SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to § 240.14a-12

|

NOVABAY PHARMACEUTICALS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

NOVABAY PHARMACEUTICALS, INC.

2000 Powell Street, Suite 1150

Emeryville, California 94608

|

|

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

|

|

|

Date:

|

Time:

|

Place:

|

|

October 9, 2019

|

5:00 p.m. PDT

|

Virtual meeting; please visit

www.meetingcenter.io/242942723

|

To the Stockholders of NovaBay Pharmaceuticals, Inc.:

You are cordially invited to attend the 2019 Special Meeting of Stockholders (the “Special Meeting”) of NovaBay Pharmaceuticals, Inc., a Delaware corporation. The Special Meeting will be a virtual meeting of stockholders. Registered holders, and beneficial stockholders who register for the meeting in advance, will be able to participate in the meeting, vote, and submit questions during the meeting via live webcast by visiting www.meetingcenter.io/242942723. If you are a registered holder, a secure control number that will allow you to attend the meeting electronically can be found on your proxy card. If you hold your shares in the name of a broker, bank or other holder of record, you may either: (i) vote in advance of the meeting by contacting your broker and attend the virtual meeting as a guest; or (ii) register to attend the virtual meeting as a stockholder in advance (allowing you to both vote and ask questions during the meeting) by following the instructions in the Proxy Statement and at www.investorvote.com/NBY.

The Special Meeting will be held for the purposes of the following:

|

|

1.

|

To approve both (i) the conversion of 2,700,000 shares of our Series A Convertible Preferred Stock, par value $0.01, into 2,700,000 shares of our common stock, par value $0.01, and (ii) the 2,700,000 shares of our common stock that may be issued upon the exercise of 2,700,000 warrants granted to the purchasers of the Series A Convertible Preferred Stock, in accordance with the stockholder approval requirements of NYSE American LLC Company Guide Section 713(a).

|

|

|

2.

|

To adjourn the Special Meeting, if necessary or appropriate, to establish a quorum to permit further solicitation of proxies if there are not sufficient votes cast at the time of the Special Meeting in favor of Proposal One.

|

The record date for the Special Meeting is September 9, 2019. Only stockholders of record at the close of business on that date are entitled to notice of, and may vote at, the virtual Special Meeting or any adjournment or postponement thereof. This Notice of this Special Meeting of Stockholders, the Proxy Statement, proxy card and voting instructions are being mailed or distributed and made available on or about September 13, 2019.

A list of stockholders entitled to vote at the Special Meeting will be available at NovaBay Pharmaceuticals, Inc., 2000 Powell Street, Suite 1150, Emeryville, California 94608, for a period of ten (10) days prior to the Special Meeting. If you want to inspect the stockholder list, please contact our Corporate Secretary at (510) 899-8800. The stockholder list will also be available during the virtual Special Meeting through the following secure link www.meetingcenter.io/242942723. If you are a registered stockholder, or beneficial stockholder who registered for the meeting in advance, a secure control number included on your proxy card will allow you to view this list.

|

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on Wednesday, October 9, 2019.

The Proxy Statement to security holders is available at www.edocumentview.com/NBY (for all stockholders).

|

|

September 13, 2019

|

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

|

|

|

|

|

|

Paul E. Freiman

Chairman of the Board

|

|

|

You are cordially invited to attend, via live webcast, the virtual Special Meeting. Your vote is important. We encourage you to promptly vote your shares either by telephone, over the Internet or by completing, signing, dating and returning your proxy card, which contains instructions on how you would like your shares to be voted. Please submit your proxy regardless of whether you will attend the Special Meeting. This will help us ensure that your shares are represented at the Special Meeting. For those who receive proxy materials by mail, a return envelope (which is postage prepaid if mailed in the United States) has been provided for your convenience. Signing your proxy will not prevent you from voting electronically should you be able to attend the virtual Special Meeting, but will assure that your vote is counted if for any reason you are unable to attend. Voting instructions are printed on your proxy card and included in the accompanying Proxy Statement. Please note, however, that if your shares are held of record by a broker, bank or other nominee, you may either (i) vote in advance of the meeting by contacting your broker and attend the virtual meeting as a guest; or (ii) register to attend the virtual meeting as a stockholder in advance (allowing you to both vote and ask questions during the meeting) by following the instructions in the Proxy Statement and at www.investorvote.com/NBY.

|

TABLE OF CONTENTS

|

|

Page

|

|

PROXY STATEMENT FOR THE 2019 SPECIAL MEETING OF STOCKHOLDERS

|

1

|

|

Purpose of Meeting

|

1

|

|

Attendance at the Special Meeting

|

1

|

|

Voting; Quorum

|

2

|

|

Required Votes

|

2

|

|

Effect of Not Voting

|

2

|

|

Voting Methods

|

3

|

|

Revoking Proxies

|

4

|

|

Solicitation

|

4

|

|

Results of the Voting at the Special Meeting

|

4

|

|

PROPOSAL ONE: APPROVAL OF THE conversion of our Series A Convertible PREFERRED Stock and issuance of common stock upon the exercise of the preferred warrants

|

5

|

|

Summary of the Preferred Private Placement

|

5

|

|

Summary of the RD Offering

|

6

|

|

Consequences of the Preferred Private Placement

|

6

|

|

Stockholder Approval

|

7

|

|

Recommendation of Our Board of Directors

|

7

|

|

PROPOSAL TWO: ADJOURNMENT OF THE SPECIAL MEETING

|

8

|

|

Summary

|

8

|

|

Stockholder Approval

|

8

|

|

Recommendation of Our Board

|

8

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

9

|

|

DEADLINE FOR RECEIPT OF STOCKHOLDER PROPOSALS OR NOMINATIONS

|

11

|

|

Due Date For Stockholder Proposals and Nominations For Next Year’s Annual Meeting

|

11

|

|

HOUSEHOLDING OF PROXY MATERIALS

|

12

|

|

OTHER BUSINESS

|

12

|

NOVABAY PHARMACEUTICALS, INC.

2000 Powell Street, Suite 1150

Emeryville, California 94608

____________

PROXY STATEMENT

FOR THE 2019 SPECIAL MEETING OF STOCKHOLDERS

____________

This proxy statement (the “Proxy Statement”), the accompanying Notice of the Special Meeting of Stockholders (the “Notice”) and the enclosed proxy card are being furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of NovaBay Pharmaceuticals, Inc., a Delaware corporation (“NovaBay,” the “Company,” “we,” “our,” or “us”), to be voted at the 2019 Special Meeting of Stockholders to be held on Wednesday, October 9, 2019 (the “Special Meeting”), and at any adjournment or postponement of the Special Meeting. This Special Meeting will be held at 5:00 p.m. Pacific Time and will be a virtual meeting of stockholders. You will be able to participate in the Special Meeting, vote, and submit your questions during the meeting via live webcast by visiting www.meetingcenter.io/242942723. You must have your 15-digit control number to enter and participate in the virtual meeting. If you are a registered holder, your control number is provided by NovaBay on your proxy card. If your shares are held in the name of a broker, bank or other holder of record, you may either (i) vote in advance of the meeting by contacting your broker and attend the virtual meeting as a guest; or (ii) register to attend the virtual meeting as a stockholder in advance (allowing you to both vote and ask questions during the meeting) by following the instructions below under “Attendance at the Special Meeting” and at www.investorvote.com/NBY. This Proxy Statement and the proxy card are being delivered by mail on or about September 13, 2019, to stockholders of record as of September 9, 2019.

Purpose of Meeting

The specific proposals to be considered and acted upon at the Special Meeting are summarized in the Notice and are described in more detail in this Proxy Statement.

Attendance at the Special Meeting

As permitted by Delaware law and our Bylaws, the Special Meeting will be held solely as a virtual meeting live via the Internet. You will be able to attend the Special Meeting via live webcast by visiting the Company’s virtual meeting website (www.meetingcenter.io/242942723) at the meeting time. Upon visiting the meeting website, you will be prompted to enter your 15-digit control number provided on your proxy card if you receive proxy materials by mail. Your unique control number allows us to identify you as a stockholder and will enable you to securely log on, vote and submit questions during the Special Meeting on the meeting website.

Please note that if you hold your shares in the name of a broker, bank or other holder of record, in order to join the virtual meeting as a stockholder and be able to vote and submit questions during the Special Meeting, you will need to contact your broker, bank or other holder to receive proof of your beneficial ownership and submit such proof, along with your name and email information, to Computershare in advance of the Special Meeting no later than 5:00 pm ET on October 9, 2019, which may be submitted via email to legalproxy@computershare.com, via facsimile to (781) 575-4647 or via mail to Computershare, Company Legal Proxy, P.O. Box 43001, Providence, Rhode Island 02940-3001. Upon receipt of such beneficial ownership proof, Computershare will then register you for attendance at the virtual meeting and provide you with registration information needed to join the meeting as a stockholder.

Alternatively, if you hold your shares in the name of a broker, bank or other holder of record, you may vote in advance of the virtual meeting by contacting your holder of record (please see “Voting Methods” below) and join the virtual meeting as a guest (without the ability to vote or ask questions) without advance registration.

Voting; Quorum

The record date for determining those stockholders who are entitled to notice of, and to vote at, the Special Meeting has been fixed as September 9, 2019 (“Record Date”). Only stockholders of record at the close of business on the Record Date are entitled to notice of, and to vote at, the Special Meeting and any adjournment or postponement thereof. Each stockholder is entitled to one (1) vote for each share of our common stock held by such stockholder as of the Record Date. As of the Record Date, 25,201,850 shares of our common stock were outstanding, and 2,700,000 shares of our Series A Convertible Preferred Stock were outstanding. The holders of the Series A Convertible Preferred Stock have no voting rights for either Proposal One or Proposal Two and therefore will not vote at the Special Meeting.

The presence at the Special Meeting, either in person or by proxy duly authorized, of holders of a majority of the voting power of all the outstanding shares of our common stock entitled to vote will constitute a quorum for the transaction of business at the Special Meeting. Stockholders who log on and vote at our virtual meeting of stockholders with their 15-digit control number (which is either provided by NovaBay on your proxy card, or obtained from Computershare by those who hold their shares in the name of a broker, bank or other holder of record and register in advance of the Special Meeting) are considered present in person at the meeting. Abstentions are counted as present for purposes of determining the presence of a quorum. Shares of our common stock that are represented by broker non-votes will not be counted as shares present for purposes of determining the presence of a quorum at the Special Meeting. A broker non-vote occurs when the broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because such broker, bank or other nominee does not have discretionary voting power to vote on that proposal without specific voting instructions from the beneficial owner. Proposal One and Proposal Two described in this Proxy Statement are both non-discretionary items. If a quorum is not present, the Special Meeting will be adjourned until a quorum is obtained.

All votes will be tabulated by the inspector of election appointed for the Special Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Broker non-votes and votes marked “WITHHELD” will not be counted towards the tabulation of votes cast on such proposals presented to the stockholders.

Required Votes

Proposal One (the approval of (i) the conversion of 2,700,000 shares of our Series A Convertible Preferred Stock to common stock and (ii) the 2,700,000 shares of our common stock that may be issued upon the exercise of 2,700,000 warrants granted to the purchasers of the Series A Convertible Preferred Stock, in accordance with the stockholder approval requirements of NYSE American Company Guide Section 713(a)) requires “FOR” votes from a majority of the shares present and entitled to vote at the Special Meeting. Abstentions will have the same effect as “AGAINST” votes. Broker non-votes will have no effect. If this Proposal One is not approved by stockholders, the Series A Convertible Preferred Stock will not convert to common stock and the Purchasers will not be able to exercise the Preferred Warrants (as defined below).

Proposal Two (adjournment of the Special Meeting, if necessary or appropriate, to establish a quorum or to permit further solicitation of proxies if there are not sufficient votes cast at the time of the Special Meeting in favor of Proposal One) requires “FOR” votes from a majority of the shares present in person or represented by proxy and entitled to vote at the Special Meeting. Abstentions will have the same effect as “AGAINST” votes. Broker non-votes will have no effect.

Effect of Not Voting

Stockholder of Record; Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, over the Internet or in person at the Special Meeting, your shares will not be voted.

Beneficial Owner; Shares Registered in the Name of a Broker, Bank or Other Nominee

If you are a beneficial owner and do not instruct your broker, bank or other nominee how to vote your shares, the question of whether your broker, bank or other nominee will still be able to vote your shares depends on whether the New York Stock Exchange (“NYSE”) deems the particular proposal to be a “routine” matter. Brokers, banks or other nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management supported. Both Proposal One and Proposal Two are deemed non-routine matters. Accordingly, your broker, bank or other nominee may not vote your shares on either Proposal One or Proposal Two.

Voting Methods

If you were a registered stockholder on the Record Date, you may vote your shares at the virtual Special Meeting or by visiting the Company’s online voting website www.meetingcenter.io/242942723, which contains voting instructions as well as how to demonstrate proof of stock ownership. The meeting starts at 5:00 p.m. (Pacific Time). You may also vote your shares by telephone by calling (toll free within the U.S. and Canada) 1-800-652-VOTE (8683) and following the voting instructions read to you by the automated operator.

Upon visiting the meeting website or calling the call-in telephone line, you will be prompted to enter your 15-digit control number provided to you on your proxy card. Your unique control number allows us to identify you as a stockholder and will enable you to securely cast votes.

Internet and telephone voting facilities for stockholders of record will be available 24 hours a day beginning at 12:01 a.m. Pacific Time on September 13, 2019. Internet and telephone voting will close promptly at 5:00 p.m. Pacific Time on Wednesday, October 9, 2019. After this, you will only be able to vote by attending the Special Meeting via live webcast, as described above. After voting is closed during the Special Meeting, you will no longer have the ability to vote your shares for the specific proposals considered at the Special Meeting.

If you are a registered stockholder as of the Record Date and hold your shares in more than one fund or other affiliated investment vehicle, you will receive separate voting credentials for each such entity that is a record holder of shares of our common stock. Please be sure to log on separately for each fund in order to cast all votes that you are entitled to cast at the Special Meeting.

If your shares are held in the name of a broker, bank or other holder of record, you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers. Please note, however, that any beneficial owner who intends to vote during the Special Meeting (as opposed to in advance of the meeting) will need to register in advance with Computershare, as outlined under “Attendance at the Special Meeting” above and at www.investorvote.com/NBY.

If you receive proxy materials by mail or if you request paper copies of the proxy materials, you can vote by mail by marking, dating, signing and returning your proxy card in the postage-paid envelope. Further instructions on how to vote by mail are included on the proxy card. Only proxy cards that have been signed, dated, and timely returned will be counted towards the quorum and entitled to vote.

If your proxy card does not specify how the shares represented thereby are to be voted, the proxy will be voted “FOR” the approval of Proposal One and Proposal Two described in the Notice and this Proxy Statement.

The proxy card also grants the proxy holders discretionary authority to vote on any other business that may properly come before the Special Meeting. We have not been notified by any stockholder of his or her intent to present a stockholder proposal at the Special Meeting.

Revoking Proxies

If your shares are held in your name, you may revoke or change your vote at any time before the Special Meeting by (i) submitting another proxy on a later date on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the Special Meeting will be counted), or (ii) attending the Special Meeting live via webcast and voting during the meeting (simply attending the virtual meeting will not, by itself, revoke your proxy), or (iii) by filing a notice of revocation or another signed proxy card with a later date with our Corporate Secretary, Mr. Justin Hall, at our principal executive offices at 2000 Powell Street, Suite 1150, Emeryville, California 94608.

Solicitation

NovaBay will bear the entire cost of proxy solicitation, including the costs of preparing, assembling, printing and mailing this Proxy Statement, the Notice, the proxy card and any additional solicitation materials furnished to the stockholders. Copies of these materials will be furnished to brokers, banks or other nominees holding shares in their names that are beneficially owned by others so they may forward these materials to such beneficial owners. In addition, we may reimburse such persons for their reasonable expenses in forwarding the solicitation materials to the beneficial owners. The original solicitation of proxies by mail may be supplemented by a solicitation by personal contact, telephone, facsimile, email or any other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services.

Results of the Voting at the Special Meeting

Preliminary voting results will be announced at the Special Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four (4) business days after the Special Meeting.

MATTERS TO BE CONSIDERED AT THE SPECIAL MEETING

____________

PROPOSAL ONE:

APPROVAL OF THE conversion of our Series A Convertible PREFERRED Stock and issuance of common stock upon the exercise of the preferred warrants

Our common stock, par value $0.01 (the “Common Stock”) is currently listed on the NYSE American LLC. Section 713(a) of NYSE American LLC Company Guide (the “Company Guide”) requires stockholder approval in connection with any transaction involving the issuance, or potential issuance, of Common Stock or securities convertible into Common Stock, equal to 20% or more presently outstanding stock for less than book or market value (whichever is greater).

Summary of the Preferred Private Placement

On August 13, 2019, the Company issued and sold (i) 2,700,000 shares of the Company’s Series A Non-Voting Convertible Preferred Stock (the “Preferred Stock”) that will automatically convert into 2,700,000 shares of Common Stock (the “Conversion Shares”) upon the approval of the Company’s stockholders following such issuance at a ratio of 1:1, and (ii) Common Stock purchase warrants (the “Preferred Warrants”) exercisable for 2,700,000 shares of Common Stock. The Preferred Stock and Preferred Warrants were sold to three accredited investors (the “Purchasers”) for an aggregate purchase price of $2.7 million (the “Preferred Private Placement”) pursuant to a Securities Purchase Agreement (the “Purchase Agreement”).

The Preferred Stock does not have voting rights but does have such other rights and preferences as more fully described under “Description of Private Placement Securities” beginning on page S-11 of the Company’s prospectus supplement filed with the Securities and Exchange Commission on August 9, 2019. Upon stockholder approval, the Preferred Warrants will be exercisable at an exercise price of $1.15 per share, subject to adjustment, and will remain exercisable for five and a half (5.5) years from the date of their issuance.

The Purchasers in the Preferred Private Placement include the following: Hai Dong Pang, who purchased Preferred Stock convertible into 800,000 Conversion Shares and Preferred Warrants exercisable for 800,000 shares of Common Stock; Xiao Rui Liu, who purchased Preferred Stock convertible into 400,000 Conversion Shares and Preferred Warrants exercisable for 400,000 shares of Common Stock; and Ping Huang, who purchased Preferred Stock convertible into 1,500,000 Conversion Shares and Preferred Warrants exercisable for 1,500,000 shares of Common Stock.

China Kington Asset Management (“China Kington”) served as placement agent for the Preferred Private Placement and received a commission equal to six percent (6%) of the gross proceeds of the securities sold to the Purchasers at the closing of the Preferred Private Placement.

The Purchasers are accredited investors in accordance with applicable securities rules and regulations promulgated thereunder. The Preferred Stock, Conversion Shares, Preferred Warrants and Common Stock underlying the Preferred Warrants have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. We relied on the private placement exemption from registration provided by Section 4(a)(2) of the Securities Act and by Rule 506 of Regulation D, and in reliance on similar exemptions under applicable state laws.

The Purchasers are already stockholders of the Company. On June 17, 2019, we sold an aggregate of 1,371,427 shares of Common Stock and warrants exercisable for 1,371,427 Shares to the Purchasers for an aggregate purchase price of $2,400,000 (the “June Private Placement”). For every one (1) Share purchased at $1.75 per share, each Purchaser received a warrant to purchase one share of Common Stock, with such warrants having a one (1)-year term and an exercise price of $0.87, callable by the Company if the closing price of the Common Stock, as reported on the NYSE American, is $1.00 or greater. Mr. Liu purchased 571,428 shares and 571,428 warrants, Hai Dong Pang purchased 228,571 shares and 228,571 warrants, and Ping Huang purchased 571,428 shares and 571,428 warrants. China Kington also served as placement agent in the June Private Placement and received a commission equal to six percent (6%) of the gross proceeds received by the Company at the closing of the June Private Placement.

The total number of shares of Common Stock potentially issuable in connection with the Preferred Private Placement is 5,400,000 shares of Common Stock (2,700,000 shares upon conversion of the Preferred Stock and 2,700,000 shares upon the exercise of the Preferred Warrants), or 21.4% of the total number of shares of Common Stock currently outstanding. As a result of the total number of shares of Common Stock issued and potentially issued in connection with the Preferred Private Placement exceeding 20% of our Common Stock outstanding, stockholder approval is required under the Company Guide.

Pursuant to the Company Guide, derivative securities issued in excess of 20% of shares of Common Stock currently outstanding, such as the Preferred Stock and the Preferred Warrants issued in the Preferred Private Placement, may be issued prior to obtaining stockholder approval, but such derivative securities may not be converted into or exercised for shares of Common Stock until such time, if ever, that stockholder approval is obtained. Therefore, if stockholder approval is not obtained for the issuance of Common Stock upon conversion of the Preferred Stock and exercise of the Preferred Warrants, the Preferred Stock will not convert into Common Stock and the Preferred Warrants will not be exercisable for Common Stock.

Pursuant to this Proposal One, we are asking our stockholders to approve the conversion of the Preferred Stock into Common Stock and the issuance of Common Stock upon the exercise of the Preferred Warrants, in accordance with Section 713(a) of the Company Guide.

Summary of the RD Offering

Concurrently with the Preferred Private Placement, on August 13, 2019, the Company sold (i) an aggregate of 4,198,566 shares of Common Stock in a registered direct offering and (ii) unregistered Common Stock purchase warrants to purchase up to an aggregate of 4,198,566 shares of Common Stock upon exercise, for aggregate gross proceeds of approximately $4.2 million (the “RD Offering”). Ladenburg Thalmann & Co. Inc. served as placement agent in the RD Offering.

Consequences of the Preferred Private Placement

Dilutive Effect of Issuances of Common Stock. Upon stockholder approval, the Preferred Stock will automatically convert into Common Stock with Messrs. Liu, Pang and Huang then owning approximately 3.5%, 3.7% and 7.4%, respectively, of the Company’s outstanding shares of Common Stock, which includes the Common Stock the Purchasers bought in the June Private Placement and the Common Stock upon the conversion of the Preferred Stock but does not include the exercise of any warrants held by the Purchasers.

Exercisability of the Warrants. Pursuant to the terms of the Preferred Warrants, upon stockholder approval of this Proposal One, the Purchasers have the right to exercise the Preferred Warrants for Common Stock. Messrs. Liu, Pang and Huang will be entitled to exercise the Preferred Warrants and own an additional 400,000, 800,000 and 1,500,000 shares of Common Stock, subject to a 4.99% beneficial ownership limitation (or, at the election of a Purchaser with notice to the Company prior to exercising the Preferred Warrants, 9.99%).

Rights of Investors. If stockholder approval of Proposal One is received, the shares of Common Stock issued upon the conversion of the Preferred Stock and the shares of Common Stock issuable upon the exercise of the Preferred Warrants, when issued, shall have the same privileges and rights as all other shares of our Common Stock that are currently issued and outstanding, including the right to vote on all matters presented to the holders of our Common Stock. The Purchasers are also entitled to certain registration rights that will provide for the resale of the shares of Common Stock underlying the Preferred Stock and Preferred Warrants.

Stockholder Approval

The affirmative vote of the holders of a majority of the shares of our Common Stock present or represented and entitled to vote at the Special Meeting is required for approval of Proposal One. If approved by the stockholders, the Preferred Stock will automatically convert into Common Stock and the Purchasers will be entitled to exercise the Preferred Warrants for Common Stock. If the conversion and exercise is not approved by stockholders, the Preferred Stock will not convert to Common Stock and the Purchasers will not be able to exercise the Preferred Warrants.

Recommendation of Our Board of Directors

For the reasons described in this Proxy Statement, our Board recommends unanimously that you vote “FOR” the approval of the conversion of the Preferred Stock and issuance of Common Stock upon the exercise of the Preferred Warrants.

PROPOSAL TWO:

ADJOURNMENT OF THE SPECIAL MEETING

Summary

A proposal will be submitted to the stockholders at the Special Meeting to approve adjournment of the Special Meeting, if necessary or appropriate, to establish a quorum or to solicit additional proxies in the event that there are not sufficient votes at the time of the Special Meeting to approve Proposal One. Any adjournment of the Special Meeting may be made without notice, other than by an announcement made at the Special Meeting. Any adjournment of the Special Meeting for the purpose of soliciting additional proxies will allow stockholders who have already sent in their proxies to revoke them at any time prior to the time that the proxies are used.

Stockholder Approval

The affirmative vote of the holders of a majority of the shares of our Common Stock present or represented and entitled to vote at the Special Meeting is required for approval of Proposal Two.

Recommendation of Our Board of Directors

Our Board recommends unanimously that you cast your vote “FOR” the approval of the adjournment of the Special Meeting, if necessary or appropriate, to establish a quorum or to solicit additional proxies in the event that there are not sufficient votes at the time of the Special Meeting to approve Proposal One.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table indicates information as of September 9, 2019, regarding the ownership of our Common Stock by:

● each person who is known by us to own more than 5.0% of our shares of Common Stock;

● each of our senior executive officers who are NEOs under SEC proxy rules;

● each of our directors; and

● all of our directors and executive officers as a group.

The percentage of shares beneficially owned is based on 25,201,850 shares of Common Stock outstanding as of September 9, 2019. Except as indicated in the footnotes to this table, and as affected by applicable community property laws, all persons listed have sole voting and investment power for all shares shown as beneficially owned by them and no shares are pledged.

|

Name and Address of Beneficial Owner(1)

|

|

Number of

Shares

Beneficially

Owned

|

|

|

Percent

of Class

|

|

|

Beneficial Owners Holding More Than 5.0% (other than Executive Officers and Directors)

|

|

|

|

|

|

|

|

|

|

Mr. Jian Ping Fu(2)

|

|

|

5,302,350

|

|

|

21.0%

|

|

|

11 Williams Road

|

|

|

|

|

|

|

|

|

|

Mt. Eliza, Melbourne VIC 3930

|

|

|

|

|

|

|

|

|

|

Australia

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

China Pioneer Pharma Holdings Limited(3)

|

|

|

5,188,421

|

|

|

20.6%

|

|

|

190 Elgin Avenue, George Town,

|

|

|

|

|

|

|

|

|

|

Grand Cayman, Cayman Islands KY1-9005

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Empery Asset Management, LP(4)

|

|

|

2,098,566

|

|

|

8.3%

|

|

|

1 Rockefeller Plaza, Suite 1205

|

|

|

|

|

|

|

|

|

|

New York, New York 10020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Armistice Capital Master Fund Ltd.(5)

|

|

|

1,747,944

|

|

|

6.9%

|

|

|

20 Genesis Close

|

|

|

|

|

|

|

|

|

|

P.O. Box 314

|

|

|

|

|

|

|

|

|

|

Grand Cayman KY1-1104, Cayman Islands

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Officers and Directors

|

|

|

|

|

|

|

|

|

|

Justin M. Hall, Esq.(6)

|

|

|

199,390

|

|

|

|

*

|

|

|

Jason Raleigh(7)

|

|

|

37,111

|

|

|

|

*

|

|

|

Paul E. Freiman, Ph.D.(8)

|

|

|

85,009

|

|

|

|

*

|

|

|

Xinzhou (Paul) Li(3),(9)

|

|

|

25,248

|

|

|

|

*

|

|

|

Gail Maderis, M.B.A.(10)

|

|

|

84,211

|

|

|

|

*

|

|

|

Xiaopei (Ray) Wang

|

|

|

—

|

|

|

|

*

|

|

|

Mijia (Bob) Wu, M.B.A.(11)

|

|

|

35,245

|

|

|

|

*

|

|

|

Todd Zavodnick, M.B.A.(12)

|

|

|

53,699

|

|

|

|

*

|

|

|

All directors and executive officers as a group (8 persons)

|

|

|

519,913

|

|

|

2.0%

|

|

________________

*Less than one percent (1%).

|

(1)

|

The address for each director and officer of NovaBay listed is c/o NovaBay Pharmaceuticals, Inc., 2000 Powell Street, Suite 1150, Emeryville, CA 94608. Number of shares beneficially owned and percent of class is calculated in accordance with SEC rules. A beneficial owner is deemed to beneficially own shares the beneficial owner has the right to acquire within 60 days of September 9, 2019. For purposes of calculating the percent of class held by a single beneficial owner, the shares that such beneficial owner has the right to acquire within 60 days of September 9, 2019 are also deemed to be outstanding; however, such shares are not deemed to be outstanding for purposes of calculating the percentage ownership of any other beneficial owner.

|

|

(2)

|

Mr. Fu holds sole voting power and sole investment power over all 5,302,350 shares.

|

|

(3)

|

Director Xinzhou (Paul) Li is Chairman and Executive Director of China Pioneer Pharma and Director of Pioneer Hong Kong. Mr. Li disclaims beneficial ownership of the shares of the Company Common Stock held by China Pioneer Pharma. China Pioneer Pharma and Pioneer Hong Kong (by virtue of its indirect ownership by China Pioneer Pharma), share voting power and share investment power over the 5,188,421 shares. Pioneer Hong Kong is a wholly-owned subsidiary of China Pioneer Pharma. The address for China Pioneer Pharma is: Flat 2605, 26/F Trendy Centre, 682 Castle Peak Road, Lai Chi Kok, Kowloon, Hong Kong.

|

|

(4)

|

Based upon information contained in the Schedule 13G filed by Empery Asset Management, LP (“Empery”) with the SEC on August 15, 2019, Empery beneficially owned 2,098,566 shares of Common Stock as of August 15, 2019, with sole voting power over 0 shares, shared voting power over 2,098,566 shares, sole dispositive power over 0 shares and shared dispositive power over 2,098,566 shares. Empery shares such voting and dispositive power with Empery Tax Efficient II, LP (as to 1,293,847 of the shares), Ryan M. Lane and Martin D. Hoe, each with the same address as Empery. Empery also beneficially owns warrants exercisable for 2,098,566 shares of Common Stock which are not reflected in the above table as pursuant to the terms of such warrants Empery is prohibited from exercising such warrants while it beneficially owns more than 4.99% of the Company’s outstanding shares of Common Stock.

|

|

(5)

|

Based upon information contained in the Schedule 13G filed by Armistice Capital Master Fund Ltd. (“Armistice”) with the SEC on August 19, 2019, Armistice beneficially owned 1,747,944 shares of Common Stock as of August 19, 2019, with sole voting power over 0 shares, shared voting power over 1,747,944 shares, sole dispositive power over 0 shares and shared dispositive power over 1,747,944 shares. Armistice shares such voting and dispositive power with Armistice Capital, LLC and Steven Boyd, both with the following address: 510 Madison Avenue, 7th Floor, New York, New York 10022. Armistice also beneficially owns warrants exercisable for 2,100,000 shares of Common Stock which are not reflected in the above table as pursuant to the terms of such warrants Armistice is prohibited from exercising such warrants while it beneficially owns more than 4.99% of the Company’s outstanding shares of Common Stock.

|

|

(6)

|

Includes (i) 50,905 shares of Common Stock held directly by Mr. Hall (with sole voting power over 50,905 shares, shared voting power over no shares, sole investment power over 50,905 shares and shared investment power over no shares), and (ii) 148,485 shares issuable upon exercise of outstanding options which are exercisable as of September 9, 2019 or within 60 days after such date.

|

|

(7)

|

Includes (i) 33,155 shares of Common Stock held directly by Mr. Raleigh (with sole voting power over 33,155 shares, shared voting power over no shares, sole investment power over 33,155 shares and shared investment power over no shares), and (ii) 3,956 shares issuable upon exercise of outstanding options which are exercisable as of September 9, 2019 or within 60 days after such date.

|

|

(8)

|

Includes (i) 2,311 shares held by the Paul Freiman and Anna Mazzuchi Freiman Trust, of which Mr. Freiman and his spouse are trustees (with sole voting power over 625 shares, shared voting power over 1,061 shares, sole investment power over no shares and shared investment power over 1,686 shares), and (ii) 82,697 shares issuable upon exercise of outstanding options which are exercisable as of September 9, 2019, or within 60 days after such date.

|

|

(9)

|

Reflects 25,248 shares issuable upon exercise of outstanding options which are exercisable as of September 9, 2019, or within 60 days after such date.

|

|

(10)

|

Reflects 84,211 shares issuable upon exercise of outstanding options which are exercisable as of September 9, 2019, or within 60 days after such date. The right to exercise these stock options is held by the Gail J. Maderis Revocable Trust dated April 7, 2013.

|

|

(11)

|

Reflects 35,245 shares issuable upon exercise of outstanding options which are exercisable as of September 9, 2019, or within 60 days after such date. As Non-Executive Director of China Pioneer Pharma, Mr. Wu disclaims beneficial ownership of the shares of the Company Common Stock held by China Pioneer Pharma and Pioneer Hong Kong. See Note (2) above for shares of the Company owned by China Pioneer Pharma and Pioneer Hong Kong.

|

|

(12)

|

Reflects 53,699 shares issuable upon exercise of outstanding options which are exercisable as of September 9, 2019, or within 60 days after such date.

|

DEADLINE FOR RECEIPT OF

STOCKHOLDER PROPOSALS OR NOMINATIONS

Due Date For Stockholder Proposals and Nominations For Next Year’s Annual Meeting

Under applicable SEC rules, to be considered for inclusion in our proxy materials next year, your proposal must be submitted by December 21, 2019; however, if NovaBay’s 2020 Annual Meeting of Stockholders is held on a date more than 30 calendar days from May 30, 2020, then the deadline will be a reasonable time prior to the time we begin to print, mail or electronically deliver our proxy materials. If notice is received after December 21, 2019 it will be considered untimely, and we will not be required to present the matter at the stockholders meeting. All stockholder proposals must comply with applicable rules and regulations adopted by the SEC.

Pursuant to our Bylaws, if you wish to submit a proposal to be included in next year’s proxy materials or nominate a director, you must do so no earlier than the close of business on the 120th day, and not later than the close of business on the 90th day, prior to the first anniversary of the preceding year’s annual meeting (for next year’s 2020 annual meeting, these dates would be January 31, 2020 and March 1, 2020, respectively); provided, however, that in the event that the date of the 2020 Annual Meeting of Stockholders is held more than thirty (30) days prior to or more than thirty (30) days after May 30, 2020, your notice must be delivered not earlier than the close of business on the 120th day prior to the 2020 Annual Meeting of Stockholders and not later than the close of business on the later of the 90th day prior to the 2020 Annual Meeting of Stockholders or the 10th day following the day on which public announcement of the date of the 2020 Annual Meeting of Stockholders is first made. Stockholders are also advised to review the Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.

Stockholder proposals must be in writing and should be addressed to our Corporate Secretary, at our principal executive offices at 2000 Powell Street, Suite 1150, Emeryville, California 94608. It is recommended that stockholders submitting proposals direct them to our Corporate Secretary and utilize certified mail, return receipt requested, to provide proof of timely receipt. The presiding officer of the Annual Meeting reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements, including conditions set forth in the Bylaws and conditions established by the SEC.

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers, banks or other nominees) to satisfy the delivery requirements for proxy statements with respect to two (2) or more stockholders sharing the same address (and who do not receive electronic delivery of proxy materials) by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

For those who receive proxy materials by mail, a single proxy statement may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker, bank or other nominee or NovaBay that it will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you notify your broker, bank or other nominee or NovaBay that you no longer wish to participate in “householding.” If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement in the future, you may (1) notify your broker, bank or other nominee or (2) direct your written request to our Corporate Secretary, NovaBay Pharmaceuticals, Inc., 2000 Powell Street, Suite 1150, Emeryville, California 94608, (510) 899-8800. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request “householding” of their communications should contact their broker, bank or other nominee or NovaBay using the above information. In addition, NovaBay will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of this Proxy Statement to a stockholder at a shared address to which a single copy of the documents was delivered.

OTHER BUSINESS

The Board is not aware of any other matter which will be presented for action at the Special Meeting other than the matters set forth in this Proxy Statement. If any other matter requiring a vote of the stockholders arises, it is intended that the proxy holders will vote the shares they represent as the Board may recommend. The proxy grants the proxy holders discretionary authority to vote on any such other matters properly brought before the Special Meeting.

|

September 13, 2019

|

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paul E. Freiman

Chairman of the Board

|

|

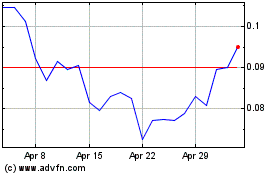

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Aug 2024 to Sep 2024

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Sep 2023 to Sep 2024