Medicare Funding Weighs on Eli Lilly's Revenue -- Update

October 23 2019 - 2:39PM

Dow Jones News

By Dave Sebastian and Peter Loftus

Eli Lilly & Co. posted a lower-than-expected revenue for the

latest quarter as the company provided more funding for seniors

through a Medicare plan under a change in federal law that took

effect this year.

The pharmaceutical company posted third-quarter revenue of $5.48

billion, up 3.2% from the same quarter last year but below the $5.5

billion analysts polled by FactSet had expected. Lilly said an 8%

volume increase drove revenue up.

Shares of Lilly fell about 2.2% in midday trading. Lilly's stock

was down about 7.2% this year.

The Indianapolis company's U.S. sales stayed about flat at $3.06

billion as higher sales for its key products, such as diabetes

treatment Trulicity, psoriasis drug Taltz and migraine medication

Emgality offset lower volume of erectile-dysfunction pill

Cialis.

Cialis saw sales drop 61% from a year earlier, with the company

attributing the decline to its loss of patent exclusivity.

Overseas sales rose 8% to $2.42 billion, Lilly said.

Trulicity sales, which rose 24% for the quarter compared with a

year earlier, still missed expectations due to Lilly's increased

share of funding for seniors in the Medicare Part D drug benefit,

Chief Executive David Ricks told The Wall Street Journal.

Under the change to Part D, companies like Lilly must now pay

70% of prescription costs when members reach a certain level of

spending for the year, up from 50% last year.

More than one-third of Trulicity's U.S. sales are through Part

D, and many seniors hit a gap in coverage known as the doughnut

hole from May through August. Lilly's funding for seniors during

the coverage gap reduced net pricing for Trulicity. Strong

prescription volume growth for Trulicity, however, paints a

"healthy picture," Mr. Ricks said.

Also contributing to the sales miss was the company's withdrawal

of its Lartruvo cancer drug after a study showed that it failed to

prolong overall survival in a clinical trial.

Lilly posted net income of $1.37 a share, up 22% from the

comparable quarter last year. Adjusted earnings were $1.48 a share,

up 10% from the prior year and beating the $1.40 a share analysts

had expected.

For the full year, Lilly said it sees adjusted earnings to be

between $5.75 a share and $5.85 a share, up from its previous

guidance of between $5.67 a share and $5.77 a share. Analysts are

expecting $5.72 a share for the full year.

The company said it is sponsoring a clinical study with the

University of Southern California's Alzheimer Institute to test

whether Lilly's drug solanezumab can slow the progression of memory

problems in older people who don't yet show symptoms of Alzheimer's

disease but are at risk of decline. The "A4" study for the drug,

which failed to help patients already diagnosed with Alzheimer's in

past trials, is likely to yield results in 2022, Chief Scientific

Officer Daniel Skovronsky said on a call with investors.

"We just have to wait patiently for those results to see if

someone can have efficacy in this very early population," Mr.

Skovronsky said.

Biogen Inc. on Tuesday said it plans to seek regulatory approval

early next year for an Alzheimer's drug that had been considered a

lost cause after the company pulled the plug on late-stage studies

due to disappointing results.

Write to Dave Sebastian at dave.sebastian@wsj.com and Peter

Loftus at peter.loftus@wsj.com

(END) Dow Jones Newswires

October 23, 2019 14:24 ET (18:24 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

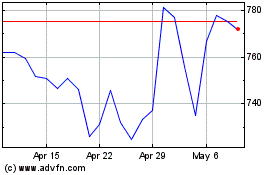

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Apr 2023 to Apr 2024