By Drew FitzGerald

AT&T Inc.'s pay-television business continued to hemorrhage

customers, adding to pressure as the company readies its own

entrant into the increasingly crowded video streaming market.

The Dallas company lost 945,000 satellite and fiber-optic TV

subscribers during the last three months of 2019, while its online

channel bundle AT&T TV Now shed 219,000 customers.

AT&T vaulted to the top of the pay-TV rankings in 2015 when

it bought DirecTV, but that business lost about 4 million

subscribers over the past year as many turned to more flexible and

less expensive entertainment options.

The company ended 2019 with 20.4 million domestic pay-TV

subscribers, dropping behind cable giant Comcast Corp.'s 21.2

million video customers.

John Stankey, the company's chief operating officer, said during

a conference call Wednesday that pay-TV subscriber declines will

continue this year as more customers with discounted contracts

choose to drop service instead of paying higher rates.

"You're going to see continuing improvement in our subscriber

trends each quarter as we move through," he said. "But you just

can't flip a switch and get there overnight."

AT&T's core mobile phone business fared better, adding

229,000 postpaid phone subscribers while losing 20,000 prepaid

phone customers in the fourth quarter. Postpaid customers billed

for service at the end of the month are considered lucrative for

carriers because they are less likely to switch providers.

AT&T ended the year with more than 93 million domestic

wireless connections, excluding connected devices such as tablets

and lines sold through resellers.

The company's reported fourth-quarter profit hit $2.39 billion,

or 33 cents a share, down from $4.86 billion, or 66 cents a share,

over the same period a year earlier. The latest results were

weighed down by several one-time accounting write-offs, including

the abandonment of legacy copper phone lines in some areas.

Total fourth-quarter revenue fell 2.4% to $46.82 billion.

Shares of AT&T fell 2.5% in morning trading Wednesday. The

stock rallied over the past year as the company paid down debt by

streamlining operations and selling some assets.

AT&T still earns slightly more than half its overall profit

from customers on its wireless network. That business showed little

damage from promotions that executives said were more aggressive

near the end of the year. Rival T-Mobile US Inc. added 1 million

postpaid phone customers in the fourth quarter, while Sprint Corp.

reported a 115,000-subscriber loss.

Verizon Communications Inc. is scheduled to post its results on

Thursday.

AT&T's network performance improved last year as it used new

wireless spectrum licenses to bolster its customers' 4G download

speeds, an upgrade the company marketed as "5GE." The company on

Wednesday predicted its cellphone customer base will keep growing

through 2020 as more customers notice the service improvement.

Revenue from WarnerMedia, a collection of media assets AT&T

acquired in 2018, fell 3.3% to $8.92 billion. Gains at HBO and the

company's Turner cable channels were eclipsed by revenue declines

at Warner Bros. studios. The company said it reaped less cash from

licensing fees as it stockpiled content for HBO Max, an on-demand

video service AT&T plans to debut in May.

The company plans to market HBO Max later this year with

aggressive promotions tied to its wireless data plans, Mr. Stankey

said. The stand-alone service will cost $15, the same as

traditional HBO but more than Netflix and new entrants. Wireless

customers with premium data plans will get the service free.

U.S. cable and satellite companies are struggling with a

snowballing cord-cutting problem, though AT&T's 2019 customer

losses outstripped declines at cable rivals like Comcast. AT&T

has said the DirecTV subscriber losses have been driven by its

decision to pull back on aggressive promotions to focus on more

profitable customers.

HBO Max will combine the premium cable channel's original TV

series with Warner Bros. movies and licensed reruns of popular

shows such as "The Big Bang Theory" and "Friends."

It will build on an already valuable base of HBO subscribers,

who can switch to the expanded library for free, but faces an

increasingly crowded field that includes fresh streaming video

services from Apple Inc., Comcast and Walt Disney Co.

The quarterly results come after AT&T reached an October

truce with hedge fund Elliott Management Corp. that committed the

telecom and media giant to a three-year streamlining plan.

The strategy, some elements of which AT&T executives said

were already being considered, included a stock-buyback plan to

boost its share price and a plan to cut costs.

The company spent $2 billion to buy back 51 million of its own

shares during the fourth quarter and allocated another $4 billion

to repurchase shares starting in January. Executives have said the

company will continue to boost its share price by reducing the

amount of common stock available to the public, though the heaviest

buybacks were front-loaded around the beginning of 2020.

The company also agreed to name two new board members while

reviewing many of its portfolio of assets, a response to critiques

in a letter the investment fund sent in 2019.

AT&T said it reduced its net debt by $7.6 billion in the

fourth quarter and more than $20 billion in the full year. It ended

2019 with $151 billion of net debt. The company reiterated its

financial targets for 2020, which include 1% or 2% revenue growth

with about $28 billion in free cash flow.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

January 29, 2020 11:59 ET (16:59 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

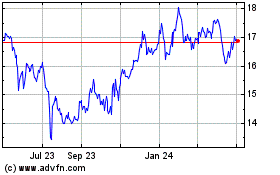

AT&T (NYSE:T)

Historical Stock Chart

From Mar 2024 to Apr 2024

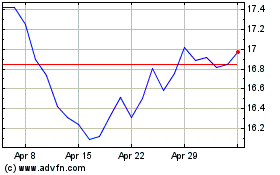

AT&T (NYSE:T)

Historical Stock Chart

From Apr 2023 to Apr 2024