ADM Broadens Revamp After Weather, Trade Challenges -- Update

April 26 2019 - 12:22PM

Dow Jones News

By Micah Maidenberg

Archer Daniels Midland Co. is expanding restructuring efforts as

the agricultural company works to rebound from challenges due to

bad weather and trade tensions.

The Chicago-based company on Friday said it plans to close aging

flour mills, cut production of high-fructose corn syrup and prepare

ethanol operations for a potential spinoff. Previously ADM had said

it would reduce staff and streamline global operations.

Biting cold and damaging floods cut ADM's first-quarter

operating profit by $60 million, the company said, disrupting rail

traffic, temporarily shutting a Nebraska corn plant and boosting

costs for other facilities.

Overall, ADM's quarterly profit fell 41%. Shares fell more than

2% in recent trading.

ADM and other global agricultural companies have faced several

years of low crop prices that have slimmed commodity-trading

margins. Over the past year, trade disputes have also disrupted

agricultural export flows. In February, ADM reported a 60% drop in

its prior quarterly earnings, after Chinese tariffs on U.S. crops

reduced soybean exports and pushed down ethanol processing

margins.

ADM Chief Executive Juan Luciano on Friday reiterated optimism

that the U.S. and China would resolve their trade dispute this

year. He said Chinese grain importers already were preparing to

resume purchases, as they drew down existing supplies and reviewed

purchase contracts with ADM.

"Everybody is inching toward a deal in the summer," Mr. Luciano

said.

Rival grain merchant Bunge Ltd. is pursuing its own revamp,

evaluating its portfolio for potential divestitures and replacing

executives, including its CEO. Other agricultural companies,

including Cargill Inc. and Louis Dreyfus Co., have shuffled grain

and supply chain executives in recent weeks. ADM last week

appointed a new grain-trading head.

ADM executives said the company plans to reduce capital spending

by 10% this year. It is creating an ethanol subsidiary that will

report results as an independent business unit, allowing the

company to potentially spin off the business to existing

shareholders. Profits from the corn-based fuel additive have

slumped by about 25 cents a gallon in recent months as inventories

climbed and foul weather increased production costs, executives

said.

ADM plans to cease high-fructose corn syrup production at its

Marshall, Minn., plant, shifting instead to starches and other food

and industrial products for which Mr. Luciano said demand is

stronger.

ADM also said it would close several century-old wheat mills,

sell some grain-storage facilities and overhaul its peanut

operations. Overall, ADM aims to save $1.2 billion in annual

expenses.

China's eight-month struggle with African swine fever, prompting

the destruction of millions of hogs in the world's largest

pork-producing nation, is set to boost ADM, Mr. Luciano said. Hog

farmers in the U.S., Europe and Brazil are preparing to expand

their herds to supply pork to China, requiring more corn, soybean

meal and other feed ingredients that ADM supplies, he said.

ADM reported a first-quarter profit of $233 million, or 41 cents

a share, down from $393 million, or 70 cents a share, a year

earlier.

After adjustments, the company recorded earnings of 46 cents a

share, weaker than the 60 cents a share analysts predicted.

Sales fell 1% in the quarter ended March 31 to $15.3 billion.

Analysts expected $15.57 billion in sales, according to

FactSet.

--Micah Maidenberg contributed to this article.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

April 26, 2019 12:07 ET (16:07 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

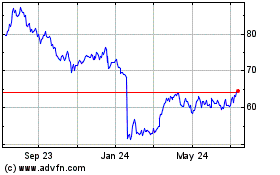

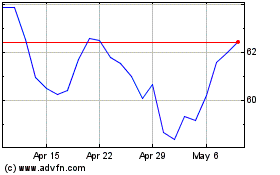

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Apr 2023 to Apr 2024