By Josh Mitchell

WASHINGTON -- The U.S.-China trade deal would deliver muted

benefits to the American economy, leaving in place most tariffs on

Chinese goods and uncertainty for the world's two largest

economies.

The limited deal, announced by officials in both countries on

Friday, would halve a 15% tariff the U.S. slapped on $120 billion

worth of Chinese-made goods on Sept. 1, including apparel, shoes

and accessories. It would also cancel a 15% tariff on $156 billion

of goods -- including smartphones, laptops and toys -- set to take

effect Sunday.

U.S. officials said the deal also calls for increasing exports

to China by $200 billion over two years, including a big increase

in farm exports. U.S. officials envision cutting the trade deficit;

helping industries such as agriculture, manufacturing and tech; and

boosting overall growth.

"We're hopeful that this is the beginning of leveling the

playing field for American workers and businesses," said Cummins

Inc., an Indiana manufacturer of diesel engines.

The company said it believed the deal would slash tariffs on

lithium-ion batteries it imports from China for electric-powered

vehicles. But the deal would leave in place tariffs on many goods

the company makes at a plant in China.

Economists said the deal would likely reduce some consumer

prices and may reassure businesses the two-year trade dispute is

headed toward a broad resolution.

But the deal leaves in place 25% tariffs on $250 billion of

goods that went into effect last year, including plastics,

chemicals and machinery. Also, since the deal is only "phase one"

of longer-term talks, it may only remove some of the business

uncertainty that economists and Federal Reserve leaders say has

held back the U.S. economy, which is plodding along in its longest

expansion ever.

The deal offers hope that trade tensions are easing, but will do

little to boost growth, said economist Mary Lovely of the Peterson

Institute for International Economics. "Given the size of the U.S.

economy I don't think this is going to get any macroeconomists'

blood pressure going," she said.

Agricultural traders were skeptical that China would buy as many

U.S. farm products as the deal calls for. "They need U.S. pork,

they need U.S. soybeans. Do they need $50 billion of agricultural

goods? Absolutely not," said Dave Marshall, a farm-marketing

adviser with First Choice Commodities Inc. "If the Chinese were to

buy $50 billion, they'd have to buy a lot of natural gas."

Nebraska farmer Dan Nerud said tariffs from China and other

countries have hit the prices he gets for each bushel of corn and

soybeans he raises with his son on about 3,000 acres.

"I'm very, very hopeful," Mr. Nerud said of Friday's deal. "But

until we actually see some stuff in writing or agreed to, that's

when I'll have the confirmation."

Tyson Foods Inc., the largest U.S. meat processor, said it hoped

the deal "leads to improved market access and lower tariffs, which

would benefit our meat and poultry businesses and the farmers and

ranchers who supply us."

Some economists said the biggest benefit would be heading off

Sunday's tariffs, which would have directly hit consumers by

driving up the price of popular items including electronics.

The tariffs already in place are set to drive up costs for U.S.

households by more than $400 a year, on average, economists say.

One estimate says that if Sunday's tariffs went into effect, that

tab would have exceeded $550. Reducing the September tariffs and

canceling Sunday's tariffs will give households a bit of a respite,

said Ms. Lovely.

Households "might not know that they dodged a bullet here," she

said.

Consumers are already spending more on certain goods because of

the tariffs, the first round of which took effect in 2018, although

businesses have absorbed some of the increased costs and U.S.

imports from China have dropped.

Bryan Riley of the National Taxpayers Union, a nonprofit

research group, said Sunday's tariffs would have hit the poorest

households the hardest. "It would be like a reverse Christmas

bonus," Mr. Riley said.

The $22 trillion U.S. economy has remained steady despite the

dispute and a slowdown in global growth. The Fed on Wednesday

projected U.S. output would expand 2.2% this year and 2.0% next

year.

But there is evidence the trade slowdown has held the economy

back. Business spending on long-term projects -- including

facilities and equipment -- rose 1.3% in the third quarter compared

with a year earlier, the weakest 12-month gain in three years.

Many economists believe a big reason for the slowdown is

uncertainty over the trade dispute. Some companies have been

holding off on key decisions -- such as how many people to hire or

where to locate a plant -- as they wait for a trade deal.

That uncertainty is one reason the Fed cut its benchmark rate

three times this year. Fed Vice Chairman Richard Clarida on Friday

said it was too soon to judge how a limited agreement to halt the

trade war between the U.S. and China would influence the economy,

but he said any reduction in policy uncertainty is "obviously a

positive for the economic outlook."

The tentative deal with China and progress on another trade

dispute could reduce some of that uncertainty. The U.S. also

reached a new trade agreement in recent days with Mexico and

Canada, a development that could offer support for the U.S.

economy.

But the U.S.-China dispute has been marked by fits and starts

and it is entirely possible the talks could yet collapse. President

Trump said Friday that the tariffs still in place will be used as

leverage in the next phase of talks with China.

Gregory Daco of Oxford Economics raised doubts about how much

certainty a "phase one" deal would provide.

"From a business perspective if you know these tariffs can come

back you're still going to be cautious about your actions, your

investment, your hiring decisions," he said.

--Bob Tita, Kirk Maltais and Jacob Bunge contributed to this

article.

Write to Josh Mitchell at joshua.mitchell@wsj.com

(END) Dow Jones Newswires

December 13, 2019 17:43 ET (22:43 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

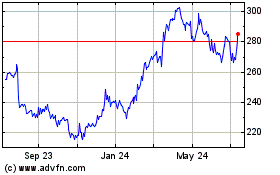

Cummins (NYSE:CMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

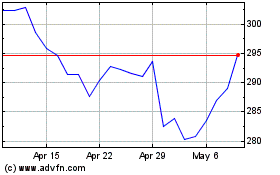

Cummins (NYSE:CMI)

Historical Stock Chart

From Apr 2023 to Apr 2024