Additional Proxy Soliciting Materials (definitive) (defa14a)

May 01 2019 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material under §240.14a-12

|

|

|

|

Biohaven Pharmaceutical Holding Company Ltd.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

|

Biohaven Pharmaceutical Holding Company Ltd.

215 Church Street

New Haven, CT 06510

ADDITIONAL DEFINITIVE PROXY MATERIALS TO BIOHAVEN PHARMACEUTIAL HOLDING COMPANY LTD.

PROXY STATEMENT

FOR THE 2019 ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 21, 2019

EXPLANATORY NOTE

On April 11, 2019, Biohaven Pharmaceutical Holding Company Ltd. (the “Company”) filed a definitive proxy statement (the “Proxy Statement”) with the Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies on behalf of the Board of Directors of the Company for use at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Tuesday, May 21, 2019, and at any adjournments or postponements thereof. The Annual Meeting will be held at 10:00 a.m. local time at the Rosewood Bermuda located at 60 Tucker’s Point Drive, Hamilton Parish, Bermuda.

These additional definitive proxy materials are being filed with the SEC by the Company on May 1, 2019 to correct errors in the Proxy Statement with respect to (i) the values for the 2018 fiscal year in the columns entitled “Option Awards ($)

(4)

” and “Total ($)” in the “2018 Summary Compensation Table” on page 36 of the Proxy Statement, (ii) the values in the column entitled “Grant Date Fair Value of Stock and Option Awards” in the “Grants of Plan-Based Awards in 2018” table on page 37 of the Proxy Statement and (iii) the values in the column entitled “Option Awards ($)

(2)

” in the “Director Compensation Table” on page 43 of the Proxy Statement.

Each of the “2018 Summary Compensation Table”, the “Grants of Plan-Based Awards in 2018” table and the “Director Compensation Table” on pages 36, 37 and 43, respectively, are amended and replaced in their entirety with the tables on the following pages.

Except as described herein, these additional definitive proxy materials do not modify, amend, supplement or otherwise affect the Proxy Statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING TO BE HELD ON MAY 21, 2019:

THESE ADDITIONAL DEFINITIVE PROXY MATERIALS, THE PROXY STATEMENT AND ANNUAL REPORT TO

SHAREHOLDERS ARE AVAILABLE AT

www.proxyvote.com

.

2018 SUMMARY COMPENSATION TABLE

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position

|

Year

|

Salary

($)

(1)(2)

|

Bonus

($)

(2)(3)

|

Option

Awards

($)

(4)

|

All Other

Compensation

($)

(5)

|

Total

($)

|

|

Vlad Coric, M.D

|

|

|

|

|

|

|

|

Chief Executive Officer

|

2018

|

500,000

|

437,500

|

4,344,638

|

12,500

|

5,294,638

|

|

2017

|

420,892

|

337,500

|

3,086,473

|

10,800

|

3,855,665

|

|

2016

|

350,000

|

245,000

|

189,428

|

—

|

784,428

|

|

James Engelhart

|

|

|

|

|

|

|

|

Chief Financial Officer

|

2018

|

380,800

|

233,240

|

1,629,239

|

14,028

|

2,257,307

|

|

2017

|

327,003

|

178,500

|

1,991,700

|

13,080

|

2,510,283

|

|

2016

|

222,592

|

137,025

|

118,298

|

4,908

|

482,823

|

|

Charles Conway, Ph.D.

|

|

|

|

|

|

|

|

Chief Scientific Officer

|

2018

|

334,960

|

205,163

|

1,412,007

|

8,932

|

1,961,062

|

|

2017

|

305,883

|

191,900

|

1,118,433

|

9,932

|

1,626,148

|

|

Kimberly Gentile

(6)

|

|

|

|

|

|

|

|

SVP, Clinical Operations

|

2018

|

327,250

|

198,297

|

1,412,007

|

15,192

|

1,952,746

|

|

John Tilton

(6)

|

|

|

|

|

|

|

|

Chief Commercial Officer

|

2018

|

309,000

|

162,225

|

651,696

|

18,849

|

1,141,770

|

|

|

|

|

(1)

|

Salary amounts represent actual amounts paid for the indicated year. See “Compensation Discussion & Analysis—2018 Executive Compensation Program in Detail—Annual Base Salary” for a description of adjustments to base salaries made during the year.

|

|

|

|

|

(2)

|

These amounts were paid to the executive by Biohaven Pharmaceuticals, Inc., which, as of December 31, 2018, is our wholly owned subsidiary.

|

|

|

|

|

(3)

|

The amounts reflect the discretionary bonuses paid for performance during 2016, 2017 and 2018, as discussed further above under “—Compensation Discussion & Analysis—The 2018 Executive Compensation Program in Detail—Annual Cash Incentive.”

|

|

|

|

|

(4)

|

The amounts reflect the full grant date fair value for awards granted during the indicated year. The grant date fair value was computed in accordance with ASC Topic 718,

Compensation—Stock Compensation

. The assumptions we used in valuing the stock option awards are described in Note 12 to our audited consolidated financial statements included in our Annual Report on Form 10‑K for the fiscal year ended December 31, 2018.

|

|

|

|

|

(5)

|

The amounts consist of Company contributions to the executive officer’s account under our 401(k) plan.

|

|

|

|

|

(6)

|

Amounts only include those paid in 2018, as Ms. Gentile and Mr. Tilton were not NEOs in 2016 or 2017.

|

GRANTS OF PLAN-BASED AWARDS IN 2018

The table below summarizes the equity and non-equity awards granted to the NEOs in 2018.

|

|

|

|

|

|

|

|

|

Name

|

Grant Date

|

All Other Option Awards: Number of Securities Underlying Options (#)

(1)

|

Exercise or Base Price of Option Awards ($/Sh)

|

Grant Date Fair Value of Stock and Option Awards ($)

(2)

|

|

Vlad Coric

|

11/20/18

|

200,000

|

32.42

|

4,344,638

|

|

James Engelhart

|

11/20/18

|

75,000

|

32.42

|

1,629,239

|

|

Charles Conway

|

11/20/18

|

65,000

|

32.42

|

1,412,007

|

|

Kimberly Gentile

|

11/20/18

|

65,000

|

32.42

|

1,412,007

|

|

John Tilton

|

11/20/18

|

30,000

|

32.42

|

651,696

|

|

|

|

|

(1)

|

The amounts in this column represent the number of time-vested stock options awarded to each NEO in 2018. The options vest in four equal installments on November 20, 2019, 2020, 2021 and 2022, subject to the executive’s continued service as of each applicable vesting date.

|

|

|

|

|

(2)

|

The amounts in this column represent the grant date fair value of option awards computed in accordance with stock-based compensation accounting rules (FASB ASC Topic 718).

|

Director Compensation Table

The following table shows for the fiscal year ended December 31, 2018 certain information with respect to the compensation of all non-employee directors of the Company. Dr. Coric, our chief executive officer, is also a director but did not receive any additional compensation for his services as a director. Dr. Coric’s compensation is set forth in the “Executive Compensation” section.

|

|

|

|

|

|

|

|

|

|

Name

|

Fees Earned or

Paid in Cash

($)

(1)

|

Option

Awards

($)

(2)

|

All other Compensation

(3)

|

Total

($)

|

|

Declan Doogan, M.D.

|

85,000

|

349,540

|

(4)

|

–

|

434,540

|

|

Eric Aguiar, M.D.

|

38,750

|

349,540

|

(5)

|

2,500

|

390,790

|

|

Gregory H. Bailey, M.D.

|

36,277

|

349,540

|

(6)

|

2,500

|

388,317

|

|

Robert Repella RPh, MBA

|

16,625

|

842,654

|

(7)

|

–

|

859,279

|

|

John W. Childs

|

36,277

|

349,540

|

(8)

|

2,500

|

388,317

|

|

Julia Gregory

|

58,750

|

349,540

|

(9)

|

2,083

|

410,373

|

|

Albert Cha

(10)

|

38,438

|

–

|

|

2,500

|

40,938

|

_________________

|

|

|

|

(1)

|

The amounts in the table reflect pro-rated amounts from January 1, 2018 or, in the case of Mr. Repella, from the time of his election to the Board in September 2018 through December 31, 2018 or, in the case of Dr. Cha, from January 1, 2018 through the time of his resignation from the Board in September 2018.

|

|

|

|

|

(2)

|

This column reflects the full grant date fair value for awards granted during the year. The grant date fair value was computed in accordance with ASC Topic 718, Compensation—Stock Compensation. The assumptions we used in valuing the stock option awards are described in Note 12 to our audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018.

|

|

|

|

|

(3)

|

This column reflects a true-up amount paid in cash during fiscal year 2018 but related to fees earned in 2017.

|

|

|

|

|

(4)

|

On May 1, 2018, Dr. Doogan received an option grant to purchase 18,000 common shares at an exercise price of $28.76 per share. The shares underlying this option will vest on May 1, 2019.

|

|

|

|

|

(5)

|

On May 1, 2018, Dr. Aguiar received an option grant to purchase 18,000 common shares at an exercise price of $28.76 per share. The shares underlying this option will vest on May 1, 2019.

|

|

|

|

|

(6)

|

On May 1, 2018, Dr. Bailey received an option grant to purchase 18,000 common shares at an exercise price of $28.76 per share. The shares underlying this option will vest on May 1, 2019.

|

|

|

|

|

(7)

|

On September 7, 2018, Mr. Repella received an option grant to purchase 36,000 common shares at an exercise price of $35.50 per share. The shares underlying this option vest in three annual installments on each of September 7, 2019, 2020 and 2021, subject to Mr. Repella’s continuous service through each vesting date.

|

|

|

|

|

(8)

|

On May 1, 2018, Mr. Childs received an option grant to purchase 18,000 common shares at an exercise price of $28.76 per share. The shares underlying this option will vest on May 1, 2019.

|

|

|

|

|

(9)

|

On May 1, 2018, Ms. Gregory received an option grant to purchase 18,000 common shares at an exercise price of $28.76 per share. The shares underlying this option will vest on May 1, 2019.

|

|

|

|

|

(10)

|

Effective September 7, 2018, Dr. Cha resigned from the Board.

|

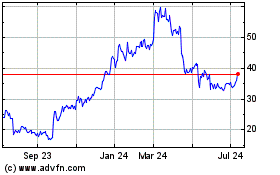

Biohaven (NYSE:BHVN)

Historical Stock Chart

From Apr 2024 to May 2024

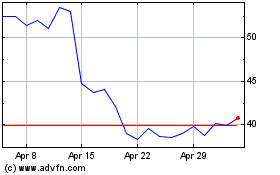

Biohaven (NYSE:BHVN)

Historical Stock Chart

From May 2023 to May 2024