Current Report Filing (8-k)

September 11 2020 - 4:38PM

Edgar (US Regulatory)

0001451505false0001451505us-gaap:CommonStockMember2020-09-112020-09-110001451505rig:SeniorUnsecuredExchangeableBonds0.5PercentMember2020-09-112020-09-1100014515052020-09-112020-09-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (date of earliest event reported): September 11, 2020

TRANSOCEAN LTD.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Switzerland

|

|

001-38373

|

|

98-0599916

|

|

(State or other jurisdiction of

|

|

(Commission

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

Turmstrasse 30

|

|

|

|

Steinhausen, Switzerland

|

|

CH-6312

|

|

|

|

|

|

(Address of principal executive offices)

|

|

(zip code)

|

Registrant’s telephone number, including area code: +41 (41) 749-0500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered:

|

|

Shares, CHF 0.10 par value

|

RIG

|

New York Stock Exchange

|

|

0.50% Exchangeable Senior Bonds due 2023

|

RIG/23

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01Entry into a Material Definitive Agreement

On September 11, 2020, in connection with the closing of the previously announced exchange offers (the “Exchange Offers”) by Transocean Inc., a wholly-owned subsidiary of Transocean Ltd. (together, “Transocean”), Transocean Inc. entered into an indenture (the “Indenture”) with Transocean Ltd., Transocean Mid Holdings 1 Limited, Transocean Mid Holdings 2 Limited, Transocean Mid Holdings 3 Limited (collectively, the “Guarantors”) and Wells Fargo Bank, National Association, as trustee, pursuant to which it issued $687,343,000 aggregate principal amount of 11.50% Senior Guaranteed Notes due 2027 (the “New 2027 Senior Guaranteed Notes”). See Item 8.01 below for a description of the final results of the Exchange Offers.

The New 2027 Senior Guaranteed Notes are fully and unconditionally guaranteed, jointly and severally, by the Guarantors on a senior unsecured basis (the “Guarantees”). The New 2027 Senior Guaranteed Notes have not been registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or under any state securities laws, and were offered only to qualified institutional buyers under Rule 144A under the Securities Act and outside the United States in compliance with Regulation S under the Securities Act.

The New 2027 Senior Guaranteed Notes are governed by the Indenture, which contains covenants that, among other things, limit Transocean Inc.’s ability to allow its subsidiaries to incur certain additional indebtedness, incur certain liens on its drilling rigs or drillships without equally and ratably securing the New 2027 Senior Guaranteed Notes, engage in certain sale and lease-back transactions covering drilling rigs or drillships, and consolidate, merge or enter into a scheme of arrangement qualifying as an amalgamation. The Indenture also contains customary events of default. Indebtedness under the New 2027 Senior Guaranteed Notes may be accelerated in certain circumstances upon an event of default as set forth in the Indenture.

The description above does not purport to be complete and is qualified in its entirety by the Indenture, which is filed herewith as Exhibit 4.1 to this Current Report on Form 8-K and is incorporated by reference herein.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

|

The information described in Item 1.01 regarding the New 2027 Senior Guaranteed Notes is incorporated herein by reference.

Item 8.01Other Events

The Exchange Offers expired at 5:00 p.m., New York City time, on September 9, 2020. The final aggregate principal amount of the existing notes validly tendered and accepted for purchase in the Exchange Offers was $1,514,108,000 (after excluding certain tendered existing notes as a result of the minimum denominations of the New 2027 Senior Guaranteed Notes and rounding), consisting of existing notes set forth in the table below. Transocean accepted for exchange all such existing notes and settled the Exchange Offers on September 11, 2020.

|

Title of Existing Notes

|

Total Consideration(2)

|

Aggregate Principal Amount Validly Tendered and Accepted(3)

|

|

6.375% Senior Notes due 2021(1)

|

$825.00

|

$37,292,000

|

|

3.800% Senior Notes due 2022(1)

|

$730.00

|

$136,031,000

|

|

7.25% Senior Notes due 2025

|

$475.00

|

$207,099,000

|

|

7.50% Senior Notes due 2026

|

$465.00(4)

|

$180,818,000

|

|

8.00% Senior Notes due 2027

|

$455.00

|

$137,868,000

|

|

8.00% Debentures due 2027

|

$375.00

|

$35,455,000

|

|

7.45% Notes due 2027

|

$405.00

|

$35,456,000

|

|

7.00% Notes due 2028

|

$375.00

|

$38,783,000

|

|

7.50% Notes due 2031

|

$395.00

|

$192,210,000

|

|

6.80% Senior Notes due 2038

|

$375.00

|

$390,344,000

|

|

7.35% Senior Notes due 2041(1)

|

$395.00

|

$122,752,000

|

______________

|

(1)

|

The interest rate for the 2021 Notes, 2022 Notes and 2041 Notes was increased to 8.375%, 5.800% and 9.35%, respectively, pursuant to the terms of the applicable indenture.

|

|

(2)

|

Consideration in the form of principal amount of New 2027 Senior Guaranteed Notes per $1,000 principal amount of notes that are validly tendered and accepted for exchange, subject to rounding. Excludes accrued and unpaid interest, which will be paid in cash in addition to the applicable total consideration on the settlement date.

|

|

(3)

|

Excludes tendered notes not accepted in the Exchange Offers as a result of the minimum denominations of the New 2027 Senior Guaranteed Notes and rounding.

|

|

(4)

|

Transocean’s press release announcing the final results of the Exchange Offers included a typographical error indicating the total consideration for the 2026 Notes was $475.00 instead of $465.00 (which was the amended total consideration for the 2026 Notes pursuant to the Supplement, dated August 24, 2020, to the Exchange Offer Memorandum and Consent Solicitation Statement, dated August 10, 2020).

|

Item 9.01Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

TRANSOCEAN LTD.

|

|

|

|

|

|

|

|

Date: September 11, 2020

|

By:

|

/s/ Daniel Ro-Trock

|

|

|

|

Daniel Ro-Trock

|

|

|

|

Authorized Person

|

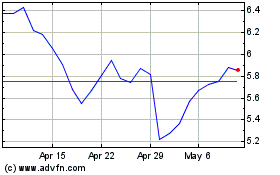

Transocean (NYSE:RIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

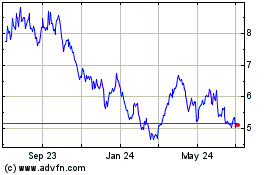

Transocean (NYSE:RIG)

Historical Stock Chart

From Apr 2023 to Apr 2024