Weak Grain Exports, Falling Coal Demand, Declining Auto Production Hurt Union Pacific -- Commodity Comment

October 17 2019 - 9:26AM

Dow Jones News

Union Pacific Corp. (UNP) said Thursday that volumes, as

measured by revenue-generating carloads, weakened 8% in the third

quarter. The decline crimped the company's revenue, which fell 7%

and missed the consensus estimate from FactSet.

Here is what railroad, which owns major freight lines throughout

the West, Midwest and Southwest parts of the U.S., said about

demand in the quarter for the various commodities and products that

it hauls.

Grains: Shipments of grains weakened 3% in the third quarter

compared with last year. Reduced exports hurt demand, Union Pacific

said in an investor presentation.

Grain products: Volumes were flat.

Fertilizer and sulfur: Volumes dropped 5%.

Sand: Shipments dropped 45% versus the year earlier.

Coal: Volumes fell 17%. The company cited "continued coal

challenges" in an investor presentation.

Petroleum, liquefied petroleum gas and renewables: Shipments

increased 18%. Crude-oil shipments bolstered results, Union Pacific

said.

Construction materials: Volumes rose 16% on strong demand,

according to the railroad.

Plastics: Volumes gained 7%.

Forest products: Shipments slipped 11%.

Domestic premium products, such as intermodal shipments and auto

parts: Demand for domestic-intermodal shipments was soft, the

company said, with volumes falling 11%.

International intermodal: Volumes fell 12%. Union Pacific cited

"tariffs and trade uncertainty" in an investor presentation when

discussing its premium business, which includes the intermodal

unit.

Finished vehicles: Volumes fall 4% from the year earlier amid

"declining auto production," the railroad said.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

October 17, 2019 09:11 ET (13:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

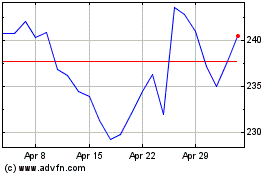

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

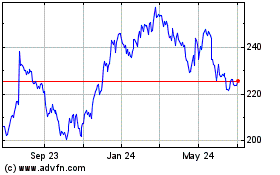

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024