|

|

|

|

|

|

|

|

|

|

Prospectus Supplement No. 6

(to prospectus dated November 12, 2020)

|

|

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-236334

|

Vertiv Holdings Co

259,672,496 Shares of Class A Common Stock

10,606,665 Warrants to Purchase Class A Common Stock

220,000 Units

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated November 12, 2020 (the “Prospectus”), related to: (1) the issuance by us of up to 33,533,301 shares of our Class A common stock, par value $0.0001 per share (“Class A common stock”) that may be issued upon exercise of warrants to purchase Class A common stock at an exercise price of $11.50 per share of Class A common stock, including the public warrants and the private placement warrants (each as defined in the Prospectus); and (2) the offer and sale, from time to time, by the selling holders identified in the Prospectus, or their permitted transferees, of (i) up to 259,672,496 shares of Class A common stock, (ii) up to 10,606,665 warrants and (iii) up to 220,000 units (each as defined in the Prospectus), with the information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission (“SEC”) on April 22, 2021 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Class A common stock is traded on the New York Stock Exchange under the symbols “VRT.” On April 22, 2021, the closing price of our Class A common stock was $21.97 per share. Our warrants and units were traded on the New York Stock Exchange under the symbols “VRT WS” and “VERT.U”, respectively; however, the warrants and units ceased trading on the New York Stock Exchange and were delisted following their redemption on January 19, 2021

Investing in our securities involves risks. See “Risk Factors” beginning on page 11 of the Prospectus and in any applicable prospectus supplement.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the Prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is April 22, 2021.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 8-K

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT REPORT

|

|

PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

|

|

Date of Report (Date of earliest event reported): April 21, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VERTIV HOLDINGS CO

|

|

Exact name of registrant as specified in its charter

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-38518

|

|

81-2376902

|

|

(State or other Jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification Number)

|

|

|

|

|

|

|

|

1050 Dearborn Drive, Columbus, Ohio 43085

|

|

(Address of principal executive offices, including zip code)

|

|

|

|

|

|

|

|

Registrant's telephone number, including area code: 614-888-0246

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A common stock, $0.0001 par value per share

|

|

VRT

|

|

New York Stock Exchange

|

|

|

|

|

|

|

|

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

Emerging growth company

|

☐

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

|

Item 2.02 Results of Operations and Financial Condition

The information set forth under Item 4.02 is incorporated into this Item 2.02 by reference.

Item 4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On April 21, 2021, the Audit Committee of the Board of Directors (the “Audit Committee”) of Vertiv Holdings Co (the “Company”), in response to the statement released by the U.S. Securities and Exchange Commission (the “SEC”) with respect to the balance sheet classification of certain contracts that may be settled in an entity’s stock, such as warrants, and after discussion with its independent registered public accounting firm, Ernst & Young LLP, its valuation firm and its legal advisors, concluded that the Company’s previously issued consolidated financial statements as of and for the year ended December 31, 2020 included in our Annual Report on Form 10-K and the Company’s unaudited condensed consolidated financial statements for the three months ended and year-to-date periods ended March 31, 2020, June 30, 2020 and September 30, 2020 (collectively, the “Impacted Filings”) included in our previously filed Quarterly Reports on Form 10-Q for those periods should be restated to reflect the impact of this guidance by the SEC and accordingly, should no longer be relied upon. Similarly, any previously furnished or filed reports, related earnings releases, investor presentations or similar communications of the Company describing the Company's financial results for the Impacted Filings should no longer be relied upon.

Background

On April 12, 2021, the SEC issued a statement (the “Statement”) on the accounting and reporting considerations for warrants issued by special purpose acquisition companies. The Statement referenced the guidance included in U.S. Generally Accepted Accounting Principles that entities must consider in determining whether to classify contracts that may be settled in its own stock, such as warrants, as equity or as an asset or liability.

After considering the Statement, the Company re-evaluated its historical accounting for its warrants and concluded it must amend the accounting treatment of the public warrants and private placement warrants (collectively, the “Warrants”) issued in connection with the initial public offering of GS Acquisition Holdings Corp (“GSAH”) and recorded to the Company’s consolidated financial statements as a result of the Company’s merger with GSAH (the “Merger”) and the reverse recapitalization that occurred on February 7, 2020. At that time, the Warrants were presented within equity and did not impact any reporting periods prior to the Merger.

Because the Warrants may be settled in cash upon the occurrence of a tender offer or exchange that involves 50% or more of the Company’s Class A shareholders, an event that is outside the control of the Company, the Company has concluded that the Warrants do not meet the conditions to be classified within equity under the Statement and should be presented as a liability and marked to fair value each reporting period. The Company intends to promptly file restated financial statements for the year ended December 31, 2020 on Form 10-K/A. The relevant unaudited interim financial information for each of the quarters ended during the year ended December 31, 2020 will also be restated in the Form 10-K/A.

In light of the restatement discussed above, the Company has reassessed the effectiveness of its disclosure controls and procedures and internal controls over financial reporting as of December 31, 2020, and has concluded that its remediation plan of its previously disclosed material weaknesses will be expanded to address this matter to improve the process and controls in the determination of the appropriate accounting and classification of our financial instruments and key agreements. As a result of the restatement, we expect to recognize incremental non-operating expense of $140 million to $160 million. We expect that there will be no impact to our historically reported cash and cash equivalents, or cash flows from operating, investing or financing activities. We anticipate that the first quarter 2021 non-operating expense will be between $10 million and $15 million. All estimates contained in this report are subject to change as management completes the Form 10-K/A, and the Company’s independent registered public accounting firms has not audited or reviewed these estimates or ranges. An audit of annual financial statements and/or review of quarterly financial statements could result in material changes to these ranges and estimates. Further details and remediation plans will be included in the Company’s Form 10-K/A.

The Company’s management and the Audit Committee have discussed the matters disclosed in this Item 4.02 with the Company’s independent registered public accounting firm, Ernst & Young LLP.

Item 7.01 Regulation FD

The information set forth under 4.02 is incorporated into this Item 7.01 by reference.

On April 22, 2021, the Company issued a press release related to the matters described in Item 4.02. A copy of the press release is included as Exhibit 99.1 and incorporated herein by reference.

The information furnished pursuant to this Item 7.01 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any filing under the Securities Act, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 (d) Financial Statements and Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Exhibit Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date: April 22, 2021

|

Vertiv Holdings Co

|

|

|

/s/ David Fallon

|

|

|

Name: David Fallon

|

|

|

Title: Chief Financial Officer

|

Vertiv Announces Response to SEC Guidance Issued on April 12, 2021 Applicable to Warrants Issued by Special Purpose Acquisition Companies (“SPACs”)

COLUMBUS, Ohio April 22, 2021 – (BUSINESS WIRE) – Vertiv Holdings Co (NYSE: VRT) today announced in a Current Report on Form 8-K, that as a result of recent guidance provided by the SEC on April 12, 2021 (see Link1) for all SPAC-related companies regarding the accounting and reporting for their warrants (the “SEC Statement”), it will restate its previously issued 2020 consolidated financial statements.

The restatement pertains to the accounting treatment for public and private placement warrants (“warrants”) that were outstanding at the time of the merger with GS Acquisitions Holding Corp on February 7, 2020. Consistent with market practice among SPACs, we had been accounting for the warrants as equity under a fixed accounting model. However, consistent with the recent SEC Statement, we intend to restate historical financial statements such that the warrants are accounted for as liabilities and marked-to-market each reporting period (the “restatement”). In general, under the mark-to-market accounting model, as our stock price increases, the warrant liability increases, and we recognize additional expense in our income statement – with the opposite when our stock price declines.

We do not anticipate the restatement to impact our previously communicated non-GAAP operating metrics for 2020 or 2021, including adjusted operating profit, adjusted operating margin, adjusted earnings per share and free cash flow.

As a result of the restatement and the increase in our stock price over the applicable period, we expect to recognize incremental 2020 non-operating expense between $140 million to $160 million. There will be no impact to our previously reported net cash flow. We anticipate that the first quarter 2021 non-operating expense will be between $10 million and $15 million.

The following provides additional detail regarding how we currently anticipate the restatement will impact our various financial statements:

•Opening Balance Sheet Impact: As of the date of our business combination (February 7, 2020) (the “Business Combination”), the fair value of the public and private placement warrants will be reflected as warrant liabilities in our balance sheet with a corresponding offset in Additional paid-in-capital within equity.

•Income Statement Impacts: Subsequent to the close of the Business Combination, any change in the fair value of the public and private warrants is recognized in our income statement below operating profit as “Change in fair value of warrant liabilities” with a corresponding amount recognized in our balance sheet. (in our case, this is recognized as warrant liabilities below current liabilities in our balance sheet).

1 https://www.sec.gov/news/public-statement/accounting-reporting-warrants-issued-spacs?utm_medium=email&utm_source=govdelivery

•Balance Sheet Impacts: As is noted above, the change in the balance of the warrant liabilities on our balance sheet is impacted by the fair value changes of the warrants. When warrants are exercised, the fair value of the liability is reclassified to Additional paid-in capital within equity. The cash received for the exercise of warrants is reflected in cash and cash equivalents, and the corresponding offset is also in Additional paid-in-capital in equity.

•Cash Flow Impacts: The impact of the changes in fair value of the warrants has no impact on net cash provided by (used for) operating activities. The cash received for the exercise of warrants is reflected in cash flows from financing activities.

•Statement of Equity Impacts: The impact to Additional paid-in-capital as of the opening balance sheet is highlighted above. Subsequent exercises of the warrants result in an reduction of our warrant liabilities with a corresponding increase to Additional paid-in-capital.

These estimates are subject to change as management completes the restatement, and our independent registered public accounting firm has not audited or reviewed these estimates. As a result, the expected financial impact described above is preliminary and subject to change.

Finally, as of today, we have approximately 10.5 million private placement warrants outstanding, which represents approximately one-third of the warrants originally issued, as all public warrants have since been exercised or redeemed.

About Vertiv Holdings Co

Vertiv (NYSE: VRT) brings together hardware, software, analytics and ongoing services to ensure its customers’ vital applications run continuously, perform optimally and grow with their business needs. Vertiv solves the most important challenges facing today’s data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Headquartered in Columbus, Ohio, USA, Vertiv employs approximately 20,000 people and does business in more than 130 countries. For more information, and for the latest news and content from Vertiv, visit Vertiv.com.

Forward-Looking Statements

This release contains a forward-looking statement within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27 of the Securities Act, and Section 21E of the Securities Exchange Act regarding Vertiv’s interest expense. This statement is only a prediction. Actual events or results may differ materially from those in the forward-looking statement set forth herein. Readers are referred to Vertiv’s filings with the Securities and Exchange Commission, including its most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q for a discussion of these and other important risk factors concerning Vertiv and its operations. Vertiv is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events or otherwise.

Category: Financial News

For investor inquiries, please contact:

Lynne Maxeiner

Vice President, Global Treasury & Investor Relations

Vertiv

T +1 614-841-6776

E: Lynne.Maxeiner@vertiv.com

For media inquiries, please contact:

Sara Steindorf

FleishmanHillard for Vertiv

T +1 314-982-1725

E: Sara.Steindorf@fleishman.com

Source: Vertiv Holdings Co

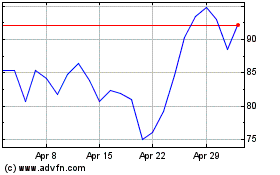

Vertiv (NYSE:VRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vertiv (NYSE:VRT)

Historical Stock Chart

From Apr 2023 to Apr 2024