Performant Financial Corporation (Nasdaq: PFMT), a leading provider

of technology-enabled recovery and related analytics services in

the United States, today reported the following financial results

for its fourth quarter and full year ended December 31, 2018:

Fourth Quarter Financial Highlights

- Total revenues of $39.8 million, compared to $33.3 million in

the prior year period, up 19.5%

- Net loss of $5.3 million or $(0.10) per diluted share, compared

to net income of $0.5 million, or $0.01 per diluted share, in the

prior year period

- Adjusted EBITDA of $2.5 million, compared to $2.0 million in

the prior year period

- Adjusted net loss of $0.4 million, or $(0.01) per diluted

share, compared to adjusted net income of $1.3 million or $0.02 per

diluted share, in the prior year period

Full Year 2018 Financial Highlights

- Total revenues of $155.7 million, compared to $132.0 million in

2017, growth of 18.0%

- Net loss of $8.0 million, or $(0.15) per diluted share,

compared to net loss of $12.7 million, or $(0.25) per diluted

share, in 2017

- Adjusted EBITDA of $(5.2) million, compared to $9.2 million in

2017

- Adjusted net loss of $14.3 million, or $(0.27) per diluted

share, compared to adjusted net loss of $7.5 million, or $(0.15)

per diluted share, in 2017

Fourth Quarter 2018 Results

Student lending revenues in the fourth quarter were $18.0

million, a decrease of 20.0% from $22.5 million in the prior year

period. Reduced revenues from Great Lakes Higher Education Guaranty

Corporation accounted for this decrease year over year, with

revenues of $5.5 million in the fourth quarter of 2018, compared to

$11.5 million in the prior year period. All other Guaranty

Agencies accounted for revenues of $12.5 million in the fourth

quarter of 2018, compared to $11.0 million in the prior year

period. Student loan placement volume (defined below) during the

quarter totaled $431.7 million, compared to $549.0 million in the

prior year period.

Healthcare revenues in the fourth quarter were $11.1 million, up

from $3.6 million in the prior year period. Medicare audit recovery

and Medicare as Secondary Payer Commercial Repayment Center

revenues were $5.1 million in the fourth quarter, an increase of

$4.6 million from the prior year period. Commercial healthcare

clients contributed revenues of $6.0 million in the fourth quarter

of 2018, an increase of $2.8 million from the prior year

period.

Other revenues in the fourth quarter were $10.7 million, up from

$7.2 million in the prior year period. This increase is due to the

growth in our outsourced customer services contract work.

Net loss for the fourth quarter of 2018 was $5.3 million,

or $(0.10) per share on a fully diluted basis, compared to net

income of $0.5 million or $0.01 per share on a fully

diluted basis in the prior year period. Adjusted EBITDA for

the fourth quarter of 2018 was $2.5 million as compared to $2.0

million in the prior year period. Adjusted net loss for the

fourth quarter of 2018 was $0.4 million, or $(0.01) per share

on a fully diluted basis. This compares to adjusted net income

of $1.3 million, or $0.02 per fully diluted share in

the prior year period.

Full Year 2018 Results

Revenues for the full year ended December 31, 2018

were $155.7 million, an increase of 18.0% compared

to $132.0 million in 2017. Student lending revenues

declined 29.5% to $66.5 million from $94.3 million in

2017. Student Loan Placement Volume totaled $2.6 billion as

compared to $2.8 billion in 2017. Healthcare revenues increased

460.0% to $56.0 million from $10.0 million in the prior

year. Other revenues increased 19.9% to $33.2 million from

$27.7 million in 2017.

Net loss for the full year was $8.0 million, or $(0.15) per

share on a fully diluted basis, compared to net loss of $12.7

million or $(0.25) per share on a fully diluted basis in

2017. Adjusted EBITDA for 2018 was ($5.2 million) as compared

to $9.2 million in 2017. Adjusted net loss for 2018

was $14.3 million, or $(0.27) per fully diluted share.

This compares to adjusted net loss of $7.5 million

or $(0.15) per fully diluted share in 2017.

As of December 31, 2018, the Company had cash, cash equivalents

and restricted cash of approximately $7.3 million.

Business Commentary and 2019 Outlook

“During 2018, we made significant progress on many of our key

initiatives, increased our investment to support contract and

revenue growth and acquired Premiere Credit of North America, which

further strengthened our long-standing relationship with ECMC.”

“Finally, we are providing full year 2019 revenue guidance of

$158 to $168 million and adjusted EBITDA to be a loss of between $2

million to $6 million. We are excited for 2019 and beyond as

our larger contracts begin to transition out of the heavy

investment phase and become sources for greater profitability that

strengthen our business in the mid to longer term,” concluded Lisa

Im, CEO of Performant.

Note Regarding Use of Non-GAAP Financial

Measures

In this press release, to supplement our consolidated financial

statements, the Company presents adjusted EBITDA and adjusted net

income. These measures are not in accordance with accounting

principles generally accepted in the United States of America (US

GAAP) and accordingly reconciliations of adjusted EBITDA and

adjusted net income to net income determined in accordance with US

GAAP are included in the “Reconciliation of Non-GAAP Results” table

at the end of this press release. We have included adjusted EBITDA

and adjusted net income in this press release because they are key

measures used by our management and board of directors to

understand and evaluate our core operating performance and trends

and to prepare and approve our annual budget. Accordingly, we

believe that adjusted EBITDA and adjusted net income provide useful

information to investors and analysts in understanding and

evaluating our operating results in the same manner as our

management and board of directors. Our use of adjusted EBITDA and

adjusted net income has limitations as an analytical tool and

should not be considered in isolation or as a substitute for

analysis of our results as reported under US GAAP. In particular,

many of the adjustments to our US GAAP financial measures reflect

the exclusion of items, specifically interest, tax and depreciation

and amortization expenses, equity-based compensation expense and

certain other non-operating expenses, that are recurring and will

be reflected in our financial results for the foreseeable future.

In addition, these measures may be calculated differently from

similarly titled non-GAAP financial measures used by other

companies, limiting their usefulness for comparison purposes.

Terms used in this Press Release

Student Loan Placement Volume refers to the dollar volume of

defaulted student loans first placed with us during the specified

period by public and private clients for recovery. Placement Volume

allows us to measure and track trends in the amount of inventory

our clients in the student lending market are placing with us

during any period. The revenue associated with the recovery of a

portion of these loans may be recognized in subsequent accounting

periods, which assists management in estimating future revenues and

in allocating resources necessary to address current Placement

Volumes.

Earnings Conference Call

The Company will hold a conference call to discuss its fourth

quarter and full year 2018 results today at 5:00 p.m.

Eastern. A live webcast of the call may be accessed on the

Investor Relations section of the Company’s website at

investors.performantcorp.com. The conference call is also available

by dialing 877-705-6003 (domestic) or 201-493-6725

(international).

A replay of the call will be available on the Company's website

or by dialing 844-512-2921 (domestic) or 412-317-6671

(international) and entering the passcode 13688455. The telephonic

replay will be available approximately three hours after the call,

through April 2, 2019.

About Performant Financial Corporation

Performant helps government and commercial organizations enhance

revenue and contain costs by preventing, identifying and recovering

waste, improper payments and defaulted assets. Performant is a

leading provider of these services in several industries, including

healthcare, student loans and government. Performant has been

providing recovery audit services for more than nine years to both

commercial and government clients, including serving as a Recovery

Auditor for the Centers for Medicare and Medicaid

Services.

Powered by a proprietary analytic platform and workflow

technology, Performant also provides professional services related

to the recovery effort, including reporting capabilities, support

services, customer care and stakeholder training programs meant to

mitigate future instances of improper payments. Founded in 1976,

Performant is headquartered in Livermore, California.

Forward Looking Statements

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements regarding our outlook for revenues,

net income and adjusted EBITDA in 2019. These forward-looking

statements are based on current expectations, estimates,

assumptions and projections that are subject to change and actual

results may differ materially from the forward-looking statements.

Factors that could cause actual results to differ materially

include, but are not limited to, the high level of revenue

concentration among the Company's largest customers and any

termination in the Company’s relationship with any of our

significant clients would result in a material decline in our

revenues, that many of the Company's customer contracts are subject

to periodic renewal, are not exclusive, do not provide for

committed business volumes and may be changed or terminated

unilaterally and on short notice, that there can be no assurance

that the Company is able to retain its new contract with the

Department of Education as the result of the protests filed by

unsuccessful bidders, that continuing limitations on the scope of

our audit activity under our RAC contracts have significantly

reduced our revenue opportunities with this client, that the

Company faces significant competition in all of its markets, that

the U.S. federal government accounts for a significant portion of

the Company's revenues, that future legislative and regulatory

changes may have significant effects on the Company's business,

that failure of the Company's or third parties' operating systems

and technology infrastructure could disrupt the operation of the

Company's business and the threat of breach of the Company's

security measures or failure or unauthorized access to confidential

data that the Company possesses. More information on potential

factors that could affect the Company's financial condition and

operating results is included from time to time in the "Risk

Factors" and "Management's Discussion and Analysis of Financial

Condition and Results of Operations" sections of the Company's

annual report on Form 10-K for the year ended December 31, 2017 and

subsequently filed reports on Forms 10-Q and 8-K. The

forward-looking statements are made as of the date of this press

release and the Company does not undertake to update any

forward-looking statements to conform these statements to actual

results or revised expectations.

Contact InformationRichard ZubekInvestor

Relations925-960-4988investors@performantcorp.com

| |

| PERFORMANT FINANCIAL CORPORATION AND

SUBSIDIARIES |

| Consolidated Balance Sheets |

| (In thousands, except per share amounts) |

| (Unaudited) |

| |

|

|

|

|

Assets |

December 31, 2018 |

|

December 31, 2017 |

| Current assets: |

|

|

|

| Cash and cash

equivalents |

$ |

5,462 |

|

|

$ |

21,731 |

|

|

Restricted cash |

1,813 |

|

|

1,788 |

|

| Trade

accounts receivable, net of allowance for doubtful accounts of $22

and $35, respectively |

20,879 |

|

|

12,494 |

|

| Prepaid

expenses and other current assets |

3,420 |

|

|

12,678 |

|

| Income

tax receivable |

179 |

|

|

6,839 |

|

| Total

current assets |

31,753 |

|

|

55,530 |

|

| Property, equipment,

and leasehold improvements, net |

22,255 |

|

|

20,944 |

|

| Identifiable intangible

assets, net |

1,160 |

|

|

4,864 |

|

| Goodwill |

81,572 |

|

|

81,572 |

|

| Deferred income

taxes |

— |

|

|

468 |

|

| Other assets |

1,019 |

|

|

1,058 |

|

| Total

assets |

$ |

137,759 |

|

|

$ |

164,436 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

| Current

liabilities: |

|

|

|

| Current

maturities of notes payable to related party, net of unamortized

discount and debt issuance costs of $126 and $171,

respectively |

$ |

2,224 |

|

|

$ |

2,029 |

|

| Accrued

salaries and benefits |

5,759 |

|

|

4,569 |

|

| Accounts

payable |

1,402 |

|

|

1,518 |

|

| Other

current liabilities |

3,414 |

|

|

3,347 |

|

| Deferred

revenue |

1,078 |

|

|

— |

|

| Estimated

liability for appeals |

210 |

|

|

18,817 |

|

| Net

payable to client |

— |

|

|

12,800 |

|

| Total

current liabilities |

14,087 |

|

|

43,080 |

|

| Notes payable to

related party, net of current portion and unamortized discount and

debt issuance costs of $2,345 and $3,245, respectively |

41,105 |

|

|

38,555 |

|

| Deferred income

taxes |

22 |

|

|

— |

|

| Earnout payable |

1,936 |

|

|

— |

|

| Other liabilities |

3,383 |

|

|

2,476 |

|

| Total

liabilities |

60,533 |

|

|

84,111 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’

equity: |

|

|

|

| Common

stock, $0.0001 par value. Authorized, 500,000 shares at

December 31, 2018 and 2017, respectively; issued and

outstanding, 52,999 and 51,085 shares at December 31, 2018 and

2017, respectively |

5 |

|

|

5 |

|

|

Additional paid-in capital |

77,370 |

|

|

72,459 |

|

| Retained

earnings (accumulated deficit) |

(149 |

) |

|

7,861 |

|

| Total

stockholders’ equity |

77,226 |

|

|

80,325 |

|

| Total

liabilities and stockholders’ equity |

$ |

137,759 |

|

|

$ |

164,436 |

|

|

|

|

|

|

|

|

|

|

| |

| PERFORMANT FINANCIAL CORPORATION AND

SUBSIDIARIES |

| Consolidated Statements of Operations |

| (In thousands, except per share amounts) |

| (Unaudited) |

| |

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31, |

|

December 31, |

| |

2018 |

|

2017 |

|

2018 |

|

2017 |

| Revenues |

$ |

39,730 |

|

|

$ |

33,289 |

|

|

$ |

155,668 |

|

|

$ |

132,049 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Salaries

and benefits |

27,782 |

|

|

20,551 |

|

|

96,144 |

|

|

82,191 |

|

| Other

operating expenses |

12,409 |

|

|

13,925 |

|

|

58,333 |

|

|

55,863 |

|

|

Impairment of goodwill and intangible assets |

2,988 |

|

|

— |

|

|

2,988 |

|

|

1,081 |

|

| Total

operating expenses |

43,179 |

|

|

34,476 |

|

|

157,465 |

|

|

139,135 |

|

| Loss from

operations |

(3,449 |

) |

|

(1,187 |

) |

|

(1,797 |

) |

|

(7,086 |

) |

| Interest expense |

(1,165 |

) |

|

(1,289 |

) |

|

(4,699 |

) |

|

(6,972 |

) |

| Interest income |

9 |

|

|

4 |

|

|

28 |

|

|

4 |

|

| Loss

before provision for (benefit from) income taxes |

(4,605 |

) |

|

(2,472 |

) |

|

(6,468 |

) |

|

(14,054 |

) |

| Provision for (benefit

from) income taxes |

660 |

|

|

(2,993 |

) |

|

1,542 |

|

|

(1,325 |

) |

| Net

income (loss) |

$ |

(5,265 |

) |

|

$ |

521 |

|

|

$ |

(8,010 |

) |

|

$ |

(12,729 |

) |

| |

|

|

|

|

|

|

|

| Net income (loss) per

share |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.10 |

) |

|

$ |

0.01 |

|

|

$ |

(0.15 |

) |

|

$ |

(0.25 |

) |

|

Diluted |

$ |

(0.10 |

) |

|

$ |

0.01 |

|

|

$ |

(0.15 |

) |

|

$ |

(0.25 |

) |

| Weighted average

shares |

|

|

|

|

|

|

|

|

Basic |

52,991 |

|

|

51,004 |

|

|

52,064 |

|

|

50,688 |

|

|

Diluted |

52,991 |

|

|

51,599 |

|

|

52,064 |

|

|

50,688 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| PERFORMANT FINANCIAL CORPORATION AND

SUBSIDIARIES |

| Consolidated Statements of Cash Flows |

| (In thousands) |

| (Unaudited) |

| |

| |

Twelve Months Ended |

| |

December 31, |

| |

2018 |

|

2017 |

| Cash flows from

operating activities: |

|

|

|

| Net loss |

$ |

(8,010 |

) |

|

$ |

(12,729 |

) |

|

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities: |

|

|

|

| Loss on

disposal of assets |

44 |

|

|

67 |

|

| Release

of net payable to client related to contract termination |

(9,860 |

) |

|

— |

|

| Release

of estimated liability for appeals due to termination of

contract |

(18,531 |

) |

|

— |

|

|

Derecognition of subcontractor receivable for appeals due to

termination of contract |

5,535 |

|

|

— |

|

|

Derecognition of subcontractor receivable for overturned

claims |

1,536 |

|

|

— |

|

| Provision

for doubtful account for subcontractor receivable |

1,868 |

|

|

— |

|

|

Impairment of goodwill and intangible assets |

2,988 |

|

|

1,081 |

|

|

Depreciation and amortization |

10,234 |

|

|

10,888 |

|

| Deferred

income taxes |

490 |

|

|

3,733 |

|

|

Stock-based compensation |

2,750 |

|

|

3,740 |

|

| Interest

expense from debt issuance costs |

1,221 |

|

|

1,336 |

|

| Earnout

mark-to-market |

(218 |

) |

|

— |

|

| Write-off

of unamortized debt issuance costs |

— |

|

|

1,049 |

|

| Interest

expense paid in kind |

— |

|

|

331 |

|

| Changes

in operating assets and liabilities: |

|

|

|

| Trade

accounts receivable |

(6,695 |

) |

|

(1,010 |

) |

| Prepaid

expenses and other current assets |

895 |

|

|

8 |

|

| Income

tax receivable |

6,660 |

|

|

(4,812 |

) |

| Other

assets |

69 |

|

|

(148 |

) |

| Accrued

salaries and benefits |

220 |

|

|

254 |

|

| Accounts

payable |

(445 |

) |

|

890 |

|

| Deferred

revenue and other current liabilities |

(657 |

) |

|

(1,062 |

) |

| Estimated

liability for appeals |

(76 |

) |

|

(488 |

) |

| Net

payable to client |

(2,940 |

) |

|

(274 |

) |

| Other

liabilities |

773 |

|

|

120 |

|

| Net cash

provided by (used in) operating activities |

(12,149 |

) |

|

2,974 |

|

| Cash flows from

investing activities: |

|

|

|

| Purchase

of property, equipment, and leasehold improvements |

(7,645 |

) |

|

(7,259 |

) |

| Premiere

Credit of North America, LLC cash acquired |

2,285 |

|

|

— |

|

| Net cash

used in investing activities |

(5,360 |

) |

|

(7,259 |

) |

| Cash flows from

financing activities: |

|

|

|

| Repayment

of notes payable |

(2,200 |

) |

|

(55,513 |

) |

| Debt

issuance costs paid |

(27 |

) |

|

(934 |

) |

| Taxes

paid related to net share settlement of stock awards |

(663 |

) |

|

(385 |

) |

| Proceeds

from exercise of stock options |

187 |

|

|

155 |

|

|

Borrowings from notes payable |

4,000 |

|

|

44,000 |

|

| Net cash

provided by (used in) financing activities |

1,297 |

|

|

(12,677 |

) |

| Effect of

foreign currency exchange rate changes on cash |

(32 |

) |

|

(3 |

) |

| Net

decrease in cash, cash equivalents and restricted cash |

(16,244 |

) |

|

(16,965 |

) |

| Cash, cash equivalents

and restricted cash at beginning of year |

23,519 |

|

|

40,484 |

|

| Cash, cash equivalents

and restricted cash at end of year |

$ |

7,275 |

|

|

$ |

23,519 |

|

| Non-cash

investing activities: |

|

|

|

| Recognition of

contingent consideration in acquisition |

$ |

2,154 |

|

|

$ |

— |

|

| Non-cash

financing activities: |

|

|

|

|

Recognition of shares issued in acquisition |

$ |

2,420 |

|

|

$ |

— |

|

|

Recognition of warrant issued in debt financing |

$ |

249 |

|

|

$ |

3,302 |

|

| Supplemental

disclosures of cash flow information: |

|

|

|

| Cash paid

(received) for income taxes |

$ |

(6,228 |

) |

|

$ |

(353 |

) |

| Cash paid

for interest |

$ |

3,477 |

|

|

$ |

4,284 |

|

| Reconciliation

of the consolidated statements of cash flows to the consolidated

balance sheets: |

|

|

|

| Cash and

cash equivalents |

$ |

5,462 |

|

|

$ |

21,731 |

|

|

Restricted cash |

$ |

1,813 |

|

|

$ |

1,788 |

|

| Total

cash, cash equivalents and restricted cash at end of period |

$ |

7,275 |

|

|

$ |

23,519 |

|

|

|

|

|

|

|

|

|

|

| |

| PERFORMANT FINANCIAL CORPORATION AND

SUBSIDIARIES |

| Reconciliation of Non-GAAP Results |

| (In thousands, except per share amounts) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31, |

|

December 31, |

| |

2018 |

|

2017 |

|

2018 |

|

2017 |

| Adjusted

Earnings Per Diluted Share: |

|

|

|

|

|

|

|

| Net income (loss) |

$ |

(5,265 |

) |

|

$ |

521 |

|

|

$ |

(8,010 |

) |

|

$ |

(12,729 |

) |

| Plus: Adjusted items

per reconciliation of adjusted net income |

4,889 |

|

|

760 |

|

|

(6,306 |

) |

|

5,208 |

|

| Adjusted Net Income

(Loss) |

$ |

(376 |

) |

|

$ |

1,281 |

|

|

$ |

(14,316 |

) |

|

$ |

(7,521 |

) |

| |

|

|

|

|

|

|

|

| Adjusted

Earnings Per Diluted Share |

(0.01 |

) |

|

0.02 |

|

|

(0.27 |

) |

|

(0.15 |

) |

| Diluted average shares

outstanding |

52,991 |

|

|

51,599 |

|

|

52,064 |

|

|

50,688 |

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31, |

|

December 31, |

| |

2018 |

|

2017 |

|

2018 |

|

2017 |

| Adjusted

EBITDA: |

|

|

|

|

|

|

|

| Net income (loss) |

$ |

(5,265 |

) |

|

$ |

521 |

|

|

$ |

(8,010 |

) |

|

$ |

(12,729 |

) |

| Provision for (benefit

from) income taxes |

660 |

|

|

(2,993 |

) |

|

1,542 |

|

|

(1,325 |

) |

| Interest expense |

1,165 |

|

|

1,289 |

|

|

4,699 |

|

|

6,972 |

|

| Interest income |

(9 |

) |

|

(4 |

) |

|

(28 |

) |

|

(4 |

) |

| Transaction expenses

(1) |

— |

|

|

— |

|

|

— |

|

|

576 |

|

| Depreciation and

amortization |

2,633 |

|

|

2,507 |

|

|

10,234 |

|

|

10,888 |

|

| Impairment of goodwill

and intangible assets (4) |

2,988 |

|

|

— |

|

|

2,988 |

|

|

1,081 |

|

| CMS Region A contract

termination (6) |

— |

|

|

— |

|

|

(19,415 |

) |

|

— |

|

| Stock based

compensation |

347 |

|

|

713 |

|

|

2,750 |

|

|

3,740 |

|

| Adjusted

EBITDA |

$ |

2,519 |

|

|

$ |

2,033 |

|

|

$ |

(5,240 |

) |

|

$ |

9,199 |

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31, |

|

December 31, |

| |

2018 |

|

2017 |

|

2018 |

|

2017 |

| Adjusted Net

Income (Loss): |

|

|

|

|

|

|

|

| Net income (loss) |

$ |

(5,265 |

) |

|

$ |

521 |

|

|

$ |

(8,010 |

) |

|

$ |

(12,729 |

) |

| Transaction expenses

(1) |

— |

|

|

— |

|

|

— |

|

|

576 |

|

| Stock based

compensation |

347 |

|

|

713 |

|

|

2,750 |

|

|

3,740 |

|

| Amortization of

intangibles (2) |

3,150 |

|

|

207 |

|

|

3,758 |

|

|

898 |

|

| Impairment of goodwill

and intangible assets (4) |

2,988 |

|

|

— |

|

|

2,988 |

|

|

1,081 |

|

| Deferred financing

amortization costs (3) |

258 |

|

|

346 |

|

|

1,221 |

|

|

2,385 |

|

| CMS Region A contract

termination (6) |

— |

|

|

— |

|

|

(19,415 |

) |

|

— |

|

| Tax adjustments

(5) |

(1,854 |

) |

|

(506 |

) |

|

2,392 |

|

|

(3,472 |

) |

| Adjusted Net Income

(Loss) |

$ |

(376 |

) |

|

$ |

1,281 |

|

|

$ |

(14,316 |

) |

|

$ |

(7,521 |

) |

| |

|

|

|

|

|

|

|

We are providing the following preliminary estimates of our

financial results for the year ended December 31, 2019:

| |

|

Year Ended |

| |

|

December 31, 2018 |

|

|

December 31, 2019 |

|

| |

|

Actual |

|

|

Estimate |

|

| Adjusted

EBITDA: |

|

|

|

|

|

|

| Net income (loss) |

|

$ |

(8,010 |

) |

|

$ |

(18,460) to

(26,445) |

|

| Provision for (benefit

from) income taxes |

|

1,542 |

|

|

|

(500)

to 500 |

|

| Interest expense |

|

4,699 |

|

|

|

5,500

to 6,500 |

|

| Interest income |

|

(28 |

) |

|

|

(40) to

(55) |

|

| Depreciation and

amortization |

|

10,234 |

|

|

|

9,500

to 10,500 |

|

| Impairment of goodwill

and customer relationship (4) |

|

2,988 |

|

|

|

— |

|

| CMS Region A contract

termination (6) |

|

(19,415 |

) |

|

|

— |

|

| Stock-based

compensation |

|

2,750 |

|

|

|

2,000

to 3,000 |

|

| Adjusted

EBITDA |

|

$ |

(5,240 |

) |

|

$ |

(2,000) to (6,000) |

|

| |

|

|

|

|

|

|

|

|

| (1) Represents costs

and expenses related to the refinancing of our indebtedness. |

| (2) Represents

amortization of capitalized expenses related to the acquisition of

Performant by an affiliate of Parthenon Capital Partners in 2004,

an acquisition in the first quarter of 2012 to enhance our

analytics capabilities, and an acquisition of Premiere Credit of

North America, LLC in the third quarter of 2018. |

| (3) Represents

amortization of capitalized financing costs related to our Credit

Agreement for 2018 and 2017, and amortization of capitalized

financing costs related to our Prior Credit Agreement for

2017. |

| (4) Represents

intangible assets impairment charges related to Great Lakes

customer relationship in 2018 and impairment charges related to our

Performant Europe Ltd. subsidiary in 2017. |

| (5) Represents tax

adjustments assuming a marginal tax rate of 27.5% for 2018, and 40%

for 2017. |

| (6) Represents the net

impact of the termination of our 2009 CMS Region A contract during

2018, comprised of release of an aggregate of $28.4 million of the

estimated liability for appeals and the net payable to client

balances into revenue, net of derecognition of $9.0 million of

prepaid expenses and other current assets, with a charge to other

operating expenses, reflecting accrued receivables associated with

amounts due from subcontractors for decided and yet-to-be decided

appeals. |

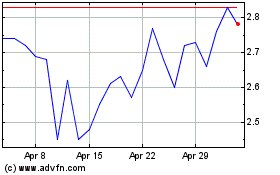

Performant Financial (NASDAQ:PFMT)

Historical Stock Chart

From Aug 2024 to Sep 2024

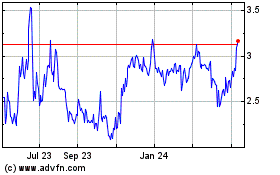

Performant Financial (NASDAQ:PFMT)

Historical Stock Chart

From Sep 2023 to Sep 2024