By Peter Loftus and Jared S. Hopkins

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 12, 2020).

Drug-company sales representatives, grounded by the coronavirus

pandemic, are blasting out emails and hosting video calls to pitch

new treatments for a variety of ailments to doctors, a different

way of doing things for a field force that had relied on visiting

with physicians in person.

On Friday, the U.S. Food and Drug Administration approved a new

cancer drug from Eli Lilly & Co. The company plans to make the

drug available within days -- and to spread the word by having

sales reps, working from home, email doctors and set up remote

meetings with slide presentations, and to run ads promoting the new

medicine on websites aimed at health-care professionals.

"We have a responsibility to make sure we inform doctors, given

that cancer is not going to take a break" during the pandemic, said

Eric Dozier, vice president of North American oncology for

Lilly.

The changes could impact company bottom lines, experts say. The

industry has long considered the launch of a drug crucial to its

sales performance.

Yet drugmakers can't now draw on the very tactics long counted

on to give new products a strong start, such as reviewing the new

drug's profile over dinner and dropping off samples at a doctor's

office.

"If a rep can't go there, and a physician doesn't read emails

thoroughly, the physician isn't going to be aware" of the new

product, said Pratap Khedkar, principal with consulting firm ZS

Associates. "The launch suffers a lot. That back-and-forth, the

learning that happens in the first six months, is not going to

happen."

The virtual drug launch is a big shift from the industry's

longtime sales and marketing approach. Before the coronavirus, an

FDA drug approval sent sales reps fanning out across the U.S. to

tout the benefits of a product physicians might not know about

otherwise.

The reps often brought free lunches for doctors, nurses and

office staff to gain precious face time for their pitches. And the

reps dropped off or arranged shipment of free drug samples, which

doctors gave away to patients.

But drugmakers ordered reps to remain at home due to the new

coronavirus. At the same time, hospitals and doctor's offices have

barred visitors to minimize the spread of the virus.

To adapt to the new reality, many drugmakers have canceled the

restaurant dinners in which they pay physician experts to discuss a

new drug's benefits and risks with other doctors, switching to

virtual events. And reps are trying to talk with doctors via

videoconference.

Veeva Systems Inc. has seen a surge in use of the software it

sells to drug companies to facilitate online interactions with

doctors. In April, companies conducted more than 316,900 remote

meetings with doctors and sent about 7 million emails to them

globally, compared with 4,900 remote meetings and 1.2 million

emails in January, according to Veeva.

Drugmakers tried some of these virtual tactics pre-pandemic, but

with limited success. Doctors engaged less with the virtual

interactions than in-person visits, industry officials say.

While nearly half of U.S. doctors allowed in-person visits from

sales reps just before the pandemic, only 10% opened emails from

company reps, according to ZS, which advises drug companies on

sales strategies.

Due to the challenges, some companies have postponed the launch

of new drugs.

Bristol-Myers Squibb Co. is delaying the launch of

multiple-sclerosis treatment Zeposia partly so its sales reps can

meet with doctors face to face because of the amount of education

involved, said Chris Boerner, the company's chief commercial

officer.

Bristol said last week it hopes to launch the drug in June, and

virtual tools will likely be a part of the launch

"You do miss something in non-personal engagement you get from

an in-person conversation, whether it's being able to read the

room, being able to understand what's really on the mind of the

customer," Dr. Boerner said. "There's simply no replacement for

that."

The new Lilly drug, Retevmo, treats lung and thyroid cancers

that have certain genetic traits. After many employees began

working from home in March, the drugmaker prepared messages for

sales reps to email to doctors upon FDA approval. The messages

discuss how the drug helped the subjects of clinical trials.

Yet the company doesn't want to overwhelm doctors with pitches.

"There's just increased pressure on the health care community right

now, so the last thing we want to be is an added burden," Mr.

Dozier said.

Lilly set a list price for Retevmo of about $20,600 per 30 days

of therapy for each patient. The company said patients'

out-of-pocket costs will vary depending on their insurance plans,

and the company will offer assistance to eligible patients to

reduce those costs.

Some doctors say the inability to pitch drugs in-person and

employ tactics like dinners or meals in offices may be a positive

move, given how research has indicated the industry's sales

strategies can improperly affect physician prescribing

practices.

"It's possible that their ability to influence physicians will

diminish because of the much more impersonal nature of virtual

interactions," said Aaron S. Kesselheim, a professor of medicine at

Harvard Medical School.

Esperion Therapeutics Inc., instead of dropping off samples of

new cholesterol drug Nexletol at doctor's offices, is sending them

to patients directly, if a physician requests, Chief Executive Tim

Mayleben said.

Due to limited face time with doctors, Biohaven Pharmaceutical

Holding Co. Ltd. started airing TV ads months earlier than planned

for its newly-approved migraine drug Nurtec, Chief Executive Vlad

Coric said. The company also placed Nurtec information on the

website of a telemedicine company several months earlier than

planned.

--Denise Roland contributed to this article.

Write to Peter Loftus at peter.loftus@wsj.com and Jared S.

Hopkins at jared.hopkins@wsj.com

(END) Dow Jones Newswires

May 12, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

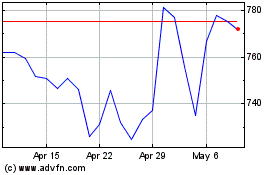

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Apr 2023 to Apr 2024