Current Report Filing (8-k)

March 10 2021 - 12:27PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): March 8, 2021

______________

HEALTHTECH SOLUTIONS, INC.

(Exact name of registrant as specified in its

charter)

______________

|

Utah

|

0-51012

|

84-2528660

|

|

(State or Other Jurisdiction

|

(Commission

|

(I.R.S. Employer

|

|

of Incorporation)

|

File Number)

|

Identification No.)

|

90 Broad Street, 16th Floor, New York,

New York 10004

(Address of Principal Executive Office) (Zip

Code)

844-926-3399

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.03 AMENDMENT TO ARTICLES OF INCORPORATION

On February 16, 2021 the Corporation

filed with the Utah Secretary of State Articles of Amendment to Articles of Incorporation, which designated 1,500,000 shares of

previously authorized preferred stock as "Series B Preferred Stock." The rights and privileges of a holder of Series

B Shares are as follows:

·

Conversion. Series B Shares may be converted by the holder at any time into shares

of our Common Stock. The number of shares of Common Stock that will be issued on the conversion of a single Series B Share will

equal Fifty Dollars ($50) divided by the Conversion Price. The "Conversion Price" will be 80% of the average closing

price of a share of our Common Stock as reported on our principal exchange or market for the 20 trading days immediately preceding

the effective date of the conversion. However, in the event that the Common Stock is listed in the future on an exchange that regulates

the terms of convertible securities, the Conversion Price will be adjusted to comply with such regulations.

·

Liquidation Preference. Upon the liquidation and dissolution of Healthtech Solutions,

Inc., before the net assets available on liquidation are distributed to any holder of the Company's equity securities, each holder

of record of Series B Shares will be entitled to receive a preferential payment of $50 per Series B Share (or such lesser amount

as is the product of the net assets available on liquidation allocated per share among the holders of the Series B Shares).

·

Voting. The holders of Series B Shares will have no voting rights, except with respect

to a proposed amendment to the Company's Articles of Incorporation that would adversely affect the rights, preferences or limitations

of the Series B Shares. In the event of such a proposal, the affirmative vote of a majority of the then-outstanding shares of Series

B Preferred Stock will be required, and be sufficient, for approval of the proposal.

·

Dividends. The holders of Series B Preferred Stock are not entitled to any payment

of dividends. However, in the event that the Company's Board of Directors declares a dividend payable to the holders of the Company's

Common Stock, the holders of Series B Shares will be entitled to receive dividends on an as-converted basis.

·

Other. The holders of Series B Shares will not have redemption rights or preemptive

rights, A holder of Series B Shares will not be subject to further calls or to assessments by the Company.

ITEM 9.01 FINANCIAL STATEMENTS

AND EXHIBITS

Exhibits

|

3-a

|

Articles of Amendment to Articles of Incorporation filed on March 8, 2021.

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned,

hereunto duly authorized.

|

|

Healthtech Solutions, Inc.

|

|

|

|

|

|

Date: March 10, 2021

|

By:

|

/s/ David Rubin

David Rubin, Chief Executive Officer

|

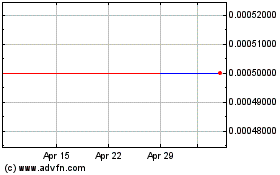

HealthTech Solutions (CE) (USOTC:HLTT)

Historical Stock Chart

From Mar 2024 to Apr 2024

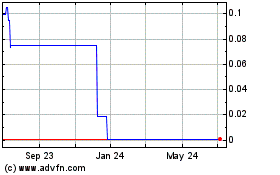

HealthTech Solutions (CE) (USOTC:HLTT)

Historical Stock Chart

From Apr 2023 to Apr 2024