Report of Foreign Issuer (6-k)

September 25 2020 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of September, 2020

Commission File Number: 001-14370

COMPANIA

DE MINAS BUENAVENTURA S.A.A.

(Exact name of registrant as specified in

its charter)

BUENAVENTURA

MINING COMPANY INC.

(Translation of registrant’s name into English)

LAS

BEGONIAS 415 FLOOR 19,

SAN

ISIDRO, LIMA 27, PERU

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

TRANSLATION

Lima, September 24, 2020

Messrs.

Superintendence of Capital Markets

|

Ref.:

|

Statement regarding alleged tax debt.

|

Dear Sirs:

As required by Section 6 of the Regulation on Material and Reserved

Information, approved by means of Resolution SMV No. 005-2014-SMV/01, Compañía de Minas Buenaventura S.A.A. (“Buenaventura”

or the “Company”) wishes to make the following clarifications in respect of certain recent news reports regarding the

existence of alleged tax debts owed by the Company.

|

|

1.

|

Buenaventura rigorously complies with the payment of its taxes on a timely basis and rejects the unfounded claims that indicate

that the Company has tax debts which are past due in an amount in excess of two billion Soles. As disclosed in the Company’s

public filings, there are ongoing proceedings before the Peruvian Tax Courts and the Judicial Branch relating to a claim made by

the National Customs and Tax Administration Superintendence (Superintendencia Nacional de Aduanas y de Administración

Tributaria or “SUNAT”) against the Company.

|

|

|

2.

|

The tax dispute in question arose after Buenaventura modified the way in which it sold gold to its clients, shifting from a

fixed price to a variable price scheme, during the years 2007 and 2008. In order to do so, the Company incurred in significant

expenses that had an effect on the Company’s financial results and, therefore, also impacted the income tax payable by the

Company for those fiscal years. However, in subsequent years, the change in pricing scheme was beneficial to Buenaventura’s

financial results, which in turn resulted on the payment of higher income taxes, representing higher tax revenues for SUNAT.

|

|

|

3.

|

Despite such increase in tax revenue, SUNAT’s position is that the Company should disregard the cost it incurred to shift

between price schemes for purposes of calculating and paying income tax for the 2007-2008 period. It is worth highlighting that,

initially, the claim amounted to 373 million Soles, that, according to SUNAT, now amount to 2,083 million Soles after factoring-in

penalties and accrued interest.

|

|

|

4.

|

Buenaventura would like to point out that its income tax payments were made in compliance with applicable tax laws, and therefore

SUNAT’s attempt to impose new obligations or to apply ex post facto regulations to create an alleged past debt is not only

an error, but also a disincentive for mining investments that are one of the drivers of our economy and already require companies

to assume significant international market risks.

|

|

|

5.

|

On the basis of the above, Buenaventura emphatically refutes any allegations that it has committed the reported tax offenses

and calls for a transparent and responsible management of information that will favor Peru’s stability.

|

|

|

6.

|

Buenaventura reaffirms its commitment to continue to contribute to Peru’ growth by means of its investments across eight

different regions, the generation of 12 thousand job positions and the development of formal and responsible mining.

|

Your faithfully,

Pedro Torres Torres

Stock Market Representative

COMPAÑÍA DE MINAS BUENAVENTURA S.A.A.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

COMPAÑÍA DE MINAS BUENAVENTURA S.A.A.

|

|

|

|

|

|

|

|

|

|

|

|

Date: September 25, 2020

|

By:

|

/s/ LEANDRO GARCÍA RAGGIO

|

|

|

|

Name:

|

Leandro García Raggio

|

|

|

|

Title:

|

Chief Executive Officer

|

|

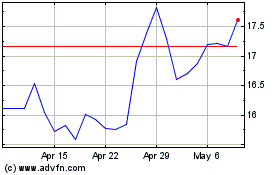

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Aug 2024 to Sep 2024

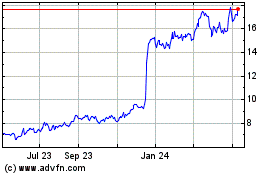

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Sep 2023 to Sep 2024