UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2019

Commission File Number: 001-35936

B2Gold

Corp.

(Translation of registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 3100, Three Bentall

Centre

595 Burrard Street

Vancouver, British Columbia V7X 1J1

Canada

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

DOCUMENTS INCLUDED AS PART

OF THIS FORM 6-K

See the Exhibit Index hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

B2Gold Corp. |

|

| |

|

|

|

| |

|

|

|

| Date: September

16, 2019 |

By: |

/s/ Roger Richer |

|

| |

Name: |

Roger Richer |

|

| |

Title: |

Executive Vice President, General Counsel & Secretary |

|

EXHIBIT INDEX

Exhibit

99.1

News Release

B2Gold Announces Positive Exploration

Results from the Anaconda Area and the Fekola Deposit and an Update on the Fekola Mine Expansion

Vancouver, September 16, 2019 - B2Gold

Corp. (TSX: BTO, NYSE AMERICAN: BTG, NSX: B2G) (“B2Gold” or the “Company”) announces positive drill results

from the Mamba zone which is located within the Anaconda area approximately 20 kilometres from the Fekola Mine, as well as positive

infill drill results from the Fekola mineral resource area and step out results north of the Fekola resource.

Highlights include:

| • | Extending the shallow, high-grade saprolite mineralized zone at Mamba by approximately 600 metres to more than one kilometre

of strike length |

| • | Discovery of a new wide good grade sulphide zone directly beneath the Mamba saprolite zone. The sulphide zone is open down

plunge to the south, indicating the potential for Fekola-type gold deposits |

| • | Successful infill drilling at the Fekola deposit completed, upgrade of the Inferred Mineral Resource (19%) to Indicated status

by the fourth quarter of 2019 |

| • | Step out drilling continues to extend the Fekola deposit further to the north, which remains open |

Recent Exploration

Drilling in 2019 in Mali has been focused

on increasing the Anaconda area saprolite resource, testing mineralized zones beneath the shallow saprolite zones, infill drilling

the Inferred portion of the Fekola Mineral Resource to Indicated status and expanding the Fekola deposit further to the north.

Based on positive drill results, in July, the Company increased the 2019 exploration budget in Mali by $3 million to $20.5 million.

Anaconda Area (see figure 1 “Mamba

long section” below)

B2Gold

has completed an 850-hole (24,863 metre) program of combined aircore, diamond and reverse circulation drilling at the Anaconda

area, including on the Company’s increased land position. Drilling focused mainly on the Mamba zone, located one kilometre

east of the Anaconda zone, where the Company previously announced an Inferred Mineral Resource estimate of 767,000 ounces of gold

at 1.1 grams per tonne (“g/t”) in near-surface saprolite mineralization over 4.5 kilometres and up to 500 metres

wide. The initial stage of the program has extended the strike length of known saprolite

mineralized structures at Mamba by over 600 metres to over approximately one kilometre. Saprolite mineralization at the Adder zone,

1.2 kilometres to the west of the Mamba zone, remains open to the north. At Mamba, the newly discovered wide zone of sulphide

mineralization is contiguous and continuous with the saprolite mineralization and remains open down plunge and to the south, indicating

the potential to host Fekola-style sulphide gold deposits.

Recent

holes include BNR_010 (61 metres at 2.25 g/t gold from 30 metres) and BNR_005 (39 metres at 3.16 g/t gold from 77 metres),

which intersected thick accumulations of good grade saprolite mineralization. Highlights from the sulphide-hosted mineralization

include BND_001, which intersected 38.40 metres at 2.40 g/t gold from 72.70 metres directly down plunge from the high-grade

saprolite mineralization and 13.95 metres at 2.20 g/t gold from 184.05 metres and hole BNR_002, which intersected 14

metres at 4.50 g/t gold from 109 metres.

These

new intersections occur approximately 150 metres up plunge from previous sulphide intercepts on the Mamba zone, which include two

holes on the same section: MSD_141(44.00 metres at 1.22 g/t gold from 80.00 metres and 46.20 metres at 1.76 g/t gold

from 168.80 metres) and the undercutting hole, MSD_132 (23.22 metres at 1.31 g/t gold from 116.48 metres, 24.50 metres at

4.02 g/t gold from 218.50 metres and 22.80 metres at 1.04 g/t gold from 253.20 metres). The geometry of this good grade

zone of mineralization is to be confirmed with additional drilling.

Highlights

from drilling to date include:

| Hole ID |

From (m) |

To (m) |

Length (m) |

Gold (g/t) |

Domain |

| BNR_001 |

17 |

27 |

10 |

2.77 |

Saprolite |

| BNR_003 |

0 |

49 |

49 |

0.82 |

Saprolite |

| BNR_003 |

55 |

110 |

55 |

2.05 |

Saprolite |

| BNR_004 |

125 |

154 |

29 |

1.34 |

Saprolite |

| BNR_005 |

55 |

73 |

18 |

6.51 |

Saprolite |

| BNR_005 |

77 |

116 |

39 |

3.16 |

Saprolite |

| BNR_007 |

126 |

145 |

19 |

1.32 |

Saprolite |

| BNAC_183 |

0 |

38 |

38 |

2.14 |

Saprolite |

| BNR_010 |

30 |

91 |

61 |

2.25 |

Saprolite |

| BNR_012 |

95 |

97 |

2 |

23.14 |

Saprolite |

| BNR_014 |

48 |

58 |

10 |

3.97 |

Saprolite |

| BNR_015 |

22 |

44 |

22 |

1.77 |

Saprolite |

| BNR_016 |

94 |

120 |

26 |

1.10 |

Saprolite |

| BNAC_178 |

0 |

36 |

36 |

2.77 |

Saprolite |

| BNAC_175 |

0 |

11 |

11 |

4.04 |

Saprolite |

| BNR_016 |

120 |

156 |

36 |

0.88 |

Sulphide |

| BNR_015 |

103 |

126 |

23 |

1.06 |

Sulphide |

| BNR_002 |

109 |

123 |

14 |

4.50 |

Sulphide |

| BND_001 |

72.70 |

111.10 |

38.40 |

2.40 |

Sulphide |

| BND_001 |

184.05 |

198.00 |

13.95 |

2.20 |

Sulphide |

Sulphide composites are reported above

0.6 g/t gold cutoff; saprolite composites are reported above a 0.2 g/t gold cutoff.

Figure 1. Mamba Zone, Anaconda Area:

Schematic Long Section (West-Facing)

Fekola Infill Program (see figure

2 “Fekola long section” below)

In October 2018, B2Gold reported an updated

Indicated Mineral Resource estimate of 92,810,000 tonnes at 1.92 g/t gold for a total of 5,730,000 ounces of gold, and an Inferred

Mineral Resource estimate of 26,500,000 tonnes at 1.61 g/t gold for a total of 1,370,000 ounces of gold (19%), for the Fekola Mine

(see news release dated October 25, 2018). A significant portion of the 2019 drilling has been focused on upgrading the

Inferred Mineral Resource estimate to Indicated status, with a total of 25,000 metres completed as of August 15, 2019.

Infill drill results to date support the

results of the 2018 resource model, which had 19% Inferred Mineral Resources and 81% Indicated Mineral Resources. Furthermore,

drill holes FKD_409 (4.03 g/t gold over 30.50 metres from 437.5 metres), FKD_413 (10.44 g/t gold over 19.8 metres from 495.2

metres) and FKD_415 (3.3 g/t gold over 38.2 metres from 467.5 metres) provide added confirmation that significant intervals

of high-grade gold mineralization occur beyond the limits of the 2019 Preliminary Economic Assessment (“PEA”) pit shell

(see news release dated May 13, 2019), within the deepest portions of the 2018 $1,400/ounce gold resource pit shell. Follow

up drilling down plunge from this good grade mineralization has been completed and assays are pending from holes FKD_431 and FKD_432.

Mineralization remains open to the north and down plunge. An updated resource model is scheduled

for completion the fourth quarter of 2019.

Highlights from the Fekola infill program

include:

| Hole ID |

From (m) |

To (m) |

Length (m) |

Gold (g/t) |

Pit Shell* |

| FKD_349 |

309.00 |

432.00 |

123.00 |

4.10 |

PEA |

| incl |

349.40 |

431.00 |

81.60 |

4.89 |

PEA |

| FKD_347 |

286.00 |

337.00 |

51.00 |

2.58 |

PEA |

| incl |

343.00 |

354.00 |

11.00 |

5.68 |

PEA |

| FKD_355 |

425.60 |

472.50 |

46.90 |

2.66 |

PEA |

| FKD_356 |

362.75 |

420.80 |

58.05 |

1.48 |

PEA |

| FKD_380 |

440.00 |

480.40 |

40.40 |

2.99 |

PEA |

| FKD_359 |

338.20 |

390.90 |

52.70 |

3.13 |

PEA |

| incl |

369.90 |

390.90 |

21.00 |

5.91 |

PEA |

| FKD_379 |

423.70 |

471.00 |

47.30 |

2.02 |

PEA |

| FKD_381 |

409.20 |

463.20 |

54.00 |

2.10 |

PEA |

| FKD_396 |

368.75 |

435.00 |

66.25 |

2.15 |

PEA |

| FKD_369 |

277.90 |

322.50 |

44.60 |

1.37 |

PEA |

| FKD_375 |

259.50 |

326.00 |

66.50 |

1.64 |

PEA |

| FKD_385 |

359.00 |

405.00 |

46.00 |

2.14 |

PEA |

| FKD_386 |

333.20 |

381.00 |

47.80 |

1.93 |

PEA |

| FKD_409 |

433.00 |

480.00 |

47.00 |

2.89 |

1400 |

| incl |

437.50 |

468.00 |

30.50 |

4.03 |

1400 |

| FKD_388 |

299.80 |

356.00 |

56.20 |

3.66 |

PEA |

| incl |

300.60 |

341.30 |

40.70 |

4.52 |

PEA |

| FKD_391 |

334.60 |

378.20 |

43.60 |

1.97 |

PEA |

| FKD_413 |

464.00 |

523.20 |

59.20 |

3.94 |

1400 |

| incl |

495.20 |

515.00 |

19.80 |

10.44 |

1400 |

| FKD_393 |

322.00 |

365.50 |

43.50 |

2.37 |

PEA |

| FKD_415 |

462.10 |

505.70 |

43.60 |

2.98 |

1400 |

| incl |

467.50 |

505.70 |

38.20 |

3.30 |

1400 |

Composites are reported above a 0.6

g/t gold cutoff. Included high-grade intervals are reported above a 1.0 g/t cutoff. *PEA denotes holes drilled within a pit shell

optimized at $1,300/oz gold (see news release dated May 13, 2019). 1400 denotes holes drilled within $1,400/oz gold resource pit

shell (see news release dated October 25, 2018).

Figure 2. Fekola Deposit, Fekola Mine:

Schematic Long Section (West-Facing)

Ongoing Exploration

Drilling is ongoing at Fekola, including

a reconnaissance program on the Cardinal zone, less than one kilometre west of the Fekola Mine open pit. Drilling on the Anaconda

area, to test the extension of the saprolite zones and further explore the sulphide mineralization below is scheduled to recommence

in the fourth quarter of 2019. An additional 30,000 metres of drilling is planned for completion before year end and the Company

expects to continue with an aggressive exploration program in 2020.

Fekola Mine Expansion Update

On March 26, 2019, B2Gold announced positive

results from the Expansion Study PEA for the Fekola Mine. As a result, the Company is proceeding with an expansion project to increase

processing throughput by 1.5 million tonnes per annum (“Mtpa”) to 7.5 Mtpa from an assumed base rate of 6 Mtpa. The

PEA reflected the significant increase in the Fekola Mineral Resource estimate announced on October 25, 2018. Based on the PEA,

once this expansion is complete, the Fekola Mine is expected to produce more gold over a longer life, with more robust economics

and higher average annual gold production, revenues and cash flows than the previous life-of-mine (“LoM”).

Highlights from the PEA include: estimated

optimized LoM extended into 2030, including significant estimated increases in average annual gold production to over 550,000 ounces

per year during the five-year period 2020-2024 and over 400,000 ounces per year over the LoM (2019-2030), projected gold production

of approximately five million ounces over the new mine life of 12 years of mining and processing (including 2019).

The processing upgrade at the Fekola Mine

will focus on increased ball mill power, with upgrades to other components including a new cyclone classification system, pebble

crushers and additional leach capacity to support the higher throughput and increase operability. Critical path items include ball

mill motors and the lime slaker, both of which the Company expects to be commissioned in the third quarter of 2020. In parallel

with the expansion, B2Gold has initiated the detailed engineering and construction for the addition of a 30-megawatt solar power

plant, which the Company expects will result in reduced operating costs and greenhouse gas emissions. Completion of the solar plant

is scheduled for the third quarter of 2020. The current on-site power plant has sufficient capacity to support the expanded processing

throughput, with or without the solar plant.

Construction will commence in October

2019 and is scheduled to be completed by the end of July 2020. All major long-lead equipment has been ordered. Detailed engineering

and design activities are progressing well and scheduled to be completed by October 2019.

Based on B2Gold’s current projections,

gold production at the Fekola Mine in 2020 is projected to be approximately 600,000 ounces of gold, primarily due to the addition

of a larger mining fleet at Fekola and the optimization of the mining sequence early in 2020, prior to completion of the mill expansion

by September 2019, providing access to higher grade portions of the deposit earlier on in the sequence.

Mineral Resources, which are not Mineral

Reserves, do not have demonstrated economic viability. The Expansion Study PEA is preliminary in nature and includes Indicated

and Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically to have economic considerations

applied to them that would enable them to be categorized as Mineral Reserves. Consequently, there is no certainty that the Expansion

Study PEA will be realized.

About B2Gold Corp.

Headquartered in Vancouver, Canada, B2Gold

is the world's new senior gold producer. Founded in 2007, today, B2Gold has five operating gold mines and numerous exploration

and development projects in various countries including Nicaragua, the Philippines, Namibia, Mali, Burkina Faso and Colombia.

In 2019, based on current assumptions, consolidated gold production is forecast to be between 935,000 and 975,000 ounces with cash

operating costs projected to be between $520 and $560 per ounce and all-in sustaining costs projected to be between $835 and $875

per ounce.

QA/QC on Sample Collection and Assaying

The primary laboratories for Fekola are

SGS Laboratories in Bamako, Mali, and Bureau Veritas Laboratories in Abidjan, Cote d'Ivoire. Periodically, exploration samples

will be analyzed at the Fekola Mine Lab. At each lab, samples are prepared and analyzed using 50-gram fire assay with atomic absorption

finish and/or gravimetric finish. Umpire assays are used to monitor lab performance monthly.

Quality assurance and quality control

(“QA/QC”) procedures include the systematic insertion of blanks, standards and duplicates into the core, reverse circulation

and aircore drilling sample strings. The results of the control samples are evaluated on a regular basis with batches re-analyzed

and/or resubmitted as needed. All results stated in this announcement have passed B2Gold’s quality assurance and quality

control protocols.

Qualified Persons

Tom Garagan, Senior Vice President of

Exploration at B2Gold, a qualified person under NI 43-101, has approved the information contained in this news release.

On

Behalf of B2GOLD CORP.

“Clive T. Johnson”

President and Chief Executive Officer

For more information on B2Gold, please

visit the Company website at www.b2gold.com or contact:

| Ian MacLean |

Katie Bromley |

| Vice President, Investor Relations |

Manager, Investor Relations & Public Relations |

| 604-681-8371 |

604-681-8371 |

| imaclean@b2gold.com |

kbromley@b2gold.com |

The Toronto Stock Exchange and the

NYSE American LLC neither approve nor disapprove the information contained in this news release.

This news release includes certain

“forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”)

within the meaning of applicable Canadian and United States securities legislation, including projections, estimates and other

statements regarding future financial and operational performance, events, production, costs, including projected cash operating

costs and all-in sustaining costs, capital expenditures, budgets and growth, production estimates and guidance, including the Company’s

projected gold production of between 935,000 and 975,000 ounces in 2018; and statements regarding anticipated exploration, development,

construction, production, permitting and other activities and achievements of the Company, including but not limited to: mineralization

in the upper portion of the Fekola North Extension zone being one continuous mineralized zone and the potential to increase the

extent of Fekola mineralization; the potential to extend good grade mineralization much further north from the Fekola resource

pit boundary; results indicating the deeper portion of the Fekola Northern Extension zone extending closer to surface and indicating

continuity with mineralization from the deeper drilling results from the upper portion of the Fekola North Extension; the potential

for additional large Fekola style deposits; the potential for highly prospective structures beneath the Anaconda and Mamba zones;;

the conversion of inferred mineral resources to indicated mineral resources; the projections included in existing technical reports,

economic assessments and feasibility studies; the results of anticipated or potential new technical reports and studies, including

the potential findings and conclusions thereof. Estimates of mineral resources and reserves are also forward-looking statements

because they constitute projections regarding the amount of minerals that may be encountered in the future and/or the anticipated

economics of production, should a production decision be made. All statements in this news release that address events or developments

that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical

facts and are generally, although not always, identified by words such as “expect”, “plan”, “anticipate”,

“project”, “target”, “potential”, “schedule”, “forecast”, “budget”,

“estimate”, “intend” or “believe” and similar expressions or their negative connotations, or

that events or conditions “will”, “would”, “may”, “could”, “should”

or “might” occur. All such forward-looking statements are based on the opinions and estimates of management as of the

date such statements are made. Forward-looking statements necessarily involve assumptions, risks and uncertainties, certain of

which are beyond B2Gold’s control, including risks and assumptions associated with the volatility of metal prices and our

common shares; risks and dangers inherent in exploration, development and mining activities; uncertainty of reserve and resource

estimates; risk of not achieving production, cost or other estimates; risk that actual production, development plans and costs

differ materially from the estimates in our feasibility studies; risks related to hedging activities and ore purchase commitments;

the ability to obtain and maintain any necessary permits, consents or authorizations required for mining activities; risks related

to environmental regulations or hazards and compliance with complex regulations associated with mining activities; the ability

to replace mineral reserves and identify acquisition opportunities; unknown liabilities of companies acquired by B2Gold; ability

to successfully integrate new acquisitions; fluctuations in exchange rates; availability of financing; risks relating to financing

and debt; risks related to operations in foreign and developing countries and compliance with foreign laws; risks related to remote

operations and the availability of adequate infrastructure, fluctuations in price and availability of energy and other inputs necessary

for mining operations; shortages or cost increases in necessary equipment, supplies and labour; regulatory, political and country

risks; risks related to reliance upon contractors, third parties and joint venture partners; challenges to title or surface rights;

dependence on key personnel and ability to attract and retain skilled personnel; the risk of an uninsurable or uninsured loss;

adverse climate and weather conditions; litigation risk; competition with other mining companies; changes in tax laws; community

support for our operations including risks related to strikes and the halting of such operations from time to time; risks related

to failures of information systems or information security threats; ability to maintain adequate internal control over financial

reporting as required by law; risks relating to compliance with anti-corruption laws; as well as other factors identified and as

described in more detail under the heading “Risk Factors” in B2Gold’s most recent Annual Information Form and

B2Gold’s other filings with Canadian securities regulators and the U.S. Securities and Exchange Commission (the “SEC”),

which may be viewed at www.sedar.com and www.sec.gov, respectively (the “Websites”). The list is not exhaustive of

the factors that may affect the Company’s forward-looking statements. There can be no assurance that such statements will

prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in, or implied

by, these forward-looking statements. Accordingly, no assurance can be given that any events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what benefits or liabilities B2Gold will derive therefrom. The Company’s

forward-looking statements reflect current expectations regarding future events and operating performance and speak only as of

the date hereof and the Company does not assume any obligation to update forward-looking statements if circumstances or management's

beliefs, expectations or opinions should change other than as required by applicable law. The Company’s forward-looking statements

are based on the applicable assumptions and factors management considers reasonable as of the date hereof, based on the information

available to management at such time. These assumptions and factors include, but are not limited to, assumptions and factors related

to the Company's ability to carry on current and future operations, including development and exploration activities; the timing,

extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the

accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or

achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs, including

gold; the timely receipt of necessary approvals or permits; the ability to meet current and future obligations; the ability to

obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions and

other assumptions and factors generally associated with the mining industry. For the reasons set forth above, undue reliance should

not be placed on forward-looking statements.

Non-IFRS Measures

This news release includes certain

terms or performance measures commonly used in the mining industry that are not defined under International Financial Reporting

Standards (“IFRS”), including “cash operating costs” and “all-in sustaining costs” (or “AISC”).

Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar

measures employed by other companies. The data presented is intended to provide additional information and should not be considered

in isolation or as a substitute for measures of performance prepared in accordance with IFRS and should be read in conjunction

with B2Gold’s consolidated financial statements. Readers should refer to B2Gold’s management discussion and analysis,

available on the Websites, under the heading “Non-IFRS Measures” for a more detailed discussion of how B2Gold calculates

such measures and reconciliation of certain measures to IFRS terms.

Cautionary Note to United States

Investors

The Company has prepared its public

disclosures in accordance with Canadian securities laws, which differ in certain respects from U.S. securities laws. In particular,

this news release may refer to “mineral resources”, “measured mineral resources”, “indicated mineral

resources” or “inferred mineral resources”. While these categories of mineralization are recognized and required

by Canadian securities laws, they are not recognized by the SEC and are not normally permitted to be disclosed in SEC filings by

U.S. companies. U.S. investors are cautioned not to assume that any part of a “mineral resource”, “measured mineral

resource”, “indicated mineral resource” or “inferred mineral resource” will ever be converted into

a “reserve.” In addition, “reserves” reported by the Company under Canadian standards may not qualify as

reserves under SEC standards. Under SEC standards, mineralization may not be classified as a “reserve” unless the mineralization

can be economically and legally extracted or produced at the time the “reserve” determination is made. Accordingly,

information contained or referenced in this news release containing descriptions of the Company’s mineral deposits may not

be compatible to similar information made public by U.S. companies subject to the reporting and disclosure requirements of U.S.

federal securities laws, rules and regulations. “Inferred mineral resources” have a great amount of uncertainty as

to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part

of an inferred mineral resource will ever be upgraded to a higher category. Historical results or feasibility models presented

herein are not guarantees or expectations of future performance.

This regulatory filing also includes additional resources:

ex991.pdf

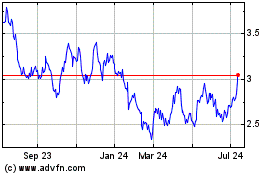

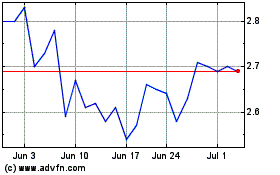

B2Gold (AMEX:BTG)

Historical Stock Chart

From Aug 2024 to Sep 2024

B2Gold (AMEX:BTG)

Historical Stock Chart

From Sep 2023 to Sep 2024