Booking Holdings: Coronavirus Will Hit 1Q Results

February 26 2020 - 4:48PM

Dow Jones News

By Micah Maidenberg

Booking Holdings Inc. issued a warning about the coronavirus as

it reported fourth-quarter results that beat Wall Street

expectations.

"While the outlook for global travel in the near term is

uncertain due to the coronavirus, we will manage the business

appropriately to enhance long-term value for our stakeholders,"

Chief Executive Glenn Fogel said in a statement Wednesday.

The spread of the virus has had "a significant and negative

impact across our business during the first quarter," the company

said. It predicted key metrics, such as the number of hotel-room

nights booked, would fall in the quarter, dragging revenue

down.

The online travel company reported fourth-quarter revenue of

$3.34 billion, up from $3.21 billion the year earlier and higher

than of forecasts from analysts of $3.28 billion.

Net income grew to $1.17 billion, or $27.75 a share, from $646

million, or $13.86 a share, in the fourth quarter 2018.

The company said profit in the quarter grew in part because it

recorded an unrealized gain of $326 million on equity

securities.

Booking reported an adjusted profit of $23.30 a share, ahead of

the average estimate of $22.04 a share on that metric on

FactSet.

Booking operates Booking.com, airline-travel site Kayak,

OpenTable, which provides restaurants reservations and other

services, and other digital-travel brands.

The company said the number of room nights booked through its

platforms grew 12% in the quarter versus the year earlier, as did

the number of rental car days.

Booking reported 11% growth in the number of airline tickets

purchased through its portals.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

February 26, 2020 16:33 ET (21:33 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

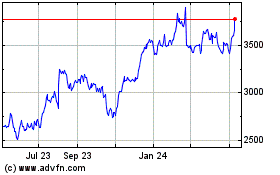

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Apr 2023 to Apr 2024