PGIM Investments invests in senior talent as part of global expansion

October 29 2019 - 7:00AM

Business Wire

PGIM Investments has made senior-level hires across its

marketing and technology functions, as well as expanded roles of

two senior executives. The investment in top talent comes on the

heels of 10 consecutive years of positive net flows for the retail

fund shop, underscoring the firm’s ongoing commitment to serving

its growing client base both in the U.S. and internationally.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20191029005324/en/

Ray Ahn, global chief marketing officer,

PGIM Investments (Photo: Business Wire)

PGIM Investments is the global manufacturer and fund distributor

of PGIM Inc., the $1.3 trillion global investment management

business of Prudential Financial, Inc. (NYSE: PRU) – a top-10

investment manager globally.

Coupled with attractive investment results, PGIM Investments has

grown its mutual fund assets under management from $28 billion to

$115 billion over the past 10 years.* To continue building its

global capabilities, PGIM Investments has added experienced

leadership in its marketing and technology functions.

Global Chief Marketing Officer

With more than 25 years of investment management marketing

experience, Ray Ahn joins PGIM Investments as global chief

marketing officer. Most recently with Capital Group/American Funds,

Ahn will lead the marketing strategy and marketing team expansion

for the retail intermediary channels in both the U.S. and

internationally. At Capital Group/American Funds, Ahn led the

firm’s build-out of its international marketing function, as well

as led product marketing teams in the U.S. He previously held

marketing roles at ProShares, T. Rowe Price and BlackRock.

Global Chief Technology and Operations Officer

With more than 30 years of financial services industry

experience, Indy Reddy joined PGIM Investments as global chief

technology and operations officer. Reddy previously served as

global head of technology and operations for Citi Private Bank

& Personal Wealth Management. He will lead the build-out of the

technology platform to support the firm’s global expansion plans,

overseeing teams spanning fund administration, transfer agency and

client service. He previously held senior technology roles with

Credit Suisse and Deutsche Bank.

Expansion of Senior Leadership Roles

In addition to augmented leadership in marketing and technology,

PGIM Investments has expanded the role of two senior

executives.

Jim Devaney has assumed the role of U.S. head of distribution,

expanding his responsibilities to include both U.S. intermediary

sales and U.S. national accounts. U.S. distribution has been a key

contributor to PGIM Investments’ growth by helping to drive 10

consecutive years of positive net flows totaling nearly $50 billion

over that time. The U.S. national accounts team was previously led

by Kimberly LaPointe.

Kimberly LaPointe has assumed a newly created role as head of

PGIM Investments International. LaPointe has relocated to London

and is focused on accelerating PGIM Investments’ growth plans

outside of the U.S. Launched in 2013, PGIM Investments’ UCITS

offering spans 29 funds registered in 17 countries across Europe,

Latin America and Asia. The firm’s UCITS range has grown from $1

billion to $4.5 billion over the past three years and established

local distribution teams across the U.K., Germany and

Switzerland.

Stuart Parker, president and CEO of PGIM Investments, noted,

“PGIM Investments is committed to bringing the best to our clients.

We’re continuing to invest in talent to serve our clients around

the world.”

About PGIM Investments and PGIM

Funds

PGIM Investments LLC offers more than 100 funds globally across

a broad spectrum of asset classes and investment styles. All

products draw on PGIM’s globally diversified investment platform

that encompasses the expertise of managers across fixed income,

equities and real estate.

PGIM Funds plc is an Ireland-domiciled UCITS umbrella fund

serving institutional and wholesale investors across the globe. For

a full list of funds available in your region, visit

pgimfunds.com.

About PGIM

With 16 consecutive years of positive third-party institutional

net flows, PGIM, the global asset management business of Prudential

Financial, Inc. (NYSE: PRU), ranks among the top 10 largest asset

managers in the world** with more than $1 trillion in assets under

management as of Sept. 30, 2019. PGIM’s businesses offer a range of

investment solutions for retail and institutional investors around

the world across a broad range of asset classes, including

fundamental equity, quantitative equity, public fixed income,

private fixed income, real estate and commercial mortgages. Its

businesses have offices in 15 countries across four continents. For

more information, please visit pgim.com.

Prudential Financial, Inc. of the United States is not

affiliated with Prudential plc, which is headquartered in the

United Kingdom. For more information please visit

news.prudential.com.

*Source: Strategic Insights/SIMFUND for the 10-year period ended

Sept. 30, 2019, including Long-Term mutual funds only; excludes

Money Market funds, Closed-End Funds and ETFs.

** Pensions & Investments’ Top Money Managers list, May 27,

2019; based on Prudential Financial total worldwide institutional

assets under management as of Dec. 31, 2018. Assets under

management (AUM) are based on company estimates and are subject to

change.

1028160-00001-00

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191029005324/en/

MEDIA: Sheila Kulik 203-745-2523

skulik@prosek.com

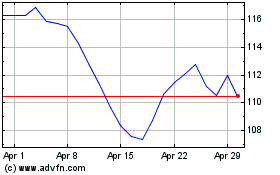

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

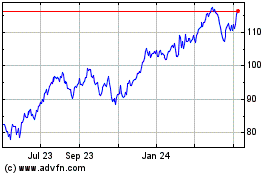

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Apr 2023 to Apr 2024