First Spaceflight from Spaceport America

Expected to Occur Between November 19-23

Rollout of Second Spaceship Scheduled to Take

Place in the First Quarter of 2021

Reopening Ticket Sales in 2021 Following Sir

Richard Branson’s Spaceflight

Virgin Galactic Holdings, Inc. (NYSE: SPCE) (“Virgin Galactic”

or the “Company”), a vertically integrated aerospace and space

travel company, today announced its financial results for the third

quarter ended September 30, 2020.

“During the quarter we made good progress completing the final

steps to prepare for VSS Unity’s first rocket powered test flight

from Spaceport America this November. This will be the first-ever

human spaceflight conducted from New Mexico,” said Michael

Colglazier, Chief Executive Officer of Virgin Galactic. “We also

made meaningful progress on our second SpaceShipTwo vehicle, which

we plan to unveil in the first quarter of 2021. During my first

three months at the Company, I have been continually impressed with

the team and the tremendous work that has gone into making the

dream of commercial spaceflight a reality. As we continue to

prepare for commercial launch, we will reopen ticket sales

following Richard Branson’s flight in 2021. I am excited and

confident in our ability to execute our vision and provide

transformative experiences to people around the world.”

Third Quarter 2020 Business Highlights:

- Completed the application of the thermal protection system on

the Wing and Fuselage, progressed on systems installation, and

successfully completed the initial Pilot Simulator evaluations of

the second SpaceShipTwo vehicle, in preparation for its expected

rollout in the first quarter of 2021.

- Completed work on Spaceport America’s third floor astronaut

training lounge and customer center.

- Installed reclining seats, cabin cameras and download link

hardware on VSS Unity for future live stream capability.

- Implemented upgraded flight control system and upgraded

horizontal stabilizers on VSS Unity to increase performance during

the boost phase of the flight profile.

- Unveiled the design of the SpaceShipTwo cabin interior via an

exclusive virtual event, streamed live on YouTube.

- Revealed initial design concept for high speed vehicle and

announced non-binding memorandum of understanding with Rolls-Royce

to collaborate in designing and developing engine propulsion

technology for vehicle.

Third Quarter 2020 Financial Highlights:

- Cash position remains strong, with cash and cash equivalents of

$742 million as of September 30, 2020.

- Net loss of $77 million, compared to a $63 million net loss in

the second quarter of 2020.

- GAAP selling, general, and administrative expenses of $31

million, compared to $26 million in the second quarter of 2020.

Non-GAAP selling, general and administrative expenses of $26

million in the third quarter of 2020, compared to $23 million in

the second quarter of 2020.

- GAAP research and development expenses of $46 million, compared

to $37 million in the second quarter of 2020. Non-GAAP research and

development expenses of $43 million in the third quarter of 2020,

compared to $35 million in the second quarter of 2020.

- Adjusted EBITDA totaled $(66) million, compared to $(54)

million in the second quarter of 2020.

- Cash paid for capital expenditures totaled $4 million, compared

to $6 million in the second quarter of 2020.

- Completed underwritten public offering of 23.6 million shares

of common stock at a public offering price of $19.50 per share,

resulting in net proceeds of over $440 million to be used for

general corporate purposes and capital expenditures.

Recent Updates:

- Expect first spaceflight from Spaceport America to occur

between November 19-23, 2020. This flight will include

revenue-generating payloads as part of the NASA flight

opportunities program.

- Entered into agreement with NASA and the Southwest Research

Institute to fly planetary scientist Dr. Alan Stern on SpaceShipTwo

vehicle from Spaceport America to conduct experiments in

space.

- Total Future Astronauts remained at approximately 600, as of

October 31, 2020.

- Reopening ticket sales in 2021 after Sir Richard Branson’s

flight.

- Retiring “One Small Step” program on December 31, 2020. The

pool of participants has now reached close to 900 participants, as

of October 31, 2020.

COVID-19 Impact

Along with its third quarter 2020 financial results, Virgin

Galactic also provided an update regarding the impact of COVID-19.

The Company is continuing to experience ongoing delays to its

business and operations due to COVID-19, which has led to

accumulated impacts to both schedule and cost efficiency. This is

expected to continue through the fourth quarter and in 2021, though

the Company has continued to stay on track for its planned upcoming

flights. The Company has implemented strict protocols to ensure

employee safety, including enforcing staggered shifts to lower

on-site density and re-working communications processes with

engineers who are primarily working from home.

The Company continues to follow rigorous health and safety

procedures and testing protocols for its employees, following

guidelines from the CDC and state and local officials. Only those

employees whose work requires them to be in Virgin Galactic’s

facilities are working on-site in Mojave and New Mexico.

Conference Call Information

Virgin Galactic will host a conference call to discuss the

results at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) today.

To access the conference call, parties should dial (778) 560-2846

and enter the conference ID number 1946019. The live audio webcast

along with supplemental information will be accessible on the

Company’s Investor Relations website at

investors.virgingalactic.com. A recording of the webcast will also

be available following the conference call.

About Virgin Galactic Holdings

Virgin Galactic Holdings, Inc. is a vertically integrated

aerospace and space travel company, pioneering human spaceflight

for private individuals and researchers, as well as a manufacturer

of advanced air and space vehicles. Using its proprietary and

reusable technologies and supported by a distinctive,

Virgin-branded customer experience, it is developing a spaceflight

system designed to offer customers a unique, multi-day,

transformative experience. This culminates in a spaceflight that

includes views of Earth from space and several minutes of

weightlessness that will launch from Spaceport America, New Mexico.

Virgin Galactic and The Spaceship Company believe that one of the

most exciting and significant opportunities of our time lies in the

commercial exploration of space and the development of technology

that will change the way we travel across the globe in the future.

Together we are opening access to space to change the world for

good.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of federal securities laws with respect to

Virgin Galactic Holdings, Inc. (the "Company"), including

statements regarding the Company’s spaceflight systems, markets and

expected performance. These forward-looking statements generally

are identified by words such as “believe,” “project,” “expect,”

“anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,” “would,” and

similar expressions. Forward-looking statements are predictions,

projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are

subject to risks and uncertainties. Many factors could cause actual

future events to differ materially from the forward-looking

statements in this presentation, including but not limited to the

factors, risks and uncertainties included in our Quarterly Report

on Form 10-Q for the quarterly period ended September 30, 2020, as

such factors may be updated from time to time in our other filings

with the Securities and Exchange Commission (the “SEC”), which are

accessible on the SEC’s website at www.sec.gov and the Investor

Relations section of our website at www.virgingalactic.com. These

filings identify and address other important risks and

uncertainties that could cause the Company’s actual events and

results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and, except as

required by law, the Company assumes no obligation and does not

intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or

otherwise.

Third Quarter 2020 Financial Results

VIRGIN GALACTIC HOLDINGS,

INC.

Condensed Consolidated

Statements of Operations and Comprehensive Loss

(Unaudited and in thousands

except for per share data)

Three Months Ended

Nine Months Ended

September 30, 2020

June 30, 2020

September 30, 2019

September 30, 2020

September 30, 2019

Revenue

$

—

$

—

$

832

$

238

$

3,252

Cost of revenue

—

—

406

173

1,690

Gross profit

—

—

426

65

1,562

Selling, general, and administrative

expenses

30,936

26,047

17,814

83,738

44,719

Research and development expenses

46,243

37,150

34,528

117,675

96,119

Operating loss

(77,179

)

(63,197

)

(51,916

)

(201,348

)

(139,276

)

Interest income

322

506

387

2,005

1,137

Interest expense

(9

)

(8

)

—

(26

)

(2

)

Other income (expense)

(44

)

221

91

5

128

Loss before income taxes

(76,910

)

(62,478

)

(51,438

)

(199,364

)

(138,013

)

Income tax (benefit) expense

40

40

37

34

123

Net loss

(76,950

)

(62,518

)

(51,475

)

(199,398

)

(138,136

)

Other comprehensive loss:

Foreign currency translation

adjustment

48

—

(58

)

(6

)

(79

)

Total comprehensive loss

$

(76,902

)

$

(62,518

)

$

(51,533

)

$

(199,404

)

$

(138,215

)

Net loss per share:

Basic and diluted

$

(0.34

)

$

(0.30

)

$

(0.27

)

$

(0.94

)

$

(0.71

)

Weighted-average shares outstanding:

Basic and diluted

225,253,536

211,784,541

193,663,150

213,193,386

193,663,150

VIRGIN GALACTIC HOLDINGS,

INC.

Condensed Consolidated Balance

Sheets

(In thousands, except share

data)

September 30, 2020

December 31, 2019

(Unaudited)

Assets

Current assets

Cash and cash equivalents

$

741,575

$

480,443

Restricted cash

13,268

12,278

Inventories

25,147

26,817

Prepaid expenses and other current

assets

9,871

17,133

Total current assets

789,861

536,671

Property, plant, and equipment, net

57,255

49,333

Other non-current assets

18,930

19,542

Total assets

$

866,046

$

605,546

Liabilities and Stockholders'

Equity

Current liabilities

Accounts payable

$

8,490

$

7,038

Accrued expenses

22,056

22,277

Customer deposits

83,190

83,362

Other current liabilities

2,300

3,168

Total current liabilities

116,036

115,845

Other long-term liabilities

23,763

22,141

Total liabilities

$

139,799

$

137,986

Stockholders' Equity

Preferred stock, $0.0001 par value;

10,000,000 authorized; none issued and outstanding

$

—

$

—

Common stock, $0.0001 par value;

700,000,000 shares authorized; 234,021,503 and 196,001,038 shares

issued and outstanding as of September 30, 2020 and December 31,

2019, respectively

23

20

Additional paid-in capital

1,047,246

589,158

Accumulated deficit

(321,075

)

(121,677

)

Accumulated other comprehensive income

53

59

Total stockholders' equity

726,247

467,560

Total liabilities and stockholders'

equity

$

866,046

$

605,546

VIRGIN GALACTIC HOLDINGS,

INC.

Condensed Consolidated

Statements of Cash Flows

(Unaudited and in thousands)

Three Months Ended

Nine Months Ended

September 30, 2020

June 30, 2020

September 30, 2019

September 30, 2020

September 30, 2019

Cash flows from operating activities

Net loss

$

(76,950

)

$

(62,518

)

$

(51,475

)

$

(199,398

)

$

(138,136

)

Stock-based compensation

8,625

5,525

—

18,575

—

Depreciation and amortization

2,677

2,615

1,714

7,397

4,920

Other operating activities, net

8

66

(129

)

75

(375

)

Change in assets and liabilities

Inventories

3,457

192

1,918

1,669

(2,310

)

Other current and non-current assets

2,891

1,119

(7,592

)

6,152

(5,928

)

Accounts payable and accrued expenses

1,633

2,064

5,361

719

2,560

Customer deposits

1,456

(1,530

)

1,125

(172

)

1,319

Other current and non-current

liabilities

1,502

892

9,664

2,394

9,664

Net cash used in operating activities

(54,701

)

(51,575

)

(39,414

)

(162,589

)

(128,286

)

Cash flows from investing activity

Capital expenditures

(3,996

)

(6,103

)

(5,380

)

(14,135

)

(13,680

)

Cash used in investing activity

(3,996

)

(6,103

)

(5,380

)

(14,135

)

(13,680

)

Cash flows from financing activities

Payments of finance lease obligations

(40

)

(26

)

(8

)

(89

)

(55

)

Net transfer from Parent Company

—

—

4,944

—

106,119

Proceeds from Parent Company

—

—

40,000

—

40,000

Proceeds from issuance of common

stocks

460,200

—

—

460,200

—

Transaction costs

(19,399

)

(770

)

—

(20,866

)

—

Withholding taxes paid on behalf of

employee on net settled stock-based awards

(399

)

—

—

(399

)

—

Net cash provided by (used in) by

financing activities

440,362

(796

)

44,936

438,846

146,064

Net increase (decrease) in cash and cash

equivalents

381,665

(58,474

)

142

262,122

4,098

Cash, cash equivalents and restricted cash

at beginning of period

373,178

431,652

85,324

492,721

81,368

Cash, cash equivalents and restricted cash

at end of period

$

754,843

$

373,178

$

85,466

$

754,843

$

85,466

Cash and cash equivalents

$

741,575

$

359,912

$

74,438

$

741,575

$

74,438

Restricted cash

13,268

13,266

11,028

13,268

11,028

Cash, cash equivalents and restricted

cash

$

754,843

$

373,178

$

85,466

$

754,843

$

85,466

Use of Non-GAAP Financial Measures (Unaudited)

This press release references certain non-GAAP financial

measures, including adjusted EBITDA, non-GAAP selling, general, and

administrative expense and non-GAAP research and development

expense. The Company defines adjusted EBITDA as earnings before

interest expense, taxes, depreciation and amortization, stock-based

compensation, and certain other items the Company believes are not

indicative of its core operating performance. It defines non-GAAP

selling, general, and administrative expenses as selling, general,

and administrative expenses other than stock-based compensation and

non-capitalized transaction costs, and non-GAAP research and

development expenses as research and development expenses other

than stock-based compensation. None of these non-GAAP financial

measures is a substitute for or superior to measures of financial

performance prepared in accordance with generally accepted

accounting principles in the United States (GAAP) and should not be

considered as an alternative to any other performance measures

derived in accordance with GAAP.

The Company believes that presenting these non-GAAP financial

measures provides useful supplemental information to investors

about the Company in understanding and evaluating its operating

results, enhancing the overall understanding of its past

performance and future prospects, and allowing for greater

transparency with respect to key financial metrics used by its

management in financial and operational-decision making. However,

there are a number of limitations related to the use of non-GAAP

measures and their nearest GAAP equivalents. For example, other

companies may calculate non-GAAP measures differently, or may use

other measures to calculate their financial performance, and

therefore any non-GAAP measures the Company uses may not be

directly comparable to similarly titled measures of other

companies.

A reconciliation of adjusted EBITDA to net loss for the three

months September 30, 2020, June 30, 2020, September 30, 2019 and

nine months ended September 30, 2020 and 2019, respectively, are

set forth below:

Amounts in thousands ($)

Three Months Ended

Nine Months Ended

September 30, 2020

June 30, 2020

September 30, 2019

September 30, 2020

September 30, 2019

Net Loss

(76,950

)

(62,518

)

(51,475

)

(199,398

)

(138,136

)

Income tax (benefit) expense

40

40

37

34

123

Interest expense

9

8

—

26

2

Depreciation & amortization

2,677

2,615

1,715

7,397

4,921

EBITDA

(74,224

)

(59,855

)

(49,723

)

(191,941

)

(133,090

)

Non-capitalized transaction costs*

—

—

—

697

—

Stock-based compensation

8,625

5,525

—

18,575

—

Adjusted EBITDA

(65,599

)

(54,330

)

(49,723

)

(172,669

)

(133,090

)

A reconciliation of selling, general, and administrative

expenses to non-GAAP selling, general, and administrative expenses

for the three months ended September 30, 2020, June 30, 2020,

September 30, 2019 and nine months ended September 30, 2020 and

2019, respectively, are set forth below:

Amounts in thousands ($)

Three Months Ended

Nine Months Ended

September 30, 2020

June 30, 2020

September 30, 2019

September 30, 2020

September 30, 2019

Selling, general, and administrative

expenses

30,936

26,047

17,814

83,738

44,719

Stock-based compensation

5,056

3,546

—

11,472

—

Non-capitalized transaction costs*

—

—

—

697

—

Non-GAAP selling, general, administration

expenses

$

25,880

$

22,501

$

17,814

$

71,569

$

44,719

A reconciliation of research and development expenses to

non-GAAP research and development expenses for the three months

ended September 30, 2020, June 30, 2020, September 30, 2019 and

nine months ended September 30, 2020 and 2019, respectively, are

set forth below:

Amounts in thousands ($)

Three Months Ended

Nine Months Ended

September 30, 2020

June 30, 2020

September 30, 2019

September 30, 2020

September 30, 2019

Research and development expenses

46,243

37,150

34,528

117,675

96,119

Stock-based compensation

3,570

1,979

—

7,103

—

Non-GAAP Research and development

expenses

$

42,673

$

35,171

$

34,528

$

110,572

$

96,119

*Non-capitalized transaction costs include

non-recurring expenses related to preparation and filing of an S-1

registration statement in the first quarter.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201105006028/en/

For media inquiries:

VirginGalacticPress@virgingalactic.com UK, Middle East, Asia,

Africa – Ollie Bailey-Pratt, FTI Consulting US, Canada, South

America, Australia – Antonia Gray, FTI Consulting

VirginGalacticFin@fticonsulting.com For investor relations

inquiries: VirginGalactic-SVC@sardverb.com

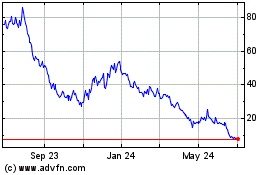

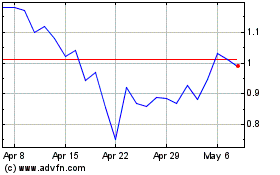

Virgin Galactic (NYSE:SPCE)

Historical Stock Chart

From Apr 2024 to May 2024

Virgin Galactic (NYSE:SPCE)

Historical Stock Chart

From May 2023 to May 2024