Banks Moving Flood-Based Mortgage Risks Out of Private Sector, Paper Finds

October 01 2019 - 4:37PM

Dow Jones News

By Michael S. Derby

Mortgage providers appear to have developed a strategy to

continue lending in areas where climate-change-related flood

threats are on the upswing, in a development that could be hiding a

growing risk in home lending, according to new research.

Faced with risks related to destructive coastal storms, lenders

are lowering the sizes of their mortgages to make sure the loans

are eligible to be taken on by government-sponsored home lenders

like Fannie Mae and Freddie Mac, a new paper distributed by the

National Bureau of Economic Research says.

The paper, written by Amine Ouazad of HEC Montreal business

school and Matthew Kahn of Johns Hopkins University, says the

declining availability of flood insurance makes mortgage lending

more risky in parts of the country. Reduced flood coverage means

homeowners are more likely to default on their loans when faced

with major storm damage to their homes.

Banks that provide mortgages understand that and know government

housing lender guidelines "do not rely on the on-the-ground

information of loan officers and may not take into account local

climate risk as accurately as the local loan officer."

With risks rising, private home lenders "may have an incentive

to sell their worse flood risk to the two main agency

securitizers." The key, the paper said, is making conforming loans,

or mortgages that don't exceed a size cap set by Fannie or Freddie

if the government-sponsored enterprises are to buy them through

securitization.

"After a billion-dollar event, lenders are significantly more

likely to increase the share of mortgages originated and

securitized below the conforming loan limit," the paper said. The

increase "is larger in neighborhoods for which such a disaster is

'new news', i.e. does not have a long history of hurricanes," the

researchers wrote.

By moving the risk of these vulnerable mortgages out of the

private sector, government-sponsored home lenders increasingly

serve as an "implicit insurer" and a "a substitute for the

declining National Flood Insurance Program," the paper said.

For this and other reasons, these types of loans put more risk

in the financial system, and it could get worse. That's because

destructive storms are likely to become a bigger risk over time due

to climate change. "Recent evidence suggests an increasing risk of

natural disasters along the" East Coast, and recent work "predicts

a doubling of category 4 and 5 storms by the end of the 21st

century in moderate scenarios."

Dealing with the impact of climate change is a top issue for the

financial industry and regulators, including the Federal Reserve.

The central bank has said that as part of its stress-testing

exercise to ensure banks are ready to navigate trouble, financial

firms must take into account severe weather events. A recent San

Francisco Fed paper said banks should get credit for lending that

helps ensure resilience against climate change events.

Write to Michael S. Derby at michael.derby@wsj.com

(END) Dow Jones Newswires

October 01, 2019 16:22 ET (20:22 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

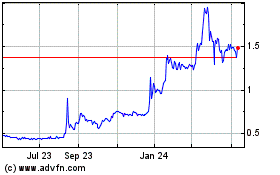

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

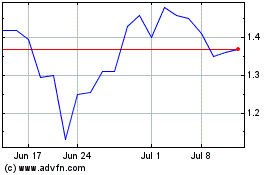

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Apr 2023 to Apr 2024