Alcoa Plans Up to $1 Billion in Asset Sales Amid Growth Fears

October 16 2019 - 5:44PM

Dow Jones News

By Micah Maidenberg

Alcoa Corp. plans to sell up to $1 billion in assets and may

close facilities over the next few years as it grapples with

slowing economic growth that has driven aluminum prices lower,

damaging its financial performance.

The Pittsburgh-based manufacturer said Wednesday it has launched

a review of the company meant to cut expenses and point it toward

sustainable profits. The company said it would try to sell what it

called noncore assets over the next year to 18 months, bringing in

between $500 million and $1 billion in proceeds.

Shares of Alcoa rose 6% in after-hours trading but have fallen

28% so far this year through Wednesday.

Over a five-year period, Alcoa plans to consider a range of

further asset sales and closures of facilities, as well as

curtailing production at other sites. It said it would review 1.5

million metric tons of smelting capacity and 4 million metric tons

of alumina-refining capacity

The company has been hurt by fears that a weaker global economy

will cut into demand for its products and crimp prices for metals.

On Tuesday, the International Monetary Fund said it expects growth

of 3% this year, lower than its forecast from July and off close to

1 percentage point compared with 2017.

Global demand for aluminum in 2019 will be weaker than Alcoa

previously expected, the company also said Wednesday, contracting

between 0.4% and 0.6%. Earlier, it said it believed demand for the

metal would rise up to 2.3% this year.

"The change is driven by weakening macroeconomic conditions,

trade tensions between the U.S. and China, and contracting

manufacturing activity, especially in the global automotive

sector," the company said in a statement.

Quarterly revenue at Alcoa fell 24% from a year earlier to $2.57

billion as aluminum prices declined. Its average selling price of

$2,138 a metric ton for aluminum in the latest quarter was down 13%

compared with the year-ago period.

Alcoa reported a quarterly loss of $221 million, or $1.19 a

share, wider than the loss of $6 million, or 3 cents a share,

recorded in the year-ago period. After adjustments, the company

reported a loss of 44 cents a share, worse than what analysts

polled by FactSet expected.

(END) Dow Jones Newswires

October 16, 2019 17:29 ET (21:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

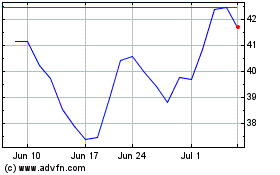

Alcoa (NYSE:AA)

Historical Stock Chart

From Apr 2024 to May 2024

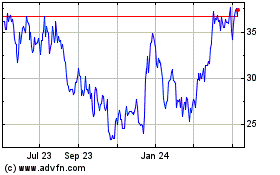

Alcoa (NYSE:AA)

Historical Stock Chart

From May 2023 to May 2024