISE-Revere Natural Gas Index, which is an

equal-weighted index comprising exchange-listed companies that

derive a substantial portion of their revenues from the exploration

and production of natural gas.

The fund will normally invest at least 90% of its net assets plus

the amount of any borrowings for investment purposes in common

stocks comprising the index. Since inception, the product has

amassed $495.9 million in assets.

Launched in April 2007, United States Natural Gas ETF

(

UNG) tracks the

Henry Hub Natural Gas

Price Index, which is also an equal-weighted index. The

product seeks to replicate the performance, net of expenses, of

natural gas. The trust invests in futures contracts on natural gas

traded on the NYMEX that is the front month contract to expire.

Compared to FCG, the ETF is rich in AUM with an asset base of

$894.8 million.

A Difference in Asset Class

FCG takes an equity based approach by including

stocks that are engaged in the production and exploration of oil

and natural gas in its portfolio. Therefore, it is implied that the

fund would not be impacted by the technicalities and complications

of the derivatives market, like its competitor UNG (Read: The Key

Differences between Natural Gas ETFs).

UNG is a futures ETF which tries to capture the

daily difference in spot prices of natural gas by gaining exposure

to future contracts. Although futures can be considered an

efficient, cost effective way to gain exposure in the commodities

market without having to deal with storage costs and physical

delivery, they still have their own risks.

Holdings

While

UNG deals in future gas contracts,

FCG holds a total of 26 U.S. based securities in

its basket. Its top 10 holdings make about 42% share in the

basket.

Trading Size & Fees

UNG has a huge average daily trading volume of

4.95 million shares a day, while

FCG has an

average daily trading volume of 641,400 shares a day

For exposure in futures contract,

UNG charges a

hefty fee of 99bps, while

FCG is a relatively

cheaper choice as it charges investors 60bps in fees (Find all

Energy ETFs).

What makes FCG attractive?

FCG employs an innovative methodology to select

stocks from the entire universe of companies engaged in the energy

exploration & production business. The stocks are screened and

ranked based on certain fundamental factors such as price to

earnings, price to book value, market capitalization and return on

equity.

The ranks are then averaged and the top 30 stocks become part of

the index and are weighted equally. However, it is prudent to note

that these stocks may not have a 1:1 correlation with the natural

gas futures price; therefore it may not be a pure play on the

commodity. Furthermore, the index eliminates those gas companies

whose reserves do not meet certain criteria.

Performance

UNG has posted a negative performance of about

1.3% year-to-date, in stark contrast to

FCG.

Despite facing some headwinds in its path, FCG has given sturdy

returns of about 23% so far this year. (Read: Natural Gas ETFs

Continue to Soar).

In terms of the last 52-week price performance FCG clearly stands

as the winner, since the product has gained almost 11%, whereas UNG

has shed close to 14.5%.

Technical Indicators

FCG is less volatile to

UNG when

compared with the S&P 500 index. Moreover

FCG

has a better Beta and R-squared score than

UNG.

The 50-Day Simple Moving Average for

UNG has

appreciated by only 1.09%, while for

FCG it has

appreciated by 7.32%.

Bottom Line

Given the strong performance, investors are more likely to switch

from investing in futures gas ETF

UNG to the

equity ETF

FCG. The fund has also performed quite

well against others in the same sector, and its lack of futures

curve issues could make it a better pick over the long term.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

FT-ISE R NAT GA (FCG): ETF Research Reports

US-NATRL GAS FD (UNG): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

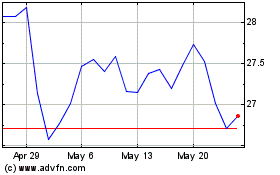

First Trust Natural Gas ... (AMEX:FCG)

Historical Stock Chart

From Apr 2024 to May 2024

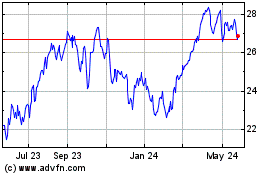

First Trust Natural Gas ... (AMEX:FCG)

Historical Stock Chart

From May 2023 to May 2024