AT&T's Pay-TV Subscribers Continue to Flee --update

April 24 2019 - 10:24AM

Dow Jones News

By Drew FitzGerald and Kimberly Chin

AT&T Inc.'s pay-TV subscriber base continued to erode during

the first quarter, adding pressure on the telecom and media giant's

project to develop a new streaming service aimed at

cord-cutters.

The Dallas company reported a net loss of 544,000 "premium" TV

customers, a category that includes DirecTV satellite subscriptions

and U-verse fiber optic packages, during the first three months of

the year. The online cablelike service DirecTV Now shed 83,000

customers.

The reported pay-TV losses would have been even deeper were it

not for a change in the way AT&T records disconnections. The

company said it now counts severed accounts based on billing

cycles, a change that boosted total pay-TV subscriptions by

117,000. All told, the company ended the quarter with 23.9 million

pay-TV connections.

"We'll continue to see declines in traditional TV subs,

particularly those areas where we can't bundle with broadband,"

Chief Executive Randall Stephenson said in a conference call with

analysts. "You'll see subscriber losses should lessen as we get

into 2020."

In its wireless business, AT&T said it added 80,000 more

"postpaid" phone subscriptions, a valuable category of customers

who tend to stick around longer. Rival Verizon Communications Inc.

said Tuesday it lost 44,000 such connections. The customer gains

boosted earnings despite declining revenue from smartphone

upgrades, which hit a "record low" during the quarter. Cellphone

users have been holding on to their devices for longer, a trend

that has forced carriers to adapt.

Overall, merger-amortization costs and integrated-relation

expenses weighed on its profit for the quarter ended March 31. Net

income attributable to AT&T totaled $4.01 billion, or 56 cents

a share, compared with $4.76 billion, or 75 cents a share, a year

earlier. Analysts polled by Refinitiv expected 60 cents a share.

Meanwhile, adjusted per-share earnings were 86 cents, in line with

analysts' expectations.

Consolidated revenue jumped 18% to $44.8 billion, primarily from

its Time Warner acquisition.

AT&T closed its purchase of the owner of Warner Bros., HBO

and a suite of cable channels including CNN last year after a

protracted antitrust battle with the U.S. Department of Justice.

The business, renamed WarnerMedia, added $1.2 billion in operating

income to the bottom line last quarter.

Results in the company's media division benefited from cost

cutting and higher revenue from Warner Bros.-produced TV series and

movies, including continuing box office sales from "Aquaman."

WarnerMedia is building an on-demand streaming video service

expected to launch in "beta" mode near the end of this year. The

still unnamed service, which wouldn't carry the live sports and

news available on DirecTV Now, is slated to join an increasingly

crowded market for internet-based entertainment that includes new

offerings from Walt Disney Co. and Apple Inc.

"The Disney announcement gave us nothing but more optimism in

terms of what we'll be able to bring to market," Mr. Stephenson

said Wednesday. WarnerMedia plans to reveal more details about its

plans in September or October.

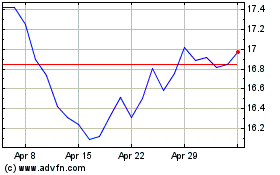

Shares of the company fell about 3% in early trading. The stock

is still up nearly 10% this year.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com and

Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

April 24, 2019 10:09 ET (14:09 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

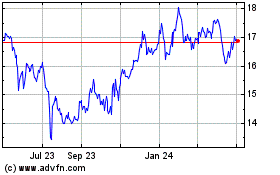

AT&T (NYSE:T)

Historical Stock Chart

From Mar 2024 to Apr 2024

AT&T (NYSE:T)

Historical Stock Chart

From Apr 2023 to Apr 2024