Standard Life Settles Arbitration With Lloyds Banking Group

July 24 2019 - 3:02AM

Dow Jones News

By Ian Walker

Standard Life Aberdeen PLC (SLA.LN) said Wednesday that it has

settled arbitration with Lloyds Banking Group PLC (LLOY.LN), after

the bank lost its case in March to end an asset-management deal

between the two companies.

Under the new deal, Standard Life will manage about 35 billion

pounds ($43.6 billion) of assets on behalf of Lloyds until at least

April 2022. It will also get an upfront payment of GBP140 million

as compensation for loss of profit.

Lloyds said in February 2018 that it would pull GBP100 billion

in assets from Standard Life, with the majority being shifted to

Schroders PLC (SDR.LN) to cement a new wealth-management joint

venture. BlackRock Inc. (BLK) was also due to receive a GBP30

billion portion of the assets.

The U.K. bank justified ending the agreement before its 2022

deadline by saying the merger of Standard Life and Aberdeen Asset

Management left the combined entity in competition with its

Scottish Widows business. Standard Life disputed the claim and the

two parties entered dispute resolution.

In March, Standard Life said that a tribunal had ruled that

Lloyds didn't have the right to end the agreement between the two

parties and that it would continue to manage the assets while

considering its next steps.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

July 24, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

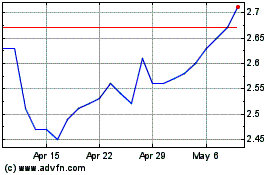

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Aug 2024 to Sep 2024

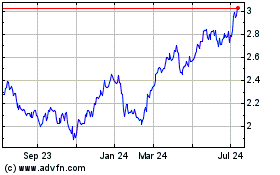

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Sep 2023 to Sep 2024