Biggest U.S. Companies' Working-Capital Performance Hits Six-Year High

June 25 2019 - 8:29AM

Dow Jones News

By Mark Maurer

U.S. companies' working-capital efficiency reached a six-year

high in 2018 as finance chiefs increasingly prioritize managing

inventories to more quickly convert the capital into cash, a new

study found.

The 1,000 largest U.S. public companies collected cash from

their customers quicker than they had since 2012, according to a

study to be released Wednesday by Hackett Group Inc., a consulting

firm.

Hackett said it sees more than $1.28 trillion that U.S.

companies can trim from their working capital. That figure

translates to about 6% of U.S. gross domestic product and marks an

approximately 15% year-over-year increase from $1.1 trillion, the

study showed.

That money could be deployed to give companies a competitive

edge. Companies that wring money from working capital can funnel

those funds toward ramping up acquisitions and initiatives that

propel growth. A company's working-capital performance can be tied

to the performance of its CFO. Finance chiefs are increasingly

standardizing processes to track working-capital performance across

an organization, to make the most of that funding source.

The top-performing companies paid suppliers almost three weeks

slower in 2018 than typical companies and collected cash from

customers almost three weeks quicker -- while holding less than

half the inventory, data showed. The amount of funds trapped in

inventory fell for the first time since 2012 last year. Despite the

improvements in the receivable and inventory categories, payables

performance deteriorated. Companies have begun to scale back on

extending payment terms, thus cutting suppliers some slack.

"Inventories are an untapped area of working capital and they're

more difficult to go after than payables," Craig Bailey, associate

principal at Hackett, said in an interview. "Companies found

there's just not much to be gained going after payment terms."

Of the 1,000 companies surveyed, nine improved their

cash-conversion cycle -- a measure of operational efficiency that

tracks the speed of converting a transaction into cash -- every

year from 2011 to 2018. The companies included PepsiCo Inc., HP

Inc., and Lennar Corp, the report showed.

Hackett's survey found that the aerospace, oil-and-gas, and

energy services industries struggled the most when it came to

working-capital performance last year.

National Oilwell Varco Inc., a Houston-based manufacturer of

oil-and-gas production equipment, was among the companies with the

largest working-capital opportunity, at $4.5 billion, according to

Hackett data provided to The Wall Street Journal.

"When an oil rig gets built, capital sometimes gets stranded,"

said Marshall Adkins, an analyst at Raymond James & Associates

Inc., who follows National Oilwell. "Many of the offshore drilling

rigs ordered five or six years ago were stymied in a shipyard."

National Oilwell recognizes the need to improve its management

of working capital, CFO and Senior Vice President Jose Bayardo has

said on earnings calls, most recently in February. The company is

trying to decrease the number of days to convert transactions to

cash, Mr. Bayardo said on the call. The company's cash-conversion

cycle was 246 days last year, down from 285 the year earlier,

Hackett data showed.

Mr. Bayardo couldn't be reached for comment Monday. A National

Oilwell spokesman declined to comment.

Write to Mark Maurer at mark.maurer@wsj.com

(END) Dow Jones Newswires

June 25, 2019 08:14 ET (12:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

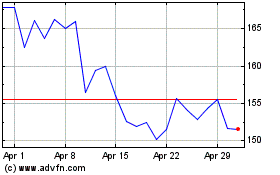

Lennar (NYSE:LEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lennar (NYSE:LEN)

Historical Stock Chart

From Apr 2023 to Apr 2024