Reflects Information That Constitutes a Substantive Change From or Addition to the Information Set Forth in the Last Offering...

September 25 2020 - 6:02AM

Edgar (US Regulatory)

Filed

Pursuant to Rule 253(g)(2)

File

No. 024-11233

An

offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission.

Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be

sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary

Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these

securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under

the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering circular by sending you a notice

within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the

offering statement in which such Final Offering Circular was filed may be obtained.

PRELIMINARY

OFFERING CIRCULAR - SUBJECT TO COMPLETION

Explanation:

Can B̅ Corp. (the “Company”) is supplementing its Offering Statement filed on Form 1-A POS, filed with the Securities

and Exchange Commission on September 11, 2020, to attach an updated consent letter from the Company’s auditor as Exhibit

11.1.

Can

B̅ Corp.

Registrant’s

principal address: 960 South Broadway, Suite 120 Hicksville, NY 11801

Registrant’s

telephone number, including area code: 516-595-9544

Registrant’s

website: https://canbcorp.com

Dated:

September [●], 2020

EXHIBITS

The

following exhibits are filed with this offering circular:

|

Exhibit

|

|

Description

|

|

|

|

|

|

2.1

|

|

Articles of Incorporation, as amended(1)

|

|

2.2

|

|

Bylaws(2)

|

|

3.1

|

|

Articles of Amendment designating Series A Preferred Stock rights(1)

|

|

3.2

|

|

Articles of Amendment designating Series B Preferred Stock rights(1)

|

|

3.3

|

|

Securities Purchase Agreement with FirstFire Global Opportunities Fund, LLC(8)

|

|

3.4

|

|

Convertible Promissory Note with FirstFire Global Opportunities Fund, LLC(8)

|

|

3.5

|

|

Security Agreement with FirstFire Global Opportunities Fund, LLC(8)

|

|

3.6

|

|

Securities Purchase Agreement with Labrys Fund, LP (12)

|

|

3.7

|

|

Convertible Promissory Note with Labrys Fund, LP(15)

|

|

3.8

|

|

Securities Purchase Agreement with EMA Financial, LLC(14)

|

|

3.9

|

|

Convertible Promissory Note with EMA Financial, LLC(14)

|

|

3.10

|

|

Securities Purchase Agreement with Eagle Equities, LLC(14)

|

|

3.11

|

|

Convertible Promissory Note with Eagle Equities, LLC(14)

|

|

3,12

|

|

Form of Certificate(13)

|

|

3.13

|

|

Articles of Amendment designating Series C Preferred Stock rights(15)

|

|

4.1

|

|

Form of Subscription Agreement(17)

|

|

6.1

|

|

Employment Agreement with Marco Alfonsi(3)

|

|

6.2

|

|

Employment Agreement with Stanley L. Teeple(3)

|

|

6.3

|

|

Employment Agreement with Andrew Holtmeyer(3)

|

|

6.4

|

|

Employment Agreement with Pasquale Ferro(3)

|

|

6.5

|

|

Employment Agreement with Phil Scala(1)

|

|

6.6

|

|

Asset Purchase Agreement with Pure Health Products(3)

|

|

6.7

|

|

Production Agreement with Pure Health Products(4)

|

|

6.8

|

|

Memorandum of Understanding with Sam International and ZetrOZ Systems LLC(5)

|

|

6.9

|

|

Asset Purchase Agreement with Seven Chakras, LLC(6)

|

|

6.10

|

|

Joint Venture Agreement with SHI Farms and NY – SHI(7)

|

|

6.11

|

|

Green Grow Stock Purchase Agreement(9)

|

|

6.12

|

|

Green Grow Modification and Lock Up Agreement(1)

|

|

6.13

|

|

License Agreement with Lifeguard Licensing Corp(10)

|

|

6.14

|

|

Can B̅ Corp. 2020 Incentive Stock Option Plan(17)

|

|

7.1

|

|

Share Purchase Agreement with Prosperity Systems, Inc., dated January 5, 2015(2)

|

|

7.2

|

|

Membership Purchase Agreement with Pure Health Products(11)

|

|

10.1

|

|

Power of Attorney(16)

|

|

11.1

|

|

Consent of BMKR, LLP

|

|

12.1

|

|

Opinion of Legality from Austin Legal Group, APC(17)

|

|

(1)

|

Filed

with the Annual Report on Form 10-K filed with the SEC on April 2, 2020 and incorporated herein by reference.

|

|

(2)

|

Filed

with the Form S-1 Registration Statement filed with the SEC on December 2, 2015 and incorporated herein by reference.

|

|

(3)

|

Filed

with the Annual Report on Form 10-K filed with the SEC on April 16, 2019 and incorporated herein by reference.

|

|

(4)

|

Filed

with the Annual Report on Form 10-K filed with the SEC on April 6, 2018 and incorporated herein by reference.

|

|

(5)

|

Filed

with the Current Report on Form 8-K filed with the SEC on January 30, 2019 and incorporated herein by reference.

|

|

(6)

|

Filed

with the Current Report on Form 8-K filed with the SEC on February 26, 2019 and incorporated herein by reference.

|

|

(7)

|

Filed

with the Current Report on Form 8-K filed with the SEC on July 18, 2019 and incorporated herein by reference.

|

|

(8)

|

Filed

with the Current Report on Form 8-K filed with the SEC on January 14, 2020 and incorporated herein by reference.

|

|

(9)

|

Filed

with the Current Report on Form 8-K filed with the SEC on December 6, 2019 and incorporated herein by reference.

|

|

(10)

|

Filed

with the Current Report on Form 8-K filed with the SEC on February 18, 2020 and incorporated herein by reference.

|

|

(11)

|

Filed

with the Current Report on Form 8-K filed with the SEC on January 15, 2019 and incorporated herein by reference.

|

|

(12)

|

Filed

with the Current Report on Form 8-K filed with the SEC on May 19, 2020 and incorporated herein by reference.

|

|

(13)

|

Filed

with the Form 1-A, Part II, filed with the SEC on June 3, 2020 and incorporated herein by reference.

|

|

(14)

|

Filed

with the Current Report on Form 8-K filed with the SEC on June 24, 2020 and incorporated herein by reference.

|

|

(15)

|

Filed

with the Form 1-A/A, Part II, filed with the SEC on July 17, 2020 and incorporated herein by reference.

|

|

(16)

|

Filed

with the Form 1-A/A, Part II, filed with the SEC on July 31, 2020 and incorporated herein by reference.

|

|

(17)

|

Filed

with the Form 1-A POS, Part II, filed with the SEC on September 11, 2020 and incorporated herein by reference.

|

SIGNATURES

Pursuant

to the requirements of Regulation A, the issuer certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form 1-A and has duly caused this offering statement to be signed on its behalf by the undersigned, thereunto duly

authorized, in Hicksville, New York, on September 24, 2020.

|

|

Can

B̅ Corp.

|

|

|

|

|

|

September

24, 2020

|

By:

|

/s/

Marco Alfonsi

|

|

|

Name:

|

Marco

Alfonsi

|

|

|

Title:

|

Chief

Executive Officer

|

|

|

|

(Principal

Executive Officer and Principal Accounting Officer)

|

|

|

|

|

|

September

24, 2020

|

By:

|

/s/

Stanley L. Teeple

|

|

|

Name:

|

Stanley

L. Teeple

|

|

|

Title:

|

Chief

Financial Officer

|

Pursuant

to the requirements of the Securities Act of 1933, this Offering Circular has been signed by the following persons in the capacities

and on the date indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/

Marco Alfonsi

|

|

Chief

Executive Officer, Chairman, and Director

|

|

September

24, 2020

|

|

Marco

Alfonsi

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Stanley L. Teeple

|

|

Chief

Financial Officer, Secretary, and Director

|

|

September

24, 2020

|

|

Stanley

L. Teeple

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent

Director

|

|

|

|

Frederick

Alger Boyer Jr.

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent

Director

|

|

|

|

Ron

Silver

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent

Director

|

|

|

|

James

F. Murphy

|

|

|

|

|

|

|

|

|

|

|

|

*

/s/ Marco Alfonsi

|

|

|

|

September

24, 2020

|

|

Marco

Alfonsi

|

|

|

|

|

|

Attorney-in-fact

|

|

|

|

|

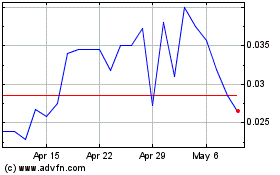

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Mar 2024 to Apr 2024

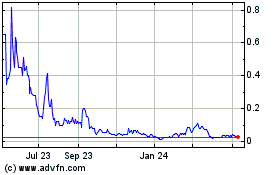

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Apr 2023 to Apr 2024