Current Report Filing (8-k)

February 11 2019 - 6:07AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2019

BioLargo, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-19709

|

|

65-0159115

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

14921 Chestnut St., Westminster, California

|

|

92683

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (949) 643-9540

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company. ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

1.01 Entry into a Material Definitive Agreement

We (BioLargo, Inc., the “Company”) entered into a 12% Convertible Promissory Note with Tangiers Global, LLC (“Tangiers”) in the aggregate principal amount of up to $495,000 (the “Tangiers Note”) dated January 31, 2019. The initial principal amount of the Tangiers Note is $330,000, for which Tangiers paid a purchase price of $300,000 on February 5, 2019, representing a 10% original issue discount, due November 5, 2019. Upon our mutual consent, Tangiers may pay up to an additional $150,000 consideration, and in such event, the maturity date for the additional payment would be nine months from the effective date of such payment, and the principal amount of the Tangiers Note would increase by $165,000 to $495,000. The sum that we must repay to Tangiers would be prorated based on the consideration actually paid by Tangiers, such that we are only required to repay the amount funded (plus the original issue discount, interest and other fees, as applicable), and we are not required to repay any unfunded portion of the Tangiers Note.

The Tangiers Note is convertible at the option of Tangiers at a conversion price equal to 75% of the lowest closing bid price of the Company’s common stock during the 25 consecutive trading days prior to the conversion date. We may prepay the Tangiers Note up to 180 days after the effective date. If a prepayment is made within 90 days, we must pay a prepayment penalty of 25%; from 91 to 180 days, we must pay a prepayment penalty of 30%. We may pay such prepayment penalties, if we so choose, by issuing common stock at the conversion price. If such shares are not eligible for removal of restrictions pursuant to a registration statement or Rule 144 within 10 trading days following the six-month anniversary of the effective date, Tangiers may rescind the stock issuance and force the Company to pay the prepayment penalty in cash. Upon the occurrence of an event of default, as such term is defined under the Tangiers Note, additional interest will accrue from the date of the event of default at a rate equal to the lower of 22% per annum or the highest rate permitted by law, and an additional 25% shall be added to the principal amount of the note.

In connection with the Tangiers Note, the Company caused its transfer agent to reserve 3,000,000 shares of the Company’s common stock, in the event that the Tangiers Note is converted.

With respect to the above transaction with Tangiers, Lincoln Park Capital Fund, LLC (“Lincoln Park”) consented to waive the provisions of the Purchase Agreement dated August 25, 2017 prohibiting variable rate transactions. As consideration for the consent, we agreed to issue Lincoln Park a stock purchase warrant allowing for the purchase of 50,000 shares of our common stock at $0.25 per share for a period of five years (the “Lincoln Park Warrant”).

This current report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy any shares of common stock, nor shall there be any sale of shares of common stock in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

The foregoing descriptions of the Tangiers Note and the Lincoln Park Warrant are qualified in their entirety by reference to the full text of such documents, copies of which are attached as Exhibits hereto. The representations, warranties and covenants contained in such agreements were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such agreements, and may be subject to limitations agreed upon by the contracting parties.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The discussion set forth in Item 1.01 is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

* Filed hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Date: February 8, 2019

|

|

|

|

BIOLARGO, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Dennis P. Calvert

|

|

|

|

|

|

|

|

|

|

Dennis P. Calvert

|

|

|

|

|

|

|

|

|

|

President and Chief Executive Officer

|

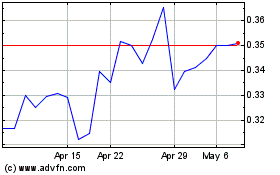

BioLargo (QB) (USOTC:BLGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

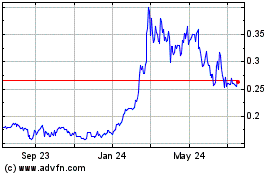

BioLargo (QB) (USOTC:BLGO)

Historical Stock Chart

From Apr 2023 to Apr 2024