Current Report Filing (8-k)

November 12 2019 - 4:08PM

Edgar (US Regulatory)

false 0001703056 0001703056 2019-11-05 2019-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 5, 2019

ADT Inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38352

|

|

47-4116383

|

|

(State of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

1501 Yamato Road

Boca Raton, Florida 33431

(Address of principal executive offices)

(561) 988-3600

(Registrant’s telephone number, including area code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.01 per share

|

|

ADT

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.01.

|

Completion of Acquisition or Disposition of Assets.

|

On September 30, 2019, ADT Inc. and its wholly owned subsidiaries (collectively, the “Company”) entered into an agreement (the “Share Purchase Agreement”) to sell all of the shares of ADT Security Services Canada, Inc. (“ADT Canada”) to TELUS Corporation. On November 5, 2019, the Company completed the sale of ADT Canada for CAD $683 million (approximately $519 million as of the date of closing) in cash, which remains subject to certain post-closing purchase price adjustments (the “Sale”).

The foregoing description of the Share Purchase Agreement and the Sale does not purport to be complete and is qualified in its entirety by reference to the full text of the Share Purchase Agreement, which was filed as Exhibit 2.1 to ADT’s Current Report on Form 8-K filed with the Securities and Exchange Commission on October 1, 2019 and incorporated herein by reference.

The Share Purchase Agreement was filed to provide investors with information regarding its terms and conditions. It is not intended to provide any other factual information about ADT, Seller, Buyer, the Company or any of their respective subsidiaries or affiliates. The representations, warranties and covenants contained in the Share Purchase Agreement were made only for purposes of the Share Purchase Agreement as of the specific dates therein, were solely for the benefit of the parties to the Share Purchase Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the parties to the Share Purchase Agreement or any of their respective subsidiaries or affiliates. Information concerning the subject matter of representations and warranties may have changed after the date of the Share Purchase Agreement.

Forward Looking Statements

ADT has made statements in this filing and other reports, filings, and other public written and verbal announcements that are forward-looking and therefore subject to risks and uncertainties. All statements, other than statements of historical fact, included in this document are, or could be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are made in reliance on the safe harbor protections provided thereunder. These forward-looking statements relate to anticipated financial performance, management’s plans and objectives for future operations, business prospects, outcome of regulatory proceedings, market conditions, and other matters. Any forward-looking statement made in this filing speaks only as of the date on which it is made. ADT undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Forward-looking statements can be identified by various words such as “expects,” “intends,” “will,” “anticipates,” “believes,” “confident,” “continue,” “propose,” “seeks,” “could,” “may,” “should,” “estimates,” “forecasts,” “might,” “goals,” “objectives,” “targets,” “planned,” “projects,” and similar expressions. These forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to management. ADT cautions that these statements are subject to risks and uncertainties, many of which are outside of ADT’s control and could cause future events or results to be materially different from those stated or implied in this document, or to not occur at all, including among others, risk factors that are described in the ADT Annual Report on Form 10-K and other filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(b) Pro Forma Financial Information. The unaudited pro forma condensed consolidated financial information of ADT and its subsidiaries giving effect to the Sale is filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ADT INC.

|

|

|

|

|

|

|

|

|

|

Date: November 12, 2019

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Jeffrey Likosar

|

|

|

|

|

|

Name:

|

|

Jeffrey Likosar

|

|

|

|

|

|

Title:

|

|

Executive Vice President, Chief Financial Officer and Treasurer

|

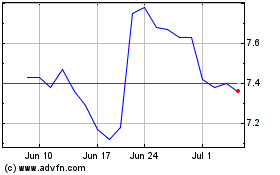

ADT (NYSE:ADT)

Historical Stock Chart

From Mar 2024 to Apr 2024

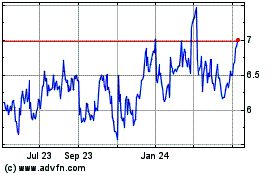

ADT (NYSE:ADT)

Historical Stock Chart

From Apr 2023 to Apr 2024