Filed by Carolina Financial Corporation

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to

Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Carolina Trust BancShares, Inc.

Commission File No.:

000-55683

[The following is a transcript of an investor call held on

July 15, 2019 in connection with the announcement of entry into an Agreement and Plan of Merger and Reorganization by and

between Carolina Financial Corporation and Carolina Trust BancShares, Inc.]

|

Carolina Financial Corp.

July 15, 2019

|

Corporate Speakers:

-

William Gehman; Carolina Financial Corporation; Executive VP & CFO

-

Jerold Rexroad; Carolina Financial Corporation; President, CEO & Director

Participants:

-

Catherine Mealor; Keefe, Bruyette, & Woods, Inc.; Research Division, MD and SVP

-

William Wallace; Raymond James & Associates, Inc.; Research Division, Research Analyst

Operator^ Good day, ladies and gentlemen, and welcome to the Carolina

Financial Corporation investor conference call. (Operator Instructions) As a reminder, this conference call may be recorded. I

would now like to introduce your host for today’s conference, Mr. William Gehman, Chief Financial Officer. Sir, you may begin.

William Gehman^ Thank you, operator, and welcome to the Carolina

Financial Corporation investor presentation of the acquisition of Carolina Trust Bancshares Inc. by Carolina Financial Corporation.

Please refer to Slides 2 and 3 regarding forward-looking statements,

non-GAAP measures and additional information about the merger. Now we’ll turn the call over to Jerry Rexroad, CEO of Carolina Financial

Corporation.

Jerold Rexroad^ Thank you, Bill. Very excited about the Carolina

Trust BancShares merger into Carolina Financial Corporation. This is something that we’ve been working on for quite some time,

and quite frankly, it’s something that we’re really excited about and believe over the long term will continue to add value to

the Carolina Financial Corporation shareholders.

If you go to Slide 4 and give you a quick update on just the 2 companies

individually, and then we’ll talk about more of the deal specifics as we go forward. Carolina Financial Corporation, at the end

of March 31, had $3.8 billion in total assets, $2.6 billion of that was in gross loans and $2.8 million of that was funded by deposits.

We had 2 subsidiaries, CresCom Bank has 61 offices located throughout

the Carolinas. Crescent Mortgage Company is a correspondent mortgage company that does business in 48 states.

In the quarter ended March 31, 2019, our operating return on assets

was 1.53%. Carolina Trust BancShares had assets of $621 million. They’re headquartered in Lincolnton, North Carolina, with offices

throughout the Charlotte MSA. Founded in 2000, with gross loans of $474 million and total deposits of $523 million.

They have 11 offices throughout that Charlotte MSA, and they had

completed a merger on January 1, 2019 that added 2 branches and $129 million in assets. If you exclude the merger-related expenses

in the first quarter, their return on average assets would have been 1.1% and it had -- their return on operating -- return on

average assets had been improving over the last year so -- and looked to continue to improve (inaudible) into the future.

A quick summary of the transaction. Each shareholder of Carolina

Trust will receive 0.3 shares of Carolina Financial over $10.57 in cash. After the merger is completed as expected, the Carolina

Financial shareholders will own approximately 90% of the stock consideration -- 90% of the shares, and the CART shareholders will

own approximately 10% of the shares.

The consideration mix for this transaction will be 10% cash and

90% stock. The implied purchase price using Friday’s closing price was $10.67 per share. That’s an implied tangible book value

per share of 168%, with a total deal value of $100.1 million.

We’re very excited to have Jonathan Reid joining our Board of Directors,

and that will give us a pro forma Board of 14 members. In addition, Jerry Ocheltree will be named President of CresCom Bank’s North

Carolina commercial banking operations, and we’re very excited to have Jerry as part of our senior management team.

Jerry has prior CEO experience before he was at Carolina Trust,

actually was the CEO of a bank approximately our size, and part of that, the CEO of a smaller bank. So very strong community bank

leadership experience, and we’re very excited to have him being added to our team.

The transaction is subject to approval by the Carolina Trust shareholders

as well as regulatory approvals. We expect the closing to be early in the first quarter of 2020, and we would expect to do the

system conversion in the latter part of the first quarter of 2020.

The -- strategically, this transaction, we believe, really continues

to add upon the story that Carolina Financial has really done over the last 5 years. It significantly expands our footprint into

the Charlotte MSA. We have just announced that we plan to do a branch in the southern part of Charlotte in the South Park area,

and this just perfectly fits the addition of our expansion into that market.

Jerry significantly adds to our management team, and we hope to

be able to add several other members of the Carolina Trust management team to our senior team. They had a very well-run organization

in the Carolina -- in the Charlotte market, and we believe that overall, our team together gets stronger.

EPS accretion of approximately 5% in 2021, while maintaining the

tangible book value earnback period of 2.8 years, and I’ll talk about that a little bit more later. And we believe that both teams

have very strong community bank credit cultures, and we operate with the same philosophy from the community banking perspective.

We always talk about our 7 value drivers. And this transaction,

we believe, just hits each one of the boxes: adds core earnings growth of 3.3% in 2020 and a little over 5% in 2021; continues

to increase our size and scale, which gives us stability to continue to scale our operations; good growth in transaction accounts.

Carolina Trust has had very good growth in their transaction accounts

over the last few years; they’re in a fabulous market; good strong loan growth over the last few years.

Of course, Carolina Financial Corporation is giving one of our stated

value drivers as being acquisitive and opportunist -- continues that, and we believe a very controlled manner in a very, very good

market. And then, Carolina Trust had very good asset quality, which of course, Carolina Financial does too.

When you look at Page 8 of the deck, you see the overall footprint

of the different branches. And I think you see that this fits in very nicely into our North Carolina franchise, giving us a 15th

deposit -- 15th largest deposit share in the Carolinas. And when you look at the Charlotte market in -- specifically on Page 9,

12 Fortune 1000 companies in Charlotte, a workforce growth since 2010 of 23%.

And I think this is the most important, the second highest growth

in numbers of small businesses. And being a community bank, that’s absolutely where we will focus our growth efforts. Markets that

are all exceeding the national growth rate.

If you look at the year-over-year deposit growth rate shown there

in the box in the bottom left, all the markets had very good deposit growth over the last year. And so we really believe this is

an excellent market to continue our growth as we go forward.

Page 10. This is, I think, one of the most important things that

we talk about as far as great markets. We are now in 8 of the top 25 growth markets in the Southeast. All of those markets, of

course, have significant higher growth than the national averages and Charlotte being #10.

And we now have really strong banking teams in all of these markets.

When you look at the national markets and the growth rate in the national markets, I’m not sure there’s too many banks in the (inaudible)

markets that can claim that there in 5 of the fastest growing markets nationally as well as quite frankly, having really good teams

in these markets.

Let’s take a few seconds to talk over the key merger assumptions

over on Page 12. We tried to give enough detail here to hope -- help everybody kind of understand the financial metric (inaudible)

behind this transaction. The growth credit and liquidity mark will be $7.2 million, and that does not include the acquired loans

that Carolina Trust had from their Clover transaction.

We do expect approximately $3.7 million of that $7.2 million to

be accreted back into income over 4 years. OREO, write-down of $400,000, expense savings expected to be approximately 28% of CART’s

pretax expense base. We expect 75% of that to be realized in 2020 and 100% to be realized thereafter.

Onetime merger costs of approximately $12.4 million on a pretax

basis, core deposit intangible is expected to be 2.25% on the nontime deposits, and that will be amortized on an accelerated method

over a 10-year period. In addition, we had a write-up of fixed assets of approximately $1.5 million.

Taking those key assumptions and giving there a quick summary of

the financial metrics of the transaction, we expect earnings to increase approximately 3.3% in 2020; 5.3% in 2021; tangible book

value dilution of approximately 2.5% or a little over $0.50 a share; tangible book value earnback period 2.8 years. However, had

we done the transaction using 100% stock, the earnback period would have been approximately 2.5 years.

After completion of the transaction, we expect pro forma capital

to be approximately 11.8%, on a tangible capital basis; leverage ratio about 12.5%; Tier 1 ratio of 15.5%; and total capital ratio

a little over 16%.

So it leaves us in a position to continue to look for acquisition

opportunities or should we find other attractive opportunities to utilize our capital, we still are in position to be able to do

that without really getting strained on capital metrics at all.

Page 14. We believe this transaction is very, very important to

our continued growth in the Carolinas, and it significantly enhances our presence in the Carolinas’ largest market. A combined

company of $4.5 billion in total assets with a market cap of approximately $850 million.

We believe it continues to position Carolina Financial to be one

of the most profitable banks in the Southeast with a premier core deposit franchise and a very strong commercial banking team.

Both companies share, I believe, a very strong community banking

focus in their operating philosophies, and we will look to make sure that we continue that as we put the 2 companies together in

the early next year.

It’s a financially attractive combination of 2 companies, and we

believe it continues to enhance our ability to get economies of scale. There’s an appendix that gives more information on Carolina

Trust, that’s on Page 16.

If you look at our loan and deposit compositions on Page 17, I think

you can see that we’re fairly similar in our balance sheets. And then if you look at Page 18, just some quick information on our

due diligence. We did look at approximately 60% of CART’s total loan portfolio.

Almost all the loans that were over $0.5 million or greater and

almost all the loans that were a nonaccrual or criticized were on the watch list. So we really focused on the higher-risk areas

and got, I think, very good coverage of the loan portfolio.

That due diligence was done completely by Carolina Financial bankers

that are primarily on our senior management team. CART does have $2.2 million of OREO at the end of March. Of course, Carolina

Financial had very small amount of OREO. So together, we still continue to have a very manageable position in other real estate

owned as we go into next year.

A little bit about the combined transaction on Page 19. I think

I’ve covered that pretty well as we’ve gone through this. And then a reconciliation of non-GAAP measures on Page 20. So thank you

for joining the call, very much appreciate each of you being on the call. And with that, I will go ahead and open it up for questions.

Operator^ (Operator Instructions) And your first question comes

from Catherine Mealor from KBW.

Catherine Mealor^ My first question was just a follow-up on the

capital management comments that you made, Jerry. Can you talk to us a little bit more about how you’re thinking about capital

from here?

I guess it’s kind of a 2-part question. One is would it be fair

to assume that you’re still going to be open to utilizing your buyback even as this deal was pending? And then the second to that

is you -- now with your excess capital, you’ve taken it over -- from over 12% now down to 11.8%.

As we move forward, how do you guys think about future M&A?

And how much cash you put in deals to try to leverage some of that to get more EPS accretion? And maybe how you kind of thought

about that balance with this deal as well?

Jerold Rexroad^ Yes, Catherine, good question. I think it’s fair

to say that we’ve been active in our repurchase plan. Since we’ve put it in place, we’ve -- I think been very disciplined in how

we purchase this stock back.

And I think we’ll continue to do that. The Board has, at this time,

authorized $25 million. We’ve still got a substantial ability to use a good portion of that over the next year -- or really 0.5

year, according to the Fed approval. And I’m sure that we will continue to look at that as an opportunity to utilize capital.

We do believe that the 12% of approximate capital level gives us

a lot of flexibility to repurchase stock or to look at acquisitions that have a cash component, and we’re going to continue to

do that. This particular transaction, we felt like using 10% cash was just the right metrics.

There’s been a lot of discussion about tangible book value earnback

period. We’ve certainly gotten that from a number of our shareholders. And so we felt like 10% was the right metric to have an

appropriate tangible book value earnback period, while at the same time, using some of our capital.

So we will continue to do that as we go forward. And each deal’s

stands on its own and has different wants and needs. And we are going to continue to look for opportunities from an acquisition

standpoint to continue to strengthen our Carolinas franchise or areas that could be contiguous to that Carolinas franchise.

I will say that from a capital management standpoint, this transaction

was, I thought, kind of perfect. We got a earnback period under 3 years. And at the same time, got good earnings accretion in 2021.

So we felt like it hit exactly what we had been looking for and

kind of what we had signaled to everybody that we were looking for in addition to just being in a fabulous market and having a

really great leadership team.

So as we go forward and look at opportunities, those are the things

that we’re going to continue to consider. And obviously, having this deal completed does put a little bit more clarity on the capital

management standpoint for us to -- because obviously, this was -- we looked at more than one transaction over the last 6 months.

And so some of those might have required more cash than this particular one.

Catherine Mealor^ Got it. That’s great color. And then maybe one

follow-up to that is given the timing of the close being in the first quarter of next year, is there any -- are there any assumptions

regarding CECL in your book dilution and earnback and all that we should be aware of? Or how you’re kind of thinking about CECL

once this deal closes?

Jerold Rexroad^ You know, Catherine, it’s a question that I expected,

but I don’t have a good answer for. It is -- CECL has several different ways it can be adopted, and we have looked at a lot of

those and are continuing to look at those. The date that this transaction closes has an impact on CECL.

Implementation, we could close it potentially before year-end or

potentially at year-end or potentially the day after year-end. All those things have different implications from an accounting

standpoint.

Bill and his team have spent a lot of time looking at those. I don’t

think there’s anything that we need to disclose regarding this transaction because quite frankly, the answer could be very, very

difficult depending on various different decisions that we make. And so we’re going to look at all those holistically, not just

this transaction, and try to make the best decision we can for our shareholders.

Operator^ (Operator Instructions) And our next question comes from

William Wallace from Raymond James.

William Wallace^ So appreciate all the commentary and the deck around

this. On -- I’m just kind of curious as you think about the location of these branches and this franchise, my recollection as it’s

a markets, and I’m curious if you view this as more of a deposit play.

Are you attracted to the deposits of that market? do you -- or do

you think there’s a really strong loan growth opportunity in those markets? Or is it really more of just kind of a kicking off

point to get you more critical mass in the MSA itself? If you could just talk a little bit about that.

Jerold Rexroad^ Honestly, Wally, I’ve gone and looked at every one

of these branches, and there are a couple that I will consider rural, I think that’s fair. But quite frankly, I think most of the

other branches are in areas that are really very urban in the fact that, that Charlotte market has just spread out so far.

And so when you look at the growth that’s going in several of these

different markets that are within, say, a 40-mile radius of Charlotte, there’s a lot of ancillary growth to the city itself. And

so we really think there’s a good opportunity for loan growth and deposit growth.

Obviously, there’s been a lot of change in that market. There’s

very, very few community banks that have really lept in that market. We have the size and scale to be able to bank the majority

of the middle-market clients that are in the Charlotte market.

But from a deposit -- but from a loan standpoint, we found that

in our due diligence, a lot of the customers that Carolina Trust had been doing business with really had much larger lending relationships,

but they couldn’t manage the entire lending relationship because of their loan to one borrower and internal limits on loan size

and relationship size.

So we really think there’s a real opportunity to expand both the

loan and deposit relationships with those customers given the fact that we obviously have a much larger combined balance sheet

that can allow their team members to expand the relationship with the borrowers that they have as well as a lot of other borrowers

in those North and Eastern parts of the Charlotte market that we weren’t going to be able to cover really with our branch down

in South Park.

William Wallace^ Okay. All right, perfect. And so it’s a little

bit tricky with their acquisition, but maybe just kind of thinking about the expected contribution from those markets.

Do you layer in the loan growth that you budgeted for the whole

franchise? Or do you look at what they’ve been doing in those markets? Can you maybe help me think about your expectations for

growth in the loan fund in that market?

Jerold Rexroad^ So we really looked at their loan growth that they

had been getting over the last, say, 18 to 24 months. And we actually moderated that sum in our estimates. We know what our loan

growth has been in our markets.

And so using the combination of the fact that their loan growth

had actually been higher than our loan growth, we actually moderated that sum, to be honest with you, just to try to be a little

bit conservative and used a number that was more closely representative of what we’ve been able to accomplish really over the last

couple of years ourselves and what we’re projecting in our own internal models going forward.

So all those things were considered in getting that growth rate.

But that’s kind of a big picture overview of how we thought through it.

William Wallace^ And last question on the deposit side, what’s the

commercial versus retail breakout of their deposit base?

Jerold Rexroad^ Wally, off the top of my head, Bill’s taking a quick

look, but I cannot answer that question. I’ll be happy to follow-up in an e-mail with you. Obviously, they’re a public company.

So it’s out there, but I just don’t know it off the top of my head.

I know they’re about 63% in transaction and savings, which is about the exact same percent that we are. But I don’t know the breakout

between retail and commercial off the top of my head.

William Wallace^ Okay. Okay, that’s fine. And then lastly, just

with Jerry Ocheltree coming on as the President of North Carolina commercial. So he’ll be, I don’t know how -- where exactly that

fits into your chart. He’ll be reporting to you? And then just trying to drive the originations across the footprint in North Carolina?

Jerold Rexroad^ He’ll be reporting to the President of the bank,

and his responsibility will be -- we have a large group of commercial loan officers in North Carolina in addition to the number

that Carolina Trust had.

So we’ve got a very large team in North Carolina. The plan would

be for him to continue to manage the people that were in the Carolina Trust franchise, whether that’d be in North or South Carolina.

And then to manage the remainder of the North Carolina franchise

with the opportunity to hopefully, continue our recruitment in those areas as well as the expansion of our commercial lending activities.

Operator^ And I am showing no further questions from our phone lines.

I’d now like to turn the conference back over to Jerry Rexroad for any closing remarks.

Jerold Rexroad^ Thank you, operator. And I am very, very excited

about the opportunity of putting these 2 companies together. I think we look and act very much similarly. We both are strong community

banking franchises, and I think the opportunities, as we go forward, to work together and continue to improve and grow our opportunities

in the Charlotte market are very, very significant.

Obviously, I want to thank all of our team members that spent a

lot of time on due diligence. I know many of them put in long hours and very much appreciative of that. And looking forward to

get to know all the Carolina Trust team members as we get ready to put our 2 companies together. Thank you for joining the call

today. Bye-bye.

Operator^ Well, ladies and gentlemen, thank you for participating

in today’s conference. This does conclude the program and you may all disconnect. Everyone, have a wonderful day.

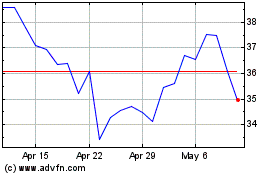

Maplebear (NASDAQ:CART)

Historical Stock Chart

From Mar 2024 to Apr 2024

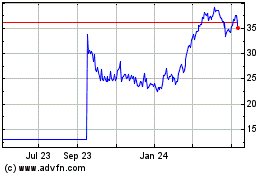

Maplebear (NASDAQ:CART)

Historical Stock Chart

From Apr 2023 to Apr 2024